Author: Robert Osborne | X | LinkedIn

A View From the Top

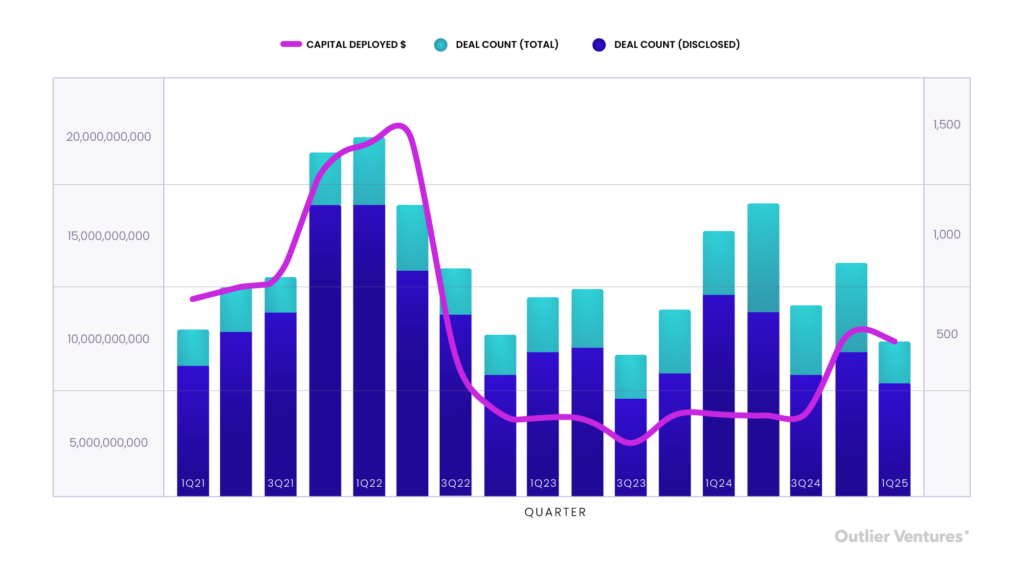

- Web3 fundraising held steady in dollar terms, with $7.7bn raised across 603 deals, nearly matching record-breaking Q4-2024. But deal count dropped 34% — the lowest since 3Q23 — signalling a shift toward capital concentration over broad exposure.

- The $2bn Binance raise accounted for more than a quarter of all capital deployed. Strip that out, and the market looks more like business as usual: ~$5.7bn in real activity, in line with 2024 averages.

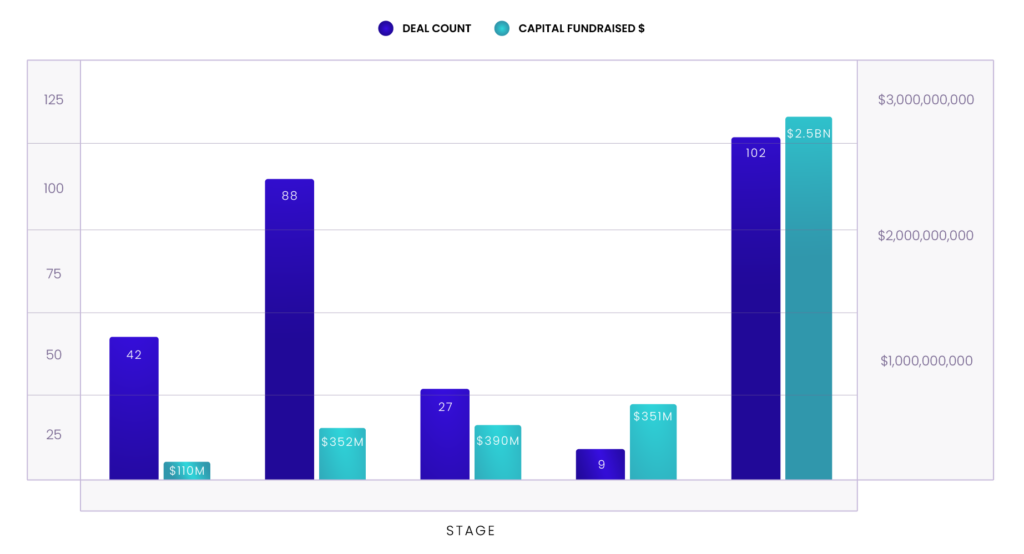

- Strategic rounds dominated, drawing in $2.5bn across just 102 deals. This continues the trend of sovereign funds and ecosystem treasuries backing big infra and L1 plays.

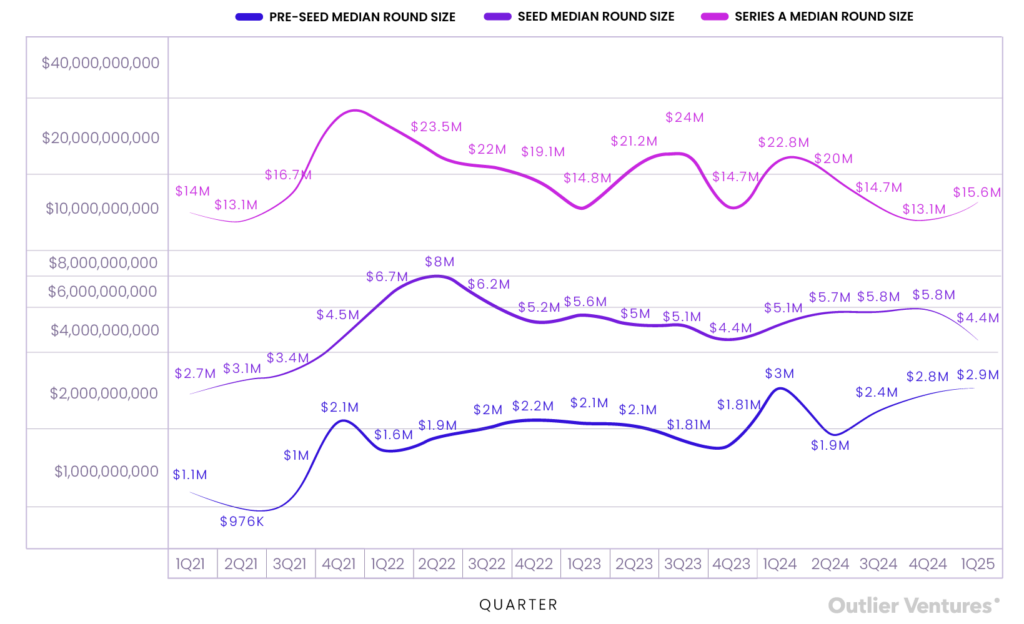

- Early-stage rounds fragmented. Seed round sizes fell to a two-year low ($4.4m), while pre-seed stayed strong at $2.9m. Series A? Still squeezed — only 27 rounds closed, despite a modest recovery in round size to $15.6m.

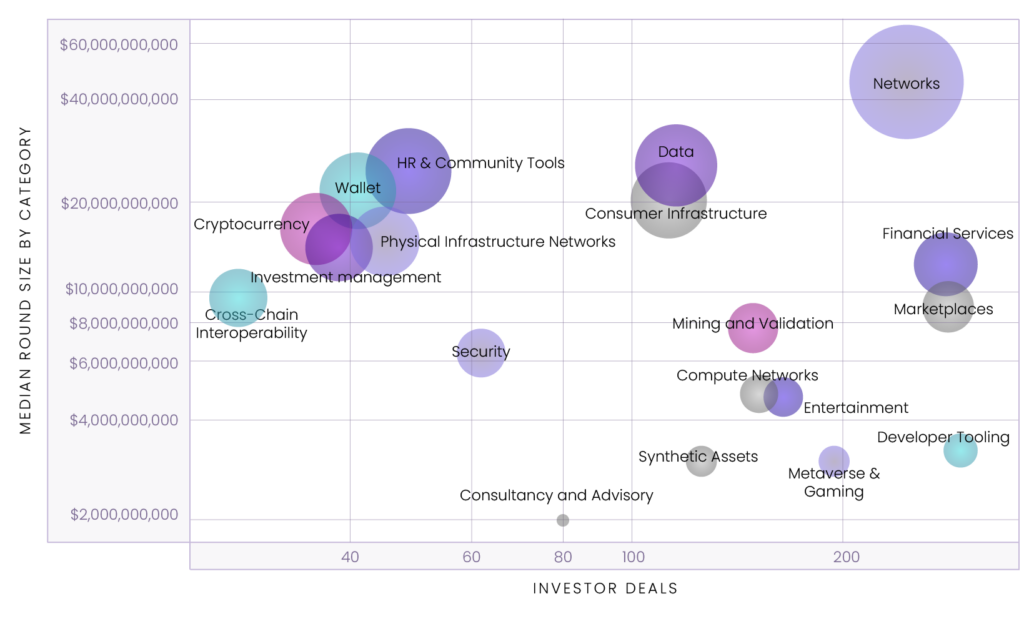

- The category picture shows fragmentation and focus. Networks took top spot (thanks to Binance), while Data, Wallets, and Consumer Infra posted strong medians. Developer Tooling attracted the most investor engagement but smaller rounds, showing it remains the long tail of infra.

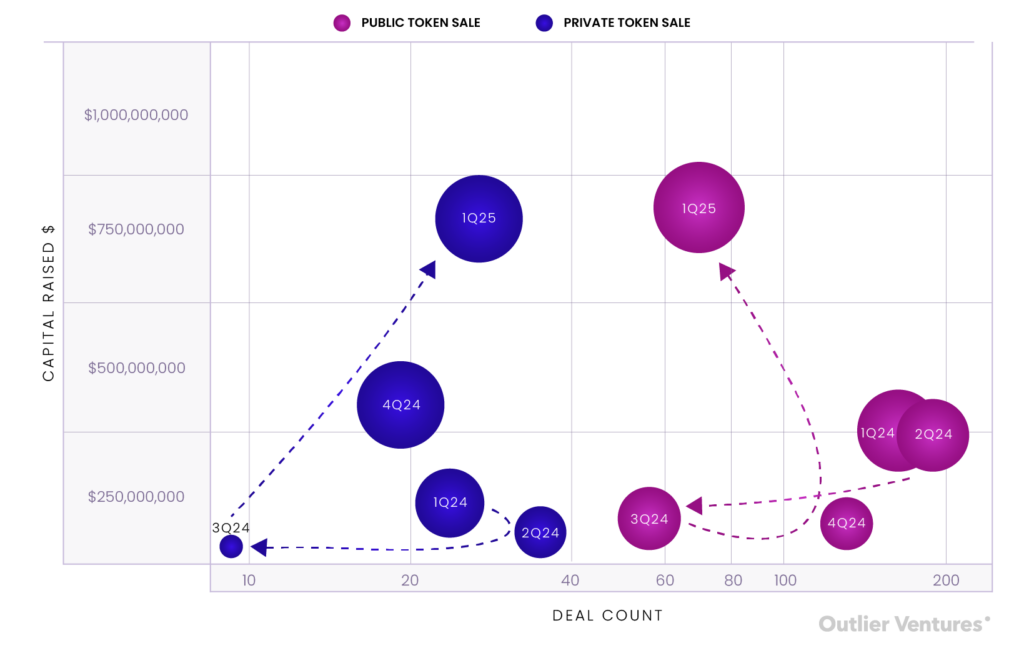

- Token raises rebounded sharply. $1.6bn raised across 96 public and private sales — the strongest quarter since 2022. Public sales dominated in number; private sales rivalled in value. World Liberty ($590m) and TON ($400m) set the tone.

Market Overview: Capital Concentration Over Volume

The opening quarter of 2025 delivered an unusual contrast in Web3 fundraising dynamics. Total capital deployed remained elevated at $7.7 billion, nearly matching the record-breaking Q4 of 2024 ($7.9bn) — yet deal count fell sharply to just 603. This represents a 34% drop from the previous quarter and is the lowest number of recorded deals since 3Q23. The implication? Investors are writing bigger cheques to fewer companies, prioritising capital concentration over broad exposure.

This divergence underscores a continuing recalibration in investor strategy. With market liquidity recovering and sentiment broadly positive, VCs appear to be doubling down on “category winners” and maturing infrastructure plays rather than distributing capital across the long tail of speculative early-stage bets. Much like 4Q24, the bulk of funding flowed into mid-to-late stage rounds and ecosystem-defining projects, often with strong traction, prominent backers, or token strategies primed for market entry. (For a deeper dive into how this shift from consumer to infra plays is unfolding, check out our previous analysis: Everything You Know About Web3 Fundraising Is Wrong.)

The headline figure of $7.7 billion, however, belies the underlying reality. Binance’s $2 billion raise — led by UAE-based MGX Capital and touted as the largest single private crypto funding round to date — accounts for over 25% of all capital deployed this quarter. Stripping that out, 1Q25 funding drops to approximately $5.7 billion, much closer to levels observed throughout 2024 (which were less than $4 billion pre-4Q24). This reflects relative continuity in investor appetite rather than a sudden resurgence in fundraising activity.

Excluding this outlier, capital deployment still shows signs of resilience. Late-stage growth rounds in infrastructure and AI-adjacent sectors continued to attract attention. Phantom ($150m Series C), Flowdesk ($91.8m), and LayerZero ($50m expansion round) point to a maturing class of infrastructure companies consolidating market share and moving toward revenue scale.

Deal Stages: Strategic Capital Takes the Lead

The breakdown of 1Q25 fundraising by round stage reinforces a key theme: strategic capital is king.

Strategic rounds accounted for just 18% of total deal volume but captured over 32% of all capital deployed: $2.5 billion across 102 deals. This is a continuation of the trend we observed in late 2024: crypto conglomerates, ecosystem funds, and sovereign-backed entities stepping in to make targeted, high-conviction bets that align with national, institutional, or protocol-level interests. These rounds tend to cluster around Layer 1s, middleware protocols, and token infrastructure — where alignment, not just ROI, drives capital deployment.

By contrast, early-stage fundraising continues to fragment. Pre-seed and seed rounds made up nearly a quarter of all deals (24%) but captured just 6% of capital deployed. The average pre-seed round came in at ~$2.6 million; seed rounds averaged ~$4 million, well below the 2024 medians. This suggests valuation compression is in effect, or that smaller cheque sizes are being deployed with tighter founder terms. It also signals the return of “real diligence”: founders need traction, not just vision, to unlock capital.

Series A continues to feel the squeeze. Just 27 Series A rounds were recorded — barely 5% of total deal count — but they absorbed $392 million in capital, with an average round size of ~$14.5 million. Investors appear to be skipping A rounds altogether, opting instead to either enter at seed with option-like exposure or wait for Series B+ maturity where risks are mitigated and token strategies are clear.

Later-stage bets are holding steady. Series B and above saw just nine deals but drew in $531 million, with an average round size of nearly $59 million. These are companies with validated models and token mechanics primed for exchange listings or treasury alignment. In many cases, these are not venture bets: they’re growth-stage, quasi-private equity deals.

Overall, the stage-level breakdown confirms the broader thesis: the fundraising market is bifurcating, not just between consumer and infra, but between early experimentation and late-stage conviction. The middle — Series A — is where risk appetite disappears, and where capital is currently least inclined to tread.

If deal count signals market sentiment and capital deployed reveals conviction, then median round size shows founder leverage. In 1Q25, that leverage is tilting away from seed-stage teams.

Pre-seed median round size landed at $2.9m, nearly matching the peak from 1Q24 and almost triple the 2021 average. This marks a quiet resurgence of confidence at the very earliest stage. Accelerators, ecosystem funds, and angel syndicates appear to still favour early bets with optionality—especially those riding high-conviction narratives like DePIN, AI-native infra, and onchain agent tooling. For founders, this is where the capital remains most founder-friendly.

Seed stage, on the other hand, took a hit. The median round size dropped to $4.4m, down from over $5.8m in Q4 and its lowest since 4Q22. It’s a strong signal that the middle is thinning. Investors are trimming cheque sizes, tightening terms, or bypassing altogether unless metrics or distribution are already in place. The ‘spray-and-scale’ model is clearly dead.

Series A, meanwhile, rebounded slightly to a median of $15.6m, up from Q4’s cyclical low ($13.2m). Still, this is far below the heady highs of 2021 and early 2022, when medians regularly topped $30m. More importantly, the low deal count at this stage (just 27) underscores how selective the market has become. These are not Series A rounds in name only—they’re priced like mini-Bs, reserved for companies with revenue, traction, and token strategy ready to execute.

Put simply, the barbell remains intact: there is still cash at the idea stage and cash at the post-traction stage, but the middle is being left behind. It’s not a funding winter, but it’s certainly a rebalancing of founder expectations.

Where the Capital Goes: Category Standouts

At a category level, 1Q25 continued to highlight the fragmentation of capital deployment — and the divergence in investor enthusiasm.

As expected, Networks dominated the leaderboard with a median round size of $45.1 million, skewed heavily by Binance’s $2 billion strategic raise. But even accounting for that outlier, the 243 investor deals in this category suggests a density of interest from institutional allocators, strategic funds, and ecosystem backers doubling down on L1s and scaling bets. Network infrastructure remains where capital goes to feel serious.

Meanwhile, Developer Tooling attracted the most investor engagement — 290 investor deals — but only saw a median round size of $3.1 million. This contrast highlights its role as the long tail of infra: high interest, lower risk, and modular potential. These are often smaller, faster deals — engineer-led, protocol-aligned, and sometimes grant-augmented.

On the consumer side, Metaverse and Gaming logged 193 investor deals with a relatively low median round of $2.9 million, echoing the shift we’ve seen from content-heavy bets to infra-for-fun plays. Entertainment followed a similar pattern — $4.65 million median, 164 investor deals — again reinforcing that VCs remain interested, but cautious, when it comes to audience-first Web3 plays.

Marketplaces and Financial Services also stood out with high investor engagement — 279 and 277 investor deals respectively — but with differing capital intensity. Marketplaces enjoyed a median round of $9 million, suggesting some renewed appetite for transactional infrastructure and tokenized commerce. Financial Services posted a median of $11.98 million, making it one of the highest-funded consumer-aligned categories this quarter.

Among infra categories, Consumer Infrastructure ($19.3m), Wallets ($20.7m), and Data ($24.3m) all posted strong median round sizes with moderate investor engagement, suggesting that while not as hyped as networks or compute, they’re benefiting from a return to fundamentals: UX, composability, and data liquidity.

At the other end of the spectrum, Consultancy & Advisory and News & Information saw both low median round sizes (~$2m) and low investor counts — categories that are struggling to justify venture-scale outcomes, and likely being crowded out by public goods funding or native monetisation models.

The standout “middleweights” of this quarter — Cross-Chain Interoperability ($9.7m), Security ($6.4m), and Compute Networks ($4.8m) — reflect a healthy layer of technical, lower-visibility infrastructure still receiving meaningful backing. These are no longer frontier categories, but rather part of the expected stack.

Token Fundraising Rebounds: Strategic and Public Sales in Sync

Token fundraising in 1Q25 saw a decisive reversal of the 2024 trend, marking a return to high-value, high-stakes private sales alongside a resurgence in blockbuster public offerings.

A total of $798 million was raised across 69 public token sales, headlined by World Liberty Financial’s $590 million raise — an event that accounted for nearly 74% of all public token capital this quarter. Meanwhile, private token sales captured $771 million across just 27 deals, led by TON Foundation’s $400 million round. Taken together, token fundraising in Q1 hit $1.6 billion, far surpassing any quarter in 2024.

Compare this to the previous year: in 1Q24, public sales vastly outnumbered private ones (163 vs 24 deals), but raised less capital overall ($296m vs $140m). The market back then favoured liquid launches, retail participation, and community-led tokenomics. By contrast, 1Q25 signals a pendulum swing back to concentrated, institutional token allocations — a sign of rising confidence, but also a preference for control, vesting, and off-market pricing.

What stands out most is not just the absolute growth, but the structural shift: public sales now account for less than 60% of total token fundraising deal volume, yet bring in just slightly more capital than private sales — despite having more than double the number of deals. That delta in capital-per-deal speaks volumes.

Private token deals are back in fashion, and they’re bigger, deeper, and more strategic. These are not your run-of-the-mill IDOs or quick-launch hype machines. They’re ecosystem-shaping plays — aligned with L1 treasuries, foundation mandates, or cross-border capital flows.

At the same time, public sales are getting top-heavy. Outside of the World Liberty raise, the remaining 68 public rounds averaged just $3 million — suggesting that while access is widening, large-scale retail demand remains concentrated in a handful of high-trust, high-brand projects.

Now Recruiting: The Post Web Accelerator

If there’s one takeaway from this quarter’s data, it’s this: early-stage funding hasn’t disappeared — it’s evolved. Investors are looking for sharper narratives, stronger foundations, and builders who understand how to navigate this new fundraising landscape.

That’s exactly what we support in The Post Web Accelerator.

Whether you’re refining your token model, building at the intersection of AI and decentralization, or laying the groundwork for user-owned infrastructure — we help early teams turn conviction into traction.

Applications are open now — but not for long.

Final Thoughts: Navigating a Bifurcated Market

The first quarter of 2025 confirms what many in the space have felt: this isn’t a bear market, it’s a focused one. Capital hasn’t disappeared; it’s just become more selective, more strategic, and more aligned with infrastructure, traction, and long-term narratives.

1Q25 also marks the return of a healthy dual-track dynamic: private rounds for strategic control; public rounds for market optics and liquidity scaffolding. For the first time in over a year, both are thriving.

For founders, the path forward is clear: You don’t need to time the market — you need to build something inevitable.