ASCENT: TOKEN LAUNCH ACCELERATOR

Go to market with Outlier Ventures

Launch your project to market with confidence with Web3’s OG operators to maximise your chances of sustainable network growth.

Ascent supports later stage projects looking to catapult to the next level.

We help teams with their token launch, token design, go-to-market strategy, product development, fundraising and more.

Token and ecosystem acceleration for the giants of web3

Outlier in numbers

150+

Tier 1 exchange listings

40+

live tokens supported to launch + grow

97%+

Coverage of Tier-1 VCs in our network

900m+

Raised by our portfolio companies

273m+

Average post launch FDV

125m+

Combined community size across socials

“When we build a token launch team with our partners, our aim is to help founders launch your project to market with confidence. Our goal is not just about token generation event, but setting up for long term sustainable growth.”

MATT LAW

Chief Commercial Officer, Outlier Ventures

The world’s leading Token Launch Advisory program

Founded in 2014, OV brings a world class and industry leading team focused on Web3 Go-To-Market

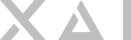

We advise founders on everything from token design & economies, token launches & distributions, NFTs, go-to-market strategy, structuring, technology, and fundraising, catapulting projects to the next level.

We support teams in successfully launching their tokens by advising on token distribution strategies, token economies, community building & user acquisition, legal structure.

We also connect projects on the program with leading investors, exchanges, launchpads, market makers, and other partners essential to ensure a successful token launch.

We partner with Web3 leaders to successfully launch their tokens with our proven framework

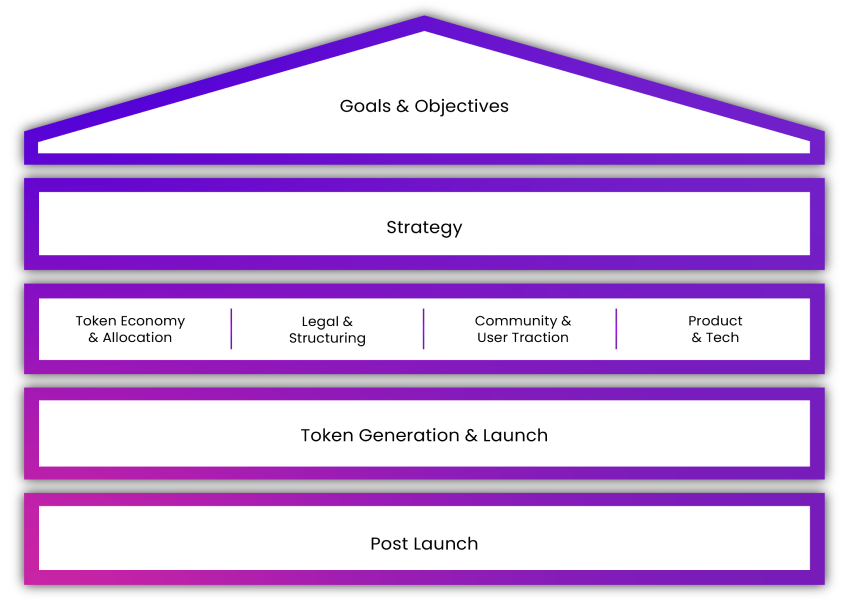

Token Launch Task Force

Outlier Ventures will assign a dedicated Program Manager to the engagement to act as the main point of contact for you and the interface between you and the wider OV organization. You will also assign a Project Manager for the engagement.

Regular engagement touchpoints:

- Weekly mission control with Token Launch Taskforce

- Workshops and 1-2-1 deep dive calls with our in-house experts incl. Token Economies team

Main communication channels & data sharing:

- Regular weekly calls for synchronous comms.

- Slack channel set up for data sharing & asynchronous comms.

- Secure Google Drive folder set-up for data storage

Success Stories

“I would encourage teams that want to be in the market within a year and with a disruptive vision… especially for teams having a strong focus on DeFi and applications”

Michael Weber, DIA Co- Founder & COO

‘It was very important for us to work with partners who could complement our skills and provide us a breadth of knowledge and competency. OV have been a perfect partner for us in all respects’

Humayun Sheikh, CEO fetch.ai

“At IOTA we are very grateful for the contribution of all our advisors, including Outlier Ventures, helping us progress the development of this revolutionary technology that will transform interoperability and sharing of resources between internet-of-things devices.”

David Sønstebø, Co-Founder & Co-Chair of IOTA

“Outlier Ventures’ involvement in Boson Protocol has been absolutely critical.”

Justin Banon, Founder & CEO of BOSON PROTOCOL

We help launch billion dollar networks

Biconomy, FDMC at

$459m

Fetch.ai, FDMC at

$2.39bn

IOTA, FDMC at

$750m

ROOT Token, FDMC at

$516m

XAI, FDMC at

$1.82bn

DIA Data FDMC at

$95m

Boson, FDMC at

$80m

Ocean, FDMC at

$1.6bn

*Data correct as of May 2024

Fuel the future of your startup with Outlier Ventures

Apply now for our Token Launch Accelerator