USD stablecoins are on the rise, surpassing $220 billion and reaching 1% of the U.S. money supply. With stablecoin legislation in the U.S. set to enable a new class of issuers, including banks, fintechs, enterprises, and governments, the market is approaching an inflection point that will transform competition, distribution, and innovation. Furthermore, the underlying business model of stablecoin issuers offers the U.S. government an innovative opportunity to financially engineer a larger base of short-term debt buyers, and extend the dollar’s monetary influence worldwide.

Greysen Cacciatore, Research Associate | X | LinkedIn & Jasper De Maere, Head of Research | X | LinkedIn

Bottom Line

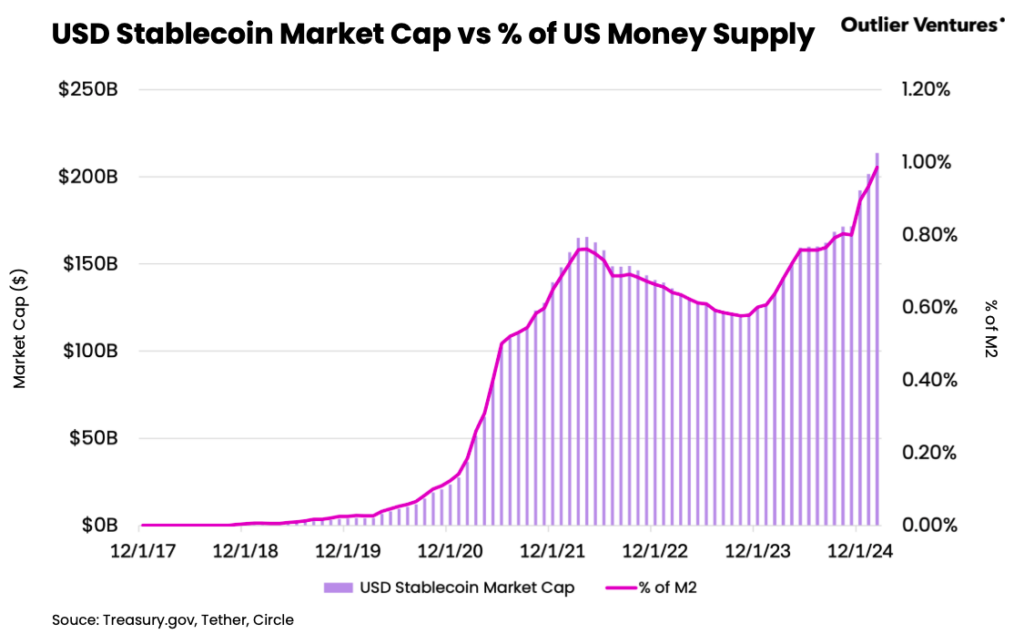

- USD stablecoins have surpassed $220 billion in market cap, now representing over 1% of U.S. M2, with year-to-date growth of 59.7% and a 40.9% increase in their ratio to M2 year-over-year.

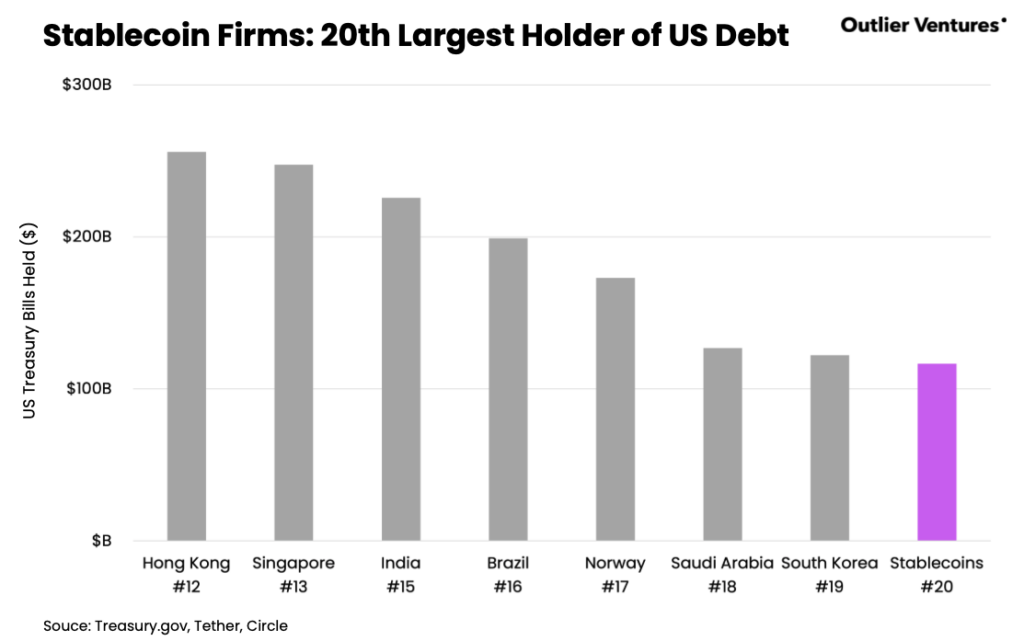

- Stablecoin issuers have emerged as the 20th largest direct holder of U.S. treasuries globally, surpassing nations such as Germany and Mexico, illustrating the market’s growth and presenting the U.S. with a strategic opportunity to align stablecoin regulation with fiscal and geopolitical objectives.

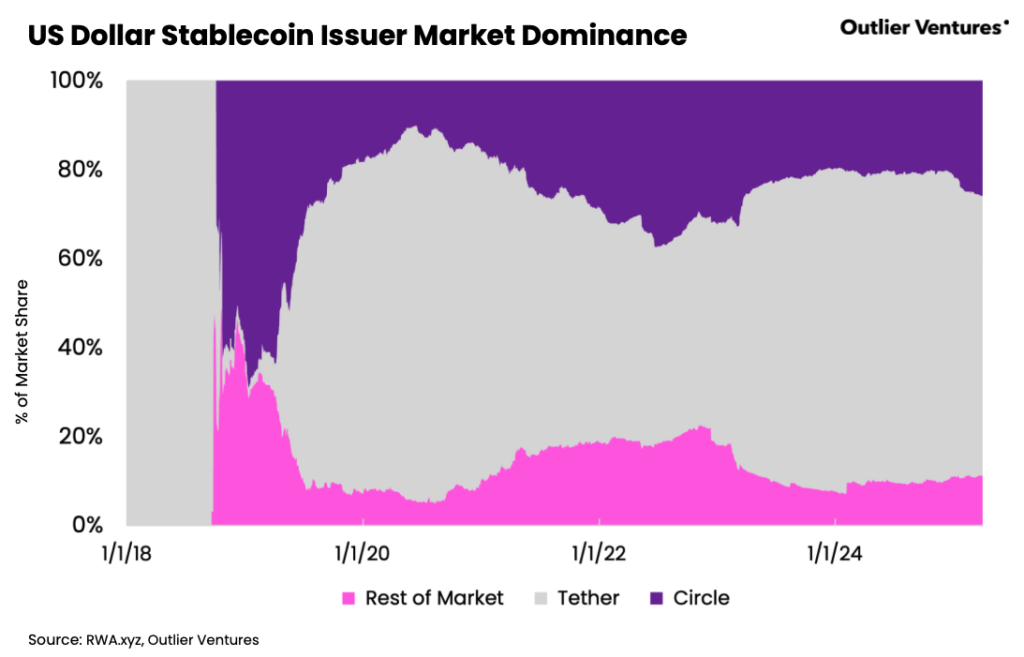

- While the stablecoin market remains dominated by Tether & Circle, who hold 89% of the market share, stablecoin legislation in the U.S. is opening the door for new market entrants, including banks and enterprises, whose extensive distribution channels could drive competition and shift market dynamics.

From Niche to Macro: Digital Dollars at Scale

Stablecoins have undoubtedly become one of the major themes of crypto in 2025 – and justly so. As of Q1 2025, USD stablecoins have surpassed $220 billion in market capitalization (representing 99.8% of all fiat-denominated stablecoins) and now account for roughly 1% of U.S. M2. Year-to-date, their total market cap has grown by 59.7%, and the USD stablecoin-to-M2 ratio has grown by 40.9% year-over-year. Exhibit 1 illustrates this dynamic below.

Exhibit 1: USD Stablecoin Market Capitalization vs. % of US M2

Source: Outlier Ventures

This trend not only represents strong, steady growth for digital dollars, but it also reflects the accelerating migration of economic activity onto distributed ledger infrastructure. With over $24 trillion worth of value transacted in stablecoins last year, stablecoins have proven themselves to be a foundational tool for blockchain-hosted finance and commerce, by providing a simple yet critical financial primitive of a stable, liquid, and programmable medium of exchange.

Looking into 2025, stablecoins are also emerging as a force in global finance within the context of sovereign debt markets and geopolitics. The underlying business model of stablecoin issuers presents a compelling opportunity for the United States government to reinforce dollar hegemony through digital assets. By passing legislation that enables and incentivizes new stablecoin issuers to open business within the United States, the U.S. can financially engineer a broader base of short-term debt buyers, drive additional demand for treasuries, and strategically extend the dollar’s monetary reach through stablecoins. Clear regulation also drives interest from enterprises, institutions, and even governments to consider entering the stablecoin issuing market, creating new market competition and dynamics.

Stablecoin Firms: A New Major Buyer of US Debt

Within the digital assets industry, it’s well understood that the stablecoin business model strongly favors the issuers of the stablecoins. By design, most stablecoins are backed one-to-one by cash and highly liquid assets including, most predominantly, short-term U.S. treasuries. However, unlike banks or money market funds, stablecoin issuers do not pass along interest earned on their reserve assets to the holders of their stablecoins. Instead, they capture the yield for themselves, generating a lucrative revenue stream based on the interest rate environment and demand for stablecoins.

At the global macroeconomic level, the stablecoin issuer business model is driving a new structural demand for U.S. government debt. Much of this new demand is underpinned by the two dominant stablecoin issuers, Tether and Circle, whose combined U.S. treasury holdings now place stablecoin firms among the top 20 direct holders of U.S. treasuries (holding $116 Billion), ahead of major sovereign nations like Germany and Mexcio. Exhibit 2 illustrates this.

Exhibit 2: Stablecoin Firms: 20th Largest Direct Holders of US Treasuries

Source: Outlier Ventures

This emergence of stablecoin firms as one of the world’s largest buyers of U.S. debt signals that stablecoins are no longer just infrastructure for crypto-native markets, but also becoming their own force in global finance. As their role in US debt markets have become visible, they present the United States with an innovative opportunity to align stablecoin adoption with the financial interests of the nation. Last month at the White House Crypto Summit, U.S. Treasury Secretary Scott Bessent stated, “We are going to keep the U.S. (dollar) the dominant reserve currency in the world, and we will use stablecoins to do that.” This comment shows that leadership in the White House are taking stablecoins seriously and viewing them as an innovative tool to defend dollar dominance.

Furthermore, at the second-order level, each new stablecoin issuer also becomes a distribution channel for digital dollars into the global economy. In emerging markets, where inflation, capital controls, and local currency instability persist, stablecoins offer individuals and businesses an accessible flight to safety. With progressive legislation, the U.S. can accelerate stablecoin adoption globally, reinforcing both the availability of dollars and the reach of U.S. monetary policy. In this way, stablecoins serve as a lever for domestic fiscal strength and a tool for extending the dollar’s influence worldwide.

Forward Looking: New Issuers & New Market Dynamics

As stablecoin regulation and clarity accelerates through the United States, the broader stablecoin market structure is on the cusp of evolution. Last week, the SEC’s Division of Corporation Finance outlined their official views on stablecoins, stating that certain stablecoins pegged to the U.S. dollar and backed by low-risk, liquid assets do not constitute securities under federal law. This, in tandem with the STABLE and GENIUS acts, will allow a powerful new class of market entrants including enterprises, fintechs, banks, and governments. New stablecoin issuers who already have strong distribution channels, are likely to reshape the dynamics of competition, distribution, and innovation, while also strengthening the overall role of stablecoins in finance and commerce.

Today, the stablecoin market is dominated by Tether & Circle, which account for over 89% of the total market cap of stablecoins, as illustrated in Exhibit 3. This concentration reflects the first-mover advantage and network effect dynamics that shaped this market to present.

Exhibit 3: USD Stablecoin Issuer Market Dominance

Source: Outlier Ventures

While it’s uncertain whether or not market share can be eroded, the reduced regulatory risks via clear regulation, opens the door for new stablecoin issuers who already have strong financial distribution channels to compete with Tether & Circle. Banks and leading fintechs are particularly well-positioned here by plugging in stablecoin products to their existing capital markets infrastructure and client distribution channels. Beyond financial institutions, large consumer-facing enterprises represent another potentially high-leveraged opportunity. With scaled customer bases and brand affinity, these companies can issue stablecoins and incentivize transacting in their stablecoin through promotions, discounts, and rewards.

Overall, as the amount of stablecoin issuers grow in the market, it’s likely that a new set of bottlenecks will unfold, particularly around user experience. In a market, where hundreds of institutions, enterprise, and government-issued stablecoins exist, there will need to be elegant solutions around user experience, including blockchain infrastructure, cross-chain interconnectivity, instant redemptions, atomic swaps, and on-and-off ramps to further driver scaled growth and adoption.

Everything Post Web at Your Fingertips

Stay ahead at postweb.io to access our latest thesis, audio documentary episodes, our accelerator program, and much more. Chapters one and two are now out, with more to come.

Or, better yet, watch Jamie Burke’s keynote on The Post Web live at ETHDenver.