The war for crypto users is taking a new shape. We see exchanges moving from closed to open systems as they embrace Web3 wallets, build EVM L2s and adopt existing infrastructure such as the lightning network. We are excited for these developments and believe it is evidence of the differentiated value proposition of existing open source Web3 networks. As demonstrated by previous tech cycles, companies entering open source networks need to play a different ball game. We believe that community & innovation sit at the center of any successful strategy. These are the factors that will define how successful exchanges and financial institutions are in participating in open source.

Open source

“Open source” is a broad definition used in software and simply means that anyone can inspect, modify and enhance the source code. There are different types of open source such as libraries, networks and infrastructure. We focus on open source Web3 networks and infrastructure such as blockchains and wallet solutions.

Innovation is key

In this short piece, we highlight the importance of innovation in open-source networks. It’s a key ingredient for the network’s long-term success and acts as a mechanism to go up against other networks that have become too value extractive.

Exchanges on the move

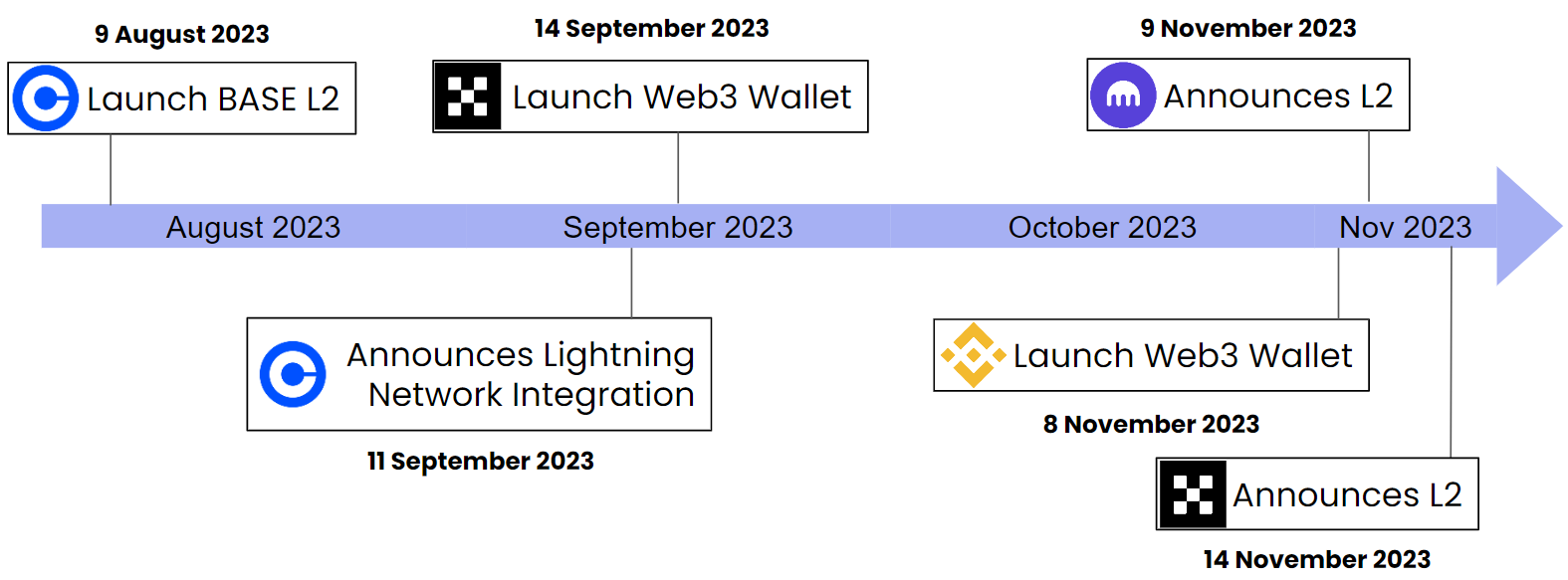

Over the past two months we have seen a slew of announcements coming from centralized crypto exchanges as they move from closed to open source systems. These include announcements of soon to launch Layer 2’s and Web3 wallets.

Timeline Of Exchange Announcements

The Convergence

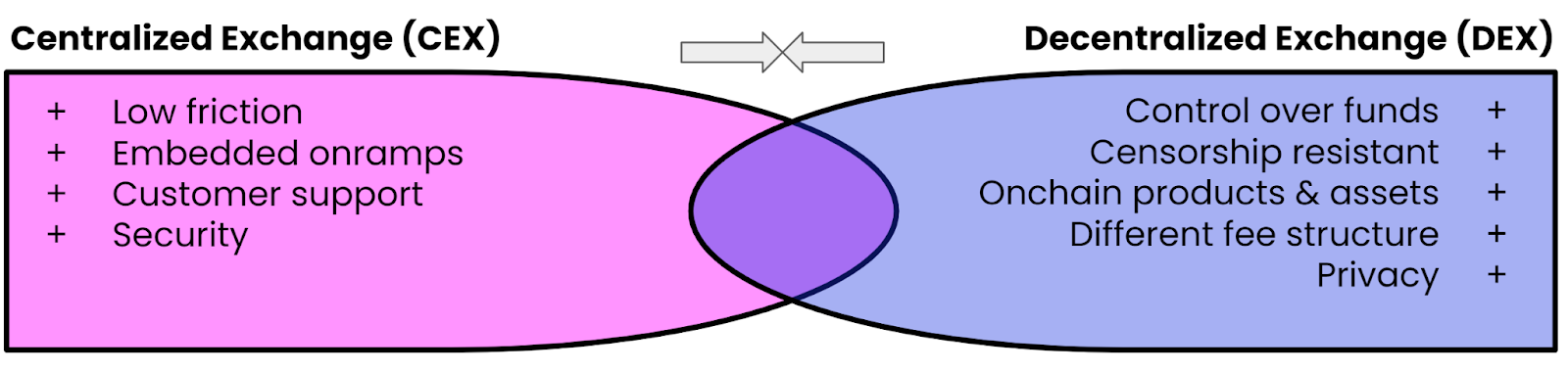

Since 2022, we see a functional convergence between decentralized and centralized exchanges evidenced by centralized exchanges moving into open source. We believe there are two key drivers behind centralized exchanges (CEXs) move:

- Products: There is a desire to tap into new and exciting DeFi products which require innovation such as EVM compatibility, zero-knowledge proofs and multi-party computation that are only accessible by leveraging blockchain technology.

- Liquidity: Despite CEX still being by far more liquid than DEX ($3T CEX vs $31B DEX spot liquidity/month), CEX are looking to top into DeFi liquidity. Liquidity on CEX is typically concentrated towards blue-chip assets such as BTC & ETH. Users would benefit from being able to access DEX liquidity pools for the long-tail of smaller tokens that are increasingly difficult for CEX to maintain and curate liquidity for.

As CEX continues to embed open source infrastructure into their product offering, the lines between centralized- and decentralized exchanges will continue to blur. We are excited about the development as this shows how a decentralized, open source network (Web3) is not only giving users an alternative to centralized incumbent players but is also influencing these players directly to move towards a more inclusive and efficient ecosystem by adopting its features.

We believe crypto exchanges are the first of many sectors across financial services that are moving towards open source systems. While we haven’t seen the same adoption headlines from banks or asset managers, we know they are experimenting with permissioned blockchains and Web2.5 wallets.

Economic moat of open source

Many believe that it is not possible for entities (protocols, companies,…) to capture value in an open source system. The ability to fork the network or copy the code makes many believe that entities will get displaced in the case that they extract too much value (make profits).

They would be right if it wasn’t for the network effects. The popular economic moat commonly used by Web2 platforms is also showing its relevance in open source systems. The difference is that in Web3 open source networks, the user controls and participates in the value they generate for the network.

The way network effects are created and maintained is very different for closed- than for open source networks. The creation of open source network effects hinges on the successful execution of two things:

- Community

“An open source network is the accumulation of community efforts”

Open source networks do not exist without their communities. Web3 communities play a vital role in driving the growth, recognition and the adoption of blockchain projects.The community serves as the engine for product development. Traditional businesses diligently plan inhouse product development. In open source this should be no different. Exchanges operating in open source need to prioritize and build out their L2 community with the same level of diligence. A strong community creates network effects between different users who increasingly benefit from the size and quality of the community.

- Innovation

“Innovation ensures that the open source network stays relevant and competitive”

Innovation plays a pivotal role in reinforcing and amplifying the network effect. When innovative features, services, or technologies are introduced within a network, they stimulate greater user participation and engagement. Through innovation, the network remains relevant, retains and attracts users and expands its outreach. Innovation also gives a sense of achievement and progress to the community building on the open source network.

In short, we believe exchanges moving into open source with their own L2s need to continue to excite a community around their product through innovation and community building efforts.

Web3 Network Effects

We see increasing evidence that Web3 protocols are successfully capturing value. By creating network effects, Web3 protocols become more valuable to each individual user, generating network effects. It is no longer without costs that users can switch to a new service by simply forking the code. There is a switching cost associated with moving away from the protocol and its many users.

Without taking a view on the direction of the voting, we believe that Uniswap’s recent tension around its fee switching proposal is an example of how network effects create an economic moat, even in open source networks. In short, a new proposal has been raised to introduce a 0.15% trading fee on its front end and wallet that is directly attributed to Uniswap Labs.

We don’t believe there are examples of open-source networks currently being too value extractive. However, if the trend of value extraction continues, we believe innovation is the key to counterbalance. Because of network effects, simply forking the networks and rebuilding it using the open source code is no real solution. Innovation is needed to create a new value proposition and add a differentiated utility to users.

“Neutral” vs “Company” Open Source

Exchanges are rolling out their own L2s in an attempt to expand the product suite and tap into DeFi liquidity. Now that these L2s backed by centralized players go live, we see two types of L2s with different strategies:

- Neutral L2s – L2 without pre-existing client base or large centralized organization backing

- Company L2s – L2 operating as extension of product offering of large centralized organization which is expanding into open source.

The success of both approaches hinges on distinct strategies, from seamless onboarding of existing users to attracting successful decentralized applications (dApps) that roll out on the L2 ecosystem. While there are nuances in the strategic approaches, innovation stands as a common imperative. Actively contributing to the innovation within the Open Network is pivotal for ensuring its long-term success. Open systems thrive when the community’s entrepreneurial spirit is encouraged to create and innovate. We believe there will be a strong positive correlation between the future innovation and the success of the different L2s.

To Conclude

At Outlier Ventures, we’re thrilled to see new evidence and confirmation of the trend toward open source systems. Certain inefficiencies observed in closed systems are more challenging to defend and justify in open source. That is why we expect to see a strategic pivot towards an innovation and community focused approach for company L2s. We think it is great that successful innovation and community building will play a more substantial role in determining the overall success of these ventures.