Fundraising Done Right for Web3 Startups + QTM Case Study

What is Token Vesting?

Many early Web3 companies are starting with a great idea that aims to revolutionize the decentralized tech world. Even the best innovation requires some form of funding to get started and build the intended flywheel economy. Those self-enforcing ecosystems are often built with fungible cryptographic tokens that can be leveraged for user adoption, behavior incentivization, and the product itself. Therefore raising funds not just on your equity business, but also on a future token is a common strategy, especially as the overall market sentiment is picking up again.

Token vesting refers to the token supply that will be released into the market over a certain period of time. In the fundraising context, token vesting refers to the release of allocated token supply to early investors and contributors. As they play a crucial role in the building phase of the Web3 startup they get discounts on or even “free” token allocations which means that they have a lower entry point as later investors and in-market participants. Applying a supply release schedule to the allocations of those privileged entities will align their long-term interest for the Web3 startup and simultaneously be more fair for later entrants.

Fig. 1: Blur token vesting by token terminal

Figure 1 shows the exemplary vesting schedule for the $BLUR token. Apart from the airdrop most of the supply will be released over the course of 4 years after an initial cliff of 6 months. Those numbers were quite common in the latest market narrative. In the 2021 bull market cycle we saw vesting durations of 12 to 18 months as standard ranges. This brings us to the actual topic of this article on how we can pick and master the right vesting terms for our early investors and contributors.

Short or Long Vesting?

The previous section indicates the possible vesting schedule ranges we see in the market. These ranges are mostly narrative driven and derived from what others are doing in the current market situation, but are not based on what is best for the holistic Web3 initiative. The narrative of what is best should definitely be taken into consideration when designing vesting schedules, but there are other factors that should be kept in mind as well, such as the following:

Early Investors and Contributors

Recognizing early investors and contributors in the vesting schedule is about acknowledging and rewarding the risks taken by stakeholders who support the project from its inception. These individuals and entities often provide the capital and resources necessary for the project’s initial development and growth. They are interested in receiving their liquid tokens as soon as possible while also being interested in the long-term health of the startup they invested in.

Fairness

Market participants take vesting conditions into account when conducting due diligence on a Web3 project, if they deem the vesting terms to be unfair this can result in a bad sentiment surrounding the project and hinder future adoption. Fairness refers to the equitable distribution of benefits among all stakeholders. Fairness ensures that no single party is disproportionately advantaged or disadvantaged by the vesting terms. It’s about creating a level playing field where the long-term participants are rewarded for their commitment, while still enabling new entrants to participate and benefit. In most cases this means that the lower the valuation entry point of an investor is the longer their vesting duration will become.

Maintain Investability

Token valuation tables and the corresponding vesting schedule design play an important role in the future investability and are in tension with the startup requirement of fast funding. Creating low valuation sales compared to the intended public launch valuation combined with short vesting durations might attract more funding early on, but it will decrease the investability for future rounds as later investors see themselves in a disadvantage against the initial investors.

Ecosystem Sustainability and Stability

The design of vesting schedules should take into account the need for the project’s ecosystem to grow sustainably. This involves setting up a schedule that avoids flooding the market with tokens and causing value dilution, hence preserving stability. A well-thought-out vesting schedule supports the ecosystem by preventing drastic price volatility, ensuring that the release of tokens match the growth and development phases of the project. A more advanced approach to maintain sustainability and stability is the Adoption Adjusted Vesting approach.1

Timings and Intervals

Timing considerations relate to the specific intervals at which tokens are released to stakeholders. It’s important to align these releases with strategic milestones and the overall progress of the project. Proper timing can help to maintain momentum, signal project maturity, and manage supply in the market. By timing the vesting with project roadmaps and development stages, participants can be assured that vesting is part of a strategic plan rather than a short-term incentive scheme. Keep in mind that the actual release of tokens should not be transient, but gradual. It can cause significant volatility when large amounts of supply are emitted into the market at once. It is better practice to smooth the release out over time to reduce market manipulations and said volatility.

Community Vesting

The community incentives are often vested over a specific time period as well. Some recent vesting schedule designs include individual address based allocations for in-market contributors. It is crucial to use these community incentives as effectively as possible. This means that each dollar given out in the form of tokens should help to accrue more than one dollar value back to the protocol. In many cases this is done by incentivizing core ecosystem behaviors and product adoption.

These aspects are not comprehensive and there are many different angles to carefully weigh and consider when it comes to token emissions into the economy. One fundamental pillar is to create suitable demand sinks to counterbalance token emissions. Imbalances between the supply and demand side cause volatility and damage to the token ecosystem. Strong Web3 startups pay attention to these dynamics and try to forecast different scenarios.

Simulating Vesting Schedules – Case Study

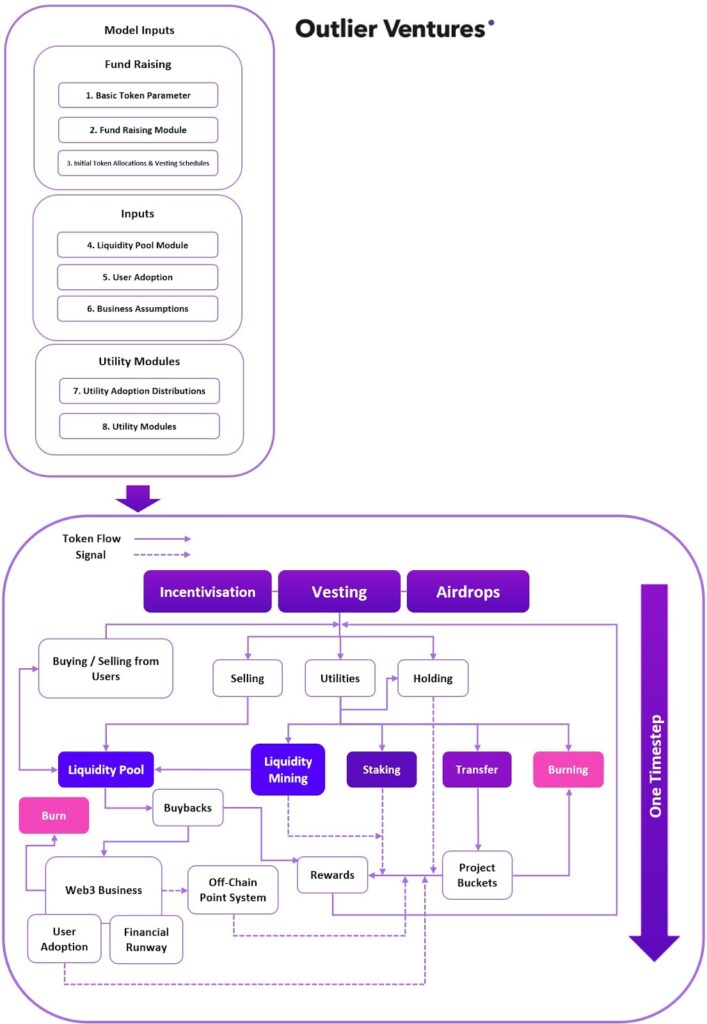

The following case study shows the impact of different lengths vesting schedules on the token valuations. It has been carried out with the Outlier Ventures open source Quantitative Token Model radCAD implementation under standard settings and medium adoption assumption.2 Figure 2 shows the general structure of the QTM which has evolved ever since the first publication about the initial spreadsheet QTM.

Fig. 2: Quantitative Token Model structural abstraction

Keep in mind that no model is capable of predicting any token valuations and they should not be construed as financial advice, especially not from a static and simplified model. However, with the QTM we can assume a certain adoption scenario as being given and then apply the different vesting schedules to test what would happen if they are changed. In the following study the exact same conditions are applied in the model apart from the different length vesting periods to find out about their impact on the token valuation stabilities.

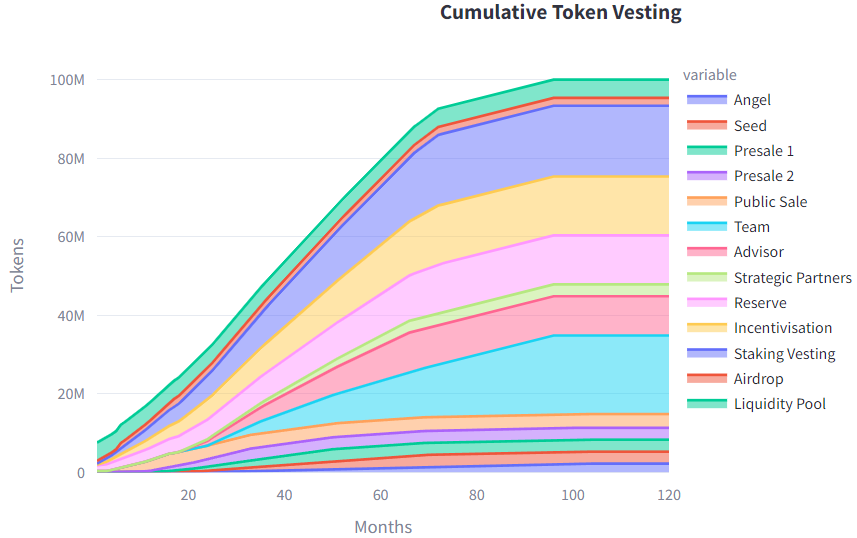

Fig. 3: Slow (top) and fast (bottom) vesting schedules for the Quantitative Token Model (QTM) case study

Figure 3 shows the assumed vesting schedules for two testing scenarios. The slow vesting is depicted on the top and the fast vesting is depicted on the bottom diagram, respectively. One can see that there are many different stakeholders involved, such as different fundraising stages, early investor groups, the team, advisors, partners, a reserve, incentivization and staking vesting buckets, airdrops, and a liquidity pool. These ecosystem participants are quite common for a vast variety of different protocols. For this case study there is no product or token utility specified apart from general staking and a transfer utility that can represent all kinds of different mechanisms, such as shop purchases or ecosystem fees. The exact use case is not relevant for the sake of this study.

In the slow vesting case it requires 8 years and in the fast vesting case it requires 4 years to fully emit all tokens into the economy. This includes the time periods from the launch of the token including cliffs and most investors will be fully vested earlier.

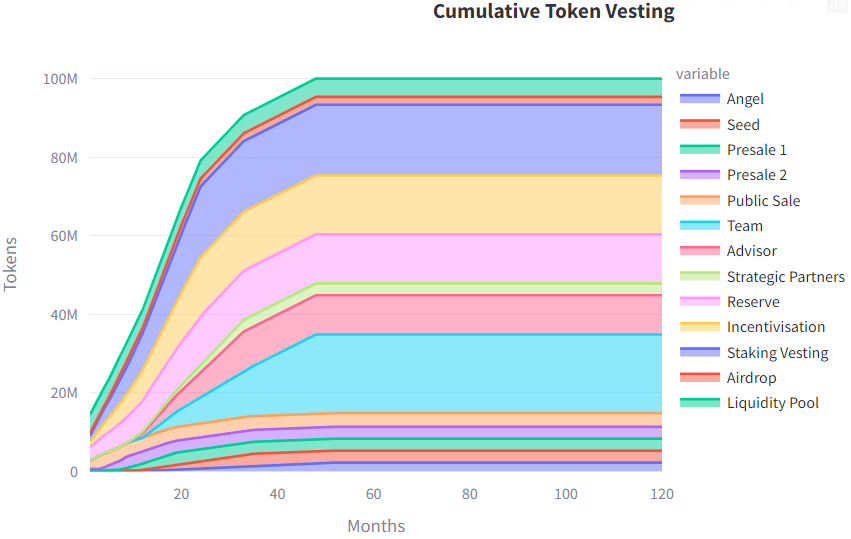

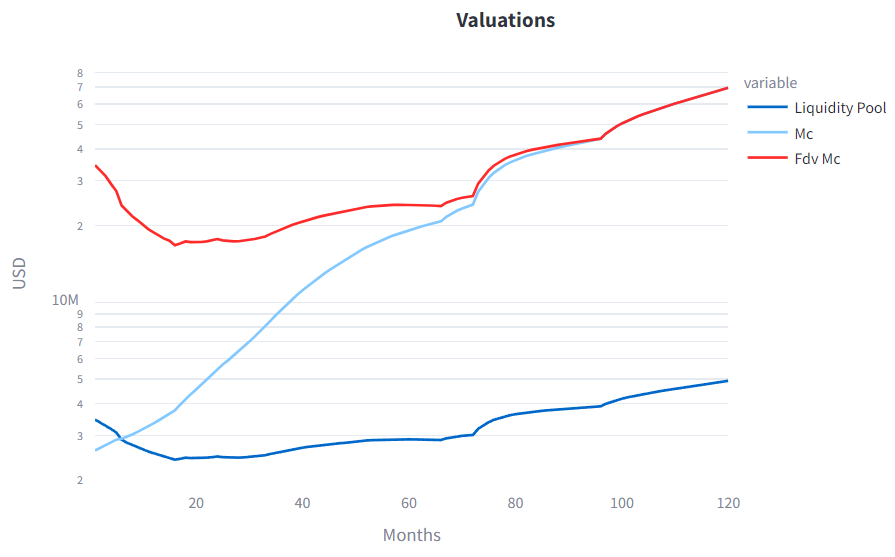

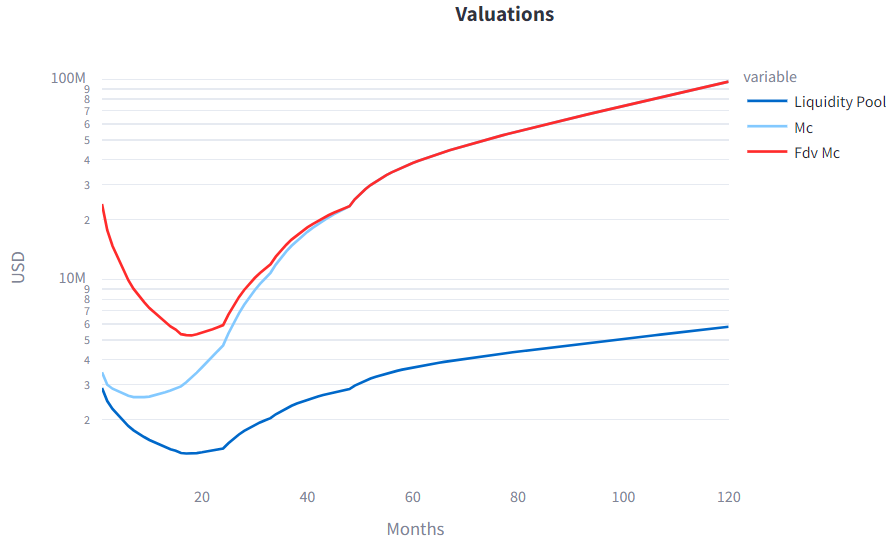

Fig. 4: Token valuations as result of the slow (top) and fast (bottom) vesting schedules

Figure 4 shows the resulting token and liquidity pool valuations from the QTM simulations under the two different vesting schedules, given by Figure 3. It is important to note that the ordinate axis is shown in a logarithmic scale. The Fully Diluted Valuation (FDV) Market Cap (MC) at launch is $40m in both cases. Both scenarios show a similar curve shape where the FDV MCs drop at the beginning of the simulation and start appreciating after some time. The circulating MC does only drop in the fast vesting schedule scenario, but starts increasing after 8 months as well. This valuation dip in the first 2 to 3 years can be observed in many Web3 token launches and is caused by the high amount of token supply that is getting released into the market while the startup is still in its building phase. Later on the valuations can keep building up again due to the increased demand, assuming a successful business model, token design, and GTM approach.

One interesting aspect is the range of valuations in both scenarios. The FDV MC of the slow vesting scenario dips about -58% 16 months after launch and reaches its peak of +74% at the end of the 10 year simulation compared to the launch valuation. In the fast vesting scenario the FDV MC valuation dips about -87% after 18 months, but reaches a peak of +145% at the end of the simulation. Even though the QTM is not capable of predicting those outcomes in an absolute way, it can give us insights on the impact of initial parameter changes under the same boundary conditions and base assumptions. In this case it is notable that the slower vesting caused less divergent valuations from the launch valuations, hence less volatility compared to the fast vesting scenario. The slower vesting causes a less extreme valuation dip, but it comes at the cost of potentially reduced upside potential long-term.

Here we need to discuss two questions: (1) What is the underlying reason for this observation? (2) What does it imply for our own vesting design?

- The reason for the stronger valuation dip in the fast vesting scenario is that more token supply gets emitted into the economy in a shorter period of time. As more supply meets the same demand a stronger valuation decline is the result. At the same time, emitting more supply faster into the economy results in less emissions at a later stage. In both scenarios the same continuous healthy growth of the Web3 business and token demand side is assumed. Hence less later stage token emissions meet the same demand compared to the slower vesting scenario and therefore lead to higher later stage valuations.

- Considering the previous reasoning one can conclude that faster vesting schedules are better for long-term token valuations. Under the given scenario this is true, but in reality there are many more factors, such as community sentiment, that need to be accounted for. Strong token devaluations are rarely associated with good market perceptions and therefore can even lead to long-term damage to the protocol’s image ultimately leading to less adoption. Even though the protocol can’t control the market conditions and forces along with the actual demand for the token, there are factors that can be controlled, such as the vesting design.

Conclusion

The above discussion and case study shows that there are no perfect static vesting schedules that account for all the influencing aspects, such as early investor and contributor interests, in-market participant interests, fairness, investability, sustainability, token stability, and appropriate incentivization. Every vesting schedule is a compromise.

The macroeconomic QTM simulation indicates the difference of slow and fast vesting schedules regarding token valuations and volatility. We acknowledge that this is not an accurate forecast of the future as the model is of static and deterministic nature,3 but it supports the expectation that slower vesting tends to cause less volatility compared to fast vesting. Even though the simulation shows higher token valuations long-term in the fast vesting scenario, it does not account for a potential reputational damage for the protocol once the early in-market investors and token holders lose significant amounts of $-denominated value.

Another dimension for the vesting schedule design should not be underestimated which is the complexity and sophistication level for the vesting schedule implementation. In the author’s opinion the most beneficial vesting happens in line with the actual demand and adoption of the protocol as it benefits all participants – even the early investors. However, such advanced approaches require careful engineering and a clean execution on-chain, which may not be achievable for all early and especially smaller Web3 startups.

In case a protocol doesn’t have the capacity for more advanced approaches there are still good practices that can be applied to traditional static vesting schedules to design them more beneficially for the token economy that are:

- Vesting schedule designs as a counterpart to the protocol growth roadmap

- No tokens emissions into the market without any utility and fundamental demand for them

- Web3 businesses run through 3 phases: building, scaling, and saturation. Most tokens should start getting emitted in the scaling phase and not in the building phase. Matching the cliffs and vesting durations accordingly is key.

- Postponed vestings via cliffs and longer durations need to be explained well to early investors. Eventually they will benefit from less aggressive vesting schedules as they provide breathing room for better product adoption and therefore more counter parties to their profit realizations.

- Perfect vesting schedules do not exist and more engineering resources should only be allocated on advanced designs if the Web3 business has the capacity for it. Therefore finding an appropriate compromise between the above discussed aspects is important.

Outlier Ventures – a strong partner for your Web3 business

Outlier Ventures (OV) empowers crypto start-ups to become successful through holistic expert advisory, networking, and fundraising. Their token economies department provides guidance for NFTs, token design, and token engineering. It leverages powerful tools, such as token design workshops and quantitative token models, to forecast the business idea of Web3 teams or to review and finalize their own token design and model. Applications for OVs’ Base Camp Accelerator for brand new start-up teams or our Ascent program for advanced teams that are about to launch a token are open. Visit our website for more information: https://outlierventures.io/.

- This publication contains also some statistics on vesting cliffs and durations. ↩︎

- See the GitHub repository UI settings for the exact numbers. ↩︎

- Token economies are complex, non-linear, and chaotic systems by nature. The QTM can only provide deterministic approximations under given input scenarios, but still is capable of producing plausible results that help in the understanding of the macroeconomic dynamics of a Web3 protocol. The latest radCAD QTM implementation is open source and the contributors are working on refinements and to implement more realistic and sophisticated agents along with optimization and parameter search algorithms. Anyone is welcome to contribute and to use the model under the given GPL-3.0 open source license. ↩︎