Web3 native teams often ask themselves whether they should issue an NFT or a fungible token. Both of them are valid paths, depending on what they want to achieve at that stage of the project. There are distinct benefits and challenges for both of these options: Fungible tokens have the benefit of not requiring a well-thought-out rarity and trait distribution, artistic elements, etc. They are ideal for implementing token based mechanisms for value capture, distribution of ownership, and resource allocation. On the other hand, since they tend to be more liquid, price volatility also tends to be more significant and therefore, token distribution over time (and the resulting supply dynamics) needs to be managed carefully.

NFTs tend to fluctuate less because they are less liquid, but in order to be successful, rarity, traits, artistic elements, and utility need to be strong (all of which take work). NFTs are ideal for bootstrapping a community and allowing members to create an on-chain identity.

<Not sure whether a token is right for you? Read this explainer first>

It is important to note that fungibility can be thought of as a spectrum: Whereas fungible tokens (i.e. ERC20 or equivalent standards on other blockchains) are entirely fungible, NFTs can also be more or less fungible. For example, a popular pattern for NFT projects has been to launch access passes (e.g. Metakey), which all grant access to the same utility and generally are only different in their serial number, so they are relatively fungible. On the other hand, PFP projects or generative art NFTs are totally unique, so not fungible at all. The fungibility of unique NFTs can also be increased by fractionalization (e.g. Fractional), since this allows increased liquidity and removes entry barriers (no need to buy the “whole” NFT). Finally, removing creator fees (e.g. approaches taken by Sudoswap and Blur) remove friction for trading and therefore increases fungibility.

Combinations of NFTs and fungible tokens

Since there are benefits and challenges to both options, combinations of them seem very interesting.There is a trend of NFT projects launching fungible tokens to better distribute value and ownership, and fungible token-based projects launching additional NFTs to engage their community. Examples include YFI, Gitcoin, and BAYC – all of which have both launched NFTs and fungible tokens. In the long run, many projects could end up having both NFTs and fungible tokens because of their relative benefits.

Some common patterns of how NFTs and fungible tokens can be combined:

- Drop an NFT first to help galvanize a community around a product or protocol, launch a fungible token later to capture value and distribute resources more efficiently

- Fungibles embedded in NFTs, e.g. Charged Particles, Aavegotchi, Hashmasks

- Patterns we expect to become more common in the future

- NFTs for access to fungbile token rewards

- Weaker version: NFTs as multipliers or discounts on mechanisms based on fungible tokens

Note that an NFT drop needs to be accompanied with marketing and community building activities, a drop is not sufficient in itself for bootstrapping a community. In general, both NFTs and fungible tokens are best used to support a strong product or ecosystem, they are not the product themselves.

When combining both of these instruments, it is important for projects to ensure incentive compatibility between holders of NFTs and fungible tokens and avoid cannibalization of utility between the two instruments. It is best practice to lean into what each instrument is best at, for example in the following manner:

- Launch an NFT first to galvanize the community, and draw in power-users by offering product benefits tied to NFT holding (potentially even with multiple tiers of benefits).

- Capture value in a fungible governance token, but airdrop it to NFT holders based on their NFT and behavior (from rarity to trading history/holding behavior).

- Use NFTs as modifiers for token based mechanisms, e.g. discount on fees for NFT holders or multiplier on governance power or rewards in fungible tokens.

Fluf World has been progressively building out its own Metaverse based on a similar approach. Note that there is a lot of optionality in how exactly NFTs and fungible tokens are combined, as well as in the roadmap of what launches when. The three-step process above is just one of many options. Over time, we will see more concrete “playbooks” emerge.

The missing piece: Reputation needs to be non-transferable

For the emergence of full token economies and autonomous DAOs, there seems to be a missing piece in the explorations above: Non-transferable assets. Especially for contexts where users are building a persistent reputation or are granted access based on prior contributions, it seems important that these credentials can’t be transferred or sold. These assets could either be not transferable at all, or transferable only by social contracts (e.g. for purposes of recovery or for roles assigned by a DAO). A recent paper from Vitalik proposed a potential solution with “soulbound tokens”, and there are interesting alternative approaches built on off-chain, non-transferrable credentials like Disco.

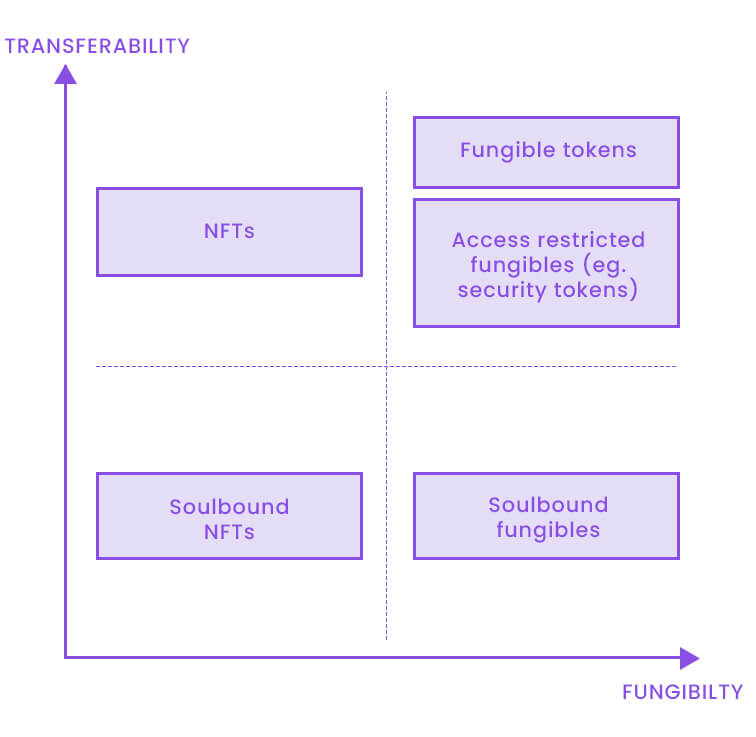

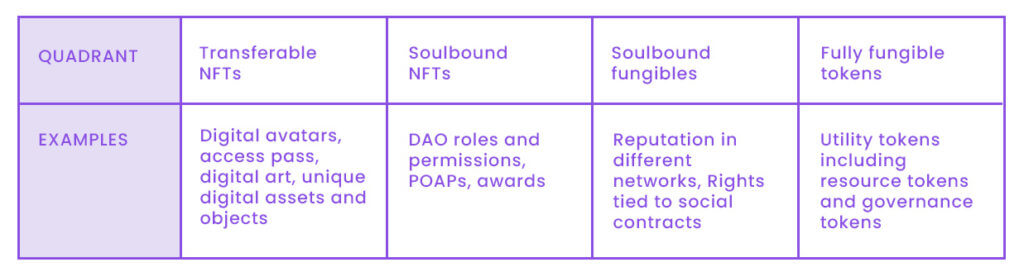

This dimension of transferability completes the “fungibility spectrum” described above, resulting in a 4-quadrant matrix with the dimensions of fungibility and transferability.

Find some examples on what different functions could be mapped by these different quadrants below:

We are seeing the first projects incorporate non-transferable assets: Crucible/Open Meta is building reputation based systems for guilds building infrastructure for the open metaverse. Colony has integrated a notion of non-transferrable reputation at the heart of their DAO operating system. Non-transferrable reputation allows for measuring a community member’s contributions over time, which could be a better basis for distributing decision-making power than mere token holdings.

The space of non-transferrable tokens is still emerging. Once these novel primitives become more established and we have the full quadrant of transferability in place as building blocks, we are likely to see what patterns mature digital native organizations will adopt. Because of the trade-offs between them, it is likely to involve a mix of several, if not all of the types of tokens, just like we are now observing on the dimension of fungibility. We expect that non-transferrable reputation & identity, which are still missing in most current token economies, will be one of the driving forces that will tie together different instruments like NFTs and fungible tokens. These elements will also be crucial for more advanced governance models that are built on meritocratic principles rather than the capital (=token holdings) of community members.

Jan joined Outlier Ventures as one of the first token designers after going through Basecamp #2 as a founder and is now in a domain leadership role as a token design manager. He has worked with over 50 teams on their token designs throughout his time at OV and is an active advisor and investor in many web3 companies. Before joining OV, Jan founded Superlinked with a senior engineer he met while working at Google. Jan studied economics at HSG St Gallen, where he wrote his thesis on tokens in 2016.