Web3 fundraising in 1H25 reached $17 billion across 773 disclosed deals, the strongest half since early 2022. Yet deal count fell to multi-year lows, less than half the total recorded in 1H24. This divergence confirms a structural shift: Web3 venture capital is no longer defined by broad coverage, but by conviction and concentration.

Author: Robert Osborne | X | LinkedIn | Substack

The article builds on Outlier Ventures’ 1Q25 and 2Q25 reports, while situating the data within wider market analysis. Reports from Wintermute, Unchained, Hackernoon, Paul Veradittakit and QCP provide additional perspective on capital flows, treasury strategies, and institutional positioning in the first half of 2025.

Market Overview: Web3 Fundraising in 1H25 Shows Larger Allocations

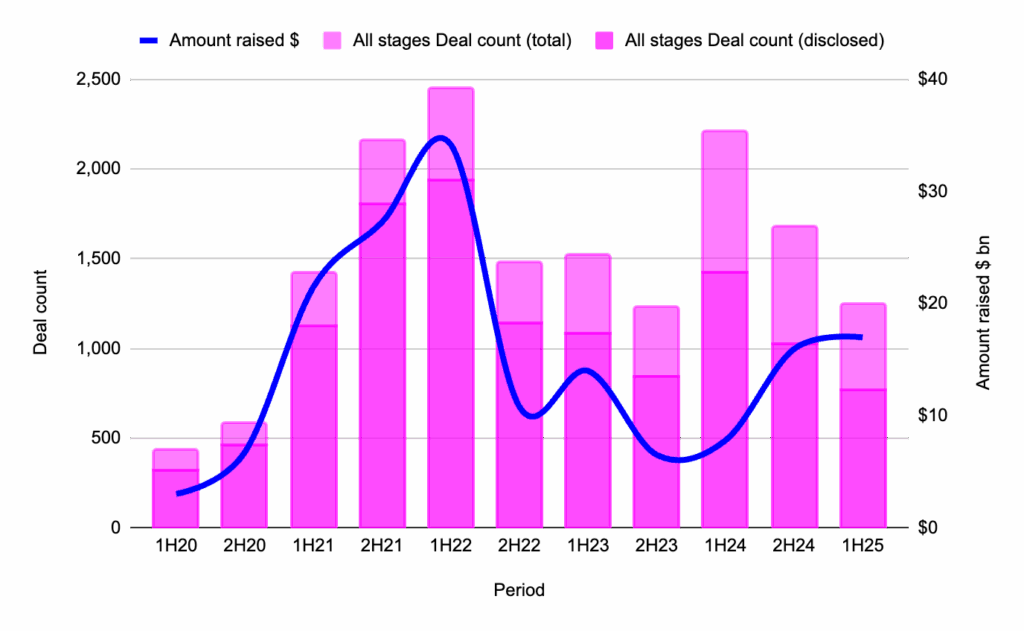

In historical context, the rebound in Web3 fundraising in 1H25 is striking. The total capital deployed sustained rough parity with 2H24, reaching $17 billion, and was double that of 1H24. At the same time, the number of disclosed deals fell to just over 1,250, the lowest half-year count since the early pandemic period.

Figure 1: Web3 Deal Count at all stages and Capital Fundraised, from 1H20 to 1H25. Source: Outlier Ventures, Messari.

Hackernoon’s State of Crypto 1H25 report described the period as one of resilience. Within the fundraising market, that resilience was not due to widespread participation but to deeper concentration in high-conviction rounds.

Early Stage Web3 Funding: The Sharpened Barbell

The recalibration of early stage activity in Web3 fundraising in 1H25 continued.

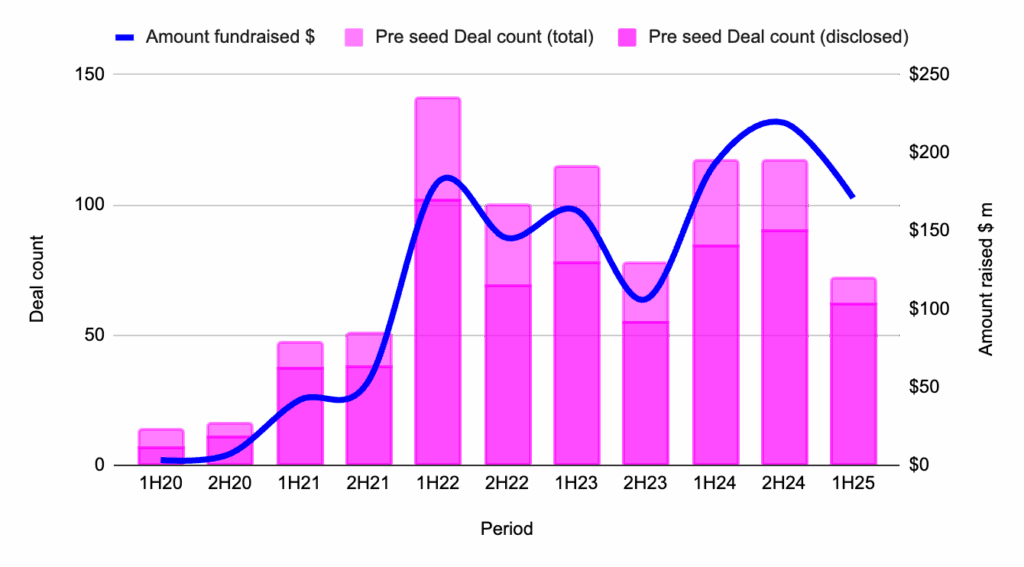

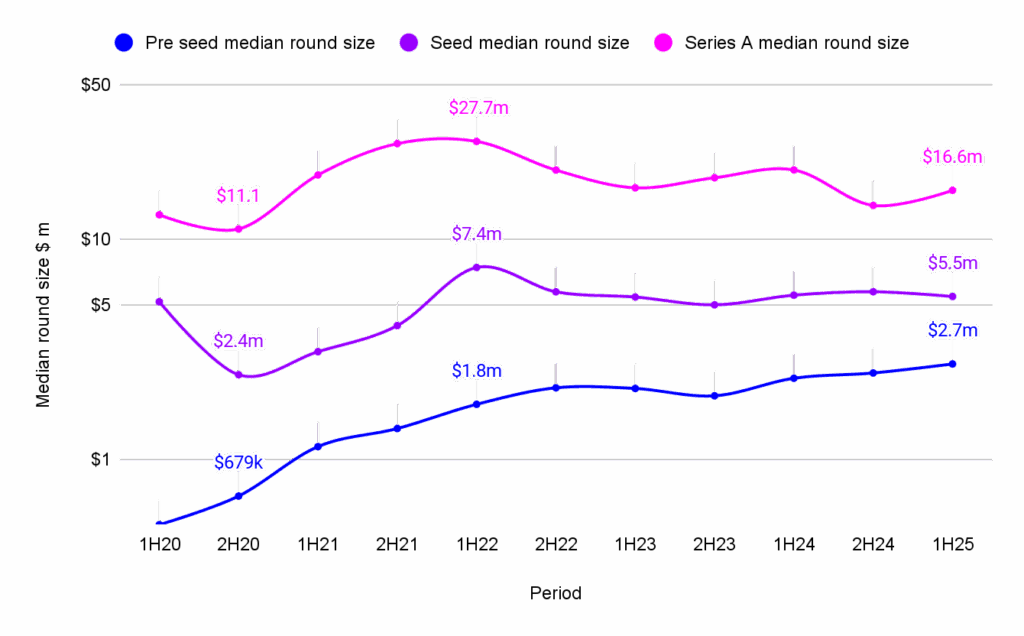

Pre-seed deal activity declined to just 62 disclosed rounds, down from 90 in 2H24 and far below the 102 recorded in 1H22, which was the all-time high. Despite this lower volume, the median pre seed round reached a record $2.7 million, the highest it has ever been. This has been supported by ecosystem treasuries, angels, and accelerators aligned with narratives such as DePIN and agentic infrastructure.

Figure 2: Web3 Deal Count at pre seed stage and Capital Fundraised, from 1H20 to 1H25. Source: Outlier Ventures, Messari.

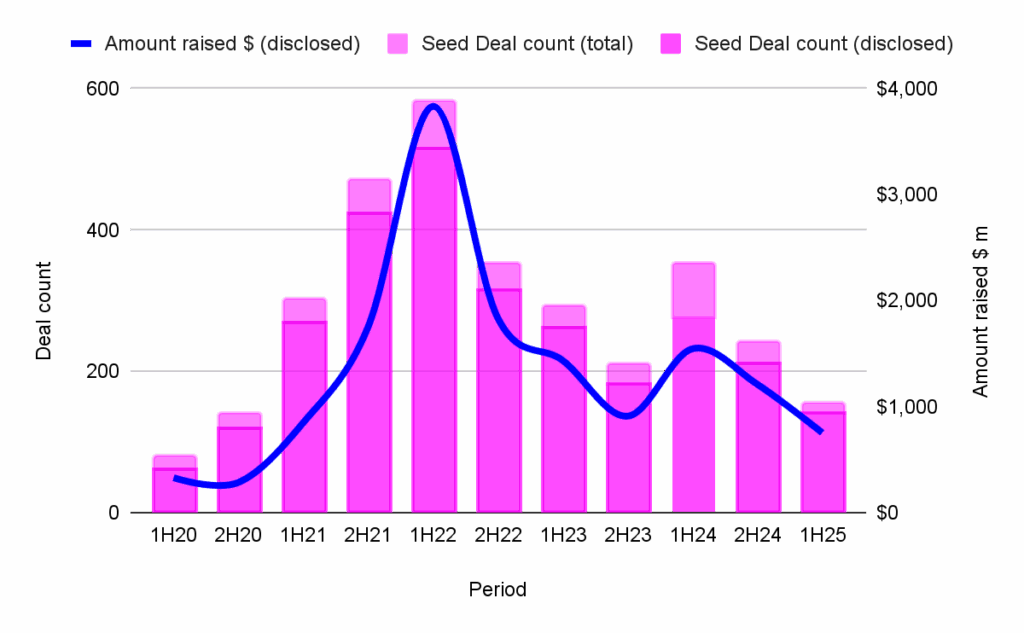

Seed-stage activity declined over the 18 months since 1H24. In 1H25, 142 rounds raised more than $800 million. Median deal size since 1H24 has remained more or less stable with it averaging $5.5 million in 1H25. With less capital fundraised and fewer deals, it suggests that those investors that are still deploying do so with conviction despite the wider venture market downturn at seed stage.

Figure 3: Web3 Deal Count at seed stage and Capital Fundraised, from 1H20 to 1H25. Source: Outlier Ventures, Messari.

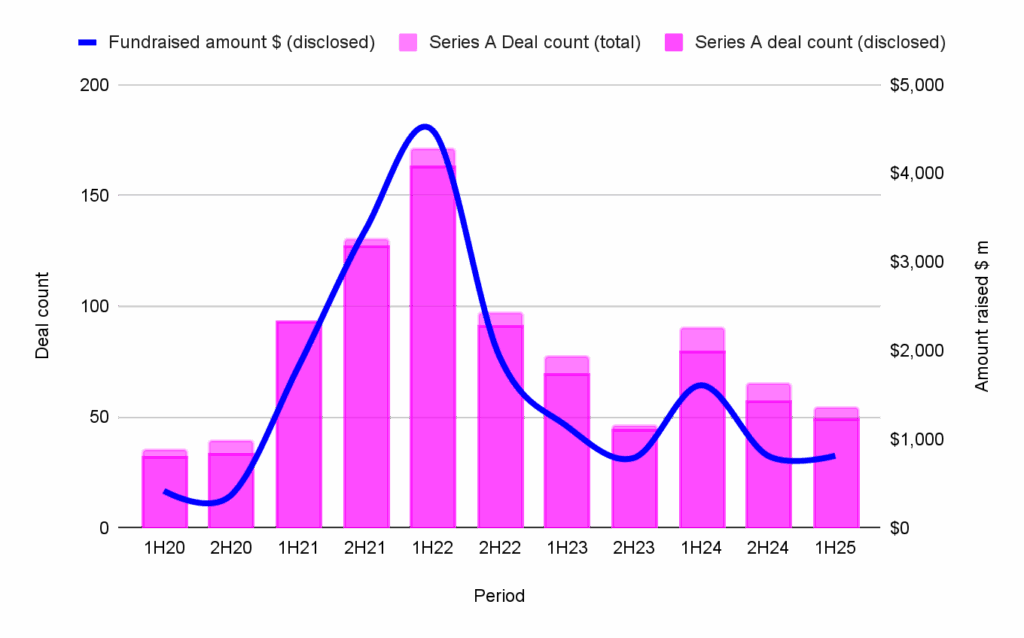

Series A was the only early-stage category that saw no meaningful change in capital raised from 2H24 to 1H25. This, alongside a decrease in the disclosed deal count from 57 to 49, saw the median Series A round increase to $16.6m, which was 17% larger than 2H24. Investors directed this capital to companies with proven product-market fit, early revenues, and integration into larger ecosystems.

Figure 4: Web3 Deal Count at Series A stage and Capital Fundraised, from 1H20 to 1H25. Source: Outlier Ventures, Messari.

Selection over spread in Web3 Fundraising in 1H25

Together, these dynamics reinforce a trend in Web3 venture capital: strong conviction at the early idea stage and later scale-up stage, with less activity in the middle. Wintermute’s OTC flow data for 1H25 reflects a similar divide. Institutions concentrated in BTC, ETH, and structured products, while retail rotated into memecoins and altcoins. Both fundraising and trading showed polarisation between high-security and high-risk bets.

Figure 5: Web3 median round sizes at pre seed, seed and Series A stages, from 1H20 to 1H25. Source: Messari, Outlier Ventures.

Infrastructure continues to lead in Web3 Fundraising in 1H25

Infrastructure categories absorbed the largest share of Web3 fundraising in 1H25, extending a trend that began in 2023. The biggest median rounds went to cryptocurrency infrastructure, mining and validation, and compute networks.

Developer tooling remained active but with smaller cheque sizes, often supported by grants or token incentives. Consumer-facing categories such as marketplaces, financial services, and entertainment showed little momentum. Gaming, once a leading vertical, was subdued.

As noted in ‘Web3 Fundraising in Focus: The Truth Behind Consumer vs Infra Investment’, during the peak activity of 2021-2022 consumer-facing projects raised more capital than their infrastructure counterparts. Under the current market conditions, the investors with conviction that continue to deploy capital are shifting their attention from those more speculative plays. Instead, infrastructure investments provide a better risk-reward analysis, particularly the 1H25 market where there are fewer token launches.

Unchained’s analysis of treasury strategies offers further context here. Treasuries are increasingly focused on yield optimisation, aligning closely with infrastructure-heavy models rather than speculative consumer plays. This reinforces why infrastructure continues to capture the majority of large rounds.

Token Fundraising in 1H25: Public vs Private Divergence

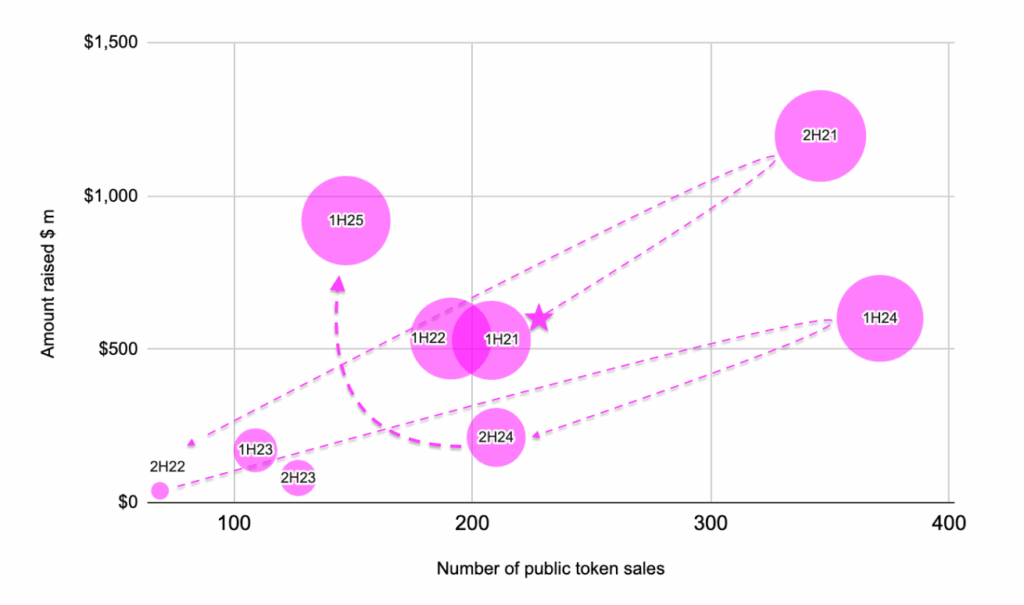

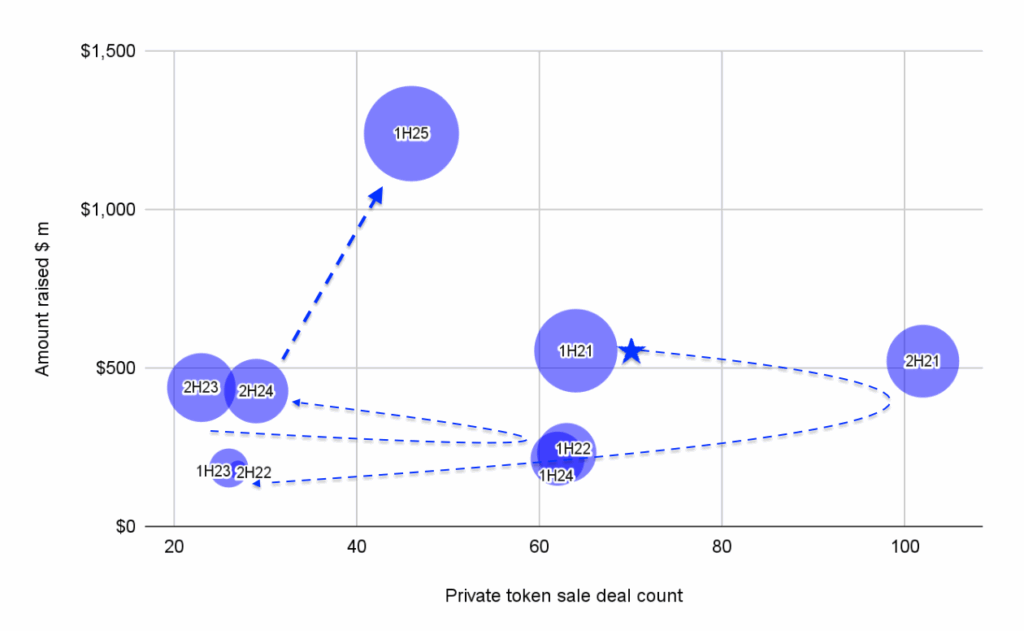

Web3 token fundraising in 1H25 highlighted a sharp divergence in public and private token sales.

In 1H25, 147 public token sales raised $920m. However, these public token sales were not spread evenly across the two quarters. In 1Q25, public token sales surged to $798 million across 112 events, the strongest quarter since 2022. This was skewed by World Liberty Financial’s $590 million raise, but even excluding that outlier, activity exceeded any quarter in 2024. These sales combined fundraising with brand-building, targeting retail investors during a brief wave of optimism. By 2Q25, public token sales fell by 83 percent to $134 million across 35 events, with median sizes halving.

Figure 6: Number of public token sales and amount raised, from 1H21 to 1H25. Source: Messari, Outlier Ventures.

Private token sales remained steadier. In 1Q25, $829 million was raised across 30 disclosed deals, almost half of which was led by ecosystem-scale initiatives from the TON Foundation. In 2Q25, $410 million was raised across fewer but larger deals. These allocations targeted validator networks, Layer 1 ecosystems, and protocol governance. Whilst there was a decline from 1Q25 to 2Q25 in private token sales, it was not nearly as shocking as its public token sale counterpart during the same period.

Figure 7: Number of private token sales and amount raised, from 1H21 to 1H25. Source: Messari, Outlier Ventures.

This divergence demonstrates the maturing of token fundraising. Public sales remain important for visibility and liquidity, but significant capital is increasingly deployed through private allocations. Wintermute’s OTC flow data mirrors this pattern: institutions concentrated in major assets while retail focused on short-term speculation.

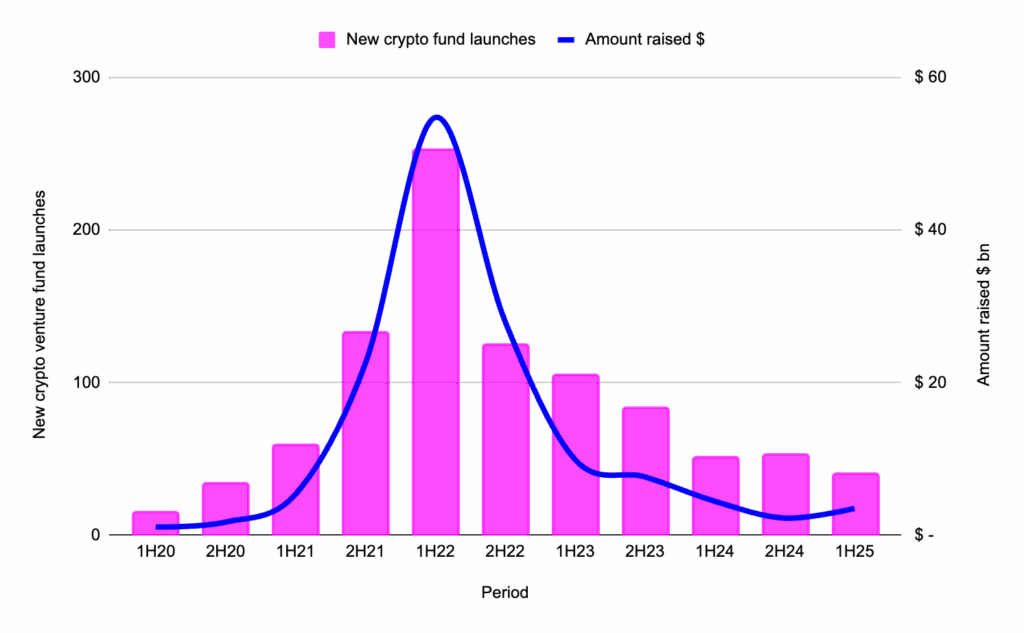

Web3 Fund Formation in 1H25: Larger Pools, Fewer Launches

The downward trend of fund formation activity in Web3 fundraising since 2H22 has continued into 1H25. Whilst the total number of new funds from 2H24 to 1H25 decreased from 53 to 40, the total capital raised increased from $2.3 billion to $3.5 billion during the same period.

This uptick in capital raised shows a slow return to early-stage Web3 and a conviction focused approach. Until there are significant new injections of capital into the venture capital market, early-stage Web3 fundraising will remain focused and conviction driven.

Figure 7: Number of Web3 venture capital funds launched and the amount raised by these funds, from 1H20 to 1H25. Source: Messari, Outlier Ventures.

The larger funds that did close in 1H25 included Foundation Capital’s eleventh fund ($600m), dao5’s second ($222m), and Galaxy Ventures’ debut ($175m). These vehicles reflect the recalibrated priorities of the venture market. Many are specifically targeting early-stage opportunities at the intersection of AI and crypto, real-world asset tokenisation, and payment infrastructure.

Veradittakit’s State of Crypto Venture Capital in 2025 interpreted this trend as evidence of a stronger and more selective market. Several adopted trans-stage mandates, offering support from pre-product through Series A and beyond, suggesting investors are prioritising flexibility in exchange for access to high-conviction projects.

Stablecoins and Treasury Power

Stablecoins were a key enabler of Web3 fundraising in 1H25, shaping liquidity flows across the ecosystem. QCP reported an 18 percent increase in stablecoin market capitalisation to $234 billion, with transaction volumes on track to surpass Visa within a decade. Real-world assets tokenised on-chain exceeded $25 billion, with BlackRock’s BUIDL alone holding $2.9 billion.

These flows show how stablecoins are now central to capital formation, supporting both TradFi integration and DeFi experimentation. Unchained’s analysis shows how treasuries are using stablecoins for yield optimisation, showing their role as the lifeblood of the Web3 ecosystem.

Partner with Outlier Ventures

If there’s one clear signal from the data, it’s this: early-stage capital hasn’t vanished, it’s become more selective. Outlier Ventures has a proven track record of navigating the early-stage Web3 venture capital market with 11+ years of experience, 45+ cohorts completed, and now almost 400 portfolio companies.

We empower startups with guidance from our in-house experts, mentorship, and resources, fostering innovation in the future digital economy. De-risking investments for partners and readying founders for future capital raises.

Recent partners & friends: Morgan Creek, Borderless, peaq Network, 1kx, Midnight Foundation, and are currently recruiting for our Injective Ecosystem Cohort.

Final Reflections on Web3 Fundraising in 1H25

Web3 fundraising in 1H25 confirmed that the market has entered a more disciplined phase. Capital deployment reached $17 billion, the highest since early 2022, but deal count dropped to multi-year lows. The result was a clear preference for fewer, larger, conviction-driven rounds.

Early-stage activity reflected a sharpened barbell: selective pre-seed and seed investments alongside a modest Series A activity. Infrastructure categories once again absorbed the bulk of funding, while consumer-facing projects remained subdued. Token fundraising split sharply, with public sales declining and private allocations holding steady, underscoring the growing importance of alignment over hype.

Fund formation slowed in volume but produced some large vehicles focused on AI, real-world assets, and payments. Meanwhile, stablecoins continued to expand as the liquidity base supporting both traditional and decentralised finance.

Founders can still raise capital, but the bar is higher: investors are concentrating on the challenge of sourcing projects with proven traction, strong infrastructure relevance, and durable token or treasury models. In this environment, conviction, not coverage, remains the defining feature of Web3 venture investment.