One of the key VC insights from Token2049 Singapore 2025 was that global investors are rethinking venture capital allocation in the post-hype cycle. Token2049 Singapore remained one of the largest crypto gatherings of the year: energetic, globally attended, and deeply pragmatic in tone. Conversations focused less on speculative growth and more on structure, liquidity, and institutional alignment, reflecting a broader recalibration across Web3 venture capital.

Regional Shifts and Market Sentiment: Key VC Insights from Token2049 Singapore 2025

Compared to previous editions, there was a noticeable regional rebalancing of attention. Anecdotally, many attendees appeared to prioritise Korea Blockchain Week over Singapore this year. This shift mirrors both growing enthusiasm in South Korea and changes in regional regulation. South Korea continues to formalise its virtual asset framework, clarifying rules around custody, taxation, and investor protection. Meanwhile, Singapore’s Monetary Authority has expanded its licensing regime, requiring even offshore-facing crypto firms to register locally.

The result is a more structured environment: South Korea signalling openness within defined parameters, and Singapore tightening its filters to ensure long-term stability. These dynamics formed part of the background for Token2049 Singapore 2025, shaping both conversation and tone.

Market Discipline and VC Maturity: What Token2049 Singapore 2025 Revealed

Beyond regional nuances, the VC insights shared at Token2049 Singapore 2025 reflected a growing market maturity. The speculative optimism of earlier cycles has evolved into pragmatic realism. Token2049 Dubai earlier in the year first hinted at this sentiment, but Singapore confirmed it: the ecosystem is recalibrating around data-driven decision-making.

At Outlier Ventures, this shift is viewed not as contraction but as evolution. It is a move toward the same evidence-based discipline that has guided our approach for over a decade. Data now underpins conviction, replacing hype with informed selection.

Capital Concentration and Later-Stage Dominance

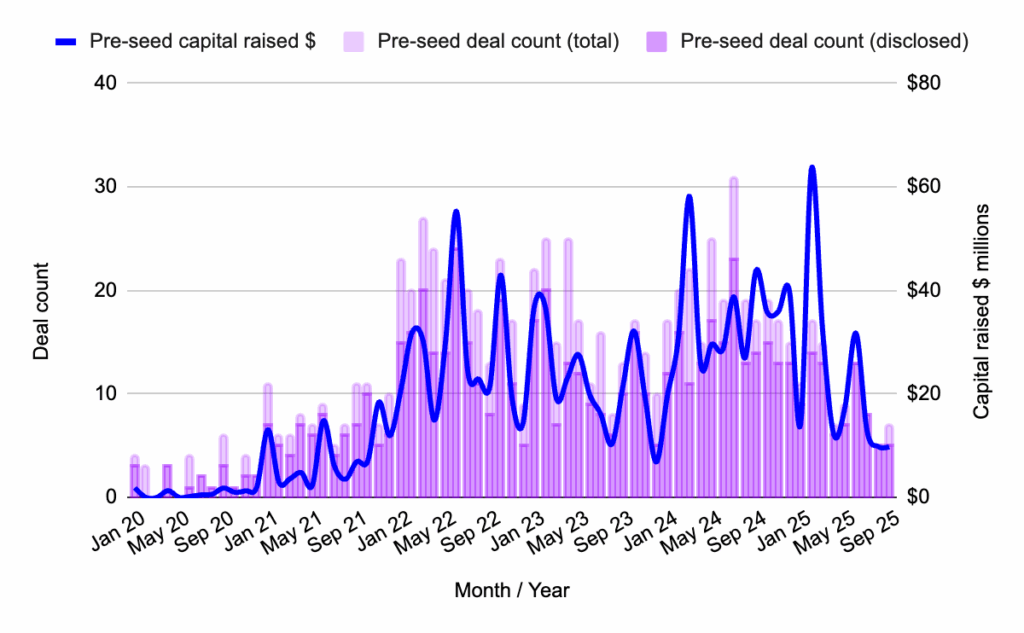

Prior to Token2049 Singapore 2025, Outlier Ventures’ analysis of Web3 fundraising data already indicated a slowdown in pre-seed to Series A allocations. Later-stage rounds, however, continued to capture investor focus. Conversations with VCs at the conference confirmed this shift: fewer early-stage deals, but larger average round sizes at Series B and beyond.

Figure 1: Percentage of total capital deployed across pre-seed + seed, Series A, and Series B+ stages, 1Q22 to 3Q25. Source: Messari, Outlier Ventures.

One factor driving this dynamic is fund deployment timing. Many vehicles raised during the 2020–2021 boom are now fully allocated, with GPs focusing on managing winners and exits rather than new bets. The lack of fresh fund launches since that peak period has reinforced this trend. Yet conviction remains: investors are still backing resilient founders who can show usage, traction, and revenue growth through market cycles. We see this reflected daily across our portfolio, where founders are building through the cycle rather than waiting for it to turn.

Data-Led Investment and Liquidity Management

Another VC insight from Token2049 Singapore 2025 was that General Partners (GPs) of funds now have a clear advantage they lacked four years ago: data. GPs now possess far more information about which portfolio sectors have demonstrated resilience, which founders have delivered real growth, and which categories have outperformed. Redeploying into existing winners is no longer defensive, it’s rational.

Some GPs have even developed OTC trading capabilities or internal liquidity teams to enter positions they previously missed. This evolution reflects a broader industry shift toward precision investing. At Outlier Ventures, data remains central to this approach. Our repository of benchmarks and traction metrics, gathered over more than a decade of accelerator operations, allows venture partners to allocate capital with greater clarity and conviction.

Figure 2: Number of Web3 venture capital funds launched and the amount raised by these funds, from 1Q20 to 3Q25. Source: Messari, Outlier Ventures.

From Momentum to Maturity: VC Insights

In addition to this, many investors at Token2049 Singapore 2025 openly reflected on lessons learned from recent cycles. The industry has matured through successive phases, moving away from high-risk bets driven by narrative momentum toward projects that can demonstrate measurable traction, revenue growth, and solid fundamentals. The speculative reflex that once defined early Web3 investing has now given way to a more data-driven discipline, a theme echoed throughout Token2049 Singapore.

For many Web3 venture capital funds, this maturity has been hard-earned. Overexposure to thematic hype, and disappointment with the performance of certain token launches, has shifted the true value of portfolios toward their equity holdings. As a result, exit opportunities have lengthened, reinforcing a more patient, evidence-based investment mindset among leading investors. This transition, as discussed at Token2049 Singapore, marks a fundamental shift from momentum trading to fundamentals-based conviction.

Figure 3: Joy Sim, Ecosystem Manager at Outlier Ventures (centre-left), speaking at Sonic Summit, Token2049 Singapore 2025.

The goal, therefore, has been to better manage the liquidity recovered from prior market cycles. This renewed discipline has reduced appetite for illiquid early-stage exposure. Instead, investors are increasingly balancing their venture portfolios with liquid assets and yield-generating protocols. These strategies act as hedges against market volatility and ensure that capital remains productive. At Token2049 Singapore 2025, several discussions underscored this trend, highlighting how liquidity management has become a core pillar of fiduciary responsibility within the Web3 venture ecosystem.

Digital Asset Treasuries (DATs): Liquidity as Strategy at Token2049 Singapore

Liquidity management emerged as one of the defining VC insights from Token2049 Singapore 2025, reflecting a clear shift in how funds approach capital efficiency. This is why Digital Asset Treasuries (DATs) featured so prominently on stage and in side discussions (the term “DAT Revolution” was even used). Initially framed as an institutional bridge between TradFi and crypto, DATs have evolved into flexible instruments for short-term capital efficiency. Their growing adoption underscores the same maturity seen across the market, an emphasis on flexibility, transparency, and measured deployment rather than unbounded risk.

However, this evolution is not without trade-offs. The more capital allocated to DATs, the less remains available for early-stage startups. In this sense, their success could indirectly extend the early-stage funding squeeze. Still, DATs should not be dismissed as another passing narrative. Their rise reflects a genuine need for liquidity, optionality, and responsible treasury management, a sign of financial sophistication rather than speculation.

LP Expectations and VC Fundraising Headwinds

Raising new Web3 venture capital funds has become increasingly demanding. Limited Partners (LPs) are applying stricter evaluation criteria, focusing on realised returns, transparency, and governance. One of the central VC insights from Token2049 Singapore 2025 was that this scrutiny signals a maturing market rather than fading investor interest. New funds will emerge, but closing them will take longer and require greater proof of discipline and data-backed performance.

At Outlier Ventures, this recalibration aligns with our own role as a bridge between institutional capital and early-stage innovation. Drawing on over a decade of data and founder performance benchmarks from nearly 400 portfolio companies, we collaborate with VCs, LPs, and ecosystem partners to surface high-quality opportunities grounded in verifiable traction and long-term conviction.

Founder Perspective: Fundraising and Credibility

As discussed throughout Token2049 Singapore 2025, founders are adapting to this new environment with sharper focus and greater realism. Bootstrapping and revenue-first models have become the standard. Market participants now expect meaningful traction before capital. Many founders we spoke to at the event shared a common view: narrative can attract attention, but performance sustains it.

Traditional fundraising mechanisms such as KOL rounds or hype-driven launchpads have largely faded. However, new routes are emerging that prioritise transparency, liquidity, and community trust. For example, platforms like Virtuals and Hyperliquid have gained traction with fair launch models, offering projects a transparent, market-driven entry point. Meanwhile, community-led token rounds through networks like Echo, Coinlist, and Legion continue to grow. These models align investors, early adopters, and users through shared long-term incentives, signalling a healthier and more sustainable path to capital formation in the Web3 ecosystem.

A Recalibration with Purpose for VCs: final thoughts on Token2049 Singapore 2025

Taken together, the VC insights from Token2049 Singapore 2025 highlight a venture ecosystem entering a phase of deliberate transformation. The industry is not contracting, it is maturing. Investors are balancing liquidity and long-term conviction, LPs are demanding clearer metrics and governance, and founders are adapting to a higher standard of validation before raising capital.

DATs and later-stage concentration may limit early-stage activity, but they also illustrate a market that is learning from experience and refining its discipline. Token2049 Singapore 2025 captured this shift in sentiment: less spectacle, more substance; less momentum, more measurement.

The overarching message is clear. Liquidity discipline, operational maturity, and product-market fit have replaced exuberance as the new signals of strength. For experienced investors, data-driven funds, and resilient founders, this is not a downturn. Rather, it is a foundation for sustainable growth. The Web3 venture ecosystem is moving from narrative to necessity, and those prepared for this new standard will define its next phase.

VC insights from Token2049 Singapore 2025 from the Outlier Ventures team:

- Robert Osborne, Investor Relations Manger | X | LinkedIn | Substack

- Joy Sim, Ecoystems Manager | X | LinkedIn

- Christopher Calder, Head of Partnerships | LinkedIn

- Dimitrios Chatzianagnostou, Chief Investment Officer | X | LinkedIn

Recruiting Now: Injective Ecosystem Builder Catalyst

Investors are backing sharper narratives, stronger infrastructure, and founders who know how to align with powerful ecosystems.

That’s exactly what the Injective Ecosystem Cohort is designed for.

Whether you’re building the next generation of DeFi protocols, unlocking cross-chain liquidity, or innovating at the edge of trading, derivatives, and decentralised infrastructure, we help early teams turn conviction into traction inside one of Web3’s most powerful ecosystems.

Applications are open now.