Storing digital copies (tokens) of real world assets on the blockchain has the potential to fundamentally change benefits and ownership tied to everyday assets. Increasingly explored by the financial industry, we believe tokenization of RWAs will have an impact on every single industry as blockchain technology diffuses across society over the next decade.

Executive Summary

A Tale Of Two Trends

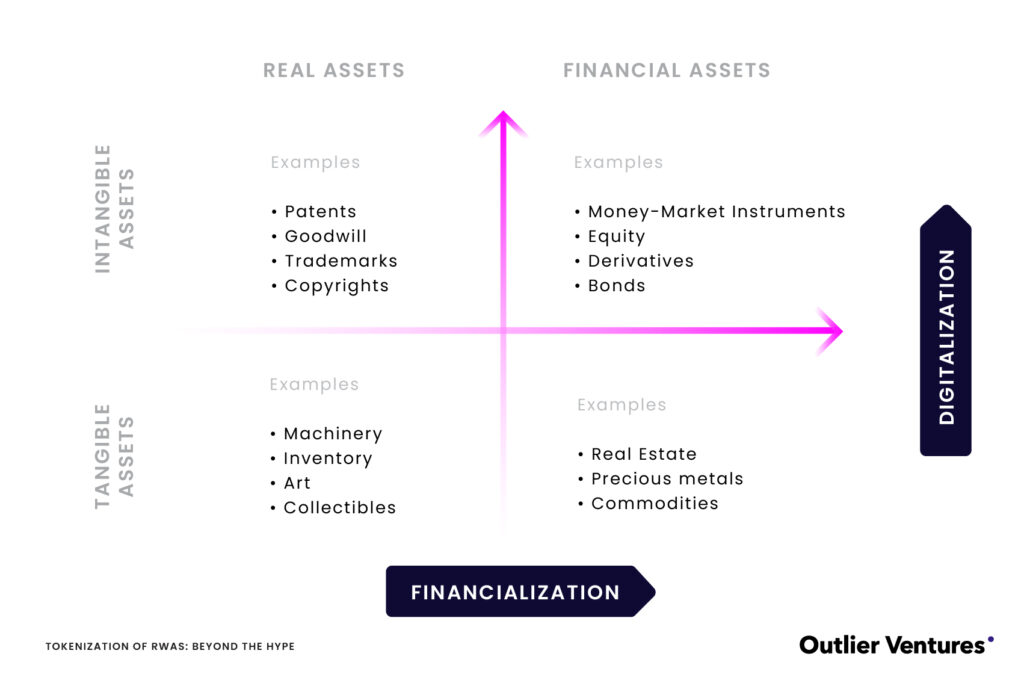

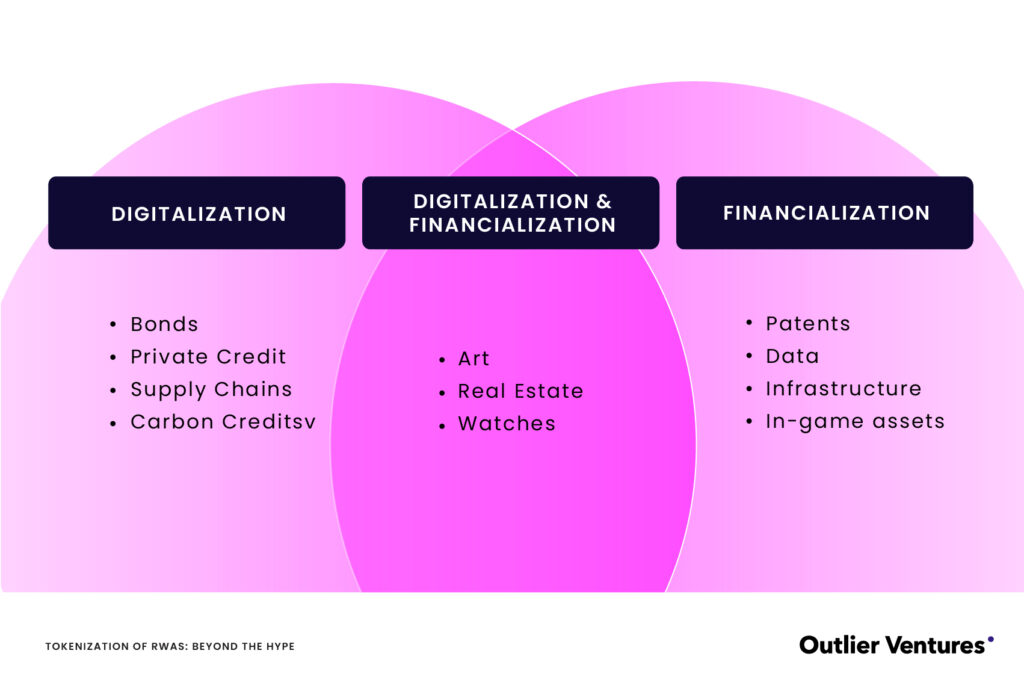

Tokenization is a tale of two trends, happening across two dimensions of real world assets (RWAs), namely the digitalization and financialization of RWA. (i) Digitalization is the transformation of physical assets into digital formats followed by further improvement in the way these assets are represented and used in a digital database. (ii) Financialization is the trend of turning real assets into financial instruments through the reengineering of cash flows and investment opportunities.

Both structural trends, now accelerated by blockchain-based tokenization, are reshaping RWAs. (i) Digitalization is driven by the blockchain’s ability to convert physical- into digital assets, while (ii) financialization leverages token programmability for innovative financial engineering. Our framework aims to demystify tokenization and its impact on digitalization and financialization of RWAs. Our goal is to equip founders and investors with a deeper understanding of the full potential of RWA tokenization.

The Time Is Ripe

Today’s excitement about tokenization of real-world assets (RWA) is quite different from the initial buzz in 2019-2020. We believe there are three key differences from previous cycles.

Firstly, the current landscape is marked by increased participation from financial players like banks, hedge funds, and asset managers, unlike the previous cycle which saw most excitement from retail investors. Today, these institutions bring substantial asset pools and deep expertise, speeding up the adoption of financial asset tokenization.

Secondly, technological advancements in blockchain have increased scalability, security, and interoperability, complemented by improved developer tools and standards. Major financial institutions are now piloting tokenization projects, a testament to their commitment and excitement about the innovation and possibilities of RWA tokenization.

Lastly, regulatory environments are evolving favorably for tokenization of real-world assets (RWA), with significant advances in digital asset regulation providing a solid framework for institutional engagement. A prime example is the UK’s Electronic Trade Documents Act, which aligns seamlessly with blockchain applications for RWA tokenization. Additionally, the emergence of transmission mechanisms like Central Bank Digital Currencies (CBDCs) and stablecoins fills previously existing gaps, enabling on-chain transaction settlements. The synergy of progressive regulation, technological advancements, and better transmission mechanisms is promising for the future adoption of RWA tokenization.

Unrecognized Potential

We believe the TAM for tokenized assets is undervalued in previous estimations and will hit $20 trillion by 2030. The total addressable market (TAM) for tokenization has been estimated to be between $10-15 trillion by 2023. We believe this is an underestimation and anticipate the true potential to be significantly greater. While the methodology used for these estimates seems reasonable, it is incomplete.

It fails to consider the potential increase in an asset’s value post-tokenization. The appreciation in value is a result of the creation of markets around tokenized RWAs. Having markets facilitates price discovery of previously illiquid assets. We believe this will lead to an increase in asset value as it can fall more easily into the hands of those appreciating the asset the most.

Another oversight in the methodology is the underestimation of tokenization’s ability to segregate different elements of assets. For instance, tokenization can segregate the carbon certificates from a piece of forest land. By doing so, it’s possible to create separate, liquid markets for these elements, leading to further price discovery and appreciation of specific parts of the asset.

A Look Ahead

We appreciate there is a lot of information in this document to digest, that’s why we provide two quick one-pagers below

Our Framework In A Nutshell

Tokenization of RWA feeds into two separate trends, making the net benefits difficult to asses. These trends are structural and have been playing out over the past decade. Tokenization of RWAs serves as a driver for the next leg of these two trends:

- Digitalization of assets – The transformation of physical assets into digital formats or the migration of already existing digital assets onto new infrastructure (ie. blockchain) to unlock even more benefits.

Tokenization examples – inventory, supply chain assets, financial products,…

- Financialization of assets – The process of turning any asset into a financial instrument by reengineering cash flows, investment opportunities and capital formation.

Tokenization examples – Data, intellectual property, in-game assets,…

As tokenization of RWA propels both financialization and digitalization of assets, we expect more assets to turn into intangible, financial assets over time.

The Benefits

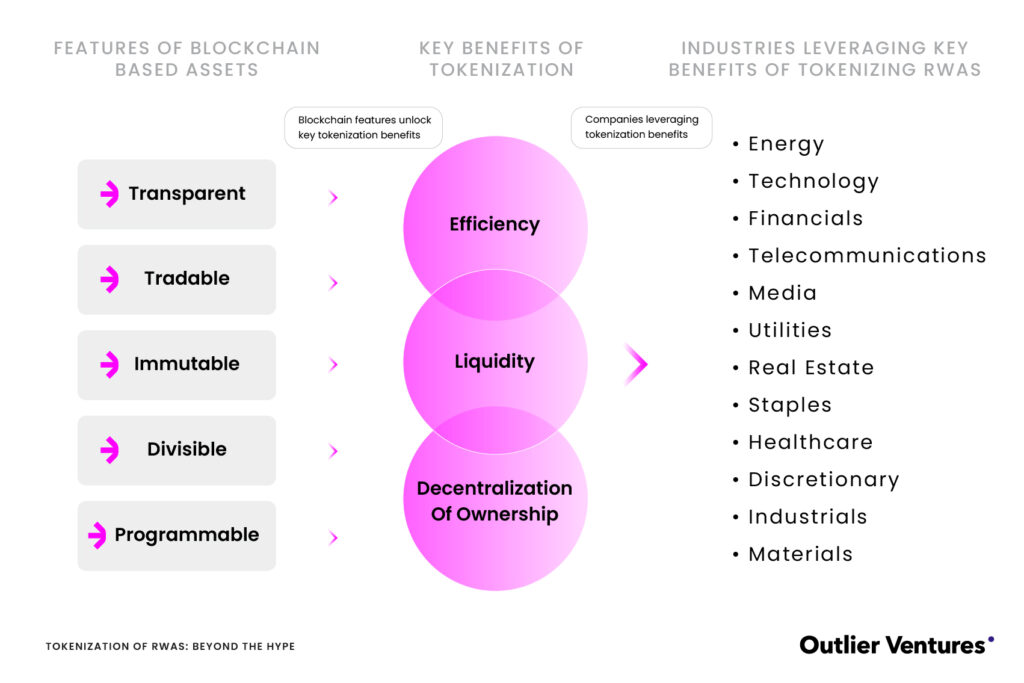

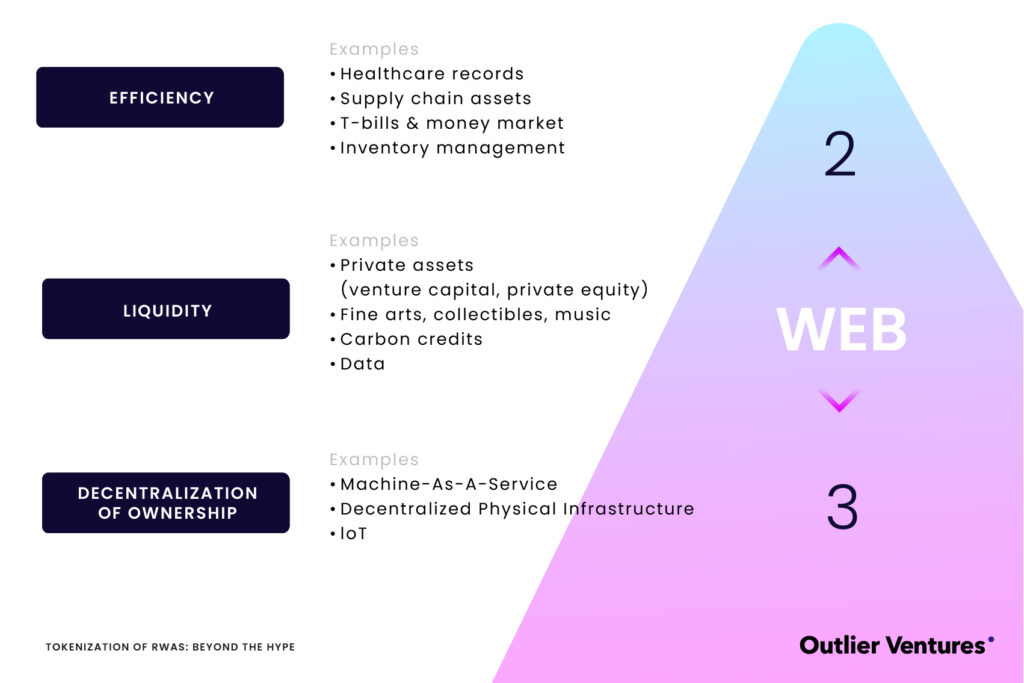

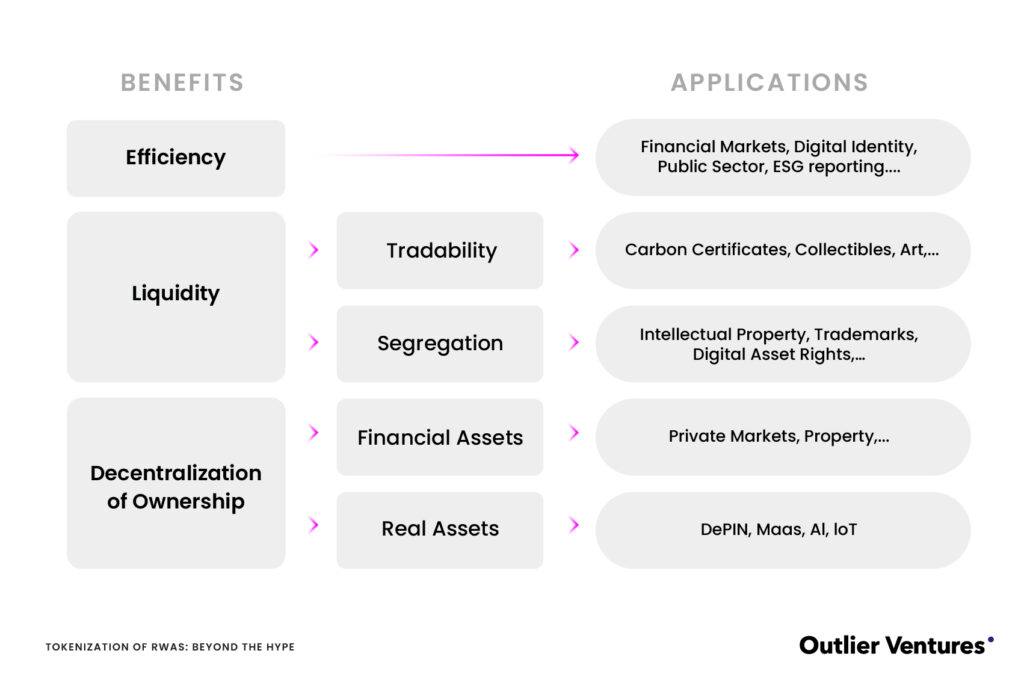

We believe through leveraging features of blockchain technology, tokenization unlock three key benefits:

- Efficiency – Improves existing processes and operating by improving transparency, traceability,… of the asset

- Challenges – Consortium formation

- Examples – Inventory management, trade finance, healthcare records, supply chain assets,…

- Liquidity – Allows assets to change ownership in a transparent and structured way and for marketplaces to be created around the asset.

- Challenge – Liquidity splintering

- Examples – Venture capital, fine art, collectibles, music, retail property, carbon credits,…

- Decentralization of Ownership – Allows distribution of asset ownership in a transparent and structured way.

- Challenge – Ownership regulation

- Examples – Decentralized Physical Infrastructure (DePIN), IoT, Machines-as-a-service,…

Why Now?

We believe this time really is different. Almost five years after its initial hype, tokenization of RWAs is looking different. We identified three key reasons that give us confidence that it’s different this time around.

- More mindshare & activity – We see more mindshare and activity from a larger set of players who are actively trying out the technology.

- Technology stack & SDKs – We are seeing significant advancements in the blockchain techstack & SDKs, particularly in scalability, security, and interoperability of tokenized assets.

- Legal & Regulatory Clarity – We have seen regulatory improvement to cater for tokenization of RWA over the past years and only expect this to accelerate as more stakeholders openly express interest.

Why are financial assets seeing so much traction?

The financial industry is currently at the forefront of blockchain-based asset tokenization. Tokenization is expected to revolutionize the way financial assets, such as stocks, bonds, and real estate, are represented and traded digitally. There are strong use cases for blockchain integration & tokenization within finance being explored.

We think there are four main reasons why the tokenized RWA narrative is so fixated on financial markets:

- Strong Fit – There is a strong fit for tokenization of RWA in the financial industry. It facilitates and improves existing (i) processes, (ii) liquidity and (iii) the decentralization of ownership of financial assets.

- Lingo & Founders-Market Fit – Financial professionals are already well familiar with the concepts of efficiency, liquidity and decentralized ownership. Therefore they are quicker to recognize the value proposition of tokenization of RWA. This understanding is less common in other industries like media, healthcare, utilities,…

- Intangible Assets & Digitally Represented – Financial assets are already largely intangible and digitally represented, lending themselves more easily to being tokenized.

- Massive Value – Financial assets make up the largest asset pool globally. Therefore the opportunity connected to tokenizing these assets is second to none.

Why are we confident adoption will continue?

We believe tokenization will continue to dominate the narrative over the next couple of years. Besides the strong fit, we see other trends in financial markets that will accelerate the adoption RWA tokenization over the next few years:

- High cost of capital – Higher risk-free rates expose the true cost of capital inefficiency. Over the past 18 months, the cost of inefficient clearing, trading & financing of activities has gone up exponentially, incentivising financial institutions to look for solutions.

- Roll-outs – Many large financial institutions have committed to building their own tokenization platform. While we don’t see this as the end-state of RWA tokenization, financial institutions are now starting to populate the blockchain with financial instruments.

- Race to the bottom – Sales & Trading, Asset management and other business lines have been under cost pressure over recent years due to increasing regulatory burden and challenger banks/fintech coming of age. As tokenization is explored more seriously, we think incumbent financial players will recognize its scaling and cost benefit potential.

What are we excited about?

It is widely accepted to state that there are three distinct layers in the technology stack that supports the tokenization of RWAs.

- Standards – Define how assets and ownership are represented.

- Infrastructure – Provide infrastructure to reflect and store RWAs on the blockchain.

- Applications – Provide utility to the holders of tokenized assets.

We see exciting developments across infrastructure and applications.

6.1 Infrastructure

Infrastructure still has a long way to go until we are ready for the RWA tokenization end-game. Nonetheless there are some interesting opportunities in the short term, especially around tokenization of financial assets.

From general purpose to use case specific tokenization infrastructure

Over the past five years we have seen significant improvements on the technical side to facilitate tokenization. We’ve seen L1 scaling, wallets, token standards (ERC20, ERC721, ERC3643, ERC2222, etc),… The general purpose tokenization infrastructure is maturing. As tokenization use cases grow more complex we expect innovation and founder attention to move from general purpose to use case specific tokenization infrastructure.

Opportunity for founders now lies in building out infrastructure to onboard buyers

We continue to see a bottleneck on the demand side of tokenization. While there are plenty of opportunities to tokenize and fractionalize asset classes, we see many verticals struggling to make a liquid market around these tokenized assets, even for assets that already have an existing liquid market. We believe the opportunity for founders now lies in building out infrastructure to onboard buyers.

Below a few that excite us:

- DAO Treasury Tooling: Tools that allow DAOs to make quick decisions and execute to manage and diversify treasury through tokenized assets.

- Risk management & assessment tooling: Traditional investors, while interested in the yields offered for example by T-bills, struggle to assess required risk premia for tokenized products. Onchain indexing tools help investors quantify and get comfortable with risk.

- Regulation-first onboarding tools: Regulatory compliance is still a bottleneck. There are some tools to be compliant however these should be simplified and abstracted away for a better onboarding and user experience.

- SDKs for complete tokens: Assets are represented through a simple token, without leveraging additional smart contract capabilities to automate the execution of terms & conditions related to the underlying asset. If we want to move from “dumb” to “smart” tokens we need tooling for users to improve token smart contract programming. It also requires regulation for these rules to become enforceable.

Interoperability for tokenized assets in a multi-chain reality

We are of the view that we are moving towards a multichain reality as blockchains are going from monolithic, general purpose ledgers towards modular and vertical- or app specific builds. This is especially true in financial services where we currently see tokens rolled out on both permissioned and permissionless blockchains.

- We believe X-chain interoperability for tokenized assets should be built out. Some examples here are:

- Data feeds

- Liquidity aggregators

- …

6.2 Applications

We categorize the applications based on their benefits and not according to their end-market. Below a quick recap of the different benefits and some application examples.

- Efficiency

Tokenization unlocks benefits between stakeholders that operate on the same value chain while not necessarily being aligned on economic incentives.

- Sustainability reporting – blockchain can be used to track carbon emissions across value chains

- Financial markets – infrastructure and processes of financial markets are completely different across asset classes. Tokenization can unify practices across asset classes.

- Digital identity – tokenizing and storing personal data in a web3 wallet allows individuals and legal entities to control the information flow and digital footprint.

- Liquidity

Despite being hard, we believe that creating a liquid market through RWA tokenization unlocks financial value embedded within assets that are currently difficult to trade.

For the use cases that excite us, we break liquidity further down in 1) tradability & 2) segregation.

Tradability – Tokenization has the potential to create a market for assets which were previously “over-the-counter” (OTC).

- Carbon Certificates – Combining efficiency and liquidity here, blockchain traded carbon certificates improve efficiency (transparency, reporting,…) and liquidity in a previously inefficient market.

- Collectibles – Tokenization brings efficient, low cost tradability to a market that was previously over-the-counter.

Segregation – Tokenization has the potential to create new assets by seperating part of an asset and putting it onchain. Liquid markets can then be created around these newly minted assets.

Example: digital property right (PRDs) – The separation of Property Digital Rights from overall property rights. These rights are defined as the right to control and monetise the physical asset in augmented reality and metaverses. The ownership is tokenized and can be fractionalised and openly traded. (see Darabase).

By defining the rights and creating a liquid market for Property Digital Rights, Darabase expects a 2% markup on the global property value over time. The mark up stems from the underutilisation of the Property Digital Rights because of the lack of a simple system for registration, ownership and tradability.

Other examples are markets around intellectual property, trademarks, etc

We expect to see more of this segregation of asset rights as tokenization diffuses across industries.

- Decentralization Of Ownership

Decentralization of ownership is the benefit that fits closest to the web3 narrative. We think the benefits change depending on whether we are dealing with financial- or real asset ownership

- Financial Asset Ownership

The applications for financial asset revolve around capital formation and the ability to get access from

- Private Markets – previously hard to access VC and PE investment opportunities become accessible through

- Property – Property ownership in the US now takes up ~60% of disposable income, crowding out the middle class from ownership. Tokenization can restructure property ownership.

- Real Asset Ownership

Tokenization restructures capital formation around capital intensive industries. Traditionally, capital intensive industries are inaccessible due to the high initial investment required. Through decentralization of ownership of real assets, the barriers to entry to these industries can be lowered and their existing business model challenges, leading to more efficiency.

- Decentralized Physical Infrastructure (DePIN) – Compute, telecommunication, storage, utilities, etc

- Machine-as-a-service – read more

- Democratization of Artificial Intelligence – Distribution of AI capabilities through partial ownership of infrastructure & computational capacity.

- Internet of Things – Redistribution of asset ownership structure to unlock full potential of IoT and smart cities.

How do we see adoption?

There are many moving parts but we believe there are two prerequisites to any adoption of tokenized assets.

- Regulation – A regulatory framework for this new asset class is critical. Not only is there no way for token holders to comply but without regulation there is no way to enforce the embedded terms and conditions linked to the token.

- Product demand – While partially tied to regulation, there needs to be a clear demand from buyers for tokenized products. We are at a point where infrastructure build out is outpacing demand. We need demand for these services to start picking up.

We lay out our framework of adoption based on the different applications that leverage the key benefits as discussed above.

The Financialization Of Real Assets

Another important trend, which we believe will open new markets and asset classes is the financialization of real assets.

In recent years, driven by advancements in technology and education, a notable trend towards the financialization of real assets has emerged. Financialization signifies the growing influence of financial markets, instruments, and motivations in the management and utilization of real assets within the broader economy. This trend has expanded liquidity and investment opportunities, particularly in real assets, where financial returns and cash flows traditionally played a lesser role in value proposition.

We believe that tokenization will play a critical role in the next leg of financialization of these assets by unlocking efficiency, liquidity and decentralization of ownership for these assets. We see tokenization bringing liquidity and decentralization to cash flows associated with these real assets. While previously hard to disassociate these cash flows from the real asset due to transparency and efficiency issues, tokenization offers a technology solution, opening up real assets to financialization. This is a movement which will ultimately make them real and financial assets at the same time, similarly to what is already happening to real estate.

Challenges

Besides the specific challenges related to the key benefits, there are overarching challenges with tokenization of RWA. Below a few key challenges:

- Network Effect – Blockchain-based applications, by their very nature, rely on network effects. With RWA, a network effect of users is needed to turn efficiency, liquidity or decentralization of ownership into a viable value proposition that convinces new users to tokenize RWAs and populate the shared blockchain.

- Oracle Problem – Difficulty when reflecting a digital asset that represents a tangible RWA. There is a requirement for a secure and reliable way to ensure the data input (token) reflects the state of the real-world asset.

- Tokenization Standards – Standardizing the tokenization of real-world assets is essential for ensuring compatibility, regulatory compliance, and investor trust in blockchain-based finance. However, the decentralized nature of blockchain and the need to address legal and technical challenges make achieving universal standards a complex task. Overcoming these challenges is crucial.