Four months after the Bitcoin halving, we’re witnessing the worst price performance following any halving to date. In this piece, we explain why the halving no longer has a fundamental impact on the price of BTC and other digital assets, with the last time it had dating back to 2016. It’s time for founders and investors to move away from the notion of a four year cycle as digital asset markets mature.

Author: Jasper De Maere | X | Linkedin

Bottom line:

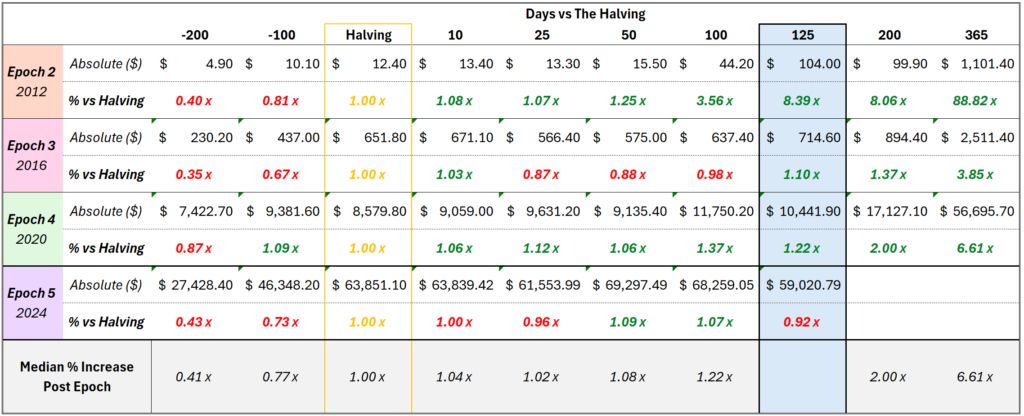

- Epoch 5, following the 2024 halving, is experiencing the worst BTC price performance more than 125 days after the event. The price is down -8%, compared to a +22% median increase seen in previous epochs.

- We believe that 2016 was the last time the halving had a significant, fundamental impact on BTC price action. Since then, the size of the miners’ BTC block reward has become negligible in the context of a maturing and increasingly diversified crypto market.

- The strong BTC and crypto market performance following the 2020 halving is coincidence, as the 2020 halving occurred during a period of unprecedented global capital injection post-COVID, with the U.S. alone increasing its money supply (M2) by 25.3% that year.

- The argument that the 4-year cycle still holds in 2024 but that the BTC ETF approval in January ’24 pulled forward demand, leading to a strong BTC run-up pre-halving, is flawed. The BTC ETF approval is a demand-driven catalyst, while the halving is a supply-driven catalyst, making them not mutually exclusive.

Bitcoin price activity significantly influences the broader market and, consequently, the ability of founders to raise capital through equity, SAFTs, and private or public token sales. Given the liquidity introduced by crypto in venture capital, it’s crucial for founders to understand top-down market drivers to better predict fundraising opportunities and forecast their runway. In this piece, we break down the concept of the four-year market cycle to lay the foundation to explore the real drivers in future work. Debunking the four-year cycle does not make us bearish on the overall market.

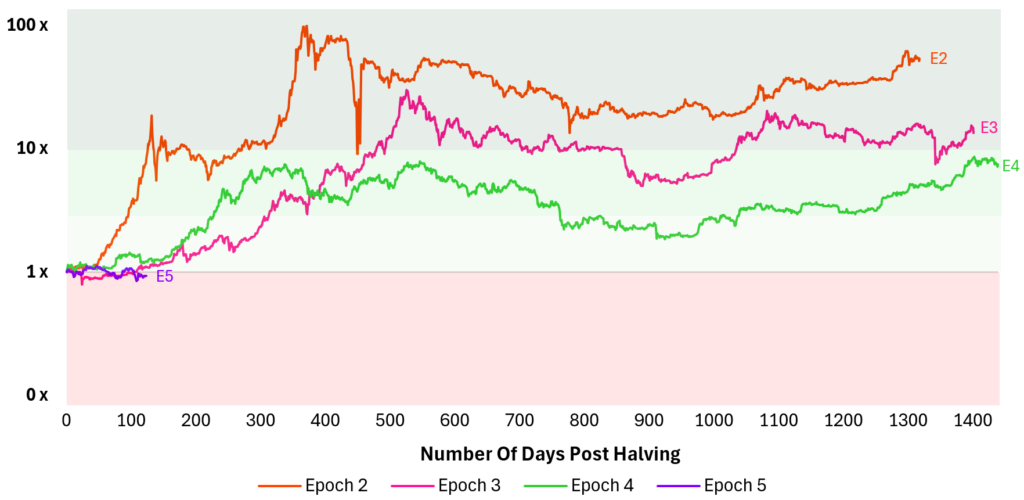

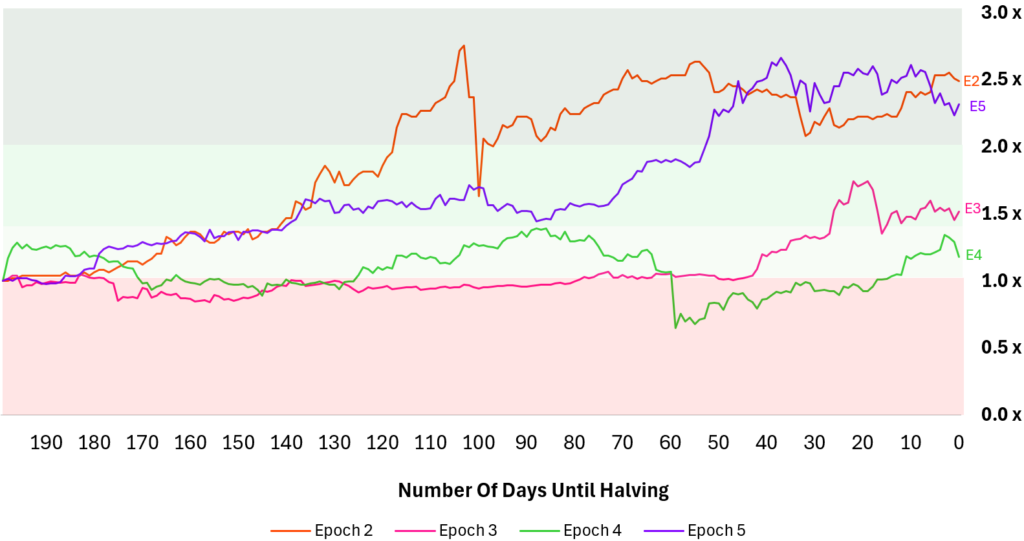

Let’s start by looking at the BTC price performance over the last few epochs since before and after the halving. It’s clear that more than 125 days in, epoch 5 (2024) is worst performing since the halving, being the only time BTC is down vs price on the day of the halving.

Exhibit 1: BTC price performance around the halving across epochs

Source: Outlier Ventures

So why does the halving even matter for the price? Simplified, there are two key reasons.

- Fundamental: Bitcoin halving reduces the new supply, creating scarcity that can drive prices up as demand outpaces the limited availability. This new dynamic also changes economics for miners.

- Psychological: Bitcoin halving heightens the perception of scarcity, reinforces expectations of price surges based on historical patterns, and attracts media attention, which can increase demand and drive prices up.

In this work, we argue that the fundamental driver behind BTC price action is overstated and has been irrelevant for the past two cycles. We will contextualize the numbers to demonstrate that the net effect of the halving is not significant enough to meaningfully impact BTC prices or the broader digital asset space.

Initial Observation – Daily BTC Rewards

if you take away one thing from this post, let it be this:

The strongest argument for the halving’s impact on the market is that, beyond reducing BTC inflation, it affects miners’ economics, leading to changes in their treasury management.

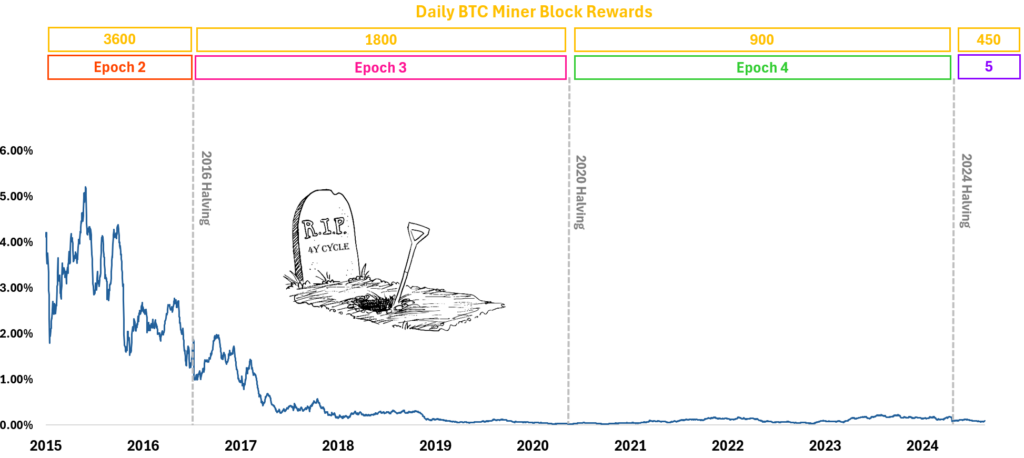

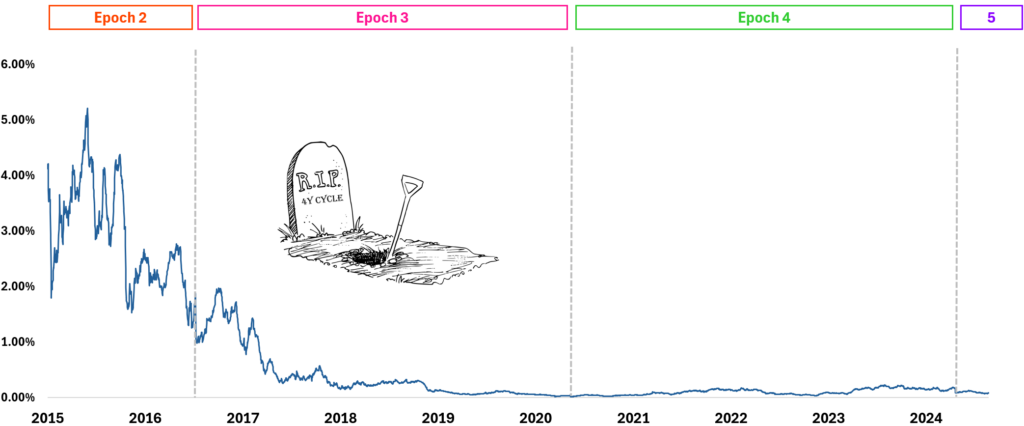

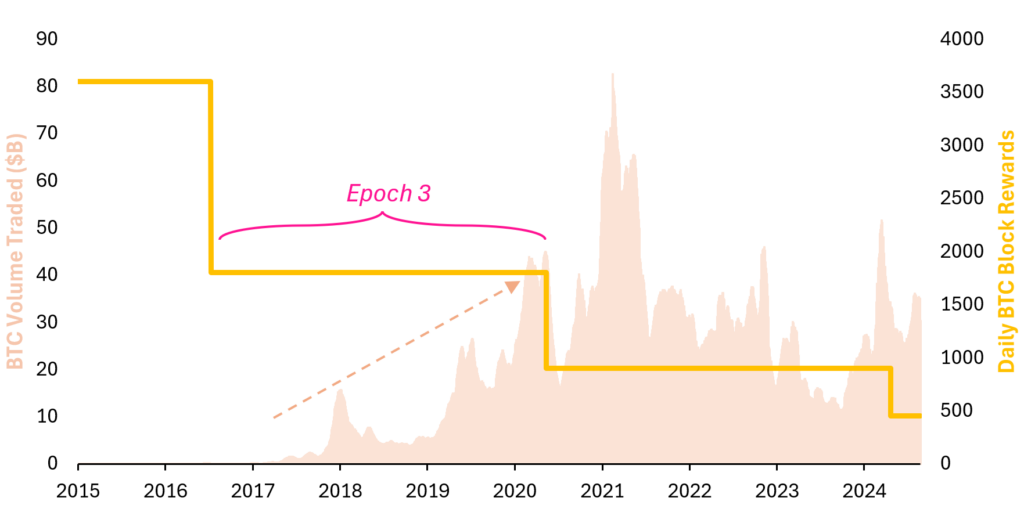

So, let’s consider the extreme scenario where all mining block rewards are instantly sold on the market. What would the selling pressure be? Below, you have the total daily block reward (in USD) obtained by all miners divided by the total volume traded in the market (in USD) to assess that impact.

Until mid-2017, miners had an impact of over 1% on the market. Today, if miners sold their entire BTC block reward, it would account for just 0.17% of the market volume. While this doesn’t account for the BTC miners have previously accumulated, it illustrates that as block rewards decrease and the market matures, the impact of BTC block rewards has become negligible compared to the total market.

Exhibit 2: Potential market impact if all miners sold their daily BTC block rewards

Source: Outlier Ventures

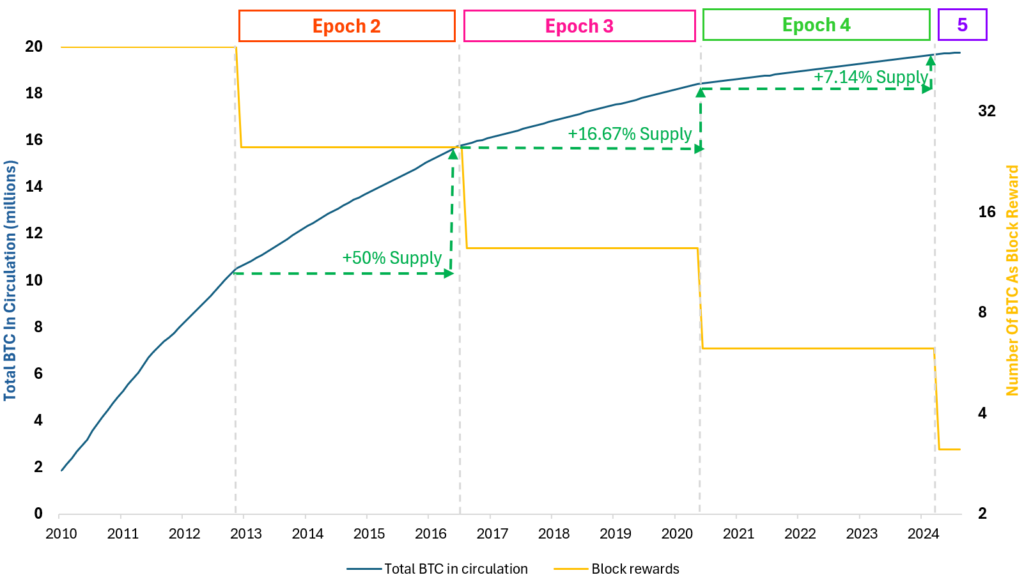

Recap – Halving Impact

First a quick recap before we move on. The Bitcoin halving is an event that occurs approximately every four years, where the block reward for miners is cut in half. This reduces the rate at which new BTC is created, decreasing the new supply entering the market. The total BTC supply is capped at 21 million, and with each halving, the pace of reaching this cap slows. The period between each halving is called an epoch, and historically, each halving has influenced Bitcoin’s price due to the reduced supply and increased scarcity. All illustrated in Exhibit 3.

Exhibit 3: Bitcoin halving dynamic, block rewards, total supply & epochs

Source: Outlier Ventures

Bitcoin Halving Performance

Starting with what’s most important to many of us, the impact on price performance, we see that the performance post the halving has been the worst since the inception of BTC. As of today (02/09/2024), BTC trades ~8% below the $63.8k levels at the start of the day of the halving on 20 April this year.

Exhibit 4: BTC price performance AFTER each halving across epochs

Source: Outlier Ventures

“What about the run up to the halving?” It is true that we have had an exceptionally strong run up to the halving. Looking at the performance 200 days before, we see that BTC almost 2.5x’d. This is almost on par with epoch 2 when the BTC made up 99% of the digital asset market cap and the halving was still meaningful.

Exhibit 5: 200 day run up BTC price performance BEFORE each halving across epochs

Source: Outlier Ventures

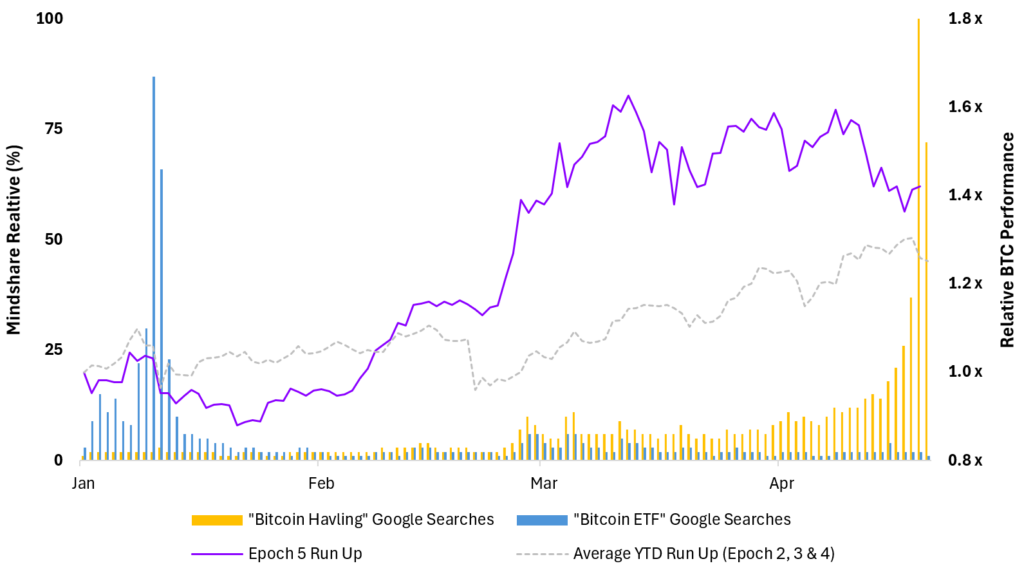

That said, it’s also important to remember what happened during that period. At the start of 2024, we had the approval of the BTC ETF which since the 11th of January 2024 have seen 299K BTC net inflow BTC bought, significantly driving the price. So let’s be honest. The run up wasn’t the anticipation of the halving.

Exhibit 6 shows the BTC performance between the BTC ETF approval and the halving. The BTC ETF approval in Jan 2024 increased the demand for BTC, leading to the 100-day run up of epoch 5 outperforming the avg epoch run ups by +17%.

Exhibit 6: 200 day run up BTC price performance BEFORE each halving across epochs

Source: Outlier Ventures, Google

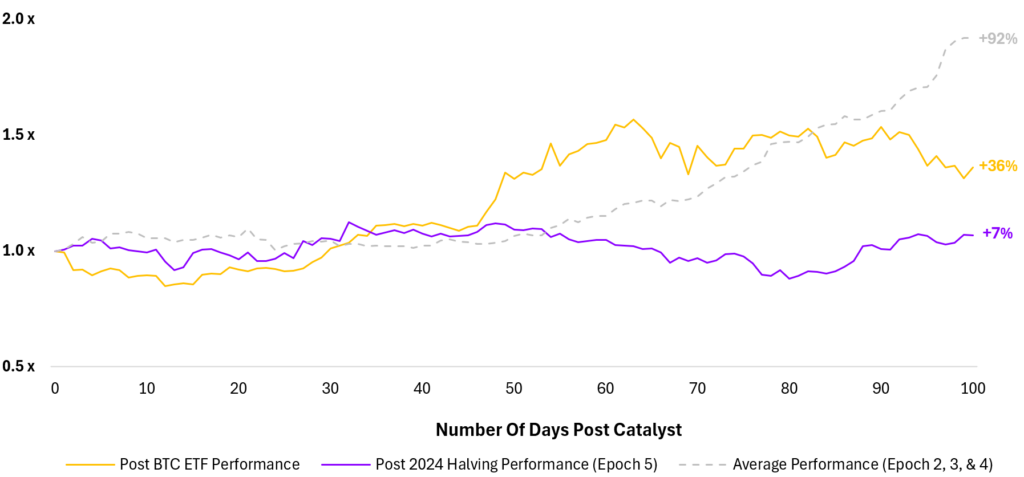

Exhibit 7 shows the 100 day performance post both the BTC ETF approval and the BTC halving. It’s clear that the ETF approval has been a more meaningful catalyst for price action than the halving as shown by the ~29% spread between both 100 day performances.

Exhibit 7: 100 Day BTC Performance POST Halving and ETF catalysts

Source: Outlier Ventures

“So the BTC ETF pulled forward the demand and price action that we usually see with the halving!”

This is a weak argument to defend the 4 year cycle. The reality is that both of these catalysts are independent and stand separate. The ETF is a demand driven catalyst, while the halving is supported to be a supply driven catalyst. They aren’t mutually exclusive and if the halving still mattered, we should’ve seen significant price actions on the back of this double catalyst.

2016 Was The Last Time

I believe that 2016 and the transition into epoch 3 was the last time the halving really had a meaningful impact on the market. As discussed in exhibit 2, the below illustrated the impact on the market if ALL miners would sell their block rewards the day they obtained it. As you can see, around mid 2017 it dropped below 1% and today it’s barely reaching above 0.20%, showing just how little it matters.

Exhibit 8: Potential market impact if ALL miners sold daily BTC block reward

Source: Outlier Ventures

To understand the decline in importance of impact of the miners’ treasury decision making, let’s take a closer look at the different variables at play.

Variables:

- Total Daily BTC Block Reward – Goes down every epoch (↓)

- Volume Daily Traded BTC – Goes up as the market matures (↑)

→ Over time, block rewards go down and markets mature, decreasing the relevance of miners’ impact.

Exhibit 9 illustrates the BTC volume traded and the cumulative BTC block rewards for miners. The drastic uptick in trading volume is what really causes the relevance of the miners’ block rewards to become negligible.

Exhibit 9: Daily BTC Miner rewards & daily volume traded

Source: Outlier Ventures

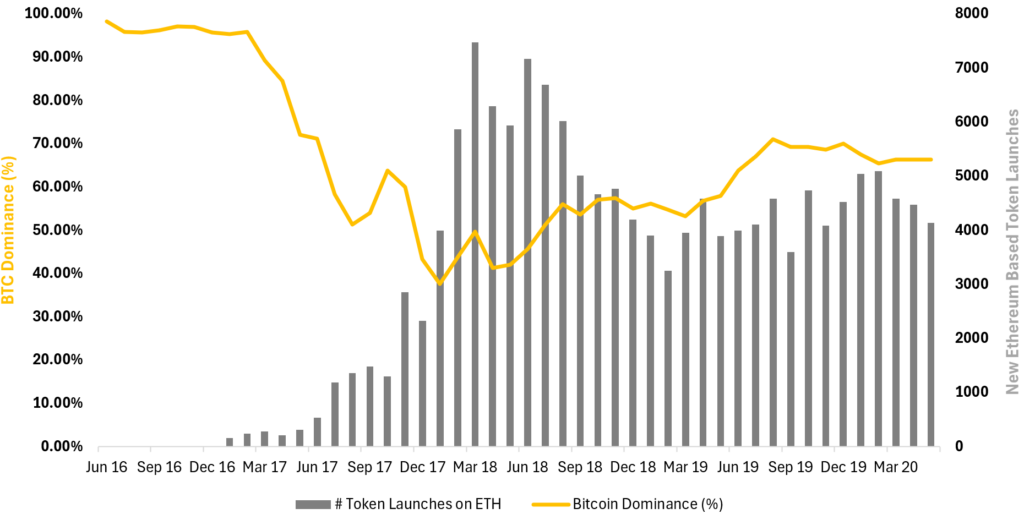

For those who were around back then, it’s clear what was driving the increase in volume during that period. To recap: After Ethereum’s launch in 2015 and the unlocking of smart contract capabilities, the ICO craze followed, leading to the creation of many new tokens on the Ethereum platform. This surge in new token launches contributed to a decline in BTC dominance. The influx of new exciting assets (i) drove trading volume to all pockets of the digital asset market, including BTC and (ii) incentivized the exchanges to mature more quickly, allowing them to onboard users more easily and process larger trading volumes.

Exhibit 10: New ETH token launches & BTC dominance during epoch 3

Source: Outlier Ventures

But…But What About 2020?

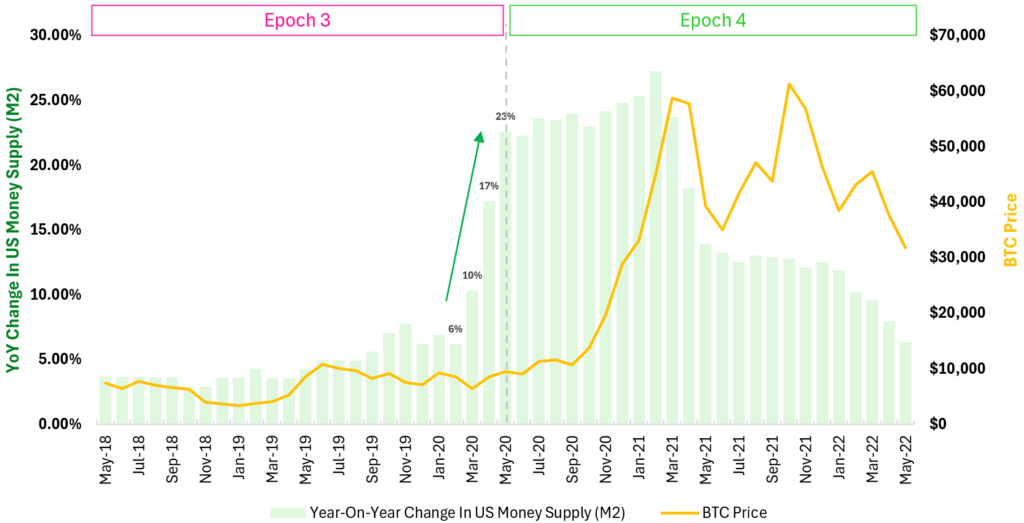

A lot happened during epoch 3 that logically reduces the impact of mining treasury management, and by extension, the halving as a BTC catalyst itself. So what about 2020, when BTC increased about 6.6x in the first year after the halving? That wasn’t because of the halving—it was due to an unprecedented amount of money being printed in response to Covid-19.

While not a fundamental factor, the halving might have influenced BTC’s price action from a psychological standpoint. With BTC making headlines around the halving, it gave people a target to invest their excess capital in at a time when there were few other spending options.

Exhibit 11 shows the real reason for the rally. Just a few months before the May 2020 halving, the US money supply (M2) surged at an unprecedented rate in modern Western history, fueling speculation and inflation across various asset classes, including property, equities, private equity, and digital assets.

Exhibit 11: US money supply (M2) & BTC price around 2020 halving

Source: Outlier Ventures, Federal Reserve Bank

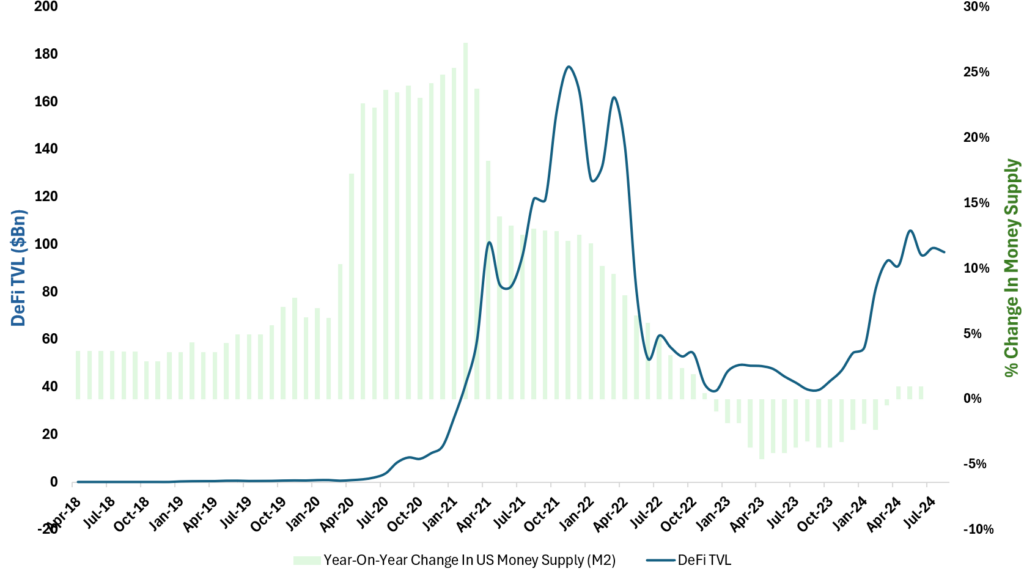

In addition to the flow into BTC, it’s important to recognize that the money printing occurred just after the DeFi spring, which then blossomed into the DeFi summer. Many investors were drawn to the attractive yield opportunities on-chain, committing capital into cryptocurrency and utility tokens to capture this value. Due to the strong correlation between all digital assets, BTC naturally benefited from this as well.

Exhibit 12: US money supply (M2) & DeFi TVL

Source: Outlier Ventures, DeFiLama

A handful of factors all pushed forward by a global helicopter money policy sparked the largest crypto rally to date at a time when the halving just happened, making it seem as if there was a fundamental impact of the change in block rewards driving the price action.

Remaining Miner Supply

“What about the remaining BTC supply that miners hold in their treasuries, built up over previous epochs when hash rates were lower and block rewards were higher?”

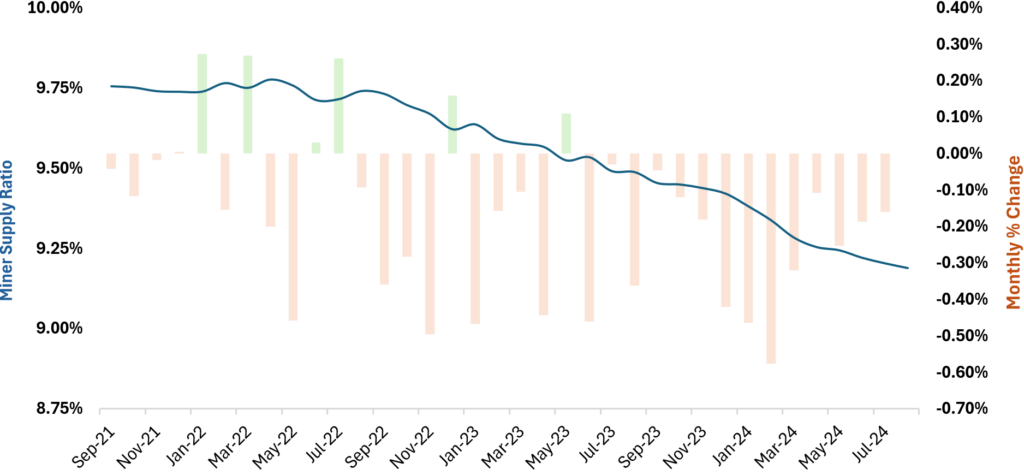

Exhibit 13 examines the miner supply ratio, which is the total BTC held by miners divided by the total BTC supply, effectively showing how much of the supply is controlled by miners. The impact of miners’ treasury decisions on BTC’s price is largely a result of the block rewards they accumulated during the earlier epochs.

As shown, the miner supply ratio has been steadily decreasing over time, currently sitting at around 9.2%. More recently, there has been an increase in OTC activity by miners as they sell BTC, likely to avoid impacting the market price too much. This trend is probably due to lower block rewards, higher input costs in the form of hardware and energy, and BTC prices not rising significantly—forcing miners to sell their BTC more quickly to remain profitable.

We appreciate the impact that the halving has on the profitability of the mining industry and that they need to adjust their treasury management to remain profitable. However the long-term direction of travel is clear. The impact on the halvening has on the BTC price will only continue to decrease over time.

Exhibit 13: Miner supply ratio & month-on-month % change

Source: Outlier Ventures, CryptoQuant

Conclusion

While the halving may have some psychological effects, reminding bag holders about their dusty BTC wallets, it’s clear that its fundamental impact has become irrelevant. The last meaningful halving impact was in 2016. In 2020, it wasn’t the halving but the response to COVID-19 and subsequent money printing that triggered the bull run. It’s time for founders and investors trying to time the market to focus on more significant macroeconomic drivers rather than relying on the four-year cycle. With this in mind, we will explore the real macro drivers behind market cycles in future Token Trendlines.