Stablecoins are entering a new competitive landscape. The USDH governance process on Hyperliquid showed how platforms can redirect annualized reserve yield away from issuers, reshaping the economics of stablecoin markets. At the macroeconomic level, stablecoins are both extending dollar dominance globally and weakening local monetary sovereignty. Over 99% of the market is U.S. dollar-denominated, and flows make up more than 6% of GDP in certain regions. Looking ahead, agentic payments represent a new frontier for stablecoins, with infrastructure for machine-native settlement already taking shape.

Greysen Cacciatore, Research Associate | X | LinkedIn

Bottom Line

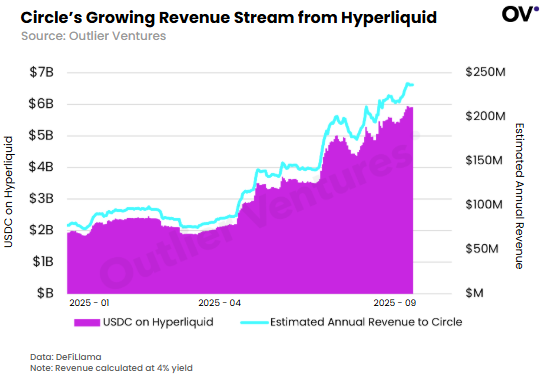

- USDC balances on Hyperliquid are now implying more than $200M in annualized reserve yield. The USDH governance process illustrates how the next phase of stablecoin competition will center on how platforms and issuers negotiate reserve economics to capture this income stream.

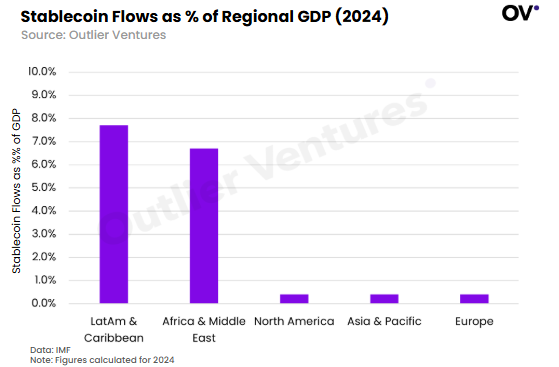

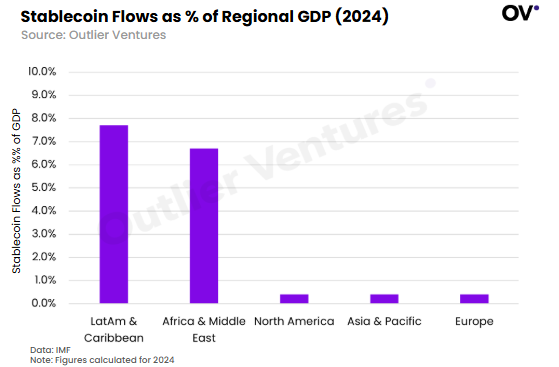

- Over 99% of stablecoin supply is U.S. dollar-denominated. In 2024, it already exceeded 6–8% of GDP in Latin America, Caribbean, Africa, and the Middle East. Stablecoins are reshaping global monetary dynamics by extending dollar dominance while laying the foundation for future multi-currency and asset-backed alternatives.

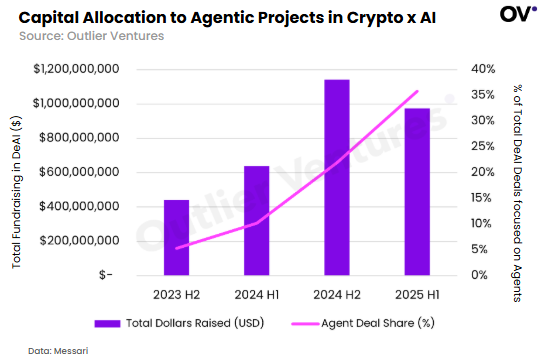

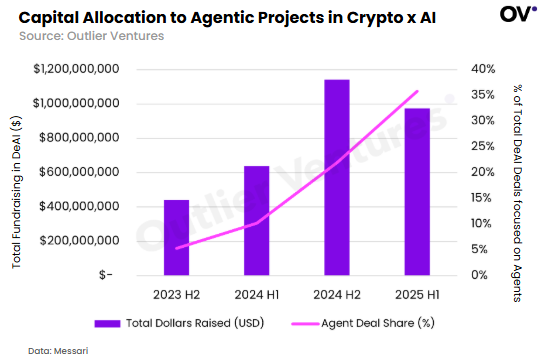

- Agentic payments represent a new frontier for stablecoins. Infrastructure for machine-native settlement is now being built out, highlighted by agent-related projects rising from 5% of all crypto AI deals in H2-2023 to 36% in H1-2025.

The Economics of Reserve Yield

The USDH governance process on Hyperliquid made public a shift in the economic relationship between stablecoin issuers and platforms. The scale of economics explains why the bidding reached such intense competition. Circle, with about $5-6 billion in USDC balances on Hyperliquid by September 2025, faced more than $200 million in potential annualized yield from reserves. This is up from about $77 million in January. Reports from the bidding process showed that Paxos and Ethena both proposed aggressive revenue-sharing models with additional incentives. Consequently, Ethena withdrew, while Native Markets ultimately won with a structure that directs half of reserve yield toward HYPE buybacks and ecosystem development.

Hyperliquid’s USDH illustrates how platforms can reconfigure stablecoin economics by redirecting reserve yield away from issuers into the platform itself, embedding value within the ecosystem. This trend is likely to expand into the market, as other ecosystems adopt similar approaches once platforms recognize their leverage.

On the issuer and infrastructure side, new revenue-sharing and issuance architectures are emerging as well. Paxos’s Global Dollar Network (USDG) distributes yield through a partner network spanning notable businesses including Kraken, Robinhood, and Galaxy. Agora (AUSD) provides infrastructure for enterprises to launch white-label stablecoins with transparent reserves and equitable revenue sharing. M0 (M0) takes a federated approach, allowing multiple qualified institutions to mint under a common standard, with decentralized governance and strict reserve requirements. OpenTrade (Outlier’s portfolio company) extends this landscape by offering yield-as-a-service infrastructure that enables issuers and fintechs to embed programmable reserves. Together, these models signal the next phase of stablecoin competition. They showcase how effective issuers and platforms design systems to capture and distribute the yield behind reserves.

FX: Dollar Dominance & Monetary Sovereignty

Dollar Dominance

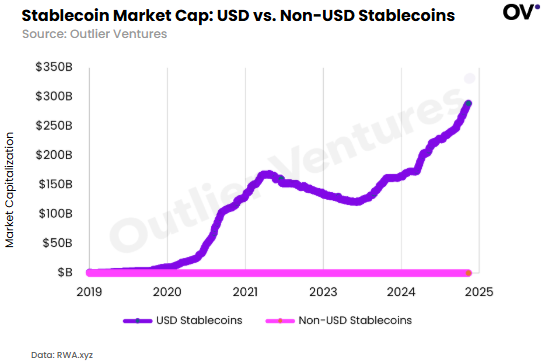

The stablecoin market today is overwhelmingly dollar-denominated, with more than 99% of stablecoin supply backed by U.S. dollars. This dominance reflects the U.S. dollar’s role as the reserve currency of global trade and finance. The trend is accelerating as the GENIUS Act opens the door to regulated, large-scale issuance of onchain dollars. Stablecoins now function as a distribution rail for U.S. monetary policy, extending dollars into regions where financial systems fall short.

At the same time, jurisdictions are advancing their own strategies for stablecoins and tokenization. China has opened a digital yuan hub in Shanghai to promote cross-border use. Hong Kong is both a core participant in the mBridge multi-CBDC platform and advancing an HKD-backed stablecoin licensing regime. Japan has approved its first regulated yen stablecoins and is piloting a digital yen. Europe is pushing forward with both a digital euro and a bank-led euro stablecoin consortium. The UK’s largest banks have launched tokenized deposit pilots in response to the BoE’s call for innovation in programmable money.

Monetary Sovereignty

The global dominance of dollar-backed stablecoins carries profound monetary consequences for monetary sovereignty in emerging markets. In economies facing high inflation and currency devaluation, dollar stablecoins function as parallel money systems. They give individuals and businesses a way to store value and transact outside the reach of domestic policy. Across Latin America and the Caribbean, stablecoin flows reached nearly 8 percent of GDP in 2024. In Africa and the Middle East they exceeded 6 percent. For central banks, this dynamic erodes monetary sovereignty by weakening capital controls and reducing demand for local currency. Stablecoins have become a structural outlet allowing populations to opt into alternative money systems whenever domestic policy credibility falters.

While dollar dominance defines the present stablecoin market, the long-term trajectory could diverge significantly. Persistent U.S. fiscal deficits and mounting debt may, over time, shift global preferences toward fiat currencies managed with greater fiscal discipline. Stablecoins make this optionality real by enabling individuals and enterprises to opt in and out of currencies with near-instant settlement and low cost. These same features open the door to multi-currency baskets, algorithmic rebalancing, and stablecoins backed by hard assets such as gold or a diversified mix of reserves. Furthermore, as more financial activity moves onchain, the demand for local-currency stablecoins may also grow, tied to the need for asset pricing, tax payments, and corporate revenues in domestic denominations.

Agentic Payments: A New Frontier for Stablecoins

The rise of autonomous agents signals a new frontier for stablecoins. As we discuss within our Post Web Thesis, agents require a unit of account, a settlement layer, and a trustless medium for value exchange at machine speed. Stablecoins are uniquely positioned to anchor this new economy of agentic payments. They combine liquidity, programmability, and global distribution in ways legacy payment networks cannot. As illustrated in Exhibit 3, the increase in funding toward agentic projects highlights investors focus on infrastructure that can power machines transactions at scale.

Teams, such as Payman.ai and Catena Labs, are building infrastructure for agentic payments, while larger incumbents, like Coinbase’s x402 and Google’s AP2 protocol, are experimenting with standards for machine-native payments. Reveel (Outlier’s portfolio company) is developing a universal Pay(ID) and AI-agent interface for stablecoin payments, enabling both people and agents to transact seamlessly across chains.

The underlying trend is that autonomous agents are emerging as a new class of economic actor. Agents expand the scope of market participation beyond humans and institutions, and reshape how value is negotiated and exchanged. This shift demands a monetary infrastructure built for machine-speed negotiation, micropayments, and provable settlement across networks. Stablecoins, already liquid, programmable, and globally distributed, uniquely offer the interoperability and trustless settlement required for both human-agent and agent-agent commerce.

Partner with Outlier Ventures

Outlier Ventures has a proven track record of navigating the early-stage Web3 venture capital market with 11+ years of experience, 45+ cohorts completed, and now almost 400 portfolio companies.

We empower startups with guidance from our in-house experts, mentorship, and resources, fostering innovation in the future digital economy. De-risking investments for partners and readying founders for future capital raises.

Recent partners & friends: Morgan Creek, Borderless, peaq Network, 1kx, Midnight Foundation, and are currently recruiting for our Injective Ecosystem Cohort.