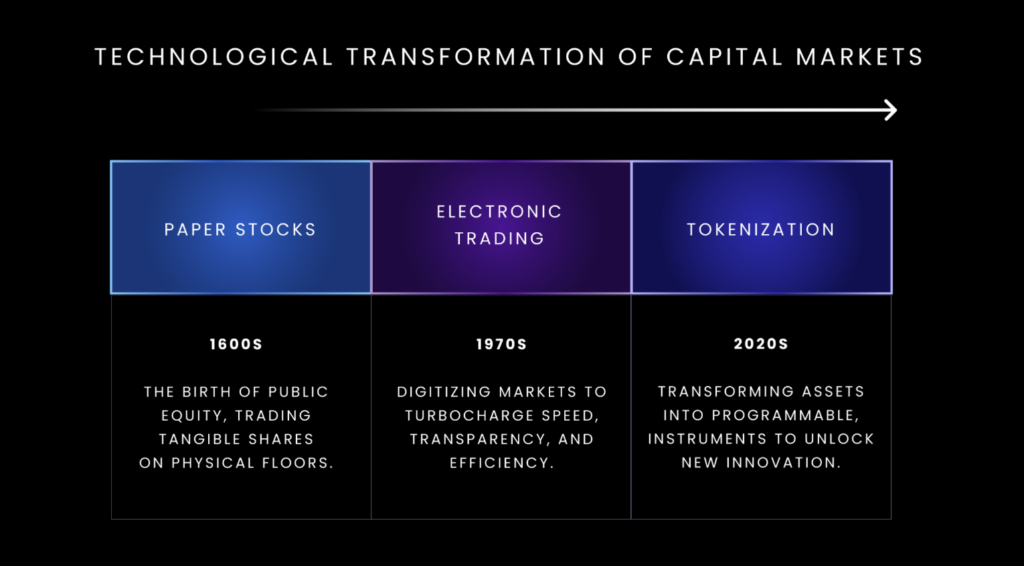

The tokenization of capital markets represents a fundamental shift in global financial market infrastructure. From the earliest days of capital markets with the Dutch East India Company in the 1600s, to present day, where capital markets represent 25% of the world’s GDP, the infrastructure of financial markets have undergone two major transformations. Tokenization marks the third major transformation, enabling all financial assets to become tokenized, unlocking greater efficiency, accessibility, and innovation. In this edition, we outline these major shifts and examine two key trends currently driving tokenized capital markets.

Greysen Cacciatore, Research Associate | X | LinkedIn & Jasper De Maere, Head of Research | X | LinkedIn

Bottom Line

- Capital market infrastructure has undergone two major transformational shifts, first in the 1600s with physically-traded stocks, and second in the 1960s with electronic trading. Now, in the 2020s, tokenization marks the third transformation.

- Tokenization has been steadily developing, with US-dollar denominated stablecoins and US treasuiries leading the way, presenting compelling financial solutions for economies that face currency inflation or less attractive financial products compared to US markets.

- 2025 brings strong tailwinds to tokenizing capital markets, notably due to positive regulations in the United States, including the recent reversal of SAB121, which is expected to accelerate institutional participation over the coming quarters.

Major Transformations in Capital Markets Infrastructure

The early 1600s marked the birth of publicly traded companies, with the Dutch East India Company, also known as VOC, launching the issuance of publicly-owned shares of their firm. With electronic systems yet to be invented, trading mechanisms were centered around physical locations, where traders physically met for commerce at scheduled times at the Amsterdam Stock Exchange.

Exhibit 1: Three Technological Transformations of Capital Markets

In the 1970s, the launch of NASDAQ ushered in the world’s first electronic stock market, transforming trading and infrastructure systems to the digital realm. This enhanced overall efficiency, enabling faster transactions and information processing, opening the door for accelerated growth of capital markets.

Flash forward to present time, the application of distributed ledger technology (DLT) within capital markets, introduces unlocked innovation for financial assets to be represented in a programmable manner, unlocking greater efficiency and opportunity across various asset classes, including fixed income, equities, and alternatives.

The Current State of Tokenization: Only The First Inning

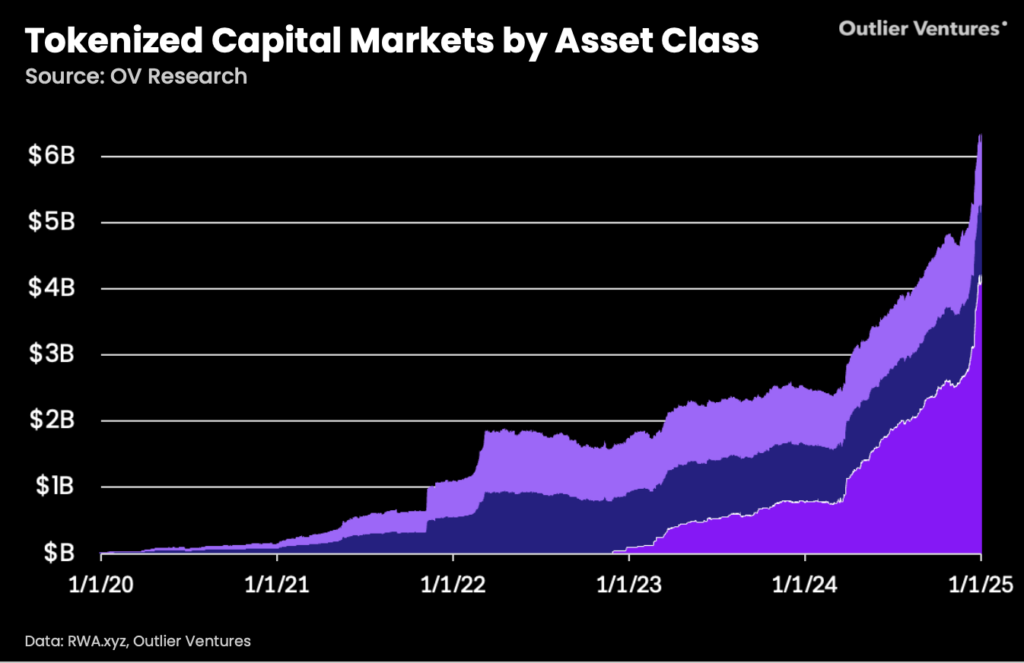

Currently, less than .000001% of global capital markets is tokenized. As shown in Exhibit 2, tokenized capital markets (excluding stablecoins) are valued at $20 billion across equities, fixed income, alternatives, and commodities. With global capital markets valued at approximately $175 trillion (excluding derivatives), it’s clear that tokenization is still in its early stages.

Exhibit 2: Tokenized Capital Markets by Asset Class

The slow and sustained adoption of tokenizing capital markets is largely due to the regulatory requirements across geographical jurisdictions, and the infrastructure upgrades needed to integrate the traditional financial system with distributed ledger technologies. Traditional financial markets function primarily underneath account-based systems, while distributed ledger technologies function within wallet-based systems. In addition, the process of effectively tokenizing capital markets requires a bespoke approach to each asset class, as each one brings its own unique set of regulations and infrastructure.

Yet, 2025 represents an exciting point in the transformation of tokenization. Institutional holdings of Bitcoin ETFs are north of $30 billion, the market capitalization of stablecoins has exceeded $220 billion, and the largest capital market in the world is gaining clear regulation. This all points to a solid foundation for accelerated growth in 2025 and beyond.

In the following sections, we zoom in on two key trends currently driving the tokenization of capital markets – the exportation of U.S. capital markets & anticipated U.S. institutional participation.

Trend #1: The Exportation of US Capital Markets

The exportation of U.S. capital markets, through tokenized dollars and tokenized treasuries, has been a strong driving force of tokenizing capital markets over the last few years. With distributed ledger technology, mobile phones, crypto wallet-based systems, and tokenized U.S. financial instruments, it has never been easier for individuals worldwide to access U.S. dollars and U.S. government debt. This virtual exportation of the U.S. dollar and U.S. T-bills worldwide have given millions of people worldwide the opportunity to have greater levels of economic freedom, by being able to opt-out of their local currency or financial market, if they face high levels of inflation or extremely volatile markets.

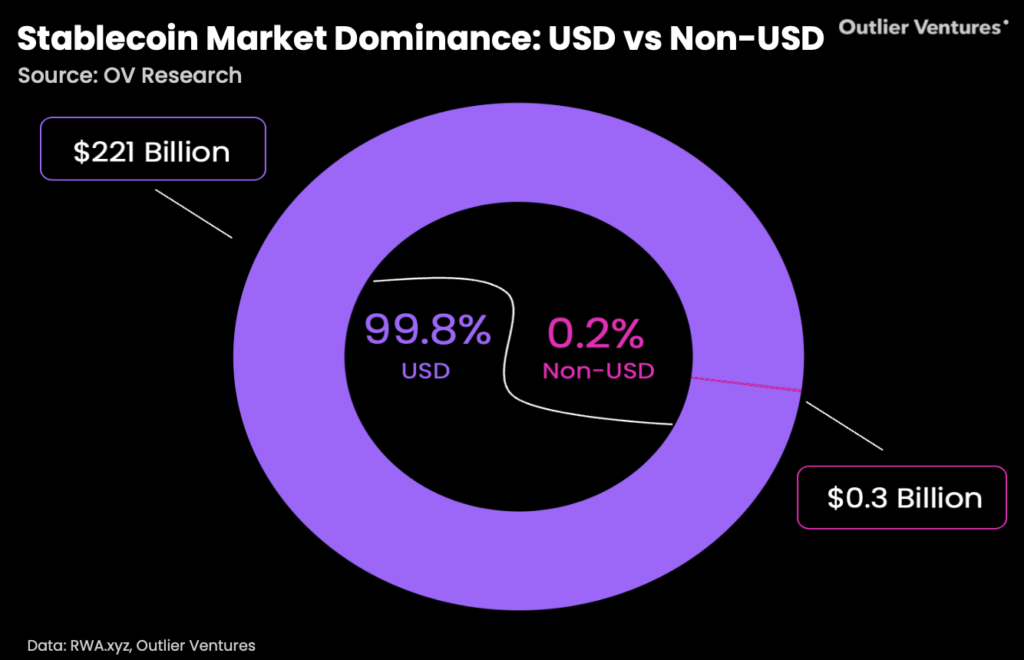

In Exhibit 3, we see how stablecoins (including USD and other currencies) have grown significantly over the last several years, reaching over $200 billion.

Exhibit 3: Stablecoins Market Capitalization

Exhibit 4: Stablecoin Market Capture: USD vs. Non USD

When zooming in further on Exhibit 4 to examine the market capture of stablecoins between USD and other currencies, it becomes clear that stablecoins have been largely a success story through the US dollar, with 99.8% of the market captured by US dollar denominated stablecoins.

We believe this has been primarily driven by the exportation of U.S. dollars to economies and regions who previously did not have access to them.

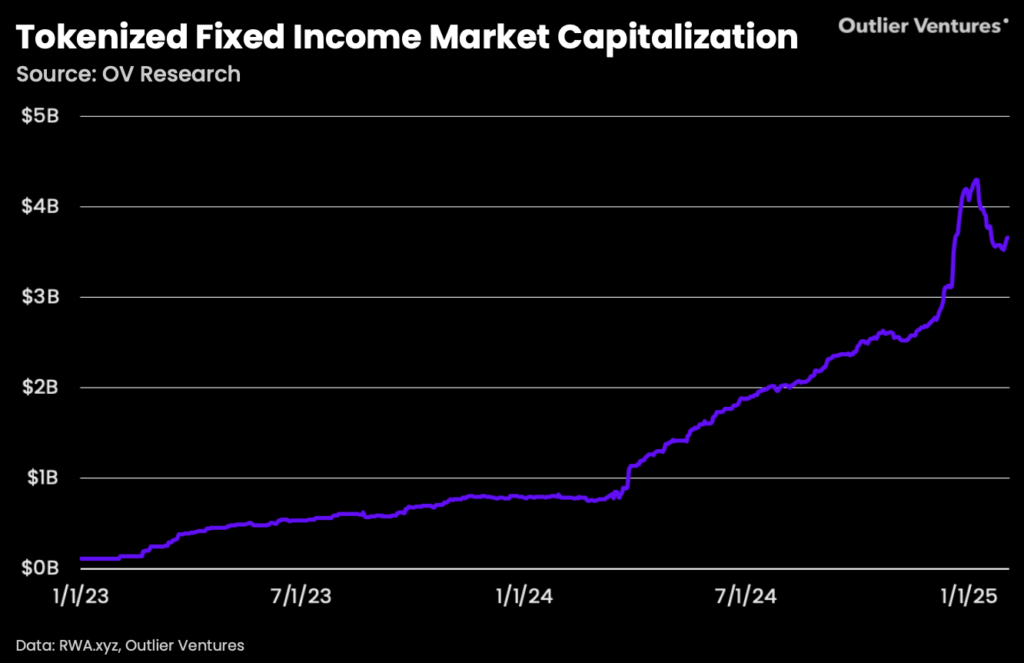

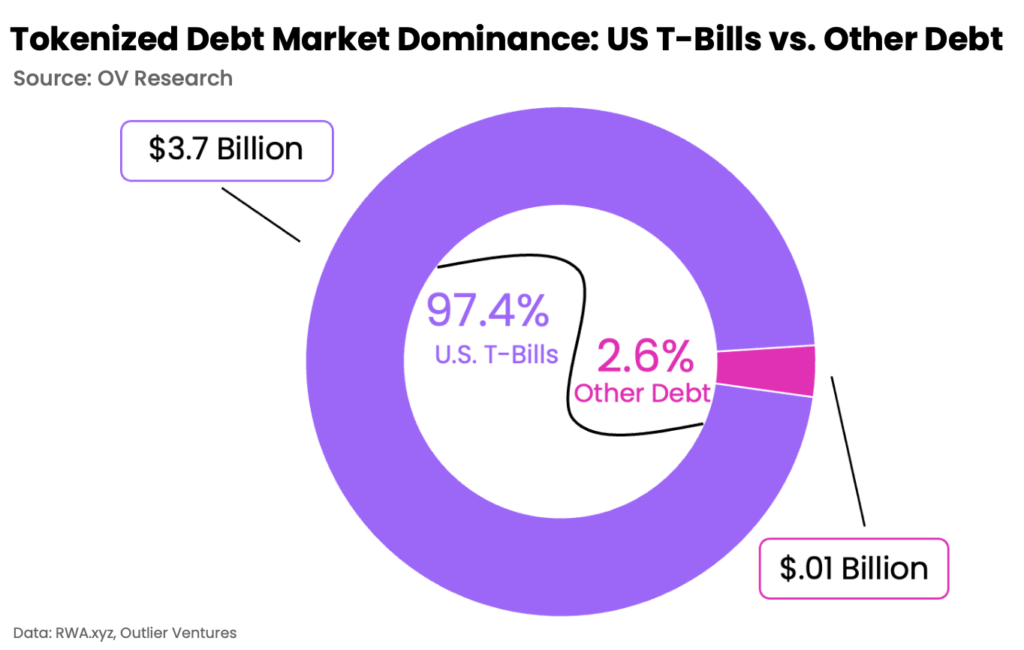

Like stablecoins, tokenized fixed income has followed a similar trend. Exhibit 5 displays the total market capitalization of tokenized fixed income (including U.S. Treasury Bills, Non-US Government Bonds, and Corporate Bonds).

Exhibit 5: Tokenized Fixed Income MC

Exhibit 6: Tokenized Fixed Income Market Capture:

When we zoom in on the market capture of tokenized fixed income across fixed income types in Exhibit 6, we see that U.S. treasuries account for over 96% of the tokenized fixed income market. It again becomes clear that expanded access to U.S. financial instruements has been a driver for the development of tokenized capital markets. For investors outside the United States, who did not previously have access to U.S. treasury bonds, and live in markets with either high inflation or weaker financial markets, this instrument provides a relatively low-risk instrument.

We believe this trend of exporting U.S. capital markets via tokenization will next extend to U.S. equities. Major digital asset firms like Ondo Finance, have recently launched tokenization platforms, opening access to U.S. equities markets via tokenized equities.

Trend #2: Anticipated Institutional Participation in the US

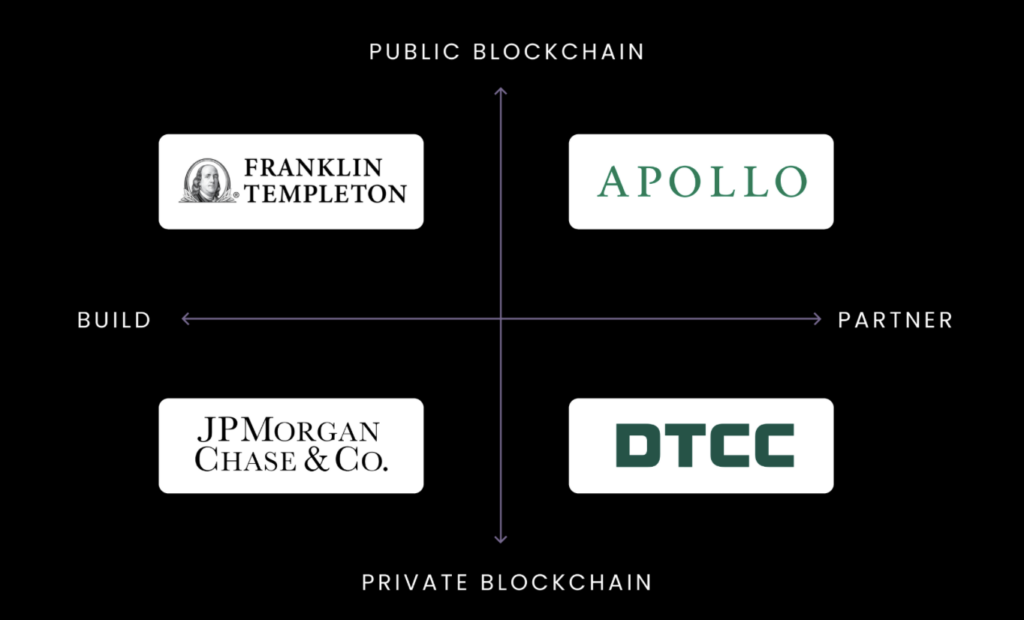

With over 40% of the global stock market situated inside the U.S. financial markets, it’s no question that both the digital asset regulation and institutional adoption in the United States will shape and impact the broader tokenization transformation worldwide. Over the past several years, we have seen several, major institutions inside the United States build and launch their own tokenization proof-of-concepts, pilot programs, and early-stage products.

Exhibit 7 highlights the spectrum of institutional participation with examples of U.S. institutions, engaged on public blockchains vs. private blockchains, and directly building vs. partnering with other firms.

Exhibit 7: Examples: Spectrum of U.S. Institutional Participation

Within the domain of public blockchains, Franklin Templeton has been one of the first major asset managers to launch a digital asset product on a public blockchain, with their tokenized money-market fund (+$400 million) across Ethereum, Solana, Avalanche, and more. Furthermore, Apollo, recently announced the launch of a tokenized private credit fund in partnership with Securitize. Within the domain of private blockchains, J.P. Morgan has been a major builder with their Kinexys (previously Onyx) platform, and DTCC recently conducted a pilot program with Canton Network.

Shifting to regulation, the SEC’s recent reversal of SAB121, now enabling institutions the ability to custody their clients’ digital assets without having to count the asset as both a liability and asset on their own balance sheet, now gives institutions less roadblocks to engaging with digital asset activities. With Citi and State Street both announcing plans to launch their own crypto custody solutions in 2026, it’s likely that we will see other major institutions follow suit. Over the next several months, we anticipate further regulatory clarity to be brought on by the SEC and the United States government via market infrastructure regulation.

Furthermore, last week’s announcement by President Trump to move forward with a U.S. Crypto Reserve highlights an additional catalyst for the diffusion of distributed ledger technology into the financial system. While the reserve is likely to represent only a minuscule portion of the overall government’s balance sheet, this initiative marks a significant milestone and will likely instill greater confidence among financial institutions to participate in tokenization.

Overall, with clearer regulation finally coming to the strongest capital market in the world, financial institutions are now positioned to accelerate and scale this transformation. However, while acceleration is near, given the global and highly regulated nature of financial markets, we believe the tokenization of capital markets will continue to be a story of slow and sustained growth. Each asset class presents a unique set of existing infrastructure and regulations to integrate with distributed ledger technology, making tokenization no simple feat.

Everything Post Web at Your Fingertips

Stay ahead at PostWeb.io to access our latest Post Web thesis, audio documentary episodes, our newly launched accelerator program, and much more. Chapters One & Two now out with more to come.