Demand for a Sustainable Future

The recent widely discussed crypto crash revealed particularly weak business and token designs in Web3. Instead of naming the individual failed projects and analyzing their individual case, this article focuses on the necessities for Web3 token economies to mature for the next adoption cycle. Better user experiences and lower technical barriers to entry for crypto newcomers are important “frontend” matters here. On the “backend”, better quantitative approaches through token engineering require much more attention. A Web3 business with a fully optimized token design can’t be successful without good marketing, adoption, and user experience. The opposite is true as well. The website can have the best user interface and graphics accompanied by huge community marketing campaigns and still not be successful without a well thought-out token design on a quantitative basis. This article demonstrates the urgent necessity for token engineering for the next maturity cycle in the crypto space and why it is especially relevant, not just for Web3 founders and token designers, but also for every crypto/Web3 enthusiast who wants to understand what is really going on in a token ecosystem.

How can Token Engineering solve it?

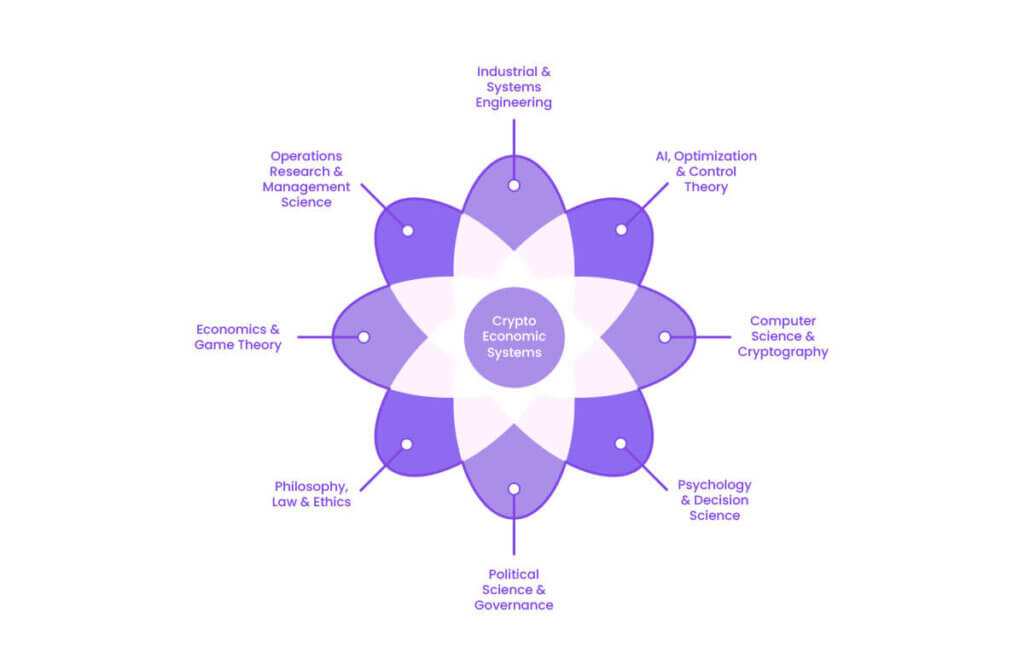

“Token Engineering” is the youngest engineering field and was first emphasized in 2018 [1]. Its interdisciplinary approach is used to design, model, verify, and optimize token-based economies. According to Sayama, token economies are complex systems that are characterized by two core concepts: emergence and self-organization [2]:

“Emergence is a nontrivial relationship between the properties of a system at microscopic and macroscopic scales. Macroscopic properties are called emergent when it is hard to explain them simply from microscopic properties.” [ibid.]

“Self-organization is a dynamical process by which a system spontaneously formsnontrivial macroscopic structures and/or behaviors over time.” [ibid.]

Both concepts can be found in crypto economic systems, where emergence can be observed as convergence of a system to certain unforeseen states, which are the result of the interaction decisions of individual agents or whole stakeholder groups. This self-organizational behavior might take place on the live interaction level with the protocols utilities or on the governance level through participation in proposals and voting. Therefore, to understand these complex interdependencies, numerical simulations must be performed by a token engineer.

Some of the diverse disciplines a token engineer has to work with to analyze crypto economic systems are depicted in Figure 1. The terms “token economy” and “crypto economy” are used interchangeably in this article.

A crypto economic system is a complex adaptive network of different agents with different goals and incentives connected by a cryptographic token that is deployed on a blockchain. The term “crypto economic” was first mentioned in the Ethereum developer community [ibid.] and refers generally to a decentralized blockchain network in which the different agents can interact based on trustless smart contracts. These smart contracts are programmatically deployed contracts on the blockchain and ensure that all transactions between the different agents are 100 % transparent and immutable. In most cases, individual agents in this network try to optimize their own financial short- or long-term profits. However, some agents optimize for more voting power if there is a decentralized governance structure in place. The voting power can bring them in a position to lead the organization in a direction that matches their own interest, which again in most cases, is their own profit. Note that Eyal’s example of the Miner’s Dilemma indicates that optimization for maximum individual profits without looking at the consequences for the ecosystem can result in lower long-term individual profits [4].

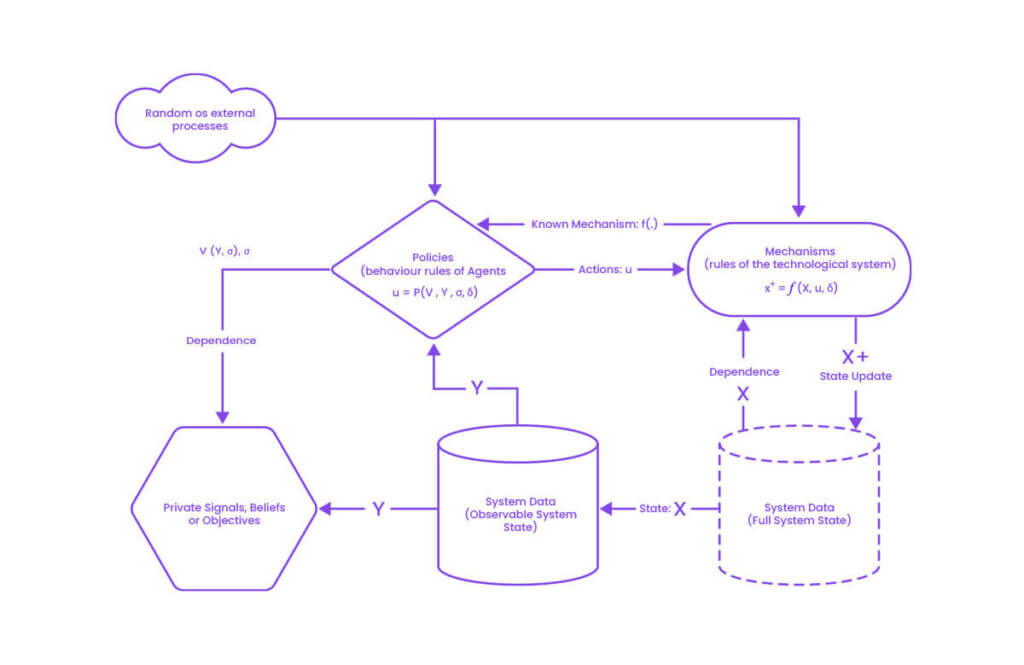

The token engineer creates a data-driven model or digital twin with the input of some or all of the shown disciplines in Figure 1 to find best design decisions to maintain system stability and sustainability in different market conditions. A modeling approach for agent based crypto ecosystems is proposed by Zhang et al.. They developed a generalized model for agents’ beliefs and their behavioral policies within a technological system of mechanisms [5]. The applied framework is a state space representation, borrowed from the field of control engineering. A high level mathematical description of the model is shown in Figure 2 for further notice.

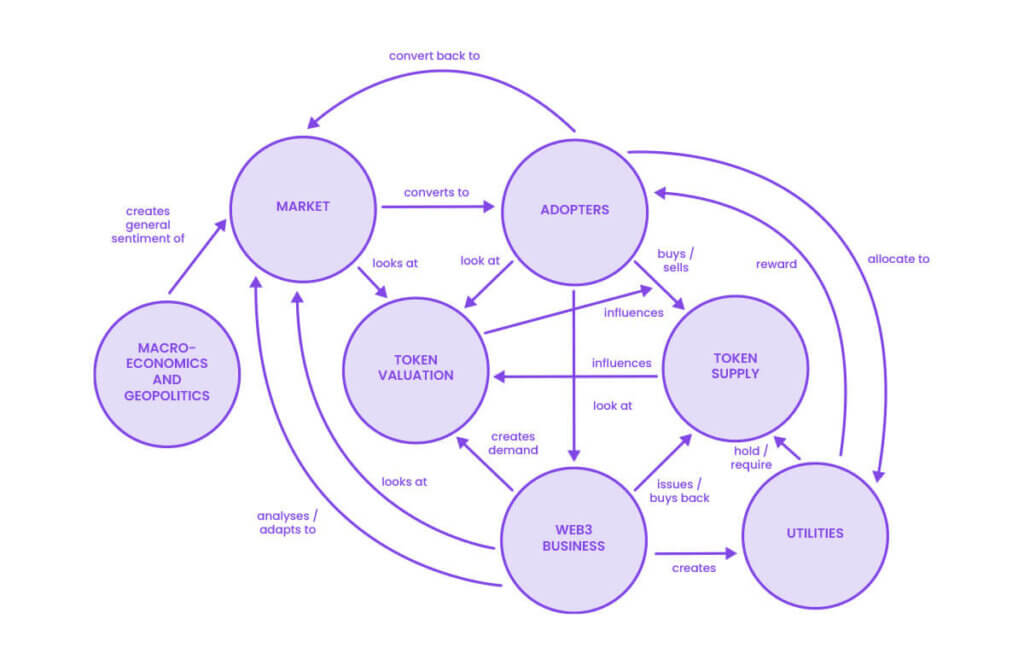

A more tangible and simplified illustration of the different fundamental entities and their influence factors that play a role in a token ecosystem is shown in Figure 3. It shows in alignment with Figure 2 that the interdependencies between the entities can be one-directional, circular, or recursive, which leads to a non-linear complex system of interactions. A one-directional relationship in Figure 3 is the sentiment creation through macroeconomics and geopolitics for the market that observes the business. The adopter buys and sells are influenced by the token valuation, which is influenced by the token supply distribution which in turn is dependent on the buys and sells and closes a circle. A recursive relationship would be the market that converts to adopters, which convert back to the market depending on their view of the business and the token valuation. Note that there are many more factors that play a role in these exemplary interaction scenarios.

All kinds of crypto ecosystems may be modeled: different layer blockchains, DeFi protocols, GameFi, Metaverses, and NFT projects are some examples. As an example, for a general fungible token based Web3 business, the engineer needs to make different design choices and assumptions for the ecosystem and the market reaction in the model, such as

- Token supply type: fixed / inflationary

- Monetary assumptions of the overall business model

- Liquidity design

- Planned token buybacks

- Investor token allocations, corresponding discounts, and vesting schedules

- Business token buckets and management

- Adoption assumptions and market sentiments

- Utilities

- Agent level granularity and behavior

The results of a model will only be as good as its underlying assumptions and inputs, and all parameters should be questioned and validated if possible. From the token perspective a well thought-out business model that answers questions about its intrinsic value and demand and has a strong objective statement, smart designed utilities, value flow charts, and stakeholder mappings are crucial for the success. The token engineer completes the picture and brings the whole crypto business to a quantitative level that has a sharper definition and is more tangible. This step is not negligible for any Web3 business or project that wants to have a stable, sustainable, and profitable future.

No Sustainability without Token Engineering

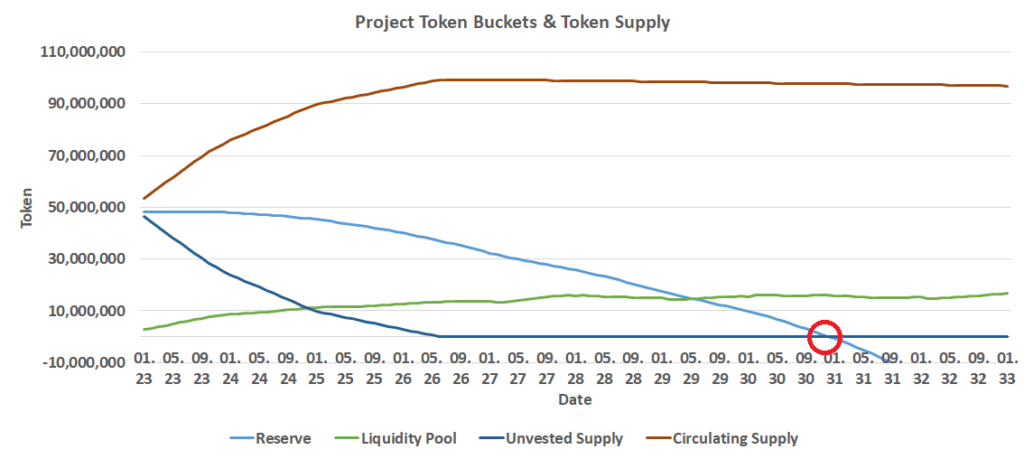

Macro market sentiments often manifest in a higher magnitude for smaller market cap tokens. Therefore a crypto bear market acts as a catalyst to expose weak crypto companies at an accelerated pace. The price action of a token alone is not representative for a holistic value capture implication, but it is an indicator for it. Token price declines are not the only concerns for Web3 businesses. Figure 4 shows the results of a simplified quantitative token model for an exemplary web3 business. The red circle indicates the point where the reserves of the company run out of tokens after around 8 years. This is a typical case for fixed supply token designs without proper numerical forecasting through a token engineering approach.

The forecast in Figure 4 is not trivial, since it is the result of many interdependent processes of tokens being transferred back into the reserves and tokens being paid out as rewards to different protocol participant stakeholder groups within volatile markets and different adoption phases.

Improved stability and sustainability are high demand properties in crypto protocols to lead them into more maturity and adoption. That is the reason why serious web3 businesses can’t avoid performing quantitative analyses of their ecosystems. Sustainability is a multifaceted word and there are different kinds of sustainability. Today’s political discussions revolve around environmental sustainability, which blockchain technology can also help to solve, see Regenerative Finance (ReFi). However, this would be a topic on its own.

Sustainability for token ecosystems is related to the token supply and to the value capture of the token. Supply sustainability means that there must always be enough tokens in the businesses wallets to vest and to pay out potential rewards to the different stakeholder groups. L1 protocols, such as Ethereum, Cardano, Solana, Avalanche, etc. tend to have token minting capabilities to ensure this requirement for the long-term. In most cases, there are burning mechanisms implemented to counter the dilutional effect of token issuing and to aim for a long-term deflationary system. However, the applied inflation rates and network support incentives have to be forecasted on a quantitative level to ensure that there will always be enough incentive to run validator nodes for increased decentralization and security. Projects built on top of these layer 1s tend to choose a fixed token supply, because it is a good selling proposition for investors to know that their share can’t be diluted. Web3 businesses have to plan carefully and complete quantitative forecasts to ensure that there are always enough tokens able to be paid out. It is also in their interest to maintain a stable or appreciating token valuation. McConaghy proposed a web3 sustainability loop model borrowed from successful Web2 businesses and national economics and is a useful starting point to nurture appreciating token valuations [6]. Token price decrease might be a negative thing from a marketing perspective, but it does not necessarily mean that holders lose $-denominated value in their share if they get appropriate token reward payouts. Again all the exact system states and parameter sets have to be tested in a digital twin of the ecosystem for different market conditions. This is likewise important to prevent potential exploits within the ecosystem of one stakeholder group over another. Token supply and valuation aspects are vital for the success of a web3 business and the data-driven nature of token engineering is necessary to handle them.

Profit Forecasts for all Scenarios

Another angle is the protocol participation incentive. Web3 businesses must always think about the incentives for their customers to buy, hold, and use their token. Token ecosystem models can help to forecast not just the potential profits for the business but also for the different stakeholders. The token and web3 business adoption is highly dependent on the monetary incentives for the stakeholders. A widely used utility for a token is locking it away to become eligible for governance participation or to receive discounts for product usage or receiving token payouts in return. Such a staking utility expresses trust by the adopters in the web3 initiative and can be rewarded. It can help to remove tokens from the circulating supply and creates scarcity. The critical part is the chosen reward yields for adopters. A high yield will potentially attract more agents to stake and will lock away more tokens to create a short-term demand.

This may lead to increased selling pressure in the near future as holders seek to realize profits from paid rewards, which subsequently may lead to declining token price. As soon as the participants see that this continues, more and more stakeholders will remove their stake and potentially sell their principal to leave the protocol, which will lead to a downward spiral. Depending on the lockup period, a too small reward yield for stakers might not provide enough incentive for people to engage with the protocol and stake and therefore mitigate the desired effect of this utility. Stakeholder behavior in these different scenarios is worth being modeled by a token engineer to prevent an unforeseen protocol exodus.

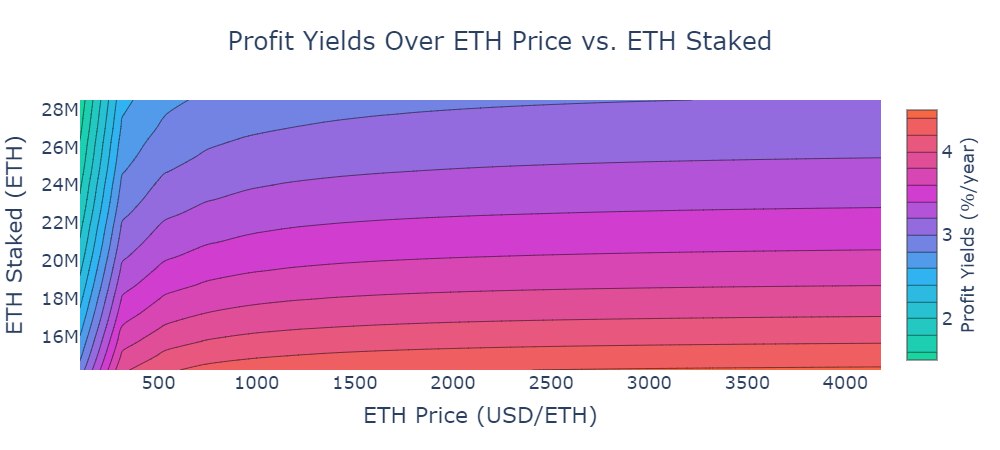

CADLabs open-source Ethereum radCAD model [7] comes with many preset experiments to examine the L1 blockchain under different angles and assumptions. It is a good example for a modeled token ecosystem and widely accepted in the community. By tweaking the Ethereum Foundation given merge [8] date of the model to one in the past it can show the expected profit yields for all proof of stake (PoS) validators at different amounts of total ETH staked in the network and ETH prices in USD, such as indicated by the color mapping in Figure 5.

Figure 5 shows that the ecosystem becomes less profitable for validators if the ETH amount staked increases, which means higher network validator participation, and vice versa. Buterin mentions this effect should lead the amount of validators to be in a healthy equilibrium where there are always enough validators to maintain the decentralization of the network, because the profit yields will increase if less ETH is staked and on the other hand prevent too much computational load on the individual validators if too many participate [9]. These insights would be difficult to quantify without the help of the provided model that has been created by token engineers.

Summary

This article highlights the demand for more mature and better designed crypto ecosystems that are based on quantitative approaches. The token engineering discipline aims to model the different non-trivial relationships within such systems. Thereby it doesn’t matter if a token ecosystem is a blockchain, crypto game economy, NFT project, DeFi application, Metaverse, or real world tokenization approach. Modeling a crypto ecosystem in a quantitative way is the only way to forecast potential emergent effects that are enforced by self-organizational agent behaviors. This article showcases examples for token supply and valuation sustainabilities, where token engineers are required to perform numerical analyses to create a data driven knowledge base on how to maintain them. The forecast of protocol inherent incentives for the different stakeholder groups is likewise crucial to prevent a token exodus, economic exploits, and other instabilities.

Overall, quantitative modeling and forecasting are required for web3 businesses to become successful. There is no way around it for the crypto space to mature for the next web3 cycle. Fortunately, token engineering communities, platforms, tools, and companies are growing, showing that recognition of the facts outlined in this article is increasing. This puts pressure on the web3 businesses that still rely on subjective intuition to transition to setting their ecosystem parameters using deterministic, rational, quantitative analyses. For those businesses that are unsure of a path forward, the good news is that there is a company helping web3 businesses from the start to the finish in a holistic, professional, and encouraging way.

Outlier Ventures – a strong partner for your web3 business

Outlier Ventures (OV) empowers crypto start-ups to become successful through holistic expert advisory, networking, and fundraising. Their token economies department provides guidance for NFTs, token design, and token engineering. It leverages powerful tools, such as token design workshops and quantitative token models, to forecast the business idea of web3 teams or to review and finalize their own token design and model. Applications for OVs’ Base Camp Accelerator for brand new start-up teams or our Ascent program for advanced teams are open. Visit our website for more information: https://outlierventures.io/

References

[1] McConaghy Trent, (2018), Towards a Practice of Token Engineering, accessed 22 September 2022, https://blog.oceanprotocol.com/towards-a-practice-of-token-engineering-b02feeeff7ca

[2] Sayama Hiroki, Introduction to the Modeling and Analysis of Complex Systems, ISBN 978-1-942341-09-3, New York, USA: 2015.

[3] Voshmgir Shermin and Zargham Michael, (2020), Foundations of Cryptoeconomic Systems, No 1, Working Paper Series/Institute for Cryptoeconomics/Interdisciplinary Research, WU Vienna University of Economics and Business, accessed 5 September 2022, https://EconPapers.repec.org/RePEc:wiw:wus051:7782.

[4] Eyal Ittay, (2015), The miner’s dilemma, 89–103, IEEE, accessed 14 September 2022, https://people.cs.uchicago.edu/~davidcash/23280-winter-19/miners.pdf.

[5] Zargham Michael, Zixuan Zhang, and Victor Preciado, (2020), On modeling blockchain-enabled economic networks as stochastic dynamical systems. Appl Netw Sci 5, 19, accessed 17 September 2022, https://doi.org/10.1007/s41109-020-0254-9

[6] McConaghy Trent, (2020), The Web3 Sustainability Loop, accessed 26 September 2022, https://blog.oceanprotocol.com/the-web3-sustainability-loop-b2a4097a36e

[7] CADLabs, (2021), Ethereum Economic Model, GitHub repository, accessed 5 September 2022, https://github.com/CADLabs/ethereum-economic-model.

[8] Ethereum Foundation, (2022), The Merge, accessed 5 September 2022, https://ethereum.org/en/upgrades/merge/.

[9] Buterin Vitalik, (2022), Validator set size capping strategies, accessed 5 September 2022, https://notes.ethereum.org/@vbuterin/validator_set_size_capping.