When it comes to token-based governance, there are many different ways of dispersing tokens and placing them in the hands of the community and relevant stakeholders. These methods can vary across airdrops, liquidity mining, novel auction mechanisms, or a combination of the aforementioned. In this article, a less often mentioned method will be examined, as well as various augmentations that can be made to tighten alignment across stakeholders as much as possible.

The DAOs of today face many issues. Chief among them is the omnipresent issue of voter apathy, something anyone who is an active contributor to a DAO knows only too keenly. That is not necessarily to say that each address that holds a specific token must engage and debate each meticulous detail; not everyone has the same incentives when engaging within a community and many cooks can spoil the broth (as well as taking an extra long time to make the broth in the first place).

Another common issue is that one commonly used distribution method, liquidity mining, puts tokens into the hands of mercenary addresses that are not necessarily interested in governance of the product or underlying cause, and attempt to dump their tokens on others – lest others dump their tokens on them. In the ruthless PvP world of DeFi you are either a dumper or a dumpee.

People providing liquidity to your token, as well as engaging in selling behaviour are not necessarily bad per se, it is normal behaviour and even to be encouraged at times. The drawback of this is that the profits of the farmers come at the expense of the mission-aligned community and the DAO treasury itself. We can observe this in the subsequent dumping of tokens following the launch of yield farms, as evidenced in this article.

There exist methods of quantifying contributions and awarding tokens more equitably to those that have invested time and effort, however these loyal holders often get dumped on by the speculators and the farmers. An intuitive solution to this would be to create vesting schedules for farmers and early buyers who are not early DAO members – the drawback to this though would be that the contributors would not really profit by selling their tokens due to less liquidity provided due to lockups, and less demand for the token. Furthermore, vesting does not necessarily reduce selling pressure, it just disperses it on a timeline.

Unfortunately, there is no perfect way of launching your governance token. What does exist however, are different approaches that can mitigate certain risks depending on the exact goals and requirements of your token launch.

An often overlooked method of token distribution is the use of a bonding curve for the minting and burning of said tokens. For those of you unfamiliar with bonding curves, here is a quick primer.

Bonding Curves: Fixed Relationships

Bonding Curves are essentially a way of ossifying the relationship between price and supply. An even simpler way of saying this is: as the supply of tokens changes by X, the price changes by Y – where Y can be either a fixed value or a percentage.

This is similar to the way an AMM works, except no liquidity is needed to seed the pool as ETH or stable coins can be deposited into the curve in order to mint tokens on demand (as opposed to needing liquidity in the pool to facilitate the swap).

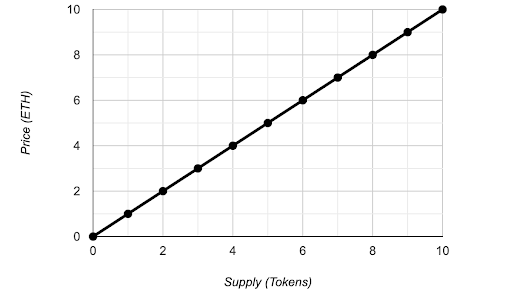

For example, we have a bonding curve where no tokens have been created yet, and the price increases and decreases by ‘1 ETH’ with each mint/burn. The starting price to mint the first token is 1 ETH.

Along comes Bob. He puts 1 ETH into the bonding curve and receives one token in return. This moves our point along the curve, increasing both X and Y to 1 and Y. The price to mint the next token is now 2 ETH.

Alice likes the look of this token Bob has minted and wants in on the action. She mints the next token for 2 ETH, and then another after that, which is now priced at 3 ETH. Overall, Alice has deposited 5 ETH into the curve and received 2 tokens in return.

Bob sees that the price has increased, and decides to cash in his token for a profit. Since the price is now at 3 ETH, Bob can deposit his token back in the curve and redeem 3 ETH, therefore pushing the point backwards along the curve and the price decreases to 2 ETH.

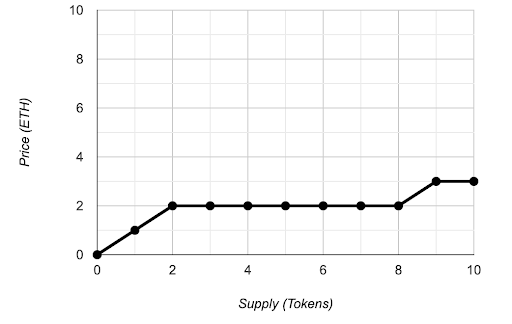

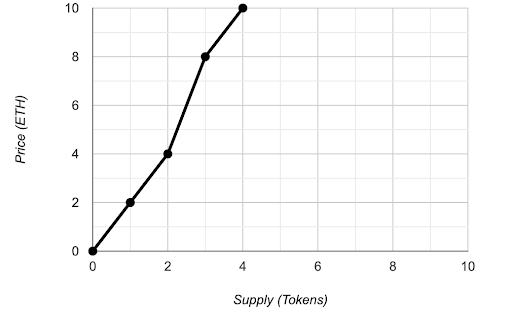

This is the essence of a simple bonding curve. It gets interesting once we start to experiment with the shape of the curve itself. What if the price increases by 10%? What if it changes by 0.5 ETH until a supply of 100 tokens is reached, at which point the curve flattens out and only moves by 1% with every mint and burn? What if the curve is a certain shape but changes once certain product milestones are met as confirmed by some oracle? A curve like this could be used to reward early believers who minted tokens when risk was higher, and after the product is more established the product can change, becoming more steep.

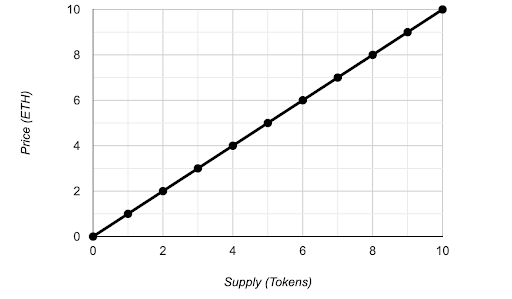

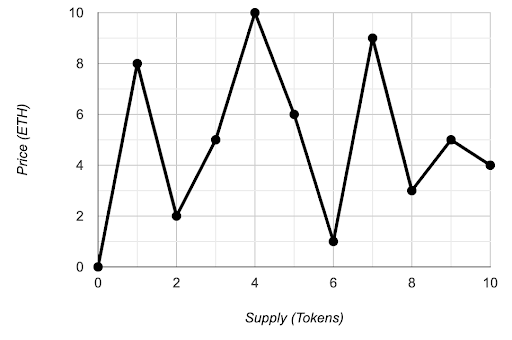

The possibilities here are endless, your curve can be a myriad of shapes. It can look like this:

Or This:

Or even this:

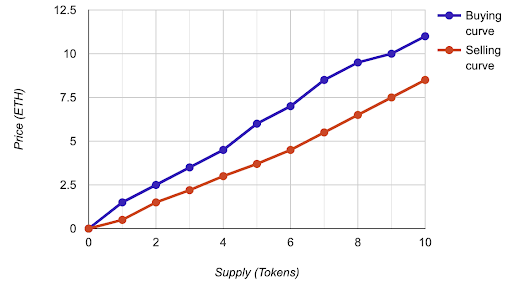

Another option is to have different curves for the buying (minting) and the selling (burning), where selling at X is slightly more expensive than buying at X. This delta can either be retained and sent to the treasury, or retained by the graph to grant even higher redemptions for each token sold back into the curve.

Other Types of Bonding Curves

Other more sophisticated types of bonding curves exist, two of which stand out. One of them is an Augmented Bonding Curve which was introduced by the Commons Stack.

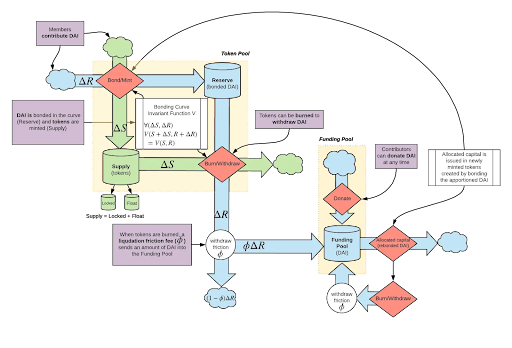

This is a vanilla bonding curve (as described above) with some interesting additions. One of them is the ‘hatching period’ – a pre-mint phase where early investors can deposit funds in order to receive tokens and make an early contribution. Some of the funds are directed to the curve itself, and some are directed to a treasury which can be used for capital allocation outside the bonding curve for the furtherment of a cause/product. In addition to this there is a vesting schedule for tokens awarded to ‘hatchers’ during the initial phase, and an exit tax where sellers pay a small fee which is redirected to the curve. Commons Stack even provides a simulator you can use on the website. It was conceived as an effective way of funding public goods.

Another variation is the Variable Rate Gradual Dutch Auction (VRGDA) as coined by Paradigm. In essence, it is a bonding curve that also takes into account a time element. To illustrate, we have a bonding curve from which we wish to disperse 10 tokens in the first two days. If less than 10 have been minted in this period, the price (Y) decreases according to a preset formula in order to incentivise an acceleration in minting. This works the other way as well, where price can increase if actual minting exceeds target minting. A more full explanation with examples can be found in the article.

In sum, bonding curves are a powerful way of aligning DAO stakeholders. Understanding the different kinds of bonding curves an how they work helps set the stage for a broader discussion ‘SuperPowered Tokens’ and how they can incentivise tighter alignment among DAO stakeholders