Abstract

The below article will focus on:

- What is the vote escrow token design

- How the token design benefits the protocol

- Meta-governance protocols and their need

- The negative aspects of the ‘ve’ token design

If you are not familiar with the Curve vote escrow token design please read this excellent primer to get a more comprehensive understanding prior to reading this series.

What is Vote Escrow?

Introduced by Curve Finance, token holders lock up their governance tokens (e.g. CRV) for a predetermined amount of time and receive vote escrowed tokens in return (e.g. veCRV). Lockers can choose a lock duration from 1 week up to 4 years. The longer you lock your tokens for, the more voting power is issued to you as a reward for your loyalty. During this lock period the locked tokens are illiquid and unable to be unstaked or sold. The locked tokens decay linearly over the duration of the lock until 0 vote escrowed tokens remain at the end of the locking period. Users may periodically relock the decayed tokens to indefinitely extend their lock period and earn the max rewards and governance rights.

In addition to locking your tokens and voting on proposals veToken holders are given additional perks, in Curve’s case they are:

- Select a pool you would like boosted CRV emissions on (up to 2.5x).

- A share of protocol fees paid in 3crv (in proportion to your % of all veCRV).

- Vote weekly on where the CRV emissions are directed (resulting in bribe revenue).

- Vote on governance proposals.

In basic terms, stakers lock their tokens for up to 4 years and in return they receive proportionate voting weight, protocol fees and other benefits.

How does this benefit the protocol?

For protocols the benefits are that the actors who lock their tokens for the longest period of time are generally the most loyal supporters of the protocol and have a long term view of where they would like the protocol to go. These lockers are willing to turn their capital into an illiquid position to receive governance power over the protocol thus improving governance (in theory), making them more willing to make informed and time conscious decisions.

The reduction in circulating supply also makes the ‘ve’ token design a self fulfilling superior token design prophecy. When a protocol pivots to the ‘ve’ token design and starts to distribute protocol rewards or accepts incentivised voting, this generally generates excitement and causes price appreciation of the tokens which are being removed from the supply and locked. Thus thinning liquidity and in turn making price appreciation more aggressive (in theory). The increase in token price plus more attention on the protocol is beneficial to building a community and standing out from competitors.

“As times get tough and we head into the other not so glorious part of the cycle, lockers just want a way out.”

Weaknesses with the ‘ve’ token model:

There are certainly advantages to the vote escrow model, which aims to reward long term holders with the majority of the governance power and passive income from protocol rewards. Locking of tokens also reduces selling pressure of the protocol’s token and creates an army of loyal supporters. While the ‘ve’ token design is a step in the right direction, the influx of liquid wrapped derivatives and meta-governance protocols building on top of it is disconcerting. A significant risk is that over time, voting power becomes more centralised and the passive income is extracted away from those loyal actors that are locked for an extended period of time.

We need ‘ve’_v2.

-‘ve’ & the Meta-governance Monster

The below will primarily focus on the Curve ecosystem, although the same weaknesses of the vote escrow design, along with the “meta-governance monster”, are theoretically applicable to all ‘ve’ tokens.

The vote escrow model is integral to the Curve ecosystem due to the highly inflationary nature of the CRV token design. Directing the CRV emissions to specific gauges to promote deep liquidity to those pools is a genius concept, resulting in protocols incentivising (bribing) veCRV holders to vote for their gauge.

Meta-governance protocols such as Convex build on top of the underlying ‘ve’ protocol, to capture as many of the governance tokens as possible and permanently lock them. This takes the governance token out of supply and reduces sell pressure, but results in the majority of governance power of the base ‘ve’ DAO being held by a meta-governance protocol. As in the case of Convex which has a much shorter locking period on its own protocol governance token, vlCVX. This means that the long term incentive has disappeared as the vlCVX holders with all the governance power now only have a 16 week time horizon.

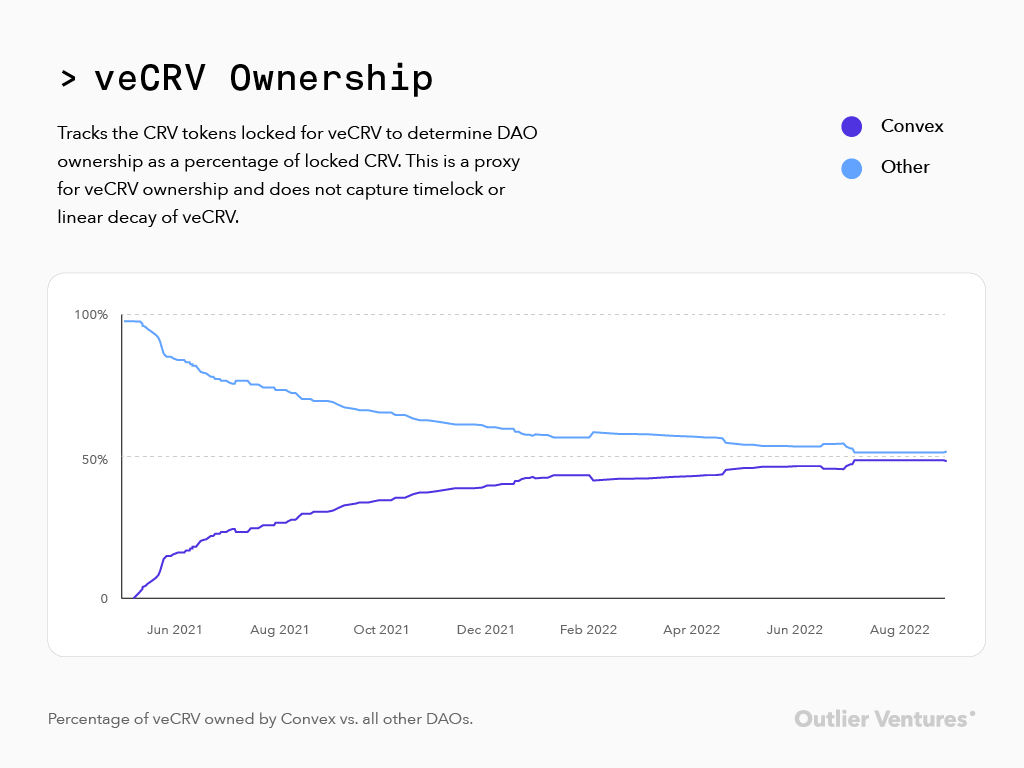

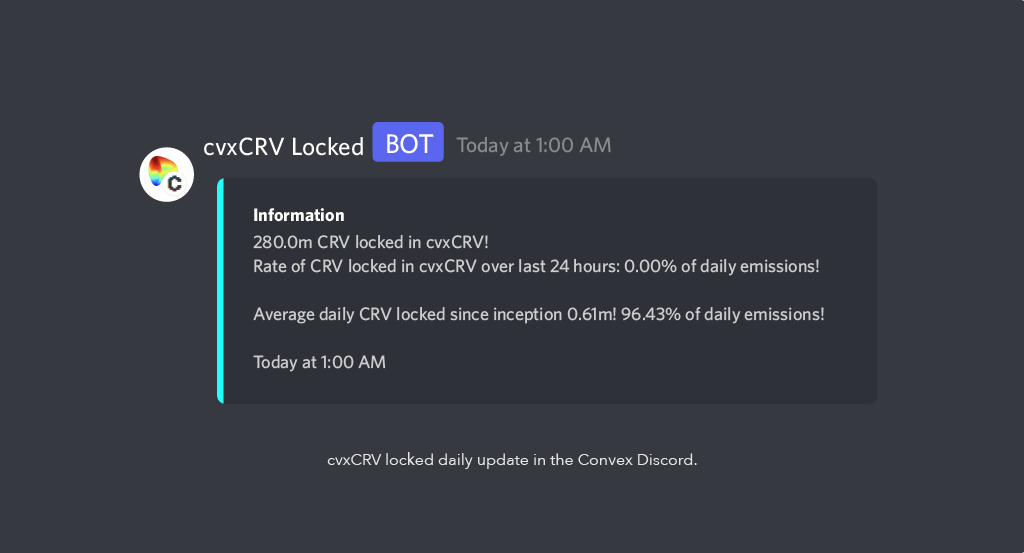

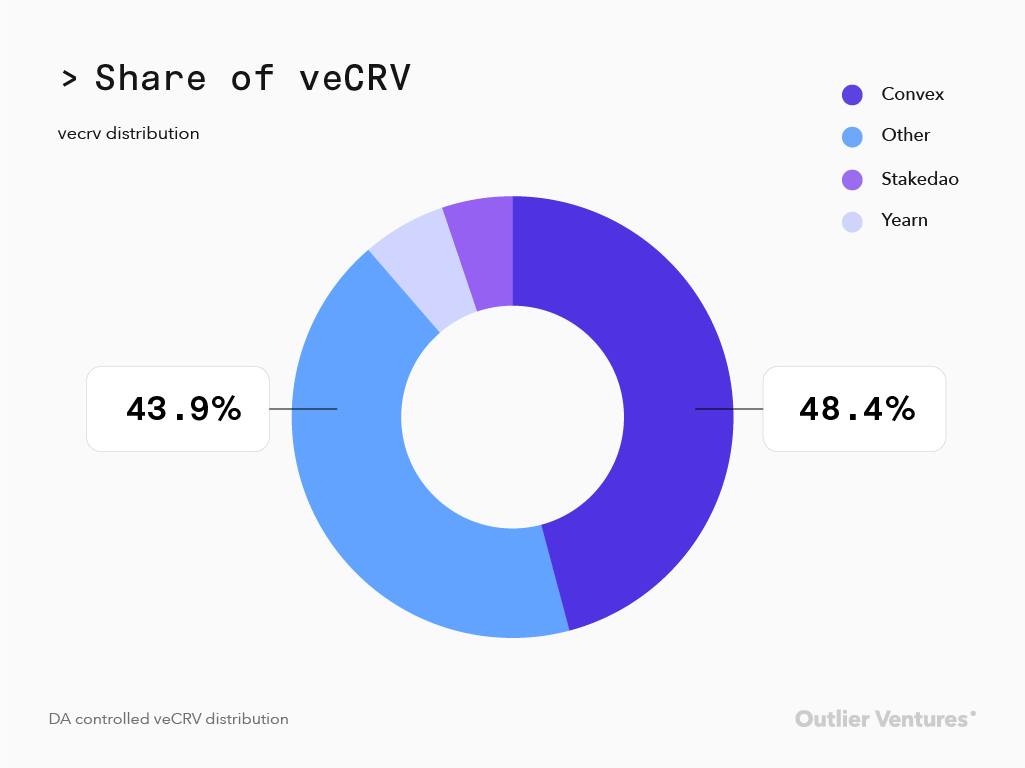

Figure 1 shows, since Convex’s inception, the amount of CRV that has been accumulated and permanently locked is reaching 50% of all veCRV that has been locked and rising fast. According to the cvxCRV locked bot in the Convex Discord, an average of 86.71%% of new daily CRV emissions have been locked into the Convex protocol since its inception.

By allowing CRV to be permanently deposited into Convex, in exchange for cvxCRV (a liquid wrapped alternative), this allows cvxCRV to be staked in order to receive similar rewards to those who have locked CRV directly with Curve for 4 years. Allowing someone to speculate on the price, receive the same rewards (excluding bribe rewards) and have a liquid position with the only risk being the cvxCRV/CRV peg seems to be an easy decision for the 281M CRV deposited by those who are willing to forfeit their governance rights to vlCVX holders in exchange for a liquid position.

This results in the majority of the governance power being taken away from individual veCRV lockers who have locked for up to 4-years and placed into the hands of vote locked CVX (vlCVX) holders who are locked for a maximum of 16 weeks. This results in the opposite outcome of what was initially hoped for the vote escrow model.

As hungry DAOs like Convex accumulate all the CRV, their voting weight increases with it; this in turn can make it more economically viable for protocols to purchase CVX rather than CRV if the ratio of veCRV controlled by 1 vlCVX grants the purchaser more governance power than purchasing that CRV and locking it. This ratio of governance power also flows down to those DAOs that are currently bribing veCRV and vlCVX holders for their votes. The poor ever diluted ‘ve’ holder is now missing out on bribe revenue as their voting power is diminishing every time someone locks another CRV into Convex.

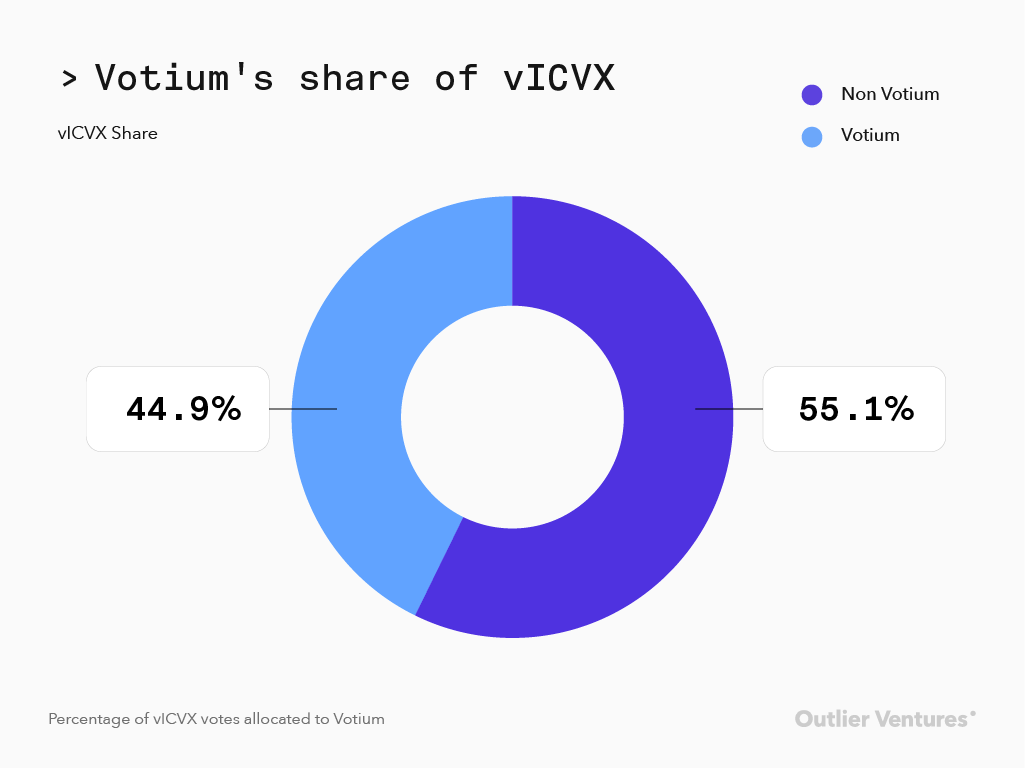

Although they hold an increasing amount of the veCRV governance power, vlCVX holders aren’t overly concerned about where the CRV emissions are directed. As shown in Figure 4, 55.0% have delegated to Votium, which is a protocol built on top of Convex and is designed to maximise voting incentives by distributing them in a way to earn the maximum revenue, rather than directing to a specific pool of their choice.

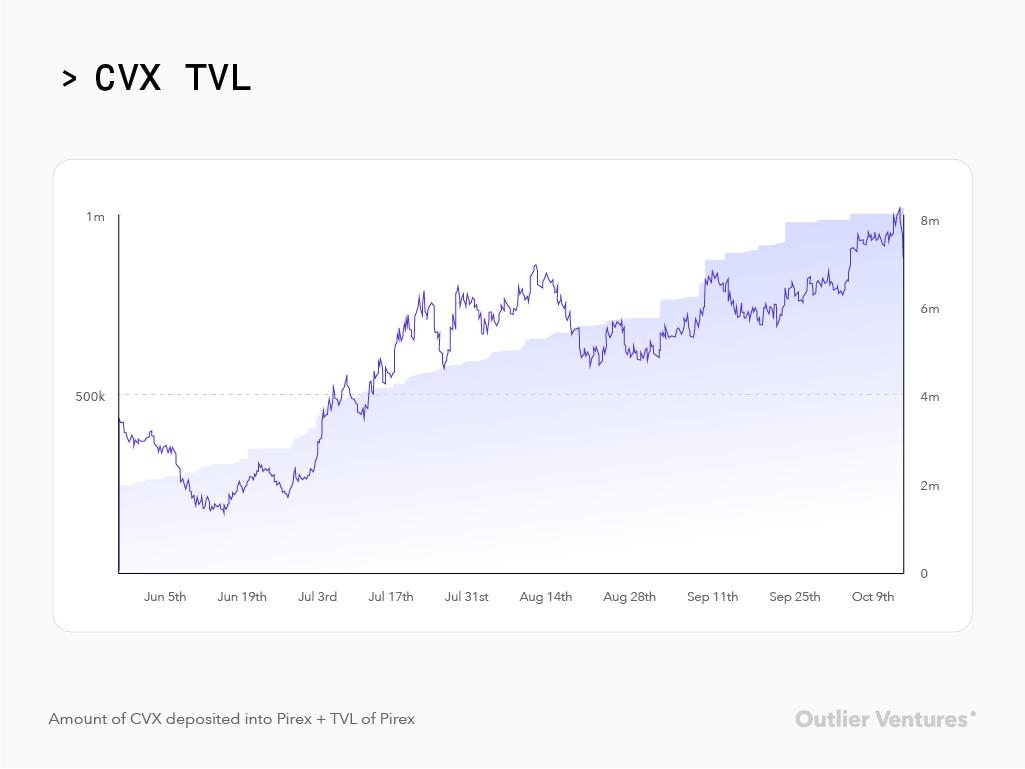

To further complicate things, we now have liquid wrappers of meta-governance tokens such as vlCVX (e.g. Pirex – which has amassed almost 1.5 million CVX since June, shown in Figure 5), making it clear a 16 week lock is too long for those who want the passive income plus a liquid position.

The end result is, ‘ve’ ends up aligning less with long term holders and more for protocols building on top, extracting the value for shorter lock times. This results in those most committed to the project at the beginning getting their voting power diluted at an ever increasing rate (unless they continue to lock the same amount of emissions as their original % of the tokens owned) by people who can exit their position every 16 weeks, or hold liquid wrapped derivative positions. When price increases this allows the liquid meta-governance token holders to sell and drive the price down on the committed community members who are locked and cannot exit their positions. As price falls and trading volume dries up, rewards distributed also deteriorate, which may lead to less attractive reward returns for certain lockers, however they can’t as they still have to wait another 3 years to escape.

“This results in those that were the most dedicated getting impacted the hardest, not a great result for the community, governance decisions and the protocol.”

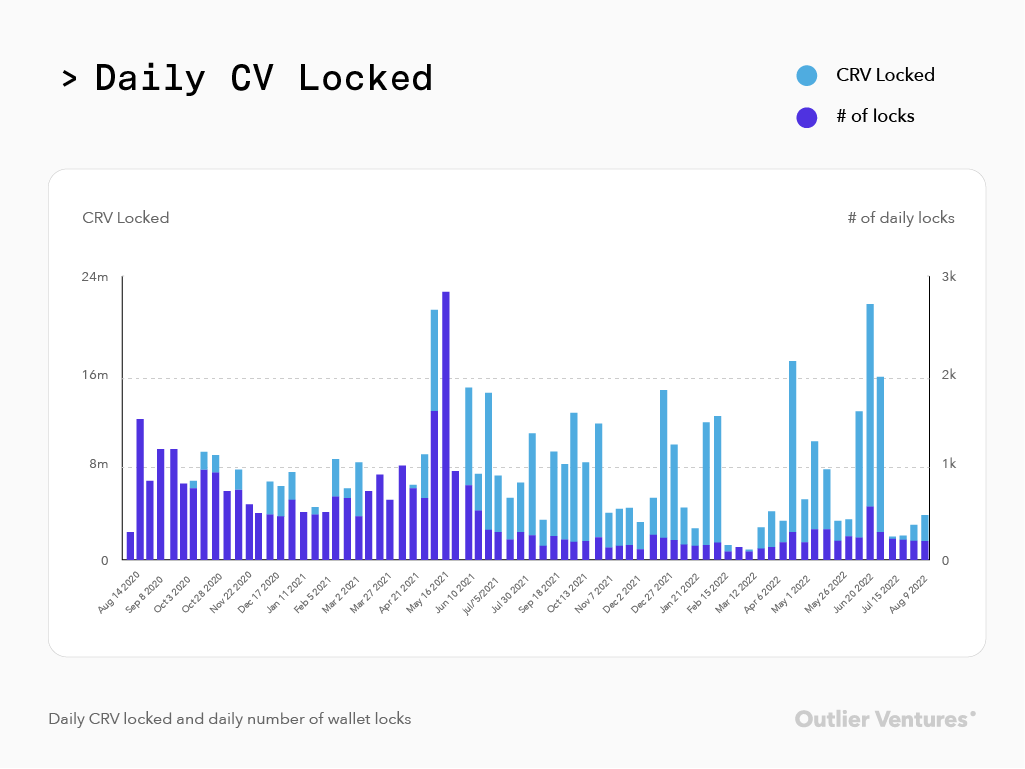

No one knows if a protocol will be around in 4 years time, let alone a dominant piece of infrastructure. Requiring a lock for 4 years to receive the maximum benefits of their purchase makes ‘ve’ tokens extremely unattractive to buy. As shown below in Figure 6, the daily number of locks has been drastically reduced since the middle of 2021, which coincides with when Convex launched.

As times get tough and we head into the other not-so-glorious part of the cycle, lockers just want a way out. Their voting power is decaying and they aren’t interested in re-locking as they are just trying to salvage as much capital as they can. New investors aren’t interested in buying and locking because they can see what’s happened to those before them. This results in low governance participation during times when leadership and community is needed the most.

The need for meta-governance:

The goal of the vote escrow token design was to incentivise long term lockers the most and build a loyal community to help govern the protocol over the next few years. As we have seen above, allowing them to lock and not allowing them to leave may not be as great as first thought. All this does is incentivise protocols to build on top, extract the governance power away from early base protocol lockers and put it in the hands of people prioritising rewards over long term governance. Protocols like Convex don’t add any infrastructural changes to the way protocols like Curve operate, their whole business model is to accumulate the governance power for themselves and rent that out to the highest bidder. If the base level protocols token design was sufficient, there would be no need for these meta-governance protocols to exist and the base level protocol could achieve more decentralisation, more community participation and reward its lockers in a fairer way…sounds like the original goal right?

The original ‘ve’ model is outdated:

Despite this thought piece having focused primarily on the Curve and Convex ecosystems, it is even more important for protocols that do not share Curve’s emissions schedule, gauge voting and superior product to think whether the current version of the vote escrow design is right for them. Implementing vote escrow tokenomics on a protocol that is trying to pivot away from former token design mistakes in the past may be an even larger risk.

The long-term incentive alignment that vote escrow was supposed to attract works well when we see a growth period like we did from 2020 – 2021. However, when goblin town arrives it’s every locker for themselves. As liquidity dries up so does volume and protocol revenue, resulting in lockers receiving substantially less rewards than they did when times were good. The loss in principle and rewards results in those most dedicated to governing the project losing faith and thus governance participation will suffer in the times it is needed most.

If Curve could have their time again, they would hopefully look to change their token design to remove the need for a protocol like Convex to step in and extract all the value away from their own holders. Unfortunately Convex holds far too much governance power for Curve to pivot. For projects launching or pivoting to ‘ve’ now, some serious consideration must be given to the current weaknesses in the model and ways to correct them, especially when the protocol does not have the same gauge voting, emissions and product that complements the current ‘ve’.

Look out for a follow up article soon on what mechanisms can be used to improve the vote-escrow token design, reward the loyal supporters, achieve more decentralisation and increase governance participation.