Two seismic problems exist in finance. Within more traditional capital markets & banking, the market is encumbered by out-moded legacy infrastructure. Within the the more emergent digital assetization arena the markets are inefficient due to a lack of liquidity.

So we are delighted to confirm, Outlier Ventures are the lead advisor and an investor in Alkemi, an open-source prime brokerage platform who are addressing a $4 billion immediate market opportunity arising from these structural issues. Bridging the gap between traditional capital markets and the rapidly accelerating programmable capital era.

Alkemi recently excelled at NYC TechStars and count Xpring, Consensys (Coven.VC) and ARC Fund as backers. The core team already have great experience and a well established network within traditional capital markets coupled with a deep understanding of the security necessary to build decentralized infrastructure.

Partnerships are already in place

Outlier Ventures includes experienced senior financial services and capital markets professionals from JP Morgan, Goldman Sachs and Chicago Mercantile Exchange. By capitalising on ours & their own network, Alkemi are already close to announcing some key partnerships. Alkemi will also be uniquely positioned to attract liquidity from the multiple tokenised protocols Outlier Ventures have already partnered with along with their rapidly expanding Diffusion network.

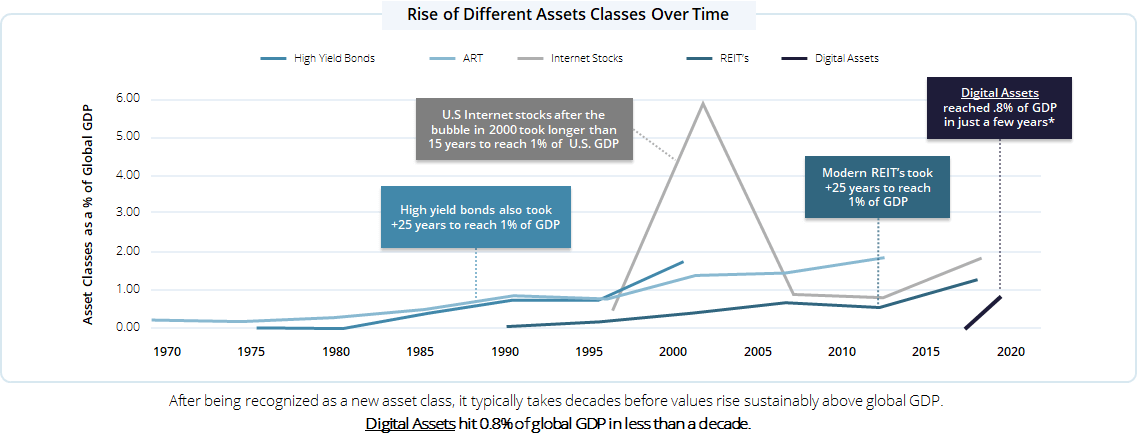

Capitalising on macro-trends

Over the last few years, we have been observing how capital is being deployed into Fintech which essentially is just slicing the same old data into utility enriched user experiences for consumers. The punitive levels of back-office settlement, compliance and data management remain because how the underlying assets are manufactured does not change. This should be a major concern when there is a clearly established trend within markets underpinned by digital technology for the manufacturing cost to head to as close to zero as possible.

Digital technology completely transformed how the music industry is manufactured from compact disc to digital, from $’s to fractions of a penny and the same forces are continuing apace to disrupt bricks & mortar retail through DTC. This is already evidenced in capital markets by trading fees plummeting to around 20 basis points from much loftier highs. Coupled with negative interest rates and all the big tech companies launching into the payment space, the battleground for omnipotence has never been harder fought.

Which is why at Outlier we are focussed on the deeper infrastructure that will underpin this next frontier of finance. Programmable assets are very much here to stay because 1) they solve the double spend problem 2) contracts can be exchanged automatically 3) securities can be settled immediately 4) everything is fully auditable & 5) taxable to mention just a few. Wiping hundreds of millions of $’s annually out of the back office budgets within the biggest institutions. Hence why the likes of Fidelity, JP Morgan, Santander and hundreds of others have been working so hard to keep up to date:

The rate of growth of digital assets is undeniably impressive, buoyed by the fact that they are cheaper, faster and better. The single biggest factor holding them back is that there is still not a regulated digital currency to facilitate on & off ramps at industrial scale.

Could China be the tipping point?

Getting the investment timing right cannot be understated. All the major central banks have had their heads turned by digital currencies. With the 2nd largest economy in the world making some very large macro plays to support their Belt & Road mega project, the smart money is on China being the first to adopt a national digital currency. The Digital Currency Electronic Payment is already in place with news leaking about a 2020 launch being in play.

This is part of the reason Outlier Ventures are running a 10 day 3 city Diffusion Tour in China in December which Alkemi are a key partner.

We also agree with the likes of Ray Dalio that a paradigm shift is happening in the world. One which will net out with developed economies having far fewer banks who are completely global. With the power shifting towards asset holders who are capable of securely supporting the widest assortment of digital assets and the plumbing necessary to enable them to be exchanged freely.

What exactly does Alkemi deliver?

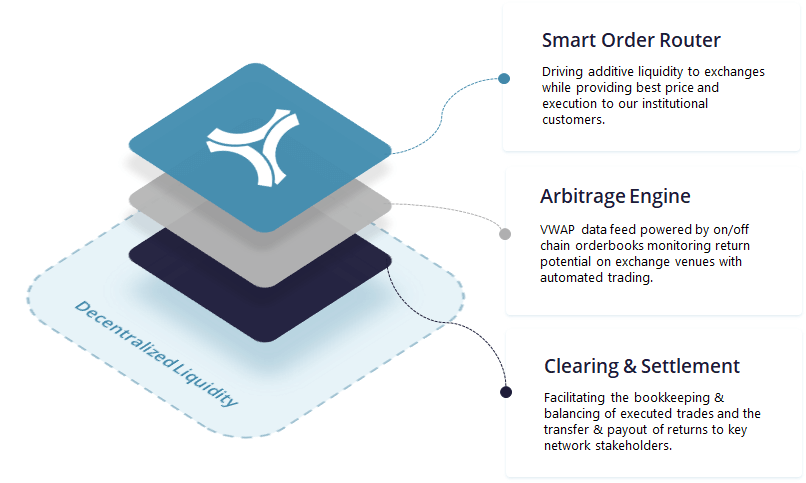

Alkemi’s platform provides the non-custodial infrastructure for digital assets to connect with exchanges. Facilitating open access to liquidity and streamlined settlement for our customers (e.g. institutional capital allocators) and partners (exchange venues & third party providers), solving the problem of digital asset market inefficiency.

Their modular infrastructure technology platform is powered by decentralized liquidity with three applications at the core: 1) Smart Order Router; 2) Arbitrage Engine; and 3) Clearing and Settlement:

Powered by decentralized liquidity pools, Alkemi’s applications help our customers connect to our partners more seamlessly and efficiently, thus driving increased opportunity for return.

How does this support institutional adoption?

For large institutions looking to enter the space today, the alternative is to enter and get off through OTC markets. Institutional facing trading products start at a size of $50,000 for a block and can scale up to $100 million in volume. Their execution today remains largely manual and cannot offer large sums within a matter of minutes. Bids and asks take time to be filled through spot exchanges today. This is at the crux of the problem Alkemi is looking to solve. Through capital that is parked on multiple spot exchanges, Alkemi can fill in an institution’s order in a matter of minutes with a guaranteed rate. Settlements are done on an IOU basis. That is, a buyer’s funds does not have to be at an exchange for it to be filled. It can simply be relayed to Alkemi who can fill it on their behalf. Since liquidity is sourced from multiple exchanges, it should reduce the spread a fund pays for coming on-board or getting off digital assets.

Alkemi on the other hand benefits from two components. By driving liquidity across multiple exchanges, it is able to maintain price parity for new institutional clients looking to come towards exchange. That is, whenever there is a difference in price across exchanges, Alkemi either buys or sells to bring the price to a common level on prominent exchanges. Although arbitrage bots exist today, they do not have the amount of capital Alkemi will be able to deploy or the exchange relationships Alkemi will hold when it is launched. So in some sense, Alkemi brings efficiency to the markets in the following ways:

- Reduction of spreads on multiple exchanges by being an active market-maker reducing price differences on spot prices

- Reducing flash-crashes and steep spreads for large orders by being able to source liquidity from multiple exchanges

- Providing much needed liquidity to large players looking to buy or sell through being an active market maker with one of the deepest order books in the market today

How does Alkemi fit within The Convergence Stack?

The convergence stack generates monetary value through digital assets. Today those assets trade through inefficient markets with little or no on-ramps for large institutions to engage with them without taking counterparty or custodial risk. Alkemi enables a new generation of investors to have access to digital assets that are crucial to the convergence stack through reducing slippage on exchanges and increasing liquidity. In other words, Alkemi is the routing layer for value within the stack