Key Insights

- Beyond Traditional L2 Tokens: RIF revolutionizes the typical L2 token model by creating tangible value accrual mechanisms.

- Dual Stakeholder Approach: The ecosystem is driven by two key players – builders (protocols and applications) and backers (RIF token stakers), creating a balanced power dynamic.

- Innovative Fee Distribution: Transaction fees are strategically distributed among merge miners, builders, and the DAO treasury, ensuring sustainable ecosystem growth.

- Empowered Token Holders: RIF stakers gain voting power over fee sharing among these above key stakeholders, directly influencing the incentivization of applications built on RSK blockchain and earn shares of their success.

- Multi-Token Incentive Structure: The system provides further utility to RIF and leverages both stRIF and RBTC tokens to create compelling rewards for ecosystem participants and to bootstrap an adoption flywheel for RIF.

Background

Most blockchains and L2s struggle with sustainable adoption. While airdrop speculations might generate short-term activity especially before the issuance, they usually do not result in high user retention metrics. We identified that the quality and adoption of the applications are the main drivers for any sustainable blockchain growth. Therefore we designed the RIF token economy in a way that it supports the attraction of quality builders, while maintaining fundamental demand for it.

Most Layer 2 (L2) blockchain tokens are pure governance tokens without many tangible value accrual mechanisms attached to them. The following blog post shows how we reimagined an existing L2 governance token to foster a strong and sustainable blockchain ecosystem growth flywheel for a Bitcoin L2 ecosystem. As Outlier Ventures is known for their innovative and bold moves in the blockchain industry, such as with our latest Post Web Thesis, we are constantly questioning and rethinking the status quo. Rootstock Labs (formerly IOV Labs) went with us on a journey to redesign their already live RIF token economy and to ignite a paradigm shift on what L2 blockchain tokens can do. The goal for the collaboration was to create a token design that benefits the L2 chain adoption, attracts quality builders, and real demand for the Rootstock Infrastructure Framework (RIF) token, while progressing on the decentralization scale.

RIF Demand and Ecosystem Flywheel

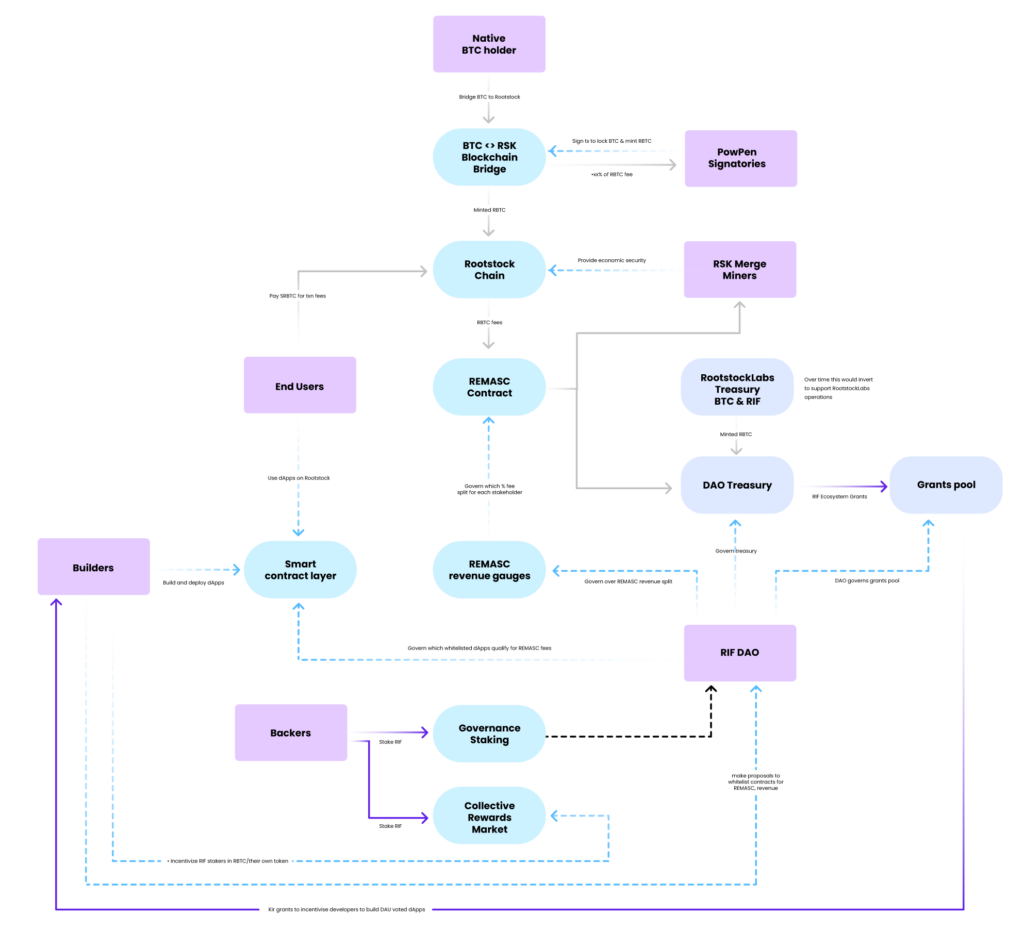

The two key stakeholders in the system are the builders and the backers. Builders are the protocols and applications that are built on the RSK blockchain. Backers can be anyone that stakes the RIF token and participates in the voting support of the backers. RIF is the core utility and stRIF (staked RIF) the governance token on the Rootstock (RSK) blockchain. It can be used to vote on infrastructure decisions and fee distribution related parameters in the ecosystem.

RSK Blockchain Fee Distribution

The on-chain transaction fees are collected in the Reward Manager Smart Contract (REMASC) and being distributed to the following entities:

- RSK merge miners who facilitate the security and merge mining of the RSK blockchain on Bitcoin

- Builders who are whitelisted applications that are being deployed on the RSK blockchain

- DAO treasury

RIF Token Value Accrual

This setup is the base on which RIF is used to accrue value to the stRIF holders when combined with one missing key component. The additional game changer is the power that RIF staker have as they can vote on the actual fee sharing towards the whitelisted applications that are being built on the RSK blockchain. By doing so they’re becoming backers.

This is the implication for the both core actors in the ecosystem: Builders can earn Collective Rewards in RIF and RBTC (BTC pegged RSK gas token) after they get whitelisted and depending on the backer voting support. Therefore builders always want to forward a share of their incentives to the backers to keep them motivated. This might result in very attractive rewards for RIF stakers. Note that this later aspect will be activated in the second phase of the rollout.

The incentives for backers to be active in the voting are coming from two different sources to them. In the initial bootstrapping phase, incentives will be subsidised by the treasury and can be in the form of RIF or RBTC. Additionally, builders do want backers to vote for their application to maximize their fee and incentive share, respectively. They can do so by promoting this on social media channels and by forwarding some of their own funds to the RIF stakers (backers) to encourage their voting support. These funds could come in the form of RBTC, RIF, or their own token.

The following value flow diagram in Fig. 1 shows the full picture of this design.

Data-Driven Validation

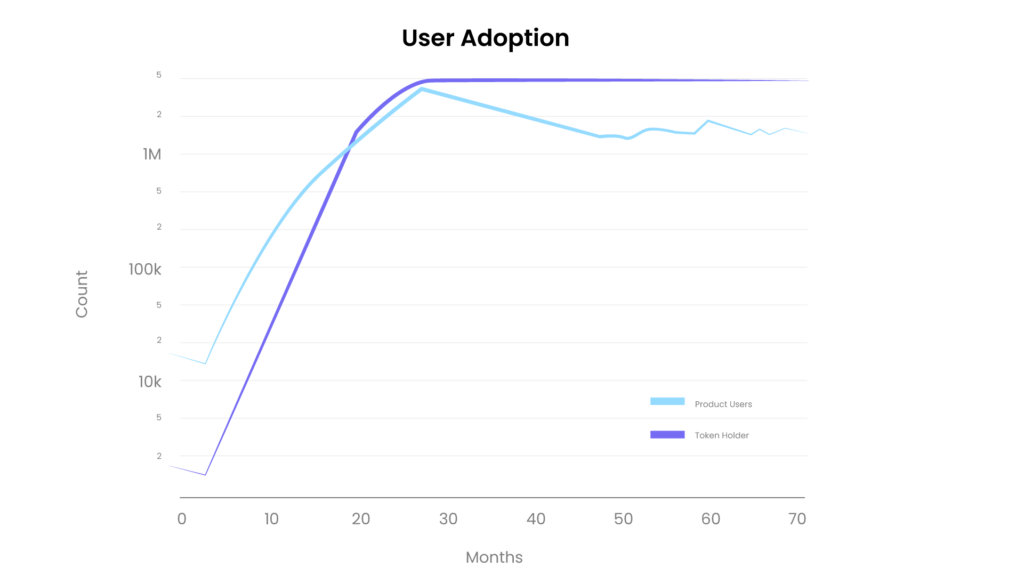

To validate our token design approach, we conducted extensive quantitative analysis using advanced token modeling techniques, such as our Quantitative Token Model. The results demonstrate clear evidence for the effectiveness of our design choices, compared to the original approach.

The comparison of 20 different scenarios indicates measurable improvements in key metrics, compared to a pure traditional governance approach. Furthermore, a traditional direct revenue sharing with token stakers faces challenges in maintaining ecosystem growth, while our innovative design demonstrates stronger adoption metrics through strategic incentive distribution with the goal of sustainable builder bootstrapping and active backer participation.

The effectiveness of the Collective Rewards forwarding mechanism plays a crucial role in the ecosystem’s success. Our modeling shows that higher participation rates by builders sharing their Collective Rewards with backers correlate significantly with the user growth compared to scenarios with lower engagement. This creates a sustainable growth flywheel, where increased participation leads to more adoption, which in turn attracts more builders and users to the ecosystem.

Another important insight from our analysis is the timing of incentive distribution. Short-term incentive programs of 24 months show better results compared to longer 60-month distributions due to the early compound effect. This demonstrates the importance of concentrated ecosystem bootstrapping to achieve sustainable growth momentum.

The model also reveals specific adoption thresholds are needed for sustainability. Under neutral market conditions, the ecosystem requires a substantial user base to become self-sustaining. However, in scenarios mirroring established Layer 2 adoption curves, these thresholds become more achievable.

These quantitative insights validated our token design decisions and provided a clear roadmap for implementation and rollout. By focusing on builder attraction and active backer participation, we create a robust foundation for sustainable ecosystem growth.

Summary

This blog post introduces a reimagined token design for RIF, the governance and utility token of the Rootstock (RSK) blockchain. The design addresses common challenges in L2 blockchain adoption by creating a sustainable ecosystem flywheel that benefits both builders and backers. Key innovations include:

- A unique fee distribution mechanism through the REMASC smart contract, allocating rewards to merge miners, builders, and the DAO treasury

- Enhanced governance rights for RIF stakers who can vote on fee sharing towards whitelisted applications by the builders

- Dual incentive structure for backers: treasury subsidies and potential rewards from builders seeking voting support

- Focus on attracting quality builders while maintaining fundamental token demand

This redesign represents a significant step forward in L2 token utility, moving beyond simple governance to create a robust economic model that aligns stakeholder interests and promotes sustainable ecosystem growth.

Learn About Our Ascent Token Launch Program

Receive hands-on, pre-TGE advice and support from seasoned Web3 experts to ensure a seamless market entry. It’s all about practical guidance to set you up for success — before launch and long after. Apply now!

Disclaimer

The content of this blog is for information purposes only and is not financial advice or an invitation to invest. References to tokens or rewards are illustrative and not endorsements. Please do your own research or seek professional advice before making any decisions.