Less than 1% of Bitcoin (BTC) is used in dApps in the Bitcoin ecosystem. BTC holders underutilize their assets by HODLing. This is set to change. Recent innovations in composability and scalability provide founders with new tools to create BTC native dApps and offer BTC holders an alternative to HODLing. We believe that creating new applications and utility for BTC holders is the largest unexplored opportunity for founders and investors in digital assets.

Narrative Shift

Bitcoin is shedding its skin. Since its creation in 2009, Bitcoin has long been a medium of exchange. A new monetary future in which Bitcoin plays a central role. The network’s high-grade integrity combined with its lack of smart contract capabilities and low scalability makes it the perfect store of value in a digital era. This is changing. 2023 brings a wave of innovation on top of the Bitcoin network. We believe this will allow developers to access an unprecedented amount of functionality, composability and scalability while leveraging the network’s security and decentralization.

Slumbering Titan

The year of breakthrough innovation for Bitcoin. Building on the Bitcoin network is a unique experience. The base layer (L1) has limitations. It was never designed to host decentralized applications (dApps). Innovation in layered solutions, protocols and proposals are changing that. Through increasing scalability of the network and adding more functionality, layers like Lightning Network, Stacks, Trustless Computer, RSK, and Liquid Network allow developers to use the Bitcoin network for new, unseen applications (DeFi, DID, Atomic Swaps, RWAs, and others).

New innovations on the Layer 1 itself also enable new use cases; Ordinals and recursive inscriptions in particular are enabling new ways of using the Bitcoin blockchain.

Despite its $530B market cap, we see only $520m (TVL) or <1% used on the four largest BTC-based projects (Stacks, Lightning, RSK, Liquid). Innovation is now allowing founders to create utility on top of the network and offer BTC holders an alternative way to HOLDing. We believe this is currently the largest untapped opportunity in digital assets. If we compare Ordinals and Inscriptions’ composability, Bitcoin has the potential to give Ethereum a run for its money.

Expansion from DeFi to Social, Gaming and more

Existing metalayer ecosystems, such as Stacks, Lightning, RSK, and Liquid, are predominantly DeFi-oriented. While DeFi presents a compelling use case for BTC, we believe this skew has been exacerbated by the lack of structured ways to issue assets on BTC. Metalayers like Stacks allow the creation of NFTs through Clarity smart contracts. However, these issued assets face challenges of interoperability across different metalayers. Historically this has been no issue for DeFi, as these dApps rely mainly on crypto-native assets, such as BTC, xBTC, L-BTC, and others.

This is changing. We believe that BRC-20 & the plethora of emerging token standards make the issuance and handling of assets on Bitcoin much easier for users and founders. As a result, we expect founders to leverage this newfound composability into their business models. We think, similar to what happened on Ethereum, we’ll see a boom in start-ups across governance, social, identity, gaming, NFTs, and more on the Bitcoin network. We also expect DeFi to continue to develop as one of the strong use cases, leveraging the scalability of the metalayers.

Same But Different

Why bother? Isn’t Bitcoin just mimicking Ethereum’s scaling and smart contract capabilities? Not quite. For starters, Bitcoin makes up more than half of the digital asset market cap. With its many holders, Bitcoin has strong network effects, and an extremely powerful brand. Additionally, Bitcoin sees a rise in popularity amongst investors and corporations.

Finally, Bitcoin has always prioritized security and stability and will continue to do so. Despite its base layer limitations, the network’s greatest strength is its security and integrity which is unmatched. All around, Bitcoin has a unique and strong value proposition for founders who are looking to build. At Outlier Ventures, we believe that Bitcoin’s ecosystem is primed for expansion as founders take advantage of the newly developed tools and functionality.

Why build on Bitcoin?

We believe the Bitcoin network has a strong and unique value proposition that should be attractive to founders looking to build:

- Network Effect – Bitcoin has the strongest network effect of all blockchains.

- Adoption – corporates and investors continue to prefer BTC over any other digital asset.

- Blockchain Trilemma – Bitcoin is uniquely positioned on the trilemma, prioritizing decentralization and security.

Building On Bitcoin – Composability & Scalability

We believe increased composability and scalability of the Bitcoin network drives adoption

2023 was a year of innovation on both fronts through:

- Launch of Ordinal protocol.

- Innovation in metalayers like RSK, Stacks, Liquid, Lightning Network & ICP.

- Adoption of existing upgrades like Taproot & debates for proposals like BIP300/301.

Innovation and developers are coming back to Bitcoin and we are excited for it

We illustrate this effect through the “Bitcoin Adoption Flywheel”. While general blockchain adoption is not exclusively driven by composability and scaling, changes in these components are critical.

Composability – Bitcoin Adoption Flywheel

- Composability unlocks new building blocks for developers to create new decentralized applications.

- New applications serve underserved users, driving network adoption.

- More users and developers have new expectations of network composability, changing governance consensus.

- New dApps require new composability to continue to grow and serve more users.

Scalability – Bitcoin Adoption Flywheel

- Network handles more transactions, lowering friction for users and specific use cases.

- Network adoption increases demand for scalability. Creating economic incentive for users and developers to adopt & work on scaling solutions.

Layers, Protocols & Upgrades

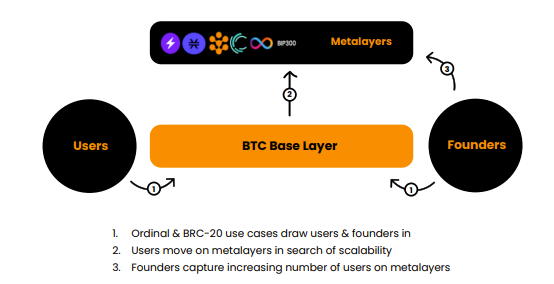

Now is the time. We believe there’s a perfect storm brewing on the Bitcoin mainchain that will lead to the adoption of sidechains. While the metalayers all bring a ton of scalability and composability, they did not see mass adoption because there was no real necessity for their product. This is quickly changing.

- Scaling: As discussed earlier. Ordinals are clogging the mempool and hogging block space on the base layer. As a result we’re seeing inflated fees, making specific economic use cases no longer viable. (we’ll discuss this in more detail during the Etheruem analogy).

→ We expect more users to try out existing scaling solutions as they are looking for cheaper ways to settle transactions on the Bitcoin network.

- Composability: We believe that the ordinal protocol and its adoption will increase the demand for smart contract capability. The ability to inscribe information into sats and mint BRC-20 tokens will increase the demand for smart contract capability.

So where do developers find a combination of scalability and smart contract capabilities? On existing metalayers like RSK, Liquid, Stacks and maybe in the future on other Drivechains. Below we have a (non-exhaustive) list of innovations in composability & scalability which we believe will have a meaningful impact on the attractiveness of the Bitcoin ecosystem for developers and founders.

At Outlier, we don’t have a strong view on which one sidechains or protocols will do best. We believe there are ample tools and opportunities available for founders to make use of the composability offered across the Bitcoin baselayer and the metalayers. Founders need to decide what’s the best technology to leverage for their USP and product. In short, we believe the following trends will happen across base- and metalayers:

Baselayer – We believe we’ll see a new wave of dApps leveraging BRC-20 tokens across DeFi, NFTs, Social, etc. Despite being early days, we continue to see strong appetite from users and founders to bring baselayer utility from other blockchains to the Bitcoin network.

Metalayers – As the baselayer gets crowded, users will start adopting sidechains and other scaling mechanisms. This is an opportunity for founders and developers wanting to capture these new sidechains users. Leveraging smart contracts we expect to see sidechain ecosystems growing as dApps increase in complexity, mimicking more mature ecosystems like Ethereum.

Conclusion

In short, we believe a surge in innovation is imminent in the Bitcoin ecosystem. A perfect storm of composability, scalability, and innovation is brewing. Ordinals and smart contract composability are providing founders with tools to leverage Bitcoin’s network effect. At the same time, scalability, provided by metalayers that have been building out over the past years, are ready to welcome new users that are looking to make use of scaling and new smart contract enabled dApps.

While building on Bitcoin is not entirely new, at Outlier Ventures, we believe the Bitcoin network has finally become widely accessible to all sorts of founders. Based on our experience in previous innovation cycles across ecosystems, we believe NOW is the time to build.