While the jury is still out on the net impact of the $Trump launch on the industry, it marks a seismic moment for the intersection of finance, culture and politics. Memecoins already took center stage in 2024, but POTUS support solidifies tokens as new financial assets and a tool for capital formation and influence-building. All of this is evidence of the hyper-financialisation of our society as finance, technology, and culture merge together.

Authors: Jasper De Maere | X | Linkedin & Greysen Cacciatore | X | Linkedin.

Bottom line:

- The $Trump token exemplifies the merging of politics, finance, and culture, validating crypto’s mainstream relevance. It highlights the financialisation of non-financial assets as a cultural phenomenon reshaping societal structures.

- Financialisation, which has dominated corporations for decades through derivatives and securitisation, is now spilling into the individual and cultural realm through tokens.

- We see three drivers behind hyper-financialisation and finance becoming a core part of culture. These are:

- Technology – The digital revolution makes financial markets accessible and innovative.

- Education – Younger generations are the most financially literate ever.

- Ethos – In today’s zeitgeist, financial success defines personal and professional achievement.

POTUS Approval

The net impact of the $Trump token on the broader ecosystem is still unclear, having a president elect launch a memecoin days before the inauguration is striking to say the least. It represents a seismic moment for the intersection of politics, finance, and culture. It solidifies tokens as a new liquid asset class and a tool for engagement, fundraising, and influence-building at the pinnacle of global influence.

Beyond validating crypto’s mainstream relevance, this move highlights the growing financialisation of non-financial assets as a profoundly cultural phenomenon. By turning intangible concepts like identity, community, and influence into tokenised assets, it demonstrates how tokens intertwine finance, technology, and culture. This marks a transformative moment in redefining societal structures and how we engage with value.

We call this hyper-financialisation, and we’ve also explored it in detail in our most recent work on the Post Web. In The Post Web, improvements in technology and financial infrastructure will enable the increased financialisation of individual assets, making them more liquid and yield-bearing. This will fundamentally reshape how value is stored, accessed, and utilised.

Not The First Time

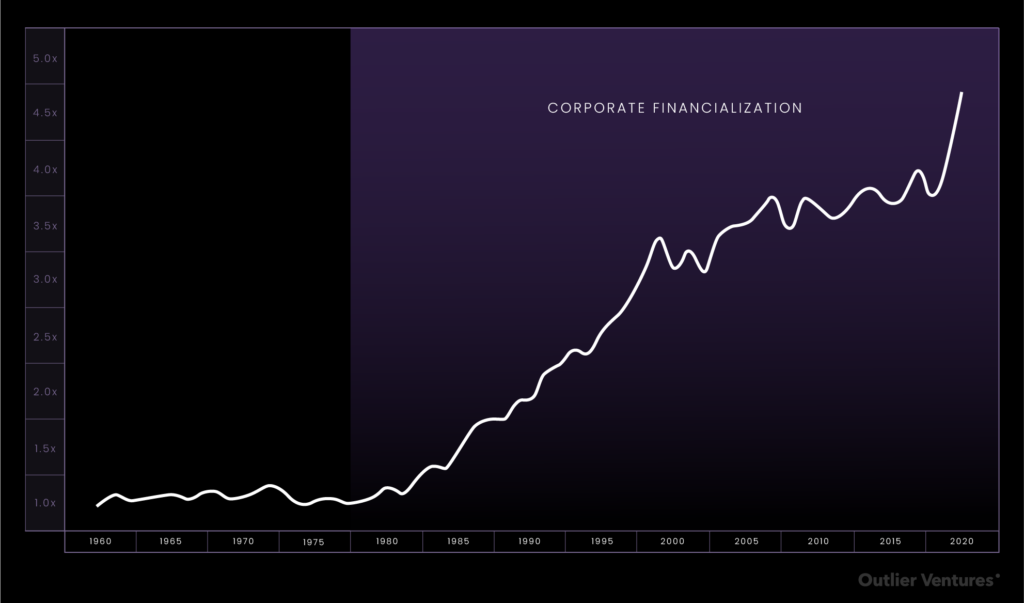

We’ve already seen financialisation happen before on the business side. Over the past 40 years, financialisation transformed the economy by turning business balance sheets into engines of speculative value. In the 1980s, deregulation and tools like derivatives, securitisation, and global credit markets allowed corporations to unlock value from financial engineering rather than production. Non-bank financial assets soared from 40% to over 200% of GDP (exh 1) as businesses increasingly leveraged financial instruments to maximise shareholder returns. This shift marked a new era where the economy was driven less by tangible goods and services and more by monetising abstract financial assets.

Exhibit 1: Non-Bank Financial Institutions’ Assets to GDP for the United States

Similar to companies, individuals also have a balance sheet (i.e. their possessions). Tokens and crypto are now bringing financialisation to the consumer level. Like derivatives and securitisation in the 80s, innovations such as tokenisation and DeFi enable individuals to extract more value from their own assets. However, unlike the 80s, crypto goes further by blending finance with culture, as seen with memecoins, where tokens can represent identity, community, and participation. Yet, much like derivatives, these new instruments in the form of tokens carry inherent risks, which we witness firsthand as the framework for managing them evolves.

Ethos, Education & Technology

The following section from Post Web Chapter 2 contextualises what we believe to be the key drivers behind hyperfinancialisation.

There is a growing trend of financialisation in everyday objects, a phenomenon we call “Hyperfinancialisation.” This socio-cultural shift sees assets not traditionally viewed as financial, especially intangible assets, quantified in monetary terms and leveraged for maximum financial gains. This push toward monetising everyday assets will drive the adoption of blockchain technology. These assets become more financially productive through tokenisation, offering attractive investment returns.

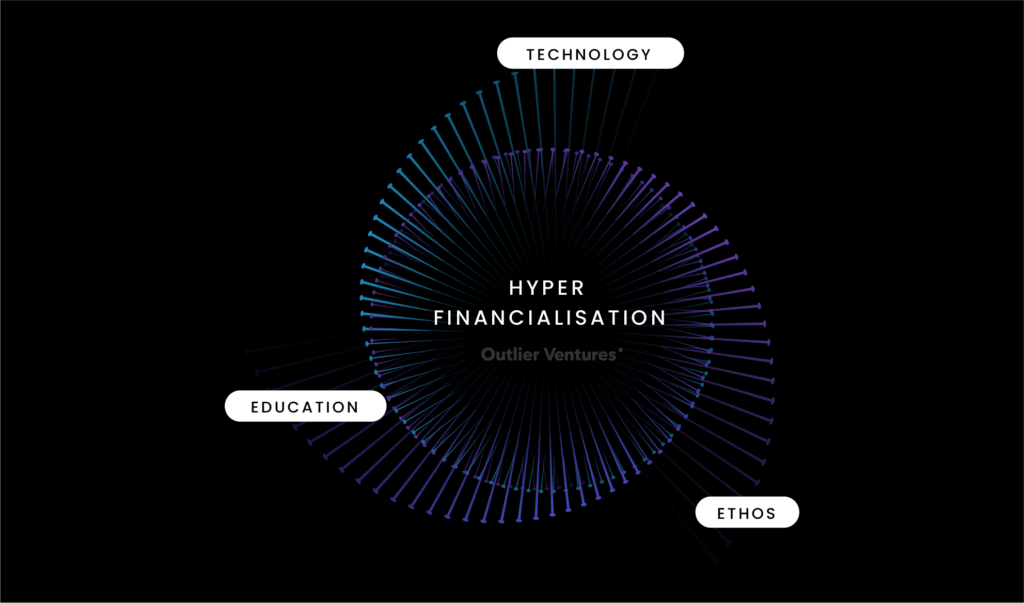

We see three key drivers behind today’s hyperfinancialisation namely (i) Education (ii) Ethos and (iii) Technology (as illustrated below).

Exhibit 2: The Three Drivers Behind The Hyperfinancialisation Of Society

Source: Outlier Ventures

1. Education

Education gives individuals the knowledge to understand financial markets and their importance. Today’s younger generations, especially Gen Z and Alpha, are the most financially literate in history, thanks to their early exposure to digital technology and ‘do it yourself’ online resources. LLMs and agents further bridge the financial literacy gap, empowering individuals globally, now in any language, to educate themselves to make informed decisions about savings, investing, and managing debt or assets, which we believe paves the way for the rise of the “100x individual” and civilisation upskilling of the global population.

Exhibit 3: Left – Contrasting Education Levels Across Generations. Right – Source of Education Across Generations.

Source: Pew Research Centre, Outlier Ventures

2. Ethos

Ethos, or the collective values of a generation, shapes the desire to participate in financial markets. In the current zeitgeist, financial success is strongly tied to personal and professional achievement. The societal valuation of financial success drives the desire to explore and participate in financial opportunities. The ethos of striving for financial success encourages the financialisation of owned assets, maximising the financial potential of an individual’s assets. We are entering a time of extreme capitalism in which financialisation will find its way into many more aspects of our lives than before.

3. Technology

Technology is critical, bridging the gap between financial knowledge, the desire to participate and actionable financial opportunities. The digital revolution has made financial markets and assets more accessible, empowering individuals to participate freely. Financial applications are not only democratising access to financial markets, but the underlying technology is also changing the types of financial products we are offered and abstracting the complexity of financial products.

Technology is Changing Financial Markets in Three Interconnected Ways

1. Democratising Access

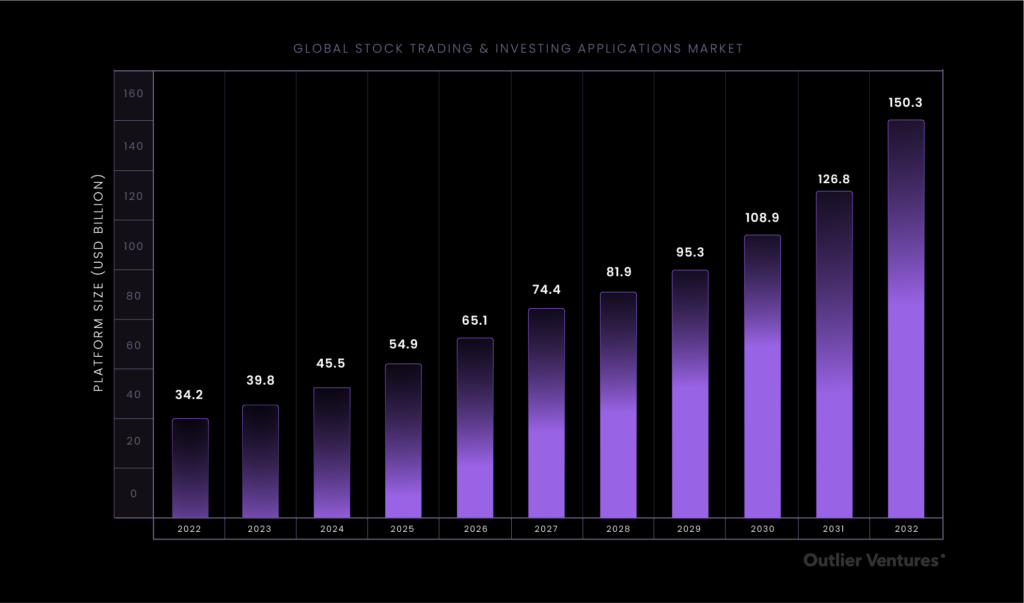

The democratisation of financial services has transformed the landscape, making financial tools and platforms widely accessible and lowering barriers for individual and non-accredited investors. This trend promotes financial inclusion, expanding market participation and rapidly increasing the addressable market for financial products.

Exhibit 4: TAM for Stock Trading & Investing. A growing TAM implies increased service activity and the number of users.

Source: Vision, Outlier Ventures

2. New Financial Products

Technology allows investors to access more complex services and markets. Blockchain-based systems, for example, unlock decentralised and tokenised finance, revolutionising how individuals manage financial assets. The intersection of technology and finance drives innovation in consumer finance and investment products.

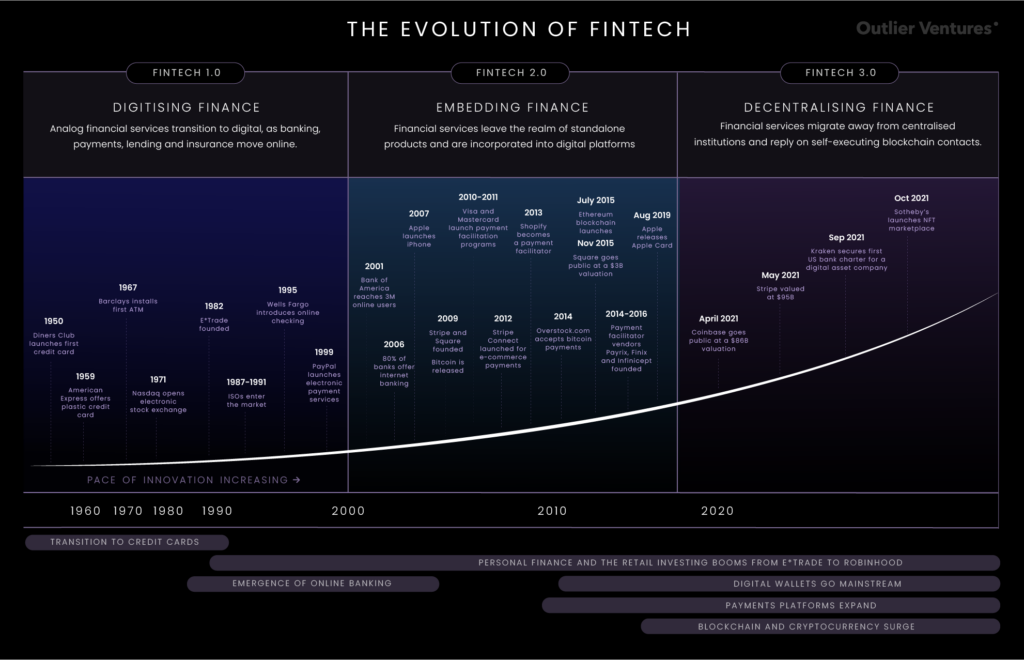

Exhibit 5: A timeline of the fintech landscape over the past 60 years shows the exponential increase in financial services and products due to technology.

Source: SVB, Outlier Ventures

3. Abstracting Complexity

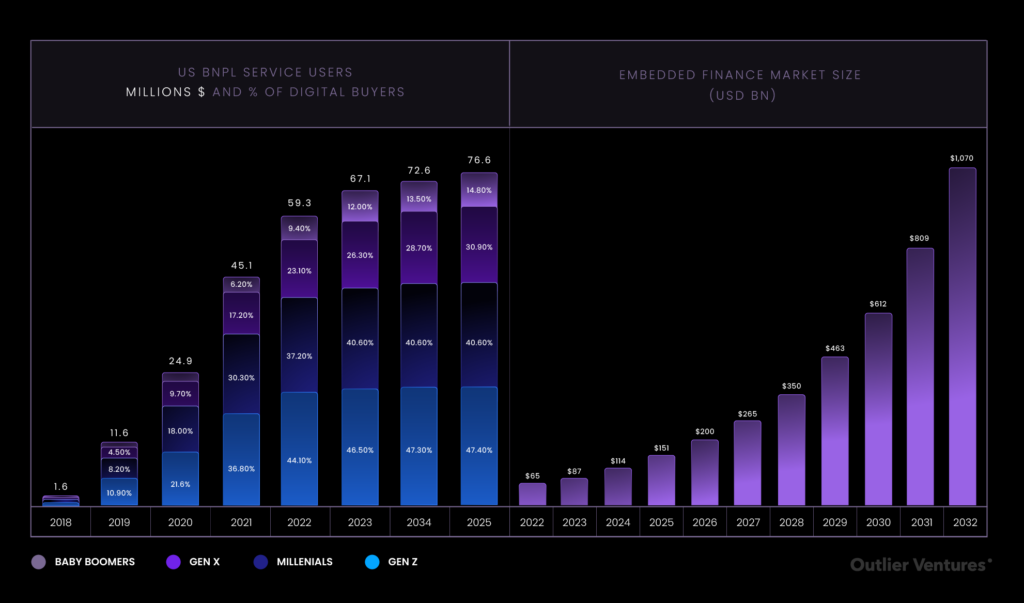

Abstraction is driving the accessibility of new financial products, making consumer finance and investments more intuitive for the average user through technology such as sophisticated algorithms, robo-advisors, and AI-driven platforms. This simplification is fueling rapid growth in adopting financial services and investment opportunities, exemplified by trends like embedded finance and buy-now-pay-later. Exhibit 6 shows that more complex products, like BNPL, are gaining adoption primarily among younger, tech-savvy generations.

Exhibit 6: Adoption of BNPL and Embedded Finance showing rapid adoption.

Source: Insider Intelligence, Outlier Ventures

As a result, transaction volumes in the modern economy are rapidly evolving. Beyond hyperfinancialisation, society is becoming increasingly transactional. Digitalisation allows more granular transactions, transforming how we pay for services. Software, for example, evolved from an upfront purchase to a subscription model as digital platforms improved payment tracking. DLT is another upgrade that enables pay-as-you-go models in Web3 services such as DePIN.

Hyperfinancialisation In The Post Web

As hyperfinancialisation is accelerated by the Post Web, addressing gaps in financial literacy and execution becomes critical. Those equipped with both skills will participate in the economic cycle, compound their wealth, and actively engage as shareholders in the tokenised economy. With the mass tokenisation of assets, Post Web LLMs and agents play a transformative role, levelling the playing field by enabling basic financial literacy and participation for everyone. These tools empower individuals to manage and leverage their tangible and intangible assets, ensuring broader access to economic opportunities and mitigating disparities in wealth and knowledge.

Everything Post Web at Your Fingertips

Stay ahead at PostWeb.io to access our latest Post Web thesis, audio documentary episodes, our newly launched accelerator program, and much more.

Join The Post Web Accelerator

Learn more about our Post Web Accelerator program designed for ambitious founders ready to build what lies beyond Web3.