The Importance of Market Segmentation in Web3 Marketing

The expression, “If something is for everybody, then it’s for nobody” is practically gospel in the world of marketing. Imagine trying to throw a party for everyone in the world… chaos, entropy, and more chaos.

However, that’s exactly what you’re doing when you’re trying to address the entire market – and it usually ends with you attractively standing alone in the proverbial party room (with an occasional rare exception where you can end up like the guy from the movie “Perfume,” and I hope I don’t need to clarify that neither of those are attractive options). So, let’s talk about that which brings life to the marketing party – market segmentation. How do you use it to throw the best party in the world?

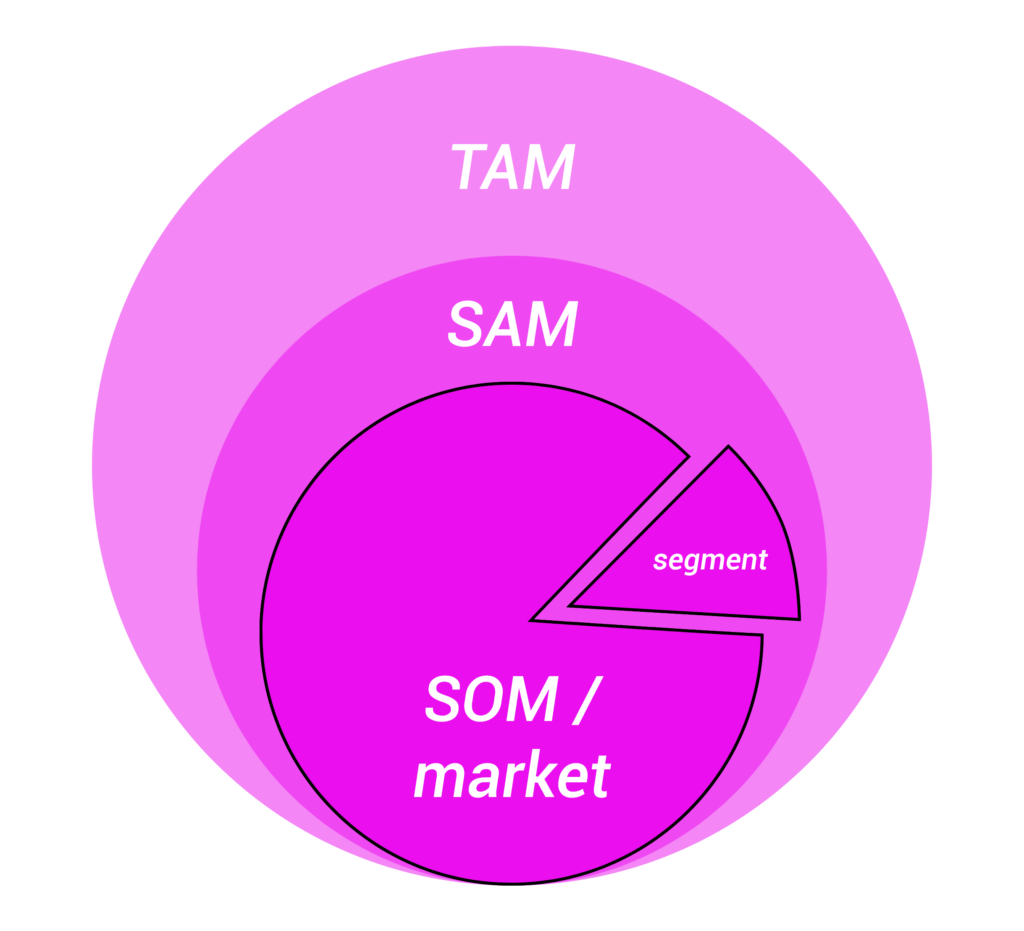

TAM, SAM, SOM, and their Relationship to Market Segmentation

In the world of tech in general, and Web3 in particular, the overview of TAM (Total Addressable Market), SAM (Serviceable Addressable Market), SOM (Serviceable Obtainable Market) is something that’s widely understood and most founders include some variant of thereof in their investor pitch decks. For investment purposes, it’s very important to ensure that the product you are launching can obtain a meaningful market share. I would argue that most of those early slides are based on hopium and wishful thinking rather than solid data, however that’s a statement that probably deserves its own separate article.

From the marketing standpoint, this slide is a useful starting point to a more nuanced conversation about market segmentation and how you can leverage your early assumptions about the market size to target your product towards a specific group of early adopters.

Serviceable Obtainable Market, otherwise known as SOM, refers to the part of the market that you can reasonably serve at your particular stage of growth. If you fail to target the appropriate market segment there are two things that can happen:

- Your marketing campaigns will fail to gain any meaningful traction for your product – usually because of the lack of coherent narrative

- (on rare occasions) Your marketing campaigns will gain notoriety and your product will fail to scale – usually because you hired a marketing pro but you didn’t listen to them when they told you that you don’t want your product to go viral

Unfortunately, specific examples of the first instance are hard to come by, mostly because those would be the companies that nobody has ever heard of – but you can reasonably consider most startups that fail due to lack of product-market-fit to qualify.

On the other hand, we’re all too familiar with stories of apps and companies that blew up much too soon and were not able to actually deliver the product that they promised because they have not developed the infrastructure to do so – Fyre Festival and Vero are two examples that come to mind.

Case Study: The Cautionary Tales of Fyre Festival and Vero

Fyre Festival

There have been quite a few headlines and even two documentaries (Netflix, Hulu) about the Fyre Festival fiasco back in 2017. Many talk about the founder, Billy McFarland, as a scam artist or discuss the impact this event had on the native residents of the Great Exuma Island where the event was supposed to take place. However, if you look at the situation through a marketing lens – the story of the Fyre Festival becomes a cautionary tale of what happens when your marketing campaign attracts more customers than you’re able to serve.

To quickly recap the story, through his network of connections Billy McFarland was able to convince many influencers and celebrities to post an orange square in December 2016 with a caption “Can’t wait for #FyreFestival. Coming soon www.fyrefestival.com.” This prompted the event to sell out in less than 48 hours even though the tickets, in some cases, cost as much as $100,000. Commonly discussed in this context is the power of FOMO and influencers but I want to draw your attention back to the main topic of this article, which is audience segmentation.

Consider this – segmentation isn’t just an arbitrary concept that allows you to narrow down a group of people you’re going to target, it is also a tool by which you must restrict access to your product or service based on your delivery capabilities. If Fyre Festival organizers were successfully able to manage the size of the event by only catering to the absolute top level VIPs, instead of ballooning up the event based on the demand, they might have been able to manage this event. In fact, they sort of did.1

In the context of Fyre Fest, we can draw some direct parallels between the actions taken (or not taken) by the organizers and the concept of market segmentation. Through their influencer campaign they targeted a broad market of “aspirational” consumers, and restricted access to the festival only through the prohibitively expensive ticket price.

“Despite a pitch deck that promised 10,000 ticket-holders each weekend, sales were low and largely discounted. Most buyers had paid somewhere between $500 and $2,000 for their tickets, despite outlandish claims that people were purchasing ticket packages for hundreds of thousands of dollars. The target audience wasn’t elite or affluent people — it was people who wanted the lifestyle but couldn’t afford it, until Fyre Festival came along.,” according Vice.

This behaviour points towards a large discrepancy between the assumptions made by the organizers as to their audience size, event demand, and the economic reality of the attendees. If the organizers had conducted appropriate market research and verified their ideas through customer and industry interviews as opposed to following the process that I can only describe as “yeeting” they could have avoided this outcome.

Vero – True Social

Vero’s story runs parallel to Fyre Festival and it is particularly interesting from a consumer application standpoint. Vero is a creator-first social app that, during the dawn of the Cambridge Analytica scandal that affected Meta, launched an ever-so-successful campaign, promising that the app will be free for the first 1 million users and paid for the rest. This caused a huge surge in (FOMO) downloads in a short period of time; subsequently the app rapidly crashed and fell from grace as its infrastructure was not able to sustain such traffic.

Why did this line of messaging work? Vero positioned themselves as an underdog standing against companies leveraging big data insights to manipulate their users at a very sensitive time when Facebook/Meta and Mark Zuckerberg were engulfed in a plethora of accusations related to privacy violations. This, combined with the FOMO-driven narrative, caused many people to sign up “just in case” Vero becomes the next Instagram.

However, one of the reasons why you might not want your software product to gain notoriety prematurely is when you’re aware of the technical limitations of your implementation – consumer applications are particularly prone to that. Stress testing is something that many startups delay as it can consume a lot of bandwidth and resources at an early stage can be scarce. It can also be simply hard to imagine that, after months or years of work, a particular marketing campaign can skyrocket your product to fame (or infamy).

This is why, you need to be realistic – or even conservative – about whether you can service a specific segment of the market and target that segment directly. Creating marketing strategies that are “too-much-too-soon” can destroy your company and turn it into an industry footnote as much as the lack of product market fit.

As a marketer, working in both Web2 and Web3 for a number of years, I have previously created and implemented multiple campaigns that resulted in viral growth. In retrospect, I have always found the outcomes to be a double edged sword.

So, if you finally decided to cut your proverbial pie into specific segments, what do you need to pay attention to as a startup founder working in Web3? Does marketing in Web3 in particular present a different set of challenges?

Early Adopters & Their Characteristics

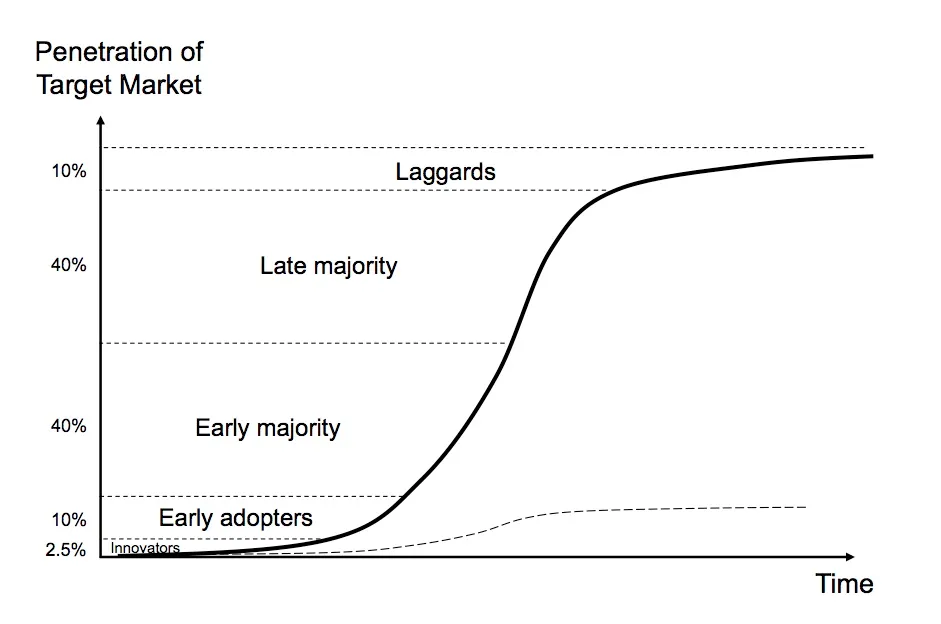

Not everyone in your SOM is your early adopter. Your SOM will include people who are inclined to join / use your product at various stages of its life cycle and that’s okay. Trying to convince “late majority” that they should join the product early won’t yield a meaningful result. You should focus your attention on those who have the right characteristics of an early adopter in your particular niche.

In her book “Web3 Marketing” Amanda Cassatt writes, “When we try to convince another person, the key isn’t what we want; it’s the other person and what they want.”2 As a marketing professional in Web3, I see this mistake being made all too often – founders can be so excited by what they are building that they don’t spend the time to verify their assumptions about their target audience, and as a result project what they think is the right answer.

This omission can also happen as a result of a limited bandwidth that many founders have at an early stage. If you don’t want to be negatively surprised on a launch date, you have to know who your audience is, the right channels to reach them, and the message that will resonate.

Making sure that this happens can be enough to keep an entire marketing team occupied for months. The question then is; how do you go about accomplishing this with a small team? The approach that I’m suggesting below can be seen as a bit of a shortcut, especially for very early stage projects that need to constrain their initial pool of users to early adopters within Web3.

Before we dive in, I want to make sure that one thing is very clear. There are two questions that you must always ask yourself first when in search of your ideal audience profile. Those are:

- Does this person have the problem my product solves?

- Can my product deliver its value proposition to this person at this particular stage in my product’s lifecycle?

As long as your audience satisfies these criteria you can help yourself in generating your brand strategy by looking at common characteristics of a Web3 persona.

Reverse Engineering of the Web3 Persona

If you’ve been in Web3 for a while you might have noticed that Web3 brands share many similarities. I’m not going to say that some of them look like they were designed by an android on acid sent from the future but what I’m going to suggest is that there are certain common characteristics that brand designers in Web3 have already identified as desirable for the broader category known as “Web3 audience” or “Web3 persona.”

Here is a list of a few visual and verbal queues and some examples of companies that use them:

- Cute animal / anime inspired avatars (Metamask, Berachain, Uniswap, AAVE)

- Candy colours and gradients that pop (Celestia, Lido)

- Psychedelic imagery (Curve, Zora)

- Retro-futurism (Base, Curve)

- Space exploration themes (Wormhole, Cosmos)

- Company names inspired by; food, astronomy, Japan and in general words that have meaning beyond the company name (eg. Sushi, Cosmos, Koii, Boba, Kusama, Oasis, Osmosis, Fantom and so on)

From the above we can reverse-engineer a group of people that these elements resonate with. Let’s define who might be interested in the above to see if we can get closer to our “Web3 persona.”

- Anime / manga / comic book fan particularly in childhood (we can assume someone who was a child in the 80s-90s or slightly younger)

- Listens to EDM, techno, tech-house, synth or other varieties of electronic music

- Interested in space exploration, the possibility of life on other planets, astrophysics or related topics

- Excited by the possibilities of the future of technology (accelerationism)

I’m not suggesting that every person who works in Web3 is the same. We’re not all connected to the same LLM (yet); but there are topics, styles/aesthetics, music, passions, that bring us together. As we expand the industry we splinter off and cross paths with other communities and demographics much in the same way as the world of DeFi overlapped with the world of art back in 2021 to give birth to the chimera of an NFT artist.

When conducting an even more in-depth analysis of the Web3 persona you will want to consider the points of intersection with other industries that Web3 overlaps with: traditional finance, banking, academia, venture financing, law, art world, trading, gaming, science etc. Depending on what area of Web3 your product is in, you can help yourself by looking up resources on its equivalent in web2 – these are much more readily available and usually just a Google search away from your fingertips. Explore the crossover between the Web3 persona and piggyback off of research that has already been done by web2 companies.

You might be creating a new product, or even a new category, but in all likelihood you’re not creating a whole other industry but rather augmenting it with your Web3 software. As such, consider the position your startup takes among not just Web3 competitors but its web2 equivalents to infer where you might be able to venture next.

Take Action: Tactics to Implement Your New Knowledge

Market Segmentation

Answer these questions:

- Consider your TAM, SAM, SOM first. Within your SOM, identify the characteristics your early adopters have in common.

- Who has the the problem your product solves? Are they aware of the problem?

- What solutions are they using to address this problem?

- Are there any Web2 products that currently serve the customers that you want to attract to your Web3 product?

- Can your product deliver value proposition (solve their problem) at this particular stage in your product’s lifecycle?

Persona

To create your ideal customer profile answer the following about your audience:

- What demographic information can you gather about members of this group?

- What content do they consume (videos, books, music, podcasts etc.)?

- What cultures/trends/philosophies are they fascinated by? What groups are they a part of?

- What ideas/themes are most prevalent in the content that they choose to engage with?

- What channels, communities, platforms are they most active on?

Tip: What did your audience watch/read as children? Never underestimate the power of nostalgia. Pay attention to particular products and styles that were popular when your customers were adolescent. Can you leverage those to create a more powerful narrative?

Competitor Analysis

Conduct competitor analysis:

- Who are your competitors and what are their products? Learn from your competition. Analyze what they are doing right and identify where they might be failing.

- What are their sales and marketing tactics? Are they working well? Can they be improved upon?

- What is their communication strategy? Pay attention to content strategy, messaging, communication channels, and levels of engagement.

- You can also perform SWOT analysis (strengths, weaknesses, opportunities, and threats).

Brand Positioning

Create a brand positioning statement for your brand. Here is a basic formula for creating a brand positioning statement:

- Target Audience: Who is your target customer?

- Differentiation: What makes your brand unique? What’s your Unique Selling Point (USP)?

- Value Proposition: What value does your brand provide to the target audience?

- Proof: What evidence supports your differentiation and value proposition?

Let’s combine these elements;

For (target audience) (my company) is the only choice that (differentiation) which positively impacts (target audience) in the following way (value proposition) as demonstrated by (proof).

Conclusion

Market segmentation, audience and competitor analysis are just first steps in your marketing journey. You can help yourself by figuring out what your competitors do and why, study their positioning, study their campaigns and use that as a starting point. However, at the end of the day, even if your market segment is very similar to theirs, your job is to differentiate from the competition – not to blend in. So rather than blindly copying their strategies, you need to to figure out what it is that they aren’t doing and what opportunities they are missing out on.

Despite the fact that many Web3 brands have very eclectic and differentiated brand positioning (as compared to generic tech startups) the space is already becoming quite saturated with copycats. This is partially why it’s so easy to identify common themes among these brands.

If you really want to stand out, open yourself to what’s happening outside of tech and study examples of what has been done before or it’s being done across industries. One of my favourite websites of all time is the one for Sketch London – a restaurant. They opened in 2003, and although they pre-date even Bitcoin, I’m sure that you can notice certain common elements between their website and the currently hip Web3 brands. Why is that? It’s because their website was clearly designed by an artist.

This might be a point that is worth exploring in a separate article, but I’m going to include it anyway, just as food for thought and future consideration. My suspicion is that quite a few artists who originally entered the Web3 space during the dawn of NFTs are the ones who are responsible for creative direction for some of the truly exceptional Web3 brands. Regardless of whether that’s true, the fact that the Web3 space is heavily saturated with artists must have an impact on how the brands present themselves now that it’s clear that the pool of early Web3 adopters includes so many artists. And if there is one thing that we know for certain, it is that a party thrown by artists is the party that you don’t want to miss.

References

- The Netflix documentary outlines a part of the promotional campaign for this event where the organizers flew in famous models to the island to shoot promotional material, effectively simulating the Fyre Festival. They specifically point out that this mini event was the actual Fyre Festival, effectively making my point – you cannot have a VIP-only event when not everyone is a VIP. ↩︎

- Amanda Cassatt, “Web3 Marketing,” p. 87 ↩︎