An analysis of the market reveals why DeFi participation has lagged the broader ecosystem: institutional participation. We believe this has been due to three critical factors: Capital, Connectivity and Control.

- Capital, because institutions have not been able to access suitably deep liquidity in the DeFi ecosystem.

- Connectivity, because centralized institutions are entrenched within the Web2 legacy financial infrastructure and have not yet successfully migrated to the natively-digital Web3 technological offerings.

- Control, because these institutions need to retain control over their allocation of assets to trusted-counterparty environments with suitable risk management and reporting mechanisms in place to meet their internal requirements.

Given the retail client-focused offerings of most protocols such as Aave and Uniswap – that are by nature open and permissionless – these three constraints have significantly limited institutional adoption of Decentralized Finance.

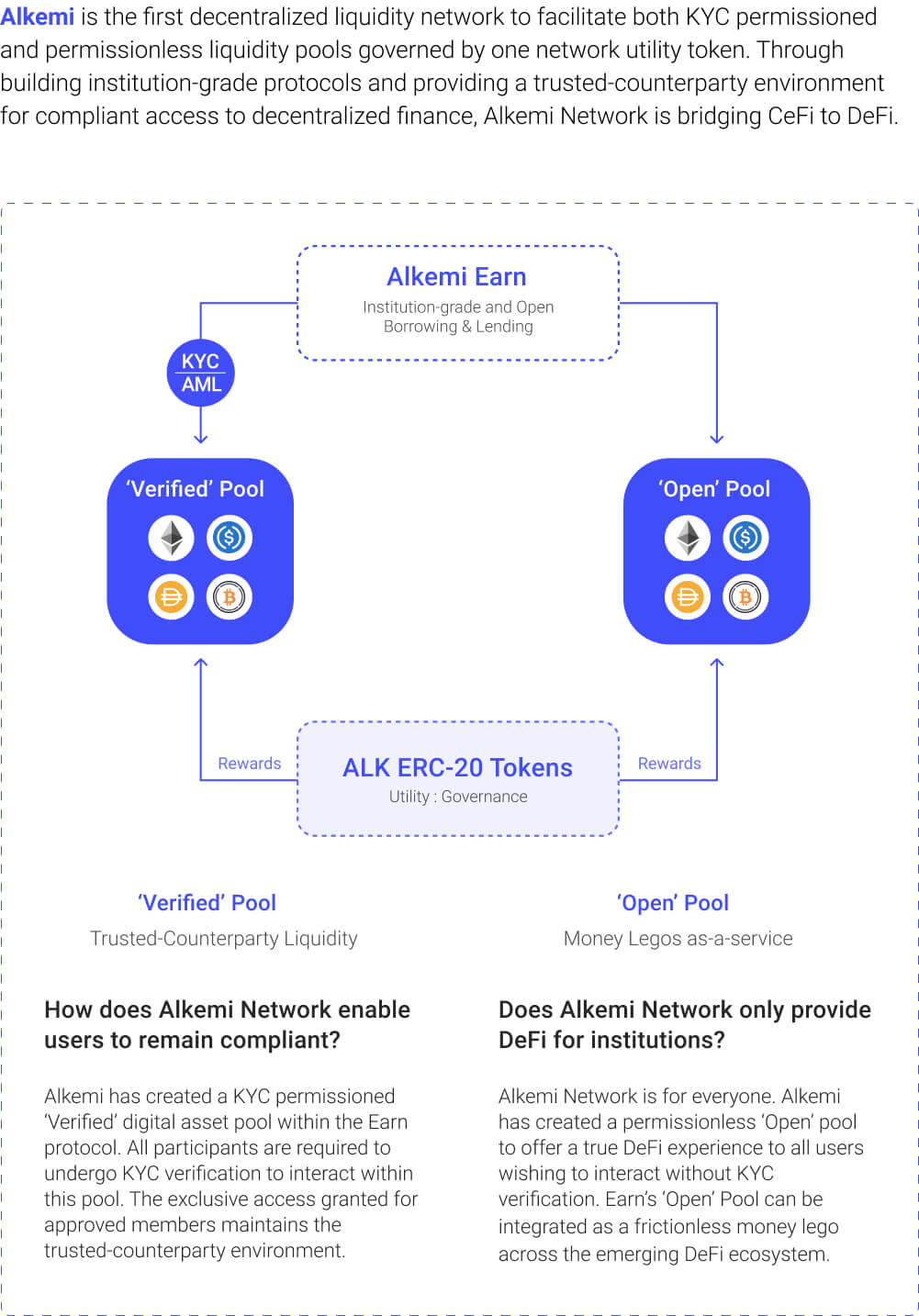

So we are delighted to officially announce we have been the lead advisor and an investor in Alkemi Network, a decentralized liquidity network facilitating permissioned and permissionless DeFi for institutions and individuals, since 2018. Alkemi Network is bridging the gap between the centralized financial markets and the rapidly accelerating programmable capital ecosystem. By delivering compliant, professional DeFi solutions, removing the constraints of capital, connectivity and control, Alkemi Network is enabling institutional adoption of decentralized finance.

Alkemi Network has had a strong track record since our initial investment in 2018, delivering a considered, compliant and patient go-to-market strategy execution, often in parallel with wider noisy market cycles like ‘DeFi Summer’. Alkemi recently closed a 6x oversubscribed $4.6m raising round and now counts both leading CeFi and DeFi funds amongst their investors: ConsenSys Mesh, LedgerPrime, GSR, GBV Capital, a195 Capital and Asymmetries Funds, to name a handful.

Partnerships are already in place

Outlier Ventures itself, as a partnership, includes many experienced senior financial services and capital markets professionals from JP Morgan, Goldman Sachs and Chicago Mercantile Exchange (CME), whilst Alkemi Network’s core team and advisors also include experienced professionals from Bank of America, Barclays, CBOE, and HSBC. By capitalising on mutual networks, Alkemi Network has secured key partnerships with hedge funds, high-net-worth individuals, market makers, exchanges, infrastructure providers, auditors and custodians across the emerging ecosystem and continues to welcome additional newcomers from the traditional financial worlds. Additionally, Alkemi’s carefully selected partnerships with Chainlink, KYC-Chain, LedgerPrime and Shift Markets have enabled their launch out of stealth, commanding a decentralized borrowing and lending protocol live on Ethereum mainnet with over $25m in liquidity. Alkemi Network is fast becoming the one-to-watch in the permissioned DeFi arena.

Capitalising on macro trends

Over the past ten years, we have been observing the process of capital deployed into Fintech, which essentially takes the form of slicing old data into utility-enriched user experiences for consumers. The punitive levels of back-office settlement, compliance and data management continue to weigh on the sector because the underlying manufacturing and infrastructure haven’t fundamentally changed. This is an undeniable concern for the legacy financial system, considering the trend within markets underpinned by digital technology is for the manufacturing cost to tend to close to zero.

Digital technology completely transformed how the music industry is manufactured from compact disc to digital, from $’s to fractions of a penny and the same forces are continuing apace to disrupt bricks & mortar retail through DTC. This is already evidenced in capital markets by trading fees plummeting to around 20 basis points from much loftier highs. Coupled with negative interest rates and all the big tech companies launching into the payment space, the battleground for omnipotence has never been harder fought.

This is why at Outlier we are focused on the deeper infrastructure that will underpin this next frontier of finance. Programmable assets are very much here to stay because:

1) They solve the double-spend problem

2) Contracts can be exchanged automatically

3) Securities can be settled immediately

4) Everything is fully auditable and taxable

Additionally, the level of transparency and visibility in decentralized finance is significantly higher. Wiping hundreds of millions of $’s annually out of the back office budgets within the biggest institutions is now possible. Hence why financial behemoths including Fidelity, JP Morgan, Santander and hundreds of others have been working so hard to keep up to speed:

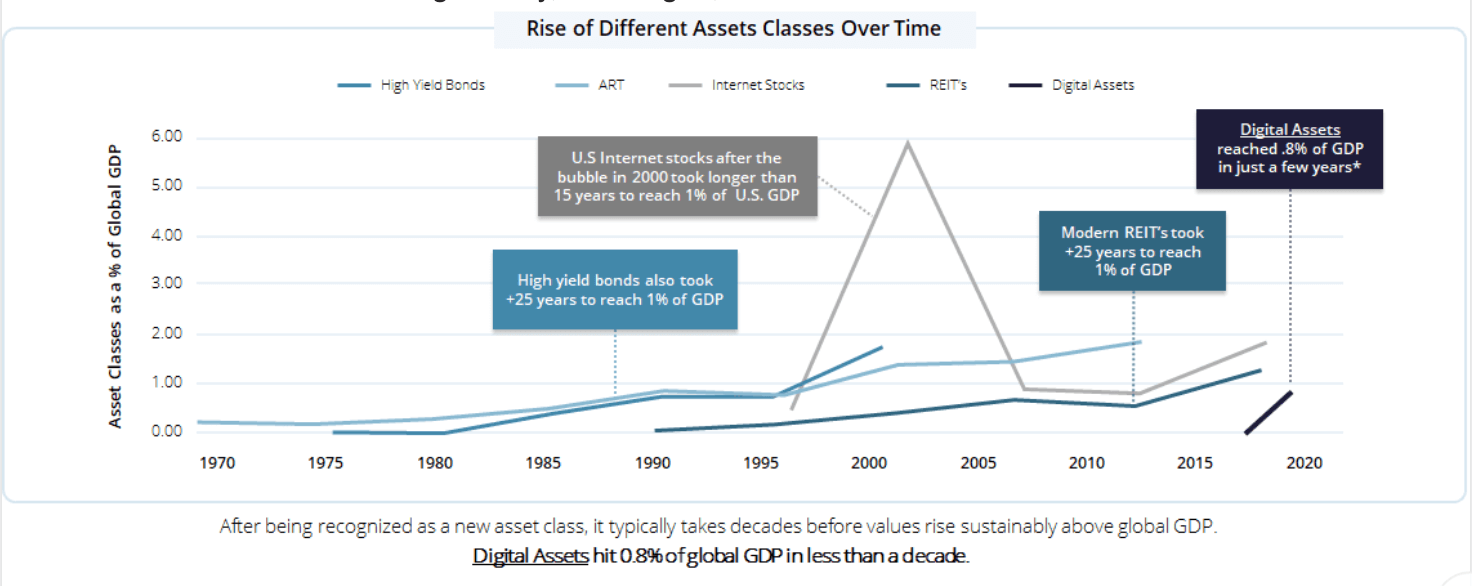

The rate of growth of digital assets is undeniably impressive, buoyed by the fact that they are cheaper, faster and generally more efficient. With the advent of Circle [USDC], there is also now a regulated dollar-pegged digital currency to facilitate on & off ramps at an industrial scale.

We also agree with the likes of Ray Dalio that a paradigm shift is happening in the world, one which will result in developed economies having far fewer banks that are completely global. The power is shifting towards asset holders who are capable of securely supporting the widest assortment of digital assets and the plumbing necessary to enable them to be exchanged freely.

What exactly does Alkemi Network deliver?

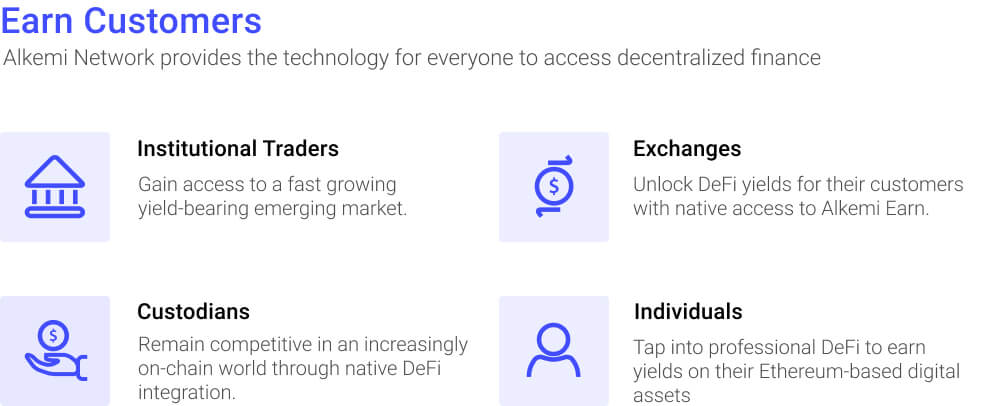

In essence, Alkemi Network is enabling institutions to participate in DeFi and benefit from the yields available on digital assets within the emerging decentralized financial ecosystem. Alkemi Network provides the technology for digital asset allocators, exchanges, custodians and individuals to access decentralized financial structured products. By tailoring their decentralized, non-custodial offerings to an institutional clientele, Alkemi Network is enabling the rise of a new compliant form of decentralized financial structured products, with both KYC-permissioned and permissionless digital asset pools for different user profiles. Integrating advanced reporting and risk management features across their products, Alkemi Network is providing the technological solutions for the new natively-digital financial paradigm.

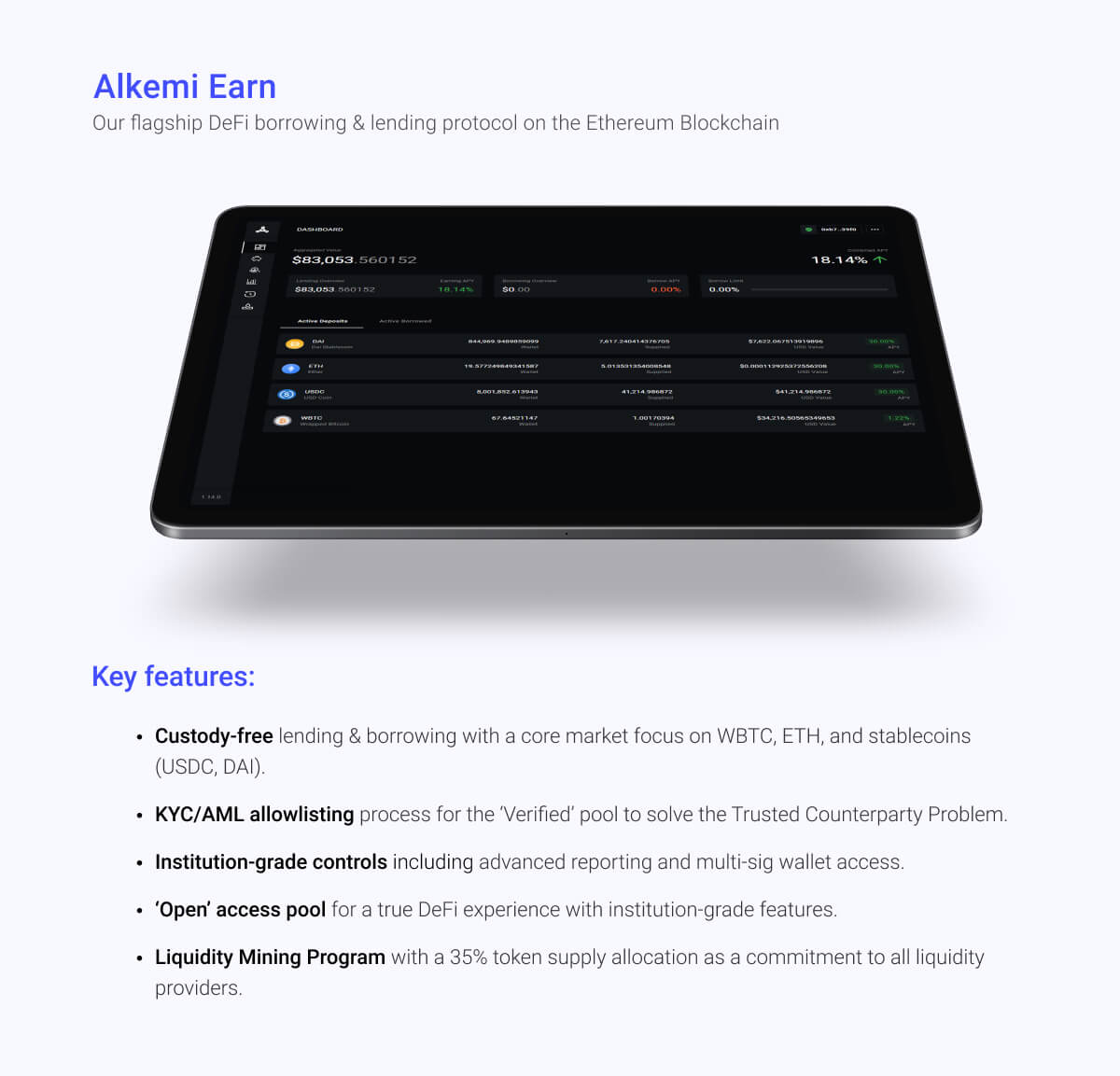

The flagship product, Alkemi Earn, a decentralized non-custodial lending protocol offers digital asset allocators the opportunity to deposit and borrow Ethereum-based assets including Wrapped Bitcoin, Ether, USDC and DAI within a trusted-counterparty liquidity environment.

How does this support institutional adoption?

Free from the constraints of capital, connectivity and control, institutional participants including hedge funds, family offices, custodians, exchanges and high-net-worth individuals can now allocate funds and also offer their clients direct access to yields through Alkemi Network’s front-end, API and whitelabel solutions. The non-custodial, self-executing smart contract structure of Alkemi Network’s offering provides a battle-tested, secure environment safeguarded through extensive auditing and monitoring.

Going live: Outlier Ventures and Ascent

Alkemi Network is scheduled to launch their token in the Summer of 2021 after three years of dedicated development to building a decentralized liquidity network.

Outlier Ventures has been backing Web 3 founders since 2014 and is the world’s leading Web 3 accelerator program on track to accelerate up to 100 startups and protocols in 2021 through both Ascent and their earlier pre-seed/seed program (Base Camp).

Both Base Camp and Ascent are recruiting for their next cohort and are looking for founders accelerating the open metaverse thesis by launching token networks. They bring together a network of 1,000 of the world’s leading Web 3 founders, protocols, and VCs to mentor and invest.