Welcome back to our blog series for founders building at the frontier of AI and Web3. In each edition, we explore the emerging trends shaping the next era of the internet—and how our accelerator is helping early teams turn theory into product.

Authors: Jasper De Maere | X | LinkedIn | Greysen Cacciatore | X | LinkedIn

In The Post Web, AI agents will not just process information, they will also be transacting, contracting, and coordinating real economic activity. But for agents to interact with the world in a meaningful way, they need more than abstractions. They need access to the same kinds of assets we use in the real world.

That’s where tokenized real-world assets come in.

Katie Lundie goes on noting that real-world asset tokenization (RWA) is the process of turning any real or intangible asset into a digital representation on-chain. Whether it’s property, art, private credit, or IP, tokenization unlocks liquidity, programmability, and shared ownership by embedding these assets into decentralized systems.

In The Post Web, where agents operate on our behalf, RWAs become economic primitives that agents can interact with directly. Without real-world representation of value on-chain, agent execution is limited to abstract financial coordination. RWAs bridge that gap.

Missed earlier posts in the series?

- What Founders Need to Know – A thesis-level view of The Post Web and why this cycle is different

- The Agentic Internet – Why agents are the new users of the internet

- DePIN Infrastructure – How decentralized infra brings agents into the real world

- Also read Beyond The Hype Of Real World Assets

TL;DR – Why Now?

Founders are tired of waiting for RWA to “arrive.” The moment is now, and here’s why:

- More mindshare & activity – We continue to see tokenization taking mindshare in the broader blockchain space with increased partnership and PoC from large asset holders, institutions and corporates.

Google Trends search for ‘Tokenization’ rebased vs. January 2021. Interest in Tokenization has upticked by x3 since 2021.

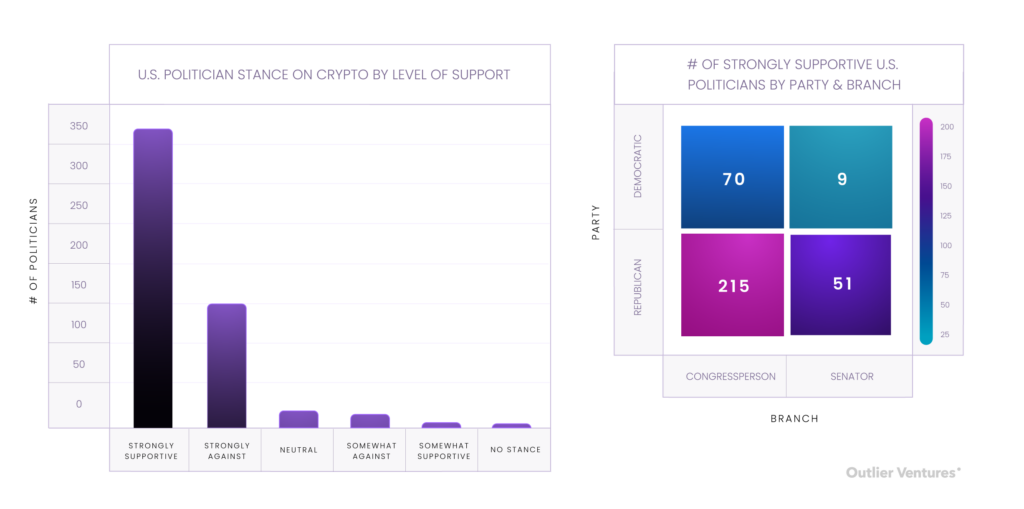

- Legal & regulatory clarity – We see improvement in regulation towards digital representation of assets and their underlying ownership. We expect this only to accelerate.

U.S. politician stances on crypto by level of support and party affiliation. Data shows that out of 542 politicians, 347 are strongly supportive of crypto.

- Agents need on-chain primitives — In the Post Web, AI agents transact on behalf of users. Tokenized real-world assets give them something tangible to work with.

The conversation around RWA has evolved from speculative narrative to real institutional movement. In the early days, excitement far outpaced capability. But the infrastructure has matured. Legal frameworks are becoming more accommodating. Most importantly, AI agents are beginning to participate in economic coordination. This shifts the role of tokenized assets from passive representations to active building blocks in agentic workflows. Assets that are readable, verifiable, and programmable become usable in a world where software acts on behalf of humans.

We are seeing financial institutions take the lead, drawn by familiar concepts like yield, liquidity, and market structure, and now empowered by more usable tech stacks. The financial industry is a natural entry point, not only because it already deals in digital assets, but also because it speaks the same language as crypto. Yet the opportunity extends well beyond finance. As tokenization expands to include everything from IP to energy infrastructure, RWA becomes the connective tissue between the physical world and the Post Web.

In a world where agents negotiate, collateralize, and manage assets autonomously, tokenized real-world assets give those actions real economic weight, anchoring agentic execution in tangible value, enforceable rights, and programmable ownership.

Where RWAs Are Gaining Real Momentum

Let’s take a look at the data, trends, and institutional adoption signals driving tokenization forward.

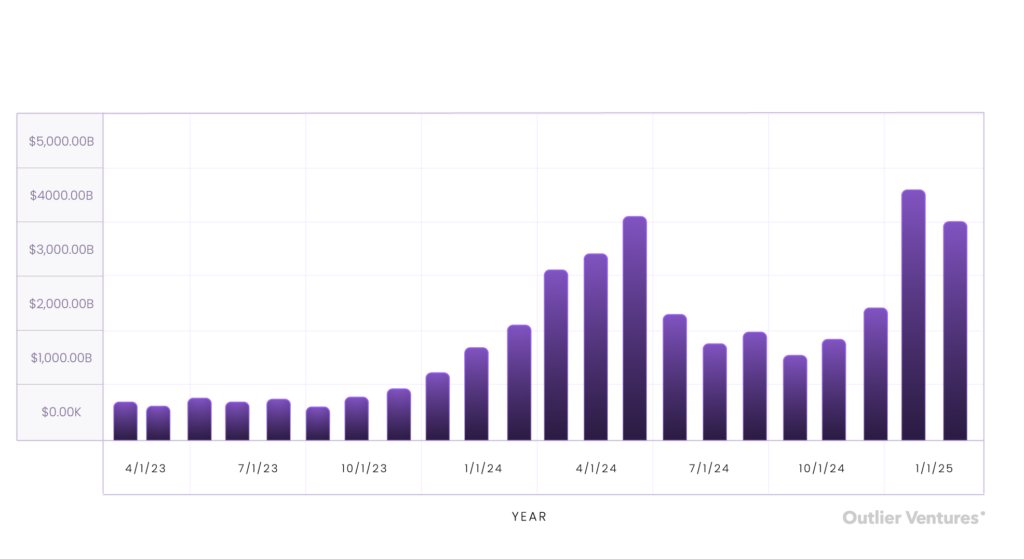

- Stablecoins – They are powering the RWA tokenization space by providing stable liquidity while also becoming increasingly used across financial markets & commerce.

Breakdown of monthly stablecoin transfer volume (trillions) from 2023 to 2025. December 2024 saw a record high of $3.9T followed by $3.4T in January 2025.

- Finance Leading – The financial industry is leading in adoption, with T-bills being the main focus, followed by tokenization of private credit, ETFs, and other alternative investments.

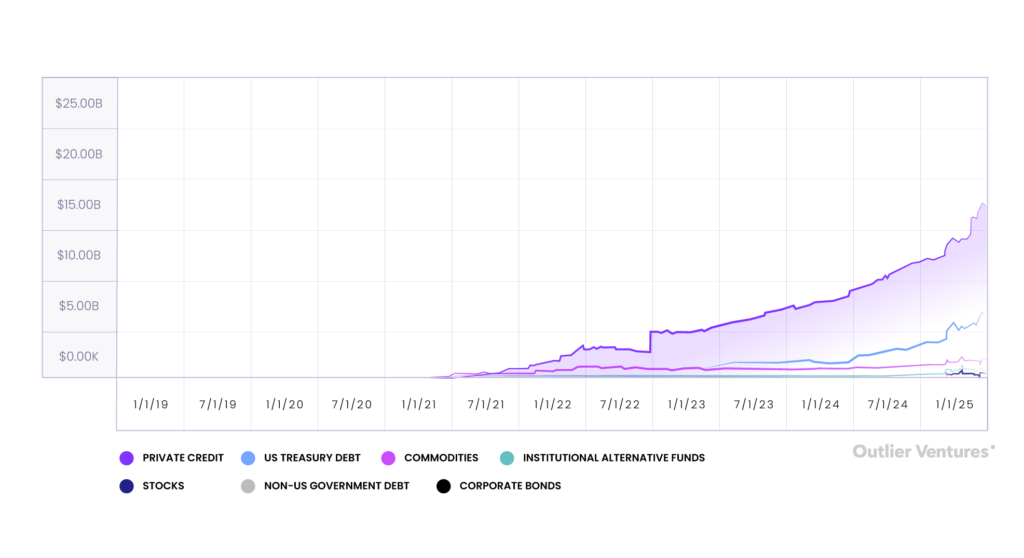

Below is the total value of tokenized real-world assets by asset class (excluding stablecoins). Private credit ($12.7B), U.S. Treasury Debt ($5.5B), Commodities ($1.3B), Institutional Alternative Funds ($433.20M), and Public Equity ($406.10M).

- Institutional & Enterprise Adoption: Major financial institutions and enterprises are launching RWA products further establishing the space and fueling interest.

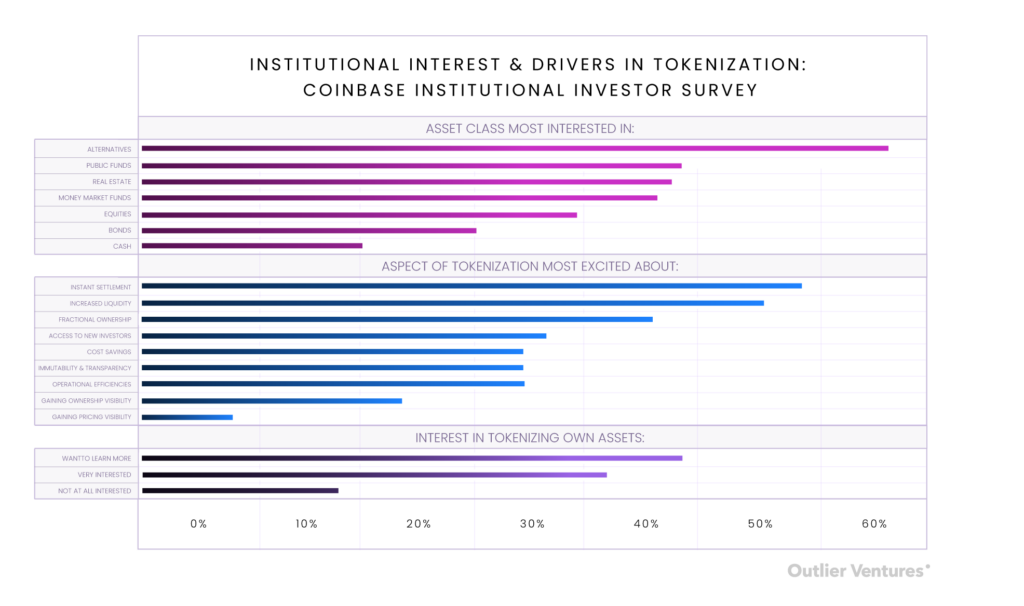

Coinbase Institutional Investor Survey of over 86 financial institutions measuring their interest in tokenization by (i) level of interest in tokenizing their own assets, (ii) aspect of tokenization most excited about, (iii) asset class most interested in.

Where Builders Can Push the Frontier

From programmable yield to agent-readable assets, here’s where the most exciting design opportunities are unfolding:

Programmable Yield Opportunities

The creation of modular, yield-optimized portfolios tailored to investor needs through on-chain composability.

RWAs enable a new generation of on-chain investment products that combine diverse sources of yield with varying liquidity profiles. Traditionally, investors had to choose between yield and liquidity, opting for liquid markets at the expense of returns or locking capital into long-term positions. Today, builders can blend yield-bearing RWAs with other assets like yield-bearing stablecoins, blue-chip utility tokens, and DeFi-native strategies into a single, programmable investment product.

This composability allows for highly tailorable risk-return profiles that meet the nuanced needs of investors. These needs are often underserved by traditional financial products. Whether it’s optimizing for short-term liquidity, steady yield, or exposure to emerging asset classes, these hybrid portfolios offer a level of flexibility and precision that is unique to on-chain finance.

Onchain Fund Infrastructure

Infrastructure for on-chain funds are laying the groundwork for programmable, transparent asset management.

While some platforms enable basic fund operations, most solutions today are either too rigid or too opaque to meet the needs of investors. Key components like compliant fund wrappers, automated investor onboarding, and real-time NAV tracking are still underdeveloped or exist in siloed products. There’s also limited interoperability between on-chain fund shares and the broader DeFi ecosystem, restricting composability, secondary trading, and use cases like collateralization. Solutions that fully integrate end-to-end infrastructure stack can make it easy to launch, manage, and scale on-chain funds in a way that aligns with both regulatory requirements and the programmability of DeFi.

Bridging Off-Chain Assets for On-Chain Agents

A secure foundation for agent-led commerce by bringing real-world assets on-chain through tokenization and verifiable data.

For on-chain agents to engage meaningfully in real-world applications such as e-commerce, logistics, and consumer services, off-chain assets must first be tokenized. Without on-chain representations, agents cannot securely verify, transact, or enforce ownership. Tokenization transforms physical assets into digital primitives that agents can interact with directly, enabling programmable and trustless interactions.

This shift brings new infrastructure requirements, especially the need to solve the oracle problem by ensuring that off-chain data is accurately and securely reflected on-chain. As autonomous agents become more common, reliable oracle networks, real-world verification mechanisms, and standardized metadata will be essential to enabling secure, scalable interactions with the physical world.

Founder Implications

If you want agents to transact in the real economy, they need real assets on-chain. RWAs are no longer a niche. They’re becoming the foundation for:

- Programmable, agent-readable value

- AI-native portfolio management

- Real-world coordination between people, protocols, and agents

If DePIN is the infrastructure layer and agents are the users, RWAs are the money, contracts, and value they’ll coordinate. In The Post Web, tokenized assets aren’t just abstractions, they’re the economic building blocks of an internet run by agents. The infrastructure is ready. The use cases are real. And the teams who start building today will be the ones shaping how intelligence and value flow tomorrow.

Ready to Build the Onchain Economy?

If you’re building at the edge of AI, Web3, and tokenized assets, we want to hear from you.

Post Web Base Camp is our accelerator for founders shaping the agentic internet. We provide funding, hands-on technical support, and access to a global network of investors, protocols, and distribution partners. Don’t miss your chance to apply.

Want to get the rest of this series in your inbox? Subscribe to our newsletter and stay ahead of the curve.