- The Real World Assets (RWA) Base Camp is a Web3 accelerator program run by Outlier Ventures with a focus on supporting early stage Web3 founders.

- The RWA Base Camp will support startups who are building the required infrastructure, applications and products that will fuel the mainstream adoption of tokenized real world assets across industries.

- The 12-week virtual accelerator program will include workshops with subject matter experts from Outlier Ventures as well as mentorship from industry experts.

- Applications are now open and will close in early April, 2024 with the program starting in mid April, 2024.

- Outlier Ventures published a 2024 thesis on tokenizing real world assets, in this research paper, we dive into the unparalleled potential of tokenizing Real World Assets and Web3’s path to mainstream adoption.

Introducing our RWA Base Camp

At Outlier Ventures, we recognize Real World Assets (RWA) as the next frontier for Web3 technology. We are committed to supporting new innovators in realizing the full potential of tokenized RWAs and facilitating the integration of this technology into the traditional economy.

Tokenizing RWAs is not just a means to bridging the gap between the crypto market and the traditional financial market, it reaches beyond that. Our recently published thesis on Tokenizing RWAs dives deeper into this. We firmly believe that the tokenization of RWAs will have a profound impact on every industry as blockchain technology extends throughout society over the next decade, which is why we are excited to launch our inaugural Real World Assets (RWA) Base Camp accelerator program.

Applications are now open until early April 2024. The program will kick off in mid-April.

Apply to join the RWA Base Camp accelerator program here.

Learn more about our thesis:

Executive Summary

Tokenizing real-world assets (RWA) is anticipated to have significant transformative potential, spanning from investing and asset management to manufacturing, real estate, and even art.

The total addressable market (TAM) for RWA tokenization is estimated to reach between $10 to 15Tr by the end of the decade and is attracting the eye of major institutional participants. We believe this is an underestimation.

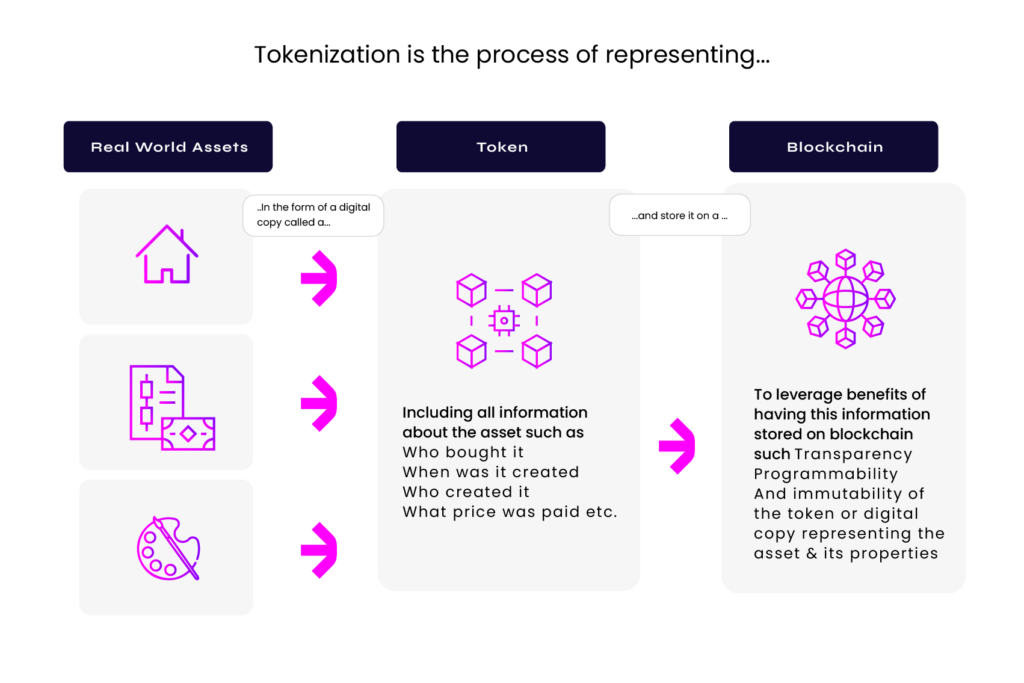

Converting physical or intangible assets into digital tokens that can be traded on a blockchain can enhance the liquidity, accessibility, and efficiency of multiple asset types. There are already existing use cases, such as tokenized bonds. But this is a drop in the ocean compared to the flood of digitized assets that could move on-chain, such as real estate, carbon credits and company assets such as inventory and intellectual property.

This study aims to provide founders and investors with a comprehensive understanding of RWA tokenization, an area we anticipate will have a significant impact over the next decade across multiple sectors.

A Tale Of Two Trends

The tokenization of real-world assets (RWAs) has two major trends; digitalization and financialization. The former transforms physical assets into a digital format, while the latter endows them with financial instrument properties. Blockchain-based tokenization is accelerating these two trends, enabling innovations, such as token programmability.

An Opportune Time

Significant interest in RWA tokenization goes back as far as 2019. However, we believe there are key differences between the current environment and previous cycles. Institutional investors, hedge funds, and asset managers now drive participation, marking a shift from previous retail-led cycles. Today’s sophisticated market participants are using advancements in blockchain scalability, security, and interoperability to pilot new tokenization projects. They are introducing these products to their clients, and shaping discussions around the evolving regulatory environment.

Robust regulatory frameworks are being introduced, fostering institutional involvement. One example of this is the UK’s Electronic Trade Documents Act, which aligns seamlessly with blockchain applications for RWA tokenization. The synergy of progressive regulation, technological advancements, and enhanced transmission mechanisms, like Central Bank Digital Currencies (CBDCs) and stablecoins, marks a promising new era in the field of RWA tokenization.

Unrecognized Potential

We believe the total addressable market, TAM, for the tokenization of RWAs, is significantly greater than the current estimate of ~$15Tr by the end of 2030. Estimates fail to consider the potential increase in an asset’s value post tokenization. A more accurate estimate should include new markets that facilitate healthy price discovery of tokenized assets. Also, tokenization can segregate an asset into different elements, creating separate, liquid markets for these elements, leading to further price discovery.

The Ultimate Endgame

Without tokenization of RWAs, the computational capacity of blockchain based smart contracts is limited to the on-chain world. Through tokenization, off-chain or real world assets are brought into the realm of smart contract capabilities, extending the computational capacities of the economy. This movement is called the computational economy and is a new economic paradigm where Web3 technologies facilitate the development of a ‘computable economy’, which enables a significant increase in economic complexity and, from this, wealth. Tokenization of RWAs is a critical step in unlocking the computational economy, which we believe is the ultimate endgame of blockchain technology.