Once these models are out in the wild, the job of token design and engineering has only just started. Token models will need to be constantly monitored, maintained, tuned, and iterated through. A good project will feel responsible for the network it has launched, ensuring its long term sustainability, effectiveness and security well past the initial network launch.

Ideally, a token model will be launched first in a test net with real users before going to a production-ready network. This will allow for further testing and optimization of the token model, and fine-tuning of the token-network fit.

Measuring, Monitoring, Maintenance

Measuring, monitoring, and maintaining your network relies heavily on the feedback loops created in the Design Phase. We discussed feedback loops in more depth in our last post, but the sooner a token model is able to produce real metrics regarding its use and overall network health, the sooner it is possible to de-risk the model.

Blockchains are great economic sensors, providing provenance of information not just on the current state of the network, but its evolutionary path. A token model’s feedback loop is a critical evolutionary component used to reduce the complexity of the network into actionable insights to direct model optimisation and create frictionless evolution. Due to the effectiveness of these networks in recording and preserving details on their current state, the question is not what can be measured, but what should be measured to determine the true state of network health. The answer to that question should be guided by the high-level network requirements outlined in the Discovery Phase, and the network’s objective function defined in the Design Phase.

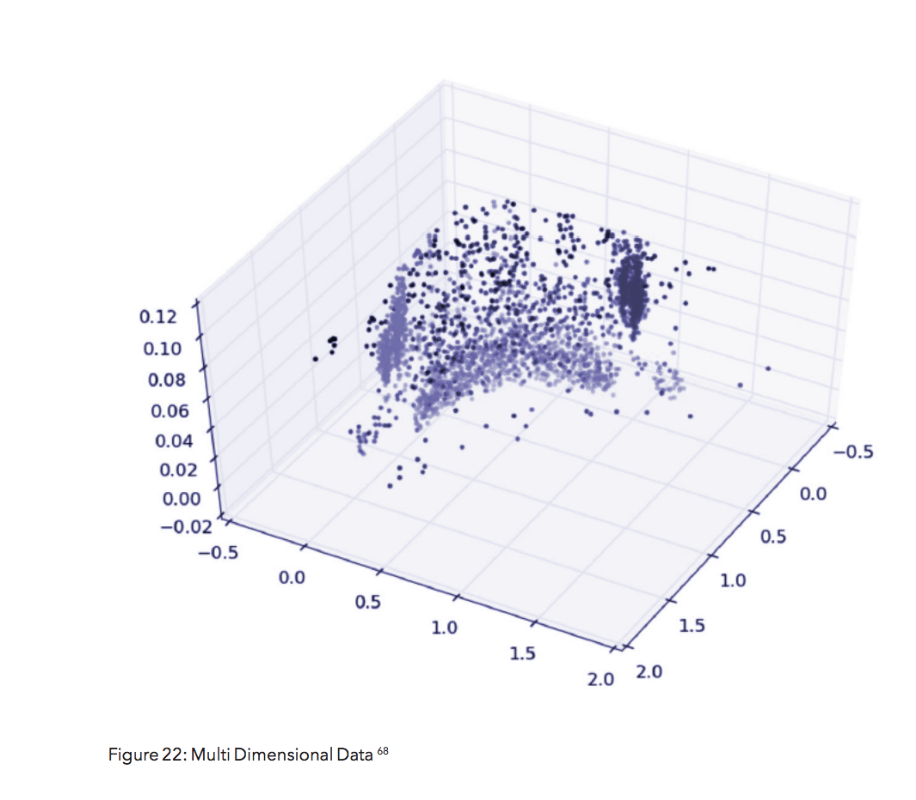

Human behavior is extremely complex, hence data collected from these networks is multidimensional, time-continuous, and always evolving. Moreover, different weights will be given to different parameters at various stages of a network’s lifecycle, and some parameters may even become irrelevant as new ones are introduced. Accordingly, choosing the right metrics to optimize around and when to optimize is critical.

Human behavior is extremely complex, hence data collected from these networks is multidimensional, time-continuous, and always evolving. Moreover, different weights will be given to different parameters at various stages of a network’s lifecycle, and some parameters may even become irrelevant as new ones are introduced. Accordingly, choosing the right metrics to optimize around and when to optimize is critical.

Well-designed token models should already have key parameters identified and all the tools in place to effectively measure and monitor their issuing network. It is worth noting that what you should measure in these token ecosystems will invariably change throughout the lifecycle of the network. Different types of users rotate in and out of the network; the network utility increases; the network forks or is acquired by other networks. Tracking this evolution to create well-structured databases of network metrics will increasingly become a huge priority for these networks, not just to optimize their own token models and ensure their own long term sustainability, but to also improve the tools used to design, build, and iterate new networks and token models.

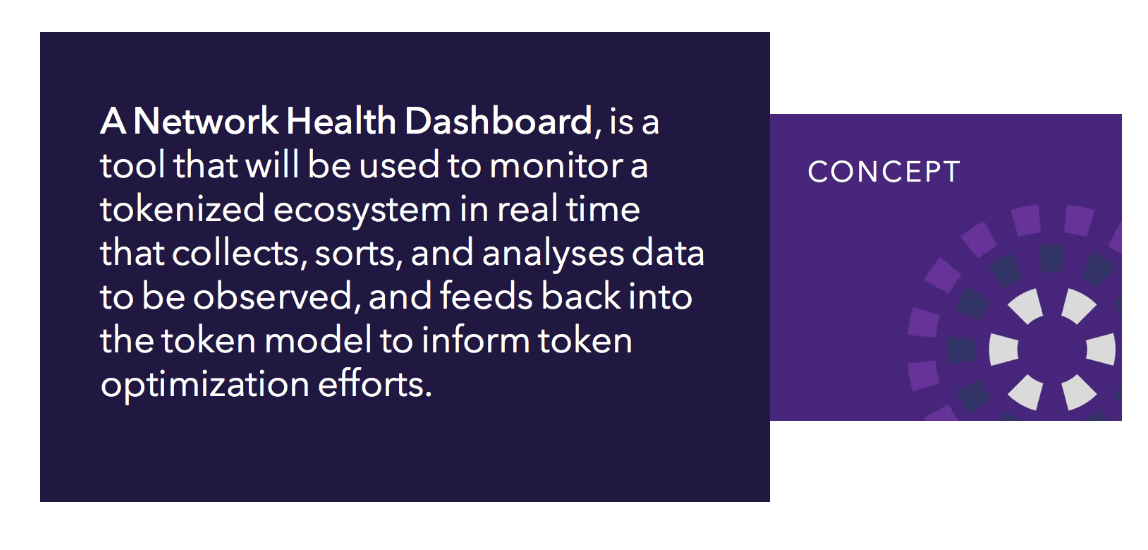

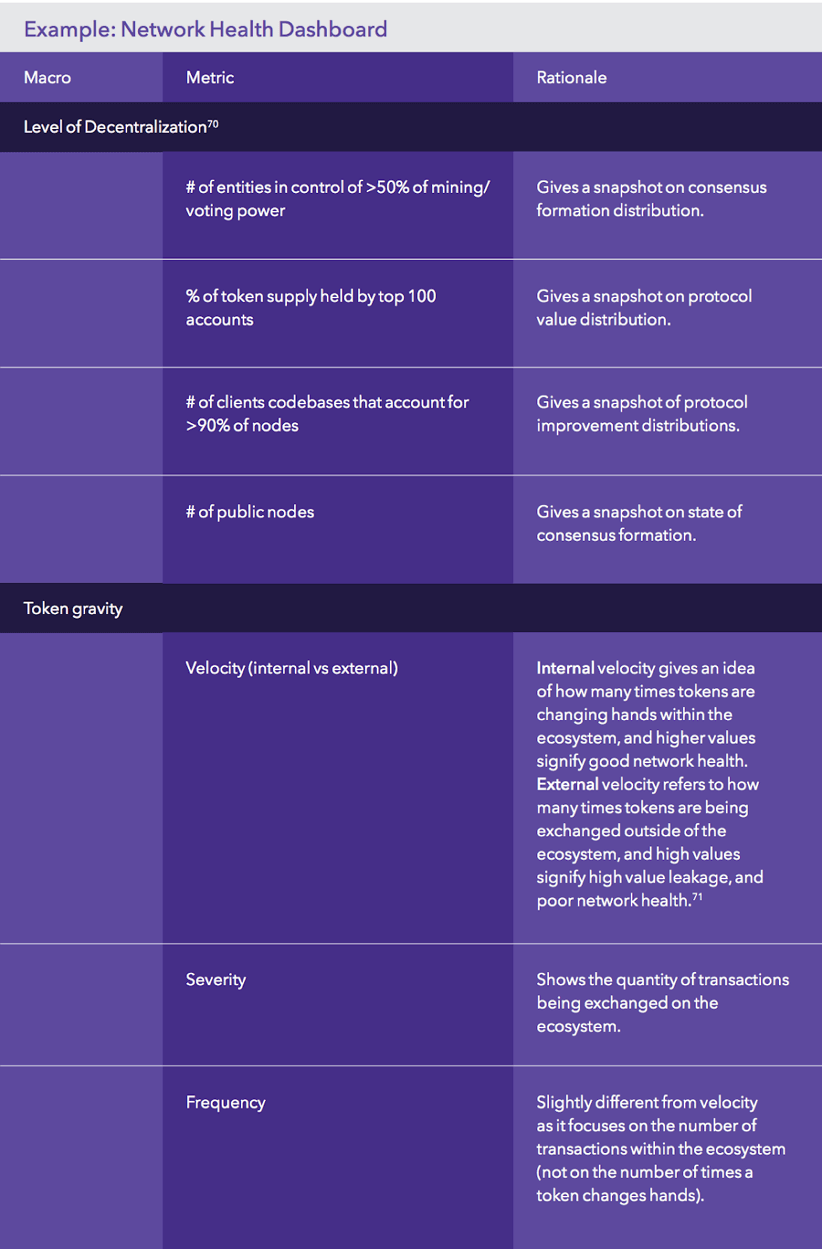

We propose that any network issuing a token will need to create a network health dashboard used to measure and react to current network states.

A Network Health Dashboard would be a key tool for monitoring the underlying health and performance of the network. Any analysis of network health should track both qualitative and quantitative aspects of on-chain and off-chain activity. In the same way that traditional early-stage tech companies optimise their offering around their lifetime customer value (LTV) and customer acquisition costs (CAC) tokenised ecosystems will optimise their operations around network health, adoption, and traction. It is still relatively early, and these are fundamentally new business models so industry standards have not fully crystallised, but metrics are beginning to percolate to the surface surrounding network economics, value flows, network safety, token ownership, developer activity, community building, corporate engagement, and other network adoption and traction indicators.

A Network Health Dashboard would be a key tool for monitoring the underlying health and performance of the network. Any analysis of network health should track both qualitative and quantitative aspects of on-chain and off-chain activity. In the same way that traditional early-stage tech companies optimise their offering around their lifetime customer value (LTV) and customer acquisition costs (CAC) tokenised ecosystems will optimise their operations around network health, adoption, and traction. It is still relatively early, and these are fundamentally new business models so industry standards have not fully crystallised, but metrics are beginning to percolate to the surface surrounding network economics, value flows, network safety, token ownership, developer activity, community building, corporate engagement, and other network adoption and traction indicators.

Looking beyond our process for token ecosystem creation, it is critical we better explore how these networks evolve and how we measure their performance to the same level of understanding we have of the other Internet business models such as SaaS, which we now know evolve from targeted growth hacking and freemium models to subscription-based monetization. We need comparable metrics like conversion rates, churn, monthly recurring revenue and customer acquisition costs to provide guidance on network growth, their financing and ongoing health for critical decision making and stewardship.

This process can better position projects to develop the network metrics and computational signals they need to navigate such complex systems. These serve, not only as reliable indicators of the economic and technical health of a network but also as ‘fundamental analysis’ for those valuing networks for over their long-term futures.

Recently at Outlier Ventures, we’ve been working on a joint project between our technology and crypto economics team developing a network health scoring tool to monitor the underlying health of a network, and can’t wait to share it.

To learn more about our phased strategic process for token ecosystem creation, download our full report on Token Ecosystem Creation.

This article is for information purposes only and does not constitute investment advice. This article does not amount to an invitation or inducement to buy or sell an investment nor does it solicit any such offer or invitation in any jurisdiction.

In all cases, readers should conduct their own investigation and analysis of the data in the article. All statements of opinion and/or belief contained in this article and all views expressed and all projections, forecasts or statements relating to expectations regarding future events represent Outlier Ventures Operation Limited own assessment and interpretation of information available as at the date of this article.

No responsibility or liability is accepted by Outlier Ventures Operations Limited or Sapia Partners LLP for reliance on the contents of this article.

Outlier Ventures is an Appointed Representative of Sapia Partners LLP, a firm authorised and regulated by the Financial Conduct Authority (FCA).