RWA (Real World Assets) Base Camp is closed

Bringing the physical world on chain

Base Camp Summary

Starting in: October 2024

Duration: 12 weeks

Where: Fully remote

Investment: Up to $100,000

Half a decade after the initial hype, RWA tokenizaton is finally ripe. That's why we're proud to be running another season of our Real World Assets Base Camp.

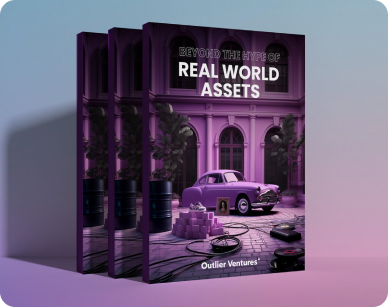

Tokenization is a Tale of Two Trends

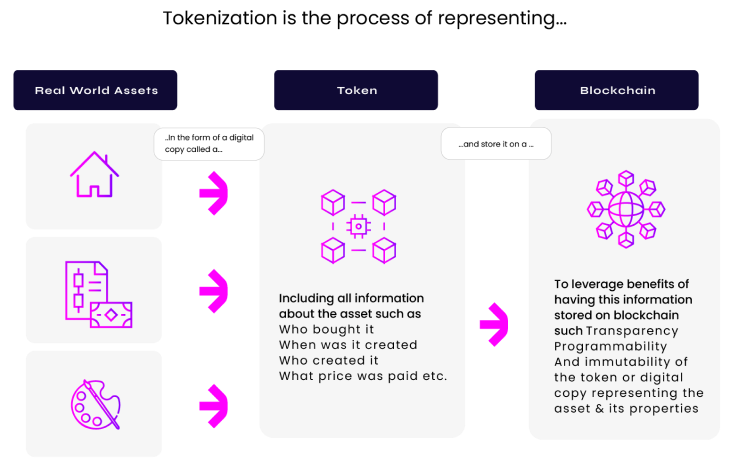

Digitalization – The transformation of physical assets into digital formats or the movement of digital assets onto new infrastructure to unlock even more benefits

Financialization – The process of turning any asset into a financial instrument by reengineering cash flows, investment opportunities and capital formation.

Why Now?

More mindshare & activity – We see more mindshare and activity from a larger group of players actively trying out the technology

Legal & regulatory clarity – We see improvement in regulation towards digital representation of assets and their underlying ownership. We expect this only to accelerate.

Katie Lundie

RWA Accelerator Lead, Outlier Ventures

What projects are we looking for?

Institutional Proof Tokenization

Corporations operate under different rules, dealing with sensitive information that requires strict regulation and offers them an economic edge. Despite a growing interest in blockchain technology, these entities need privacy assurance before tokenizing assets and storing data on a transparent database.

This can be achieved through privacy-enhancing solutions, private ledgers, or other tools. We see a significant untapped opportunity in making tokenization more accessible for institutions.

Asset Segregation

Due to its programmable nature, tokenization can untangle nested assets. In plain English, an asset may have value locked within it. For example, farmland and its associated carbon credits have economic value, but are often traded together due to the high costs of separating them.

Tokenization’s programmability and smart contracts make treating them as distinct assets easy. We encourage users to see tokenization as an opportunity to untangle assets and unlock value.

Intellectual Property

Tokenization has the potential to completely reform how IP is generated, financed, and monetized. Tokenization can create a more efficient and equitable system. We believe that IP across some industries can greatly benefit from these advancements.

Tokenization will not only democratise access to investment opportunities but also ensure creators receive fair compensation, enhance the traceability of IP rights, and streamline the management and transfer of IP assets.

RWA Indexing Tools

Conservative estimates show that $15Tr of value will be tokenized by 2030. This means an immense number of tokenized unique assets will be in the ownership of an equally large number of asset holders.

To ensure a base level of transparency and structure, RWAs need improved indexing tools to monitor the provenance and movement of these assets over time. While some of this data will be embedded directly into the token, we still need better indexing tools.

RWA Market Makers

An ongoing issue in the tokenization space is liquidity. The less fungible assets are, the more difficult it is to create liquid markets. If there isn’t sustained demand from buyers and sellers, the bid-ask spread for the asset to switch hands becomes too big. To tokenize alternative assets, we must see liquidity solutions and market makers stepping in to reduce this bid-ask spread.

It’s still largely unexplored, but we believe it will be critical to RWA’s future.

NEW THESIS

An update to our RWA vision

August 2024

When spending time on the ground, it becomes apparent that the financial industry is leading the charge on blockchain-based asset tokenization.

We expect RWA to continue to see strong adoption by challenger and incumbent players in and outside the financial realm. It’s exciting to see the rubber finally meet the road.

2023 THESIS

Tokenisation: Beyond the Hype

October 2023

The integration of Real World Assets (RWAs) into Web3 infrastructure, propelled by the tokenization of tangible assets, is poised to fundamentally alter how we interact with and perceive everyday assets.

This evolution is gaining traction, particularly in the financial sector, and is anticipated to permeate every industry as blockchain technology spreads more widely over the coming decade . We foresee this movement as a pivotal step towards the mainstream adoption of Web3, reshaping the landscape of digital and physical asset management.

What do startups get out of the program?

Part 1

Week 1-2

Helping you to maintain focus on OKRs & Web3 Readiness Framework and ensuring you’re optimally leveraging our network.

Part 2

Week 3-6

Building your knowledge and refine your idea through workshops and 1:2:1 meetings with our Subject Matter Experts across token, design, legal, engineering, fundraising and more.Part 3

Week 7-12

Having learned and refined your idea and in the first six weeks, the final weeks of the program are tailored towards supporting the key areas needed to bring product to market.Post Program

An opportunity to showcase your product to the wider Outlier network and 2 months fundraising support.

- 360 support from 40+ experts on token, product, legal, fundraising, etc.

- Access to a mentor network of industry leaders in the RWA space

- Connections with the most relevant RWA players

What we offer

- 12-week dedicated support and access to our 100+ team and network

- +2 months of additional fundraising support

- Up to $100k stipend as part of the program (terms apply)

- Up to $200k in follow-up investment (terms apply)

In return for

- Agreed equity stake and future token supply

- Option to join future equity rounds, token rounds, and NFT drops at a discount

We have accelerated 300+ teams across 34 cohorts

Testimonials

FAQs

- 3 month fully remote accelerator program

- Access to in house specialist operational, legal, commercial, and co-marketing support

- Token engineering support and business model testing to pinpoint product-market fit

- An optional $30,000 interest-free repayable loan to help with initial legal costs

- An active global mentor, partner and investor network featuring over 400+ mentors and 180+ alumni companies in Web3

Any Base Camp program is designed to nurture teams whose business potential best leverages the program’s protocol and design strengths and also aligns with Outlier Ventures’ Metaverse OS Thesis. Cohorts are generally selected through the lens of growing the protocol ecosystem across various layers such as: NFTs & Gaming, DeFi, Infrastructure, Services, and Middleware.

Participating startups will gain exposure to both Outlier Ventures’ and the protocol’s ecosystems, offering an unparalleled opportunity for founders to scale their technology and grow their business.

The Base Camp Accelerator is a fully remote and virtual program. This allows us to recruit and work with the best teams wherever. We have invested in companies across all continents. Our strength lies in the diversity of founders that we accelerate across the globe.