Leveling the playing field in DeFi

Polkadex not only increases the efficiency behind transaction settling, allowing for higher throughput, scale, and faster transactions by removing fees and in doing so solves more complex issues such as increasing liquidity and front running.

One of the key design flaws in today’s DEX are users know which transactions are taking place due to clutter in the transaction queue allowing some more sophisticated traders to identify market movements ahead of time (aka front running). As a result, those traders are happy to pay abnormally high transactions to jump ahead of the transaction queue and profit from the information arbitrage. This puts most other traders at a huge disadvantage.

Polkadex eliminates this problem through feeless transactions and its layer 2 scaling solution called Offchain State Commits. This lack of fees also opens the door for high-frequency traders, where typically cancelation fees discourage them. The result is a much more inclusive form of DeFi to a wider range of investors, while still enabling third-party market makers to link to the order book and operate in Polkadex.

More options, more liquidity

Besides high fees, other issues limiting DEX’s adoption are liquidity risk, impermanent loss, and price spillage. Polkadex tackles all of these directly by launching a Fluid Switch Protocol v2.0. In effect, it gives one more option for the seamless execution of trades, increasing liquidity. While trades are executed off-chain, they are verifiable onchain using a snapshot of state changes sent to the blockchain every 3 seconds called Offchain State Commits. This behavior is also tracked by off-chain workers that work alongside the Substrate Runtime Environment, effectively preventing the operator that makes off-chain commits from becoming a bad actor. Polkadex increases the efficiency of trades by enabling a horizontally scalable layer 2 solution to find the best option for investors.

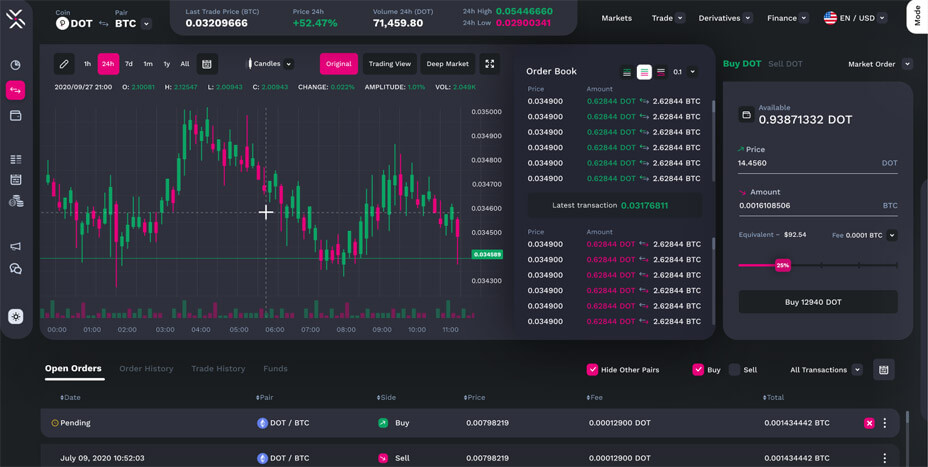

CEXy UX for DeFi

Polkadex brings the same standard of centralized trading experience its users have come to expect but to DeFi, making it a complete and easy-to-use product for both experienced and new traders.

Equally, Polkadex has already proven in testing it can also already handle comparable trading volumes to leading centralized exchanges and its future roadmap targets even higher efficiency and scale. And unlike centralized competitors, with Polkadex, traders retain full control of their assets while still operating in a secure environment, fulfilling DeFi’s commitment to decentralisation and openness.

Going live: Outlier Ventures and Ascent

Polkadex have now successfully closed their heavily oversubscribed private sale for $3m including the likes of LD Capital, Kenetic Capital, NGC Ventures, QCP Capital, AU21 Capital, CMS Holdings, Block Dream Fund, PNYX Ventures, Genesis Block Ventures, JRR Group, Cluster VC, GBIC, Momentum 6, Master Ventures, DAG, YBB Foundation, Blocksync Ventures, BTX Capital, Waterdrip Capital, Genblock Capital, Existential Capital, and Outlier Ventures. alongside the successful deployment of their testnet and are targeting main-net by the end of Q2 2021.

Polkadex joined Outlier Venture’s token launch program (Ascent) earlier this year focused on the rapid launch of DeFi and NFT protocols.

Outlier Ventures has been backing Web 3 founders since 2014 and is the world’s leading Web 3 accelerator program on track to accelerate up to 100 equity startups and protocols in 2021 through both Ascent and their earlier pre-seed/seed program (Base Camp).

Base Camp is currently recruiting for its next cohort and is looking for founders accelerating the open metaverse thesis by launching token networks focused on the new data economy, DeFi, and NFTs.

We bring together a network of 1,000 of the world’s leading Web 3 founders, protocols, and VCs to mentor and invest.