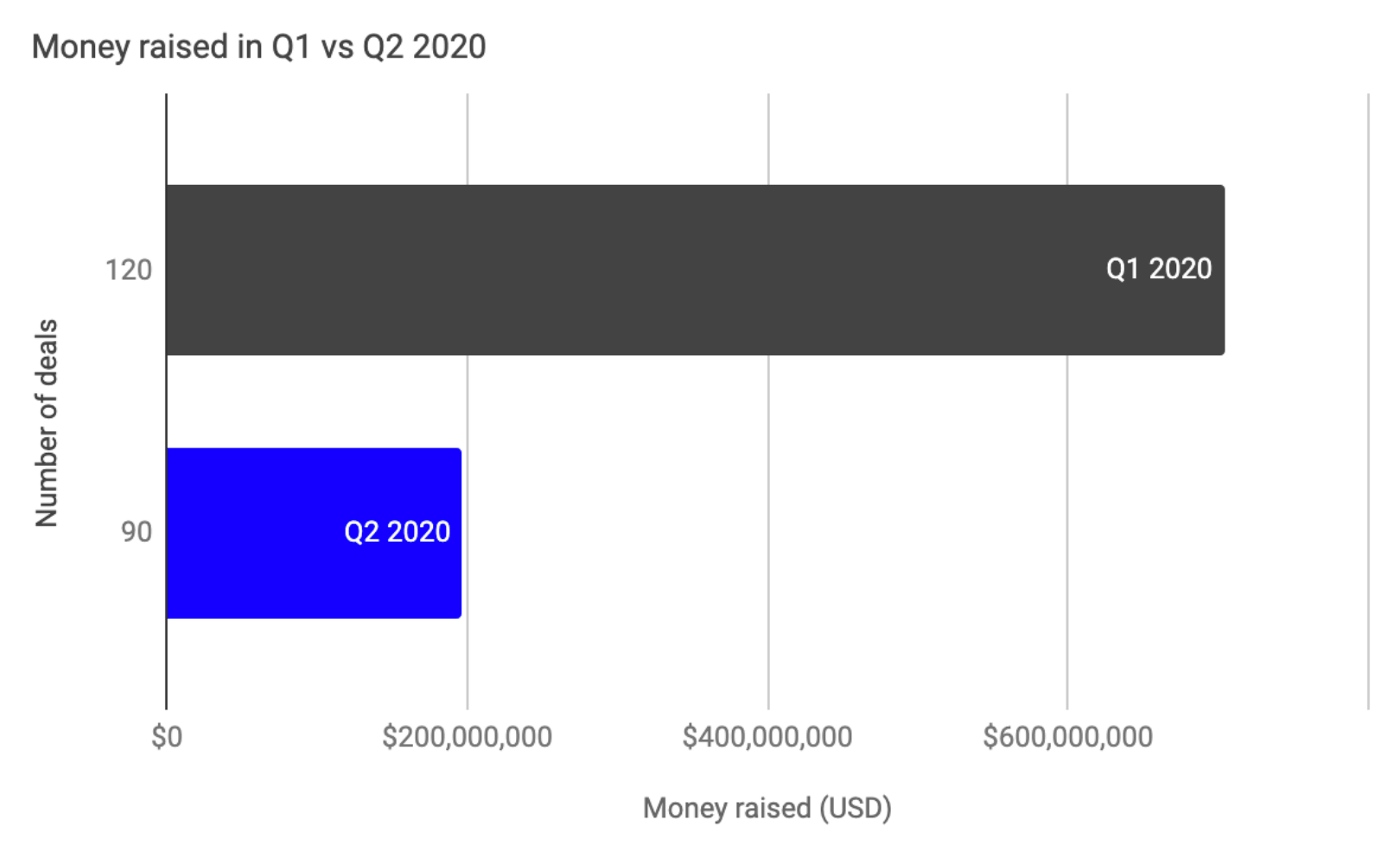

Q2 2020 saw 90 deals at nearly $200 million raised. A 70% drop in $$ commitments across 25% less deals.

Source: Crunchbase

The median raise this quarter was $2 million across 28 different verticals. The difference between Q1 and Q2 2020 is coming from less series A and B rounds. Scale ups were most likely to struggle meeting their numbers. At pre-seed and seed level the value of the company is mostly held in the team. We invest in the early signs that the founders can execute on their vision. At series A companies usually have some product-market fit validation and enter the stage where they need to double down on their winning strategies. Series B lays the foundation for a startup to grow to unicorn levels.

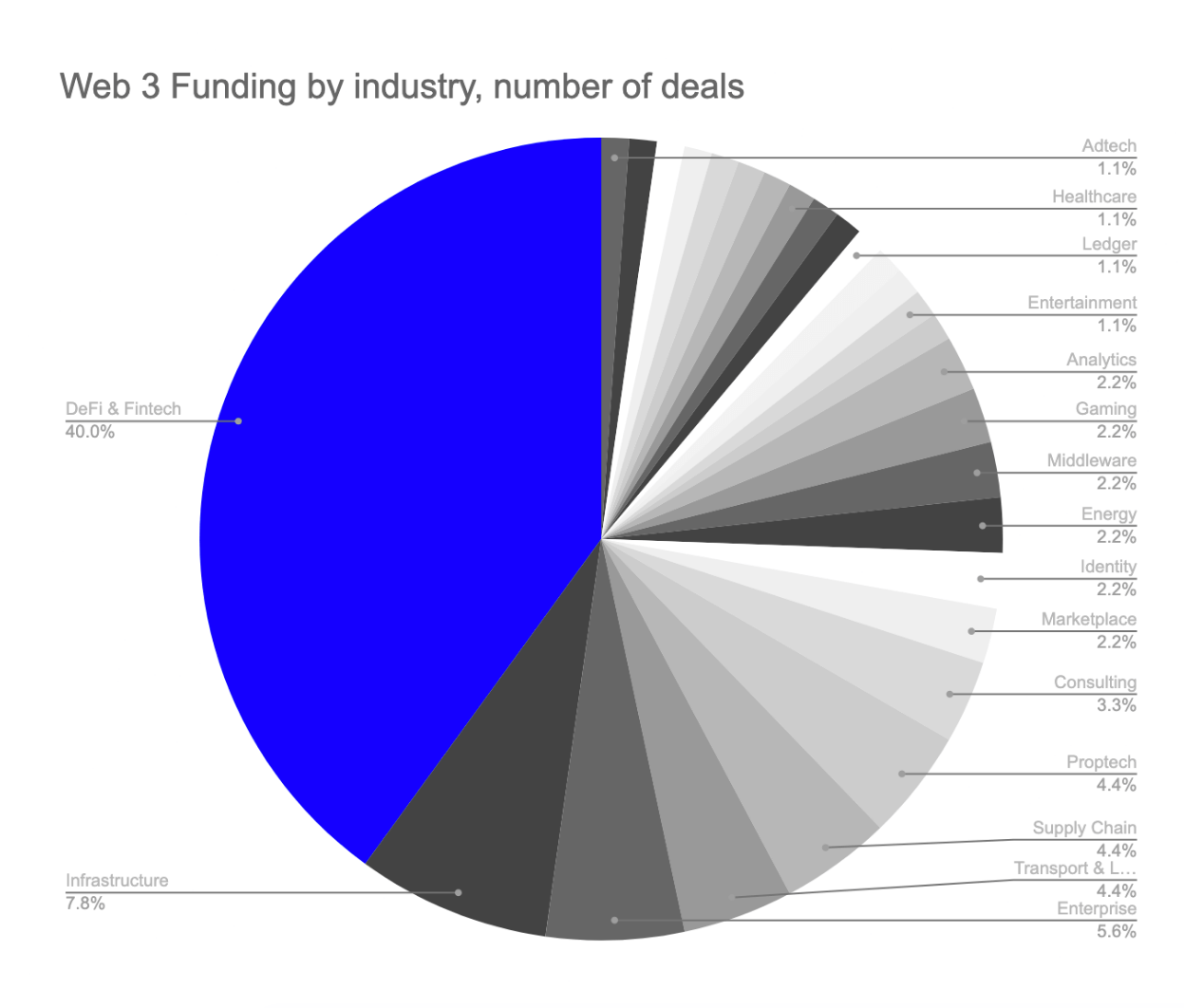

Following the monthly trend, 40% of the deals were in DeFi & Fintech.

Source: Crunchbase

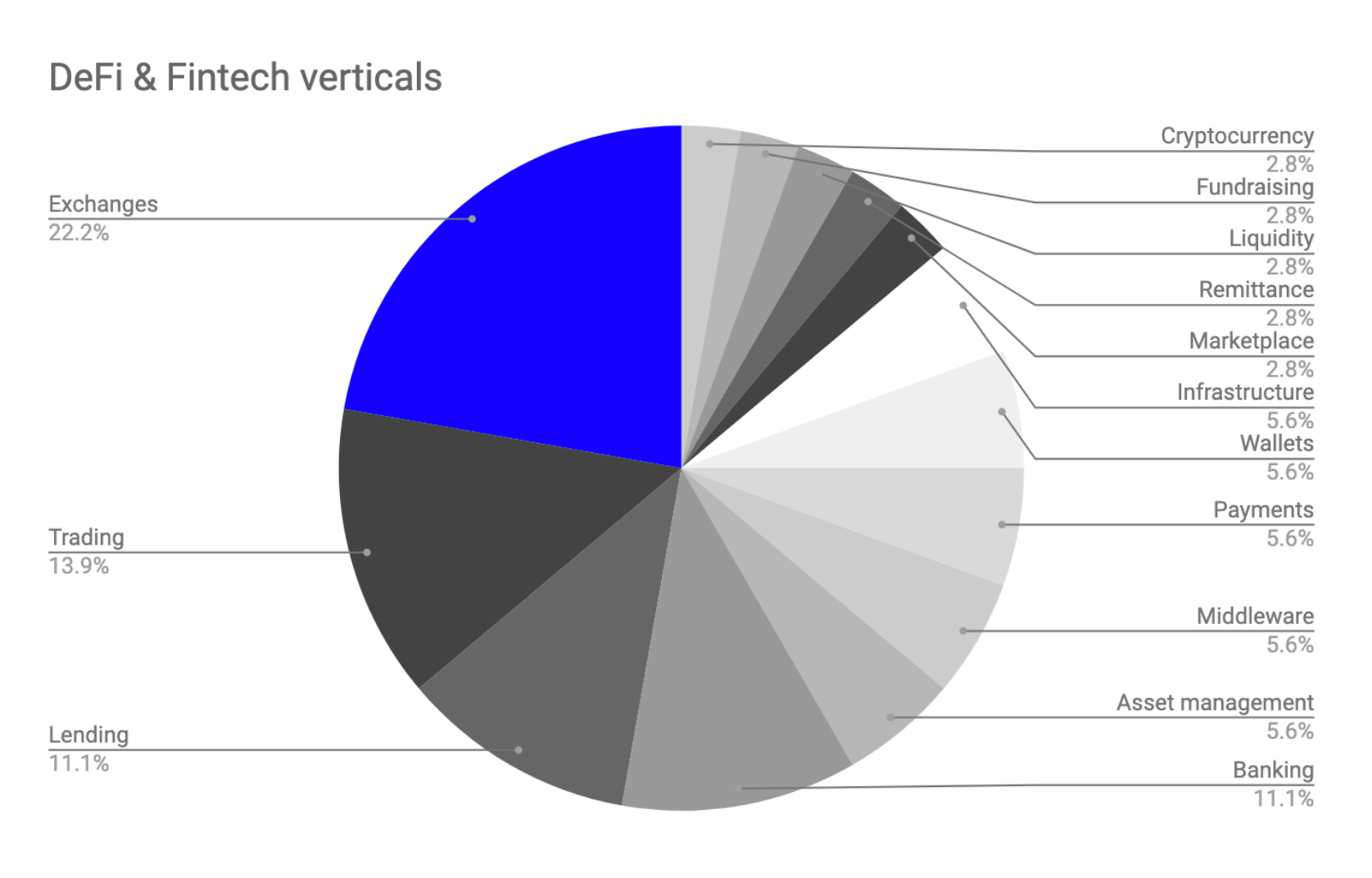

Companies that raised within Q2 2020 in DeFi & Fintech are working in 14 niches. Exchanges topped the chart with 22% or 8 deals. Closely followed by Trading platforms, Banking and Lending. Unexpectedly infrastructure, financial middleware and payments were only represented by 2 deals each. This was somewhat surprising given that we do not necessarily have the robust foundations for programmable money yet. Experimentation is in full swing, so we’re following the space closely.

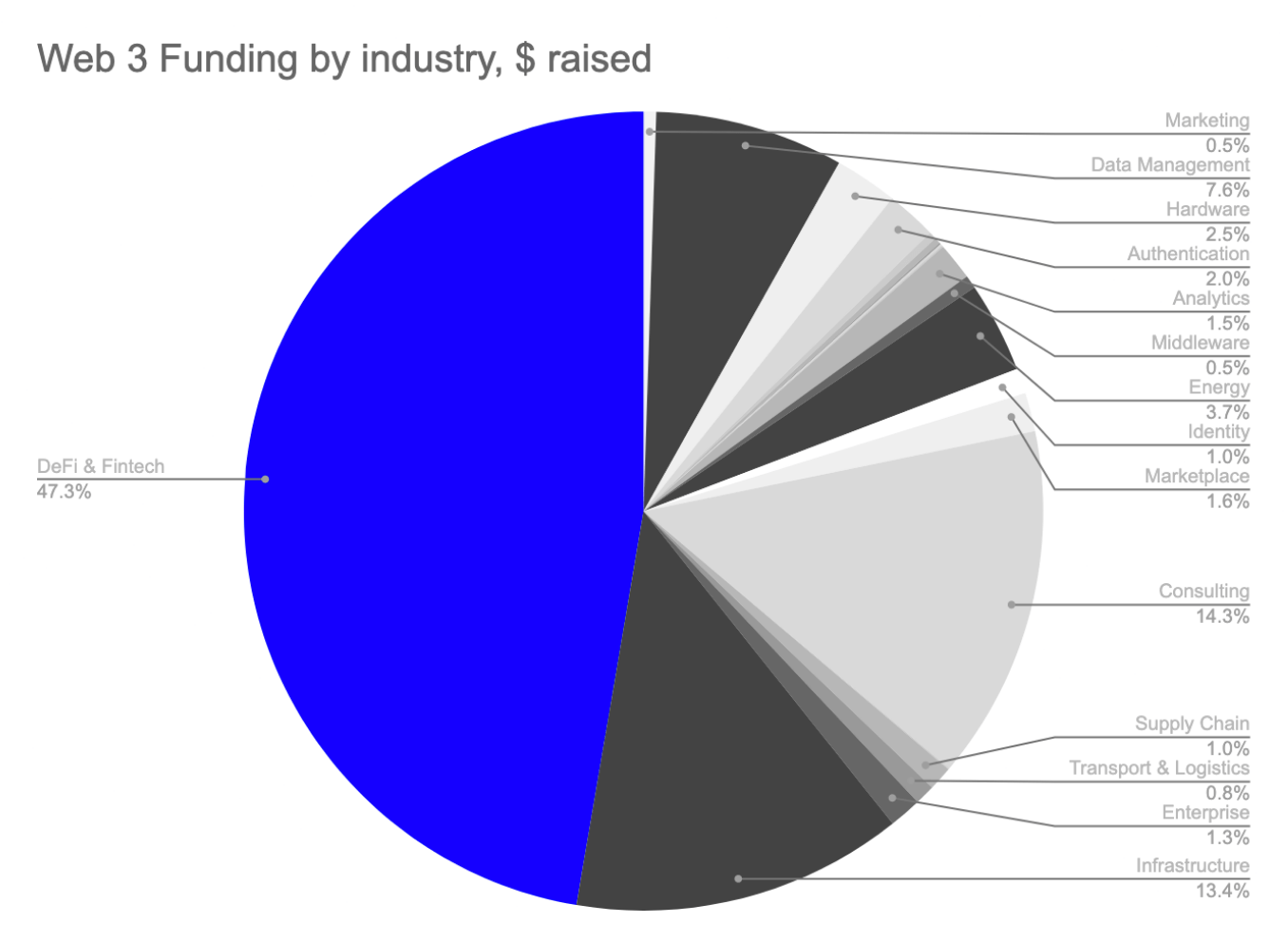

DeFi & Fintech also attracted almost half of the funding with appr. $93 million committed.

Source: Crunchbase

Consulting companies including blockchain service businesses raised almost $30 million wile Infrastructure companies raised $26 million. Everybody else failed to attract more than $3 million per category (in total for the quarter).

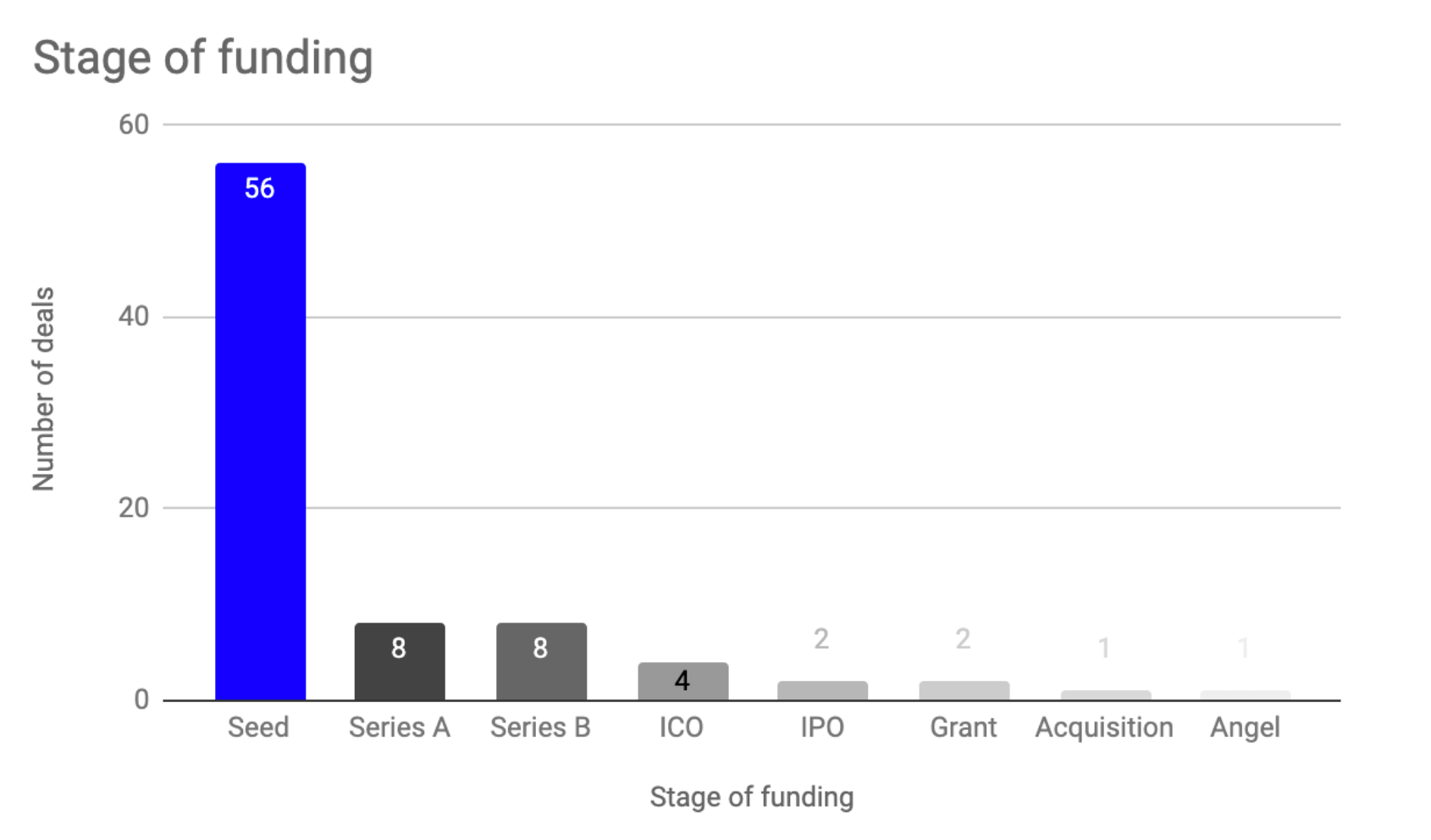

The most common round for Q2 2020 was seed.

Source: Crunchbase

Equity seed funding proved to be the most attractive stage for Q2 2020. We did see 4 token rounds and 1 acquisition but equity funding is still the most popular across professional investors. Grants are also a new way of funding early stage projects’ product development. Europe has some great opportunities. Also ledger projects have committed grants for developers building on their networks, e.g. Streamr, Ethereum, Cosmos, Tezos, Web 3 Foundation (Polkadot). If you are building on a ledger, it is worth exploring their options. Some projects like Near and Evernym even have accelerators available. We are all in this together and have the same goal – adoption. This is also the driver behind our Base Camp accelerator program (Outlier Ventures).

Less than a tenth of all funded startups in Q2 2020 are building in Infrastructure.

Source: Crunchbase

Followed by another 5% building companies enabling enterprise adoption of DLT.

Enterprise is a boring category. However, without normalising decentralised technology for the big companies we cannot keep innovating. Enterprises will bring dealflow and volume unparalleled to consumer adoption. This will allow us to innovate with more and more users onboard. The current state of 100 to 200 daily active users for DeFi is way too small for testing.

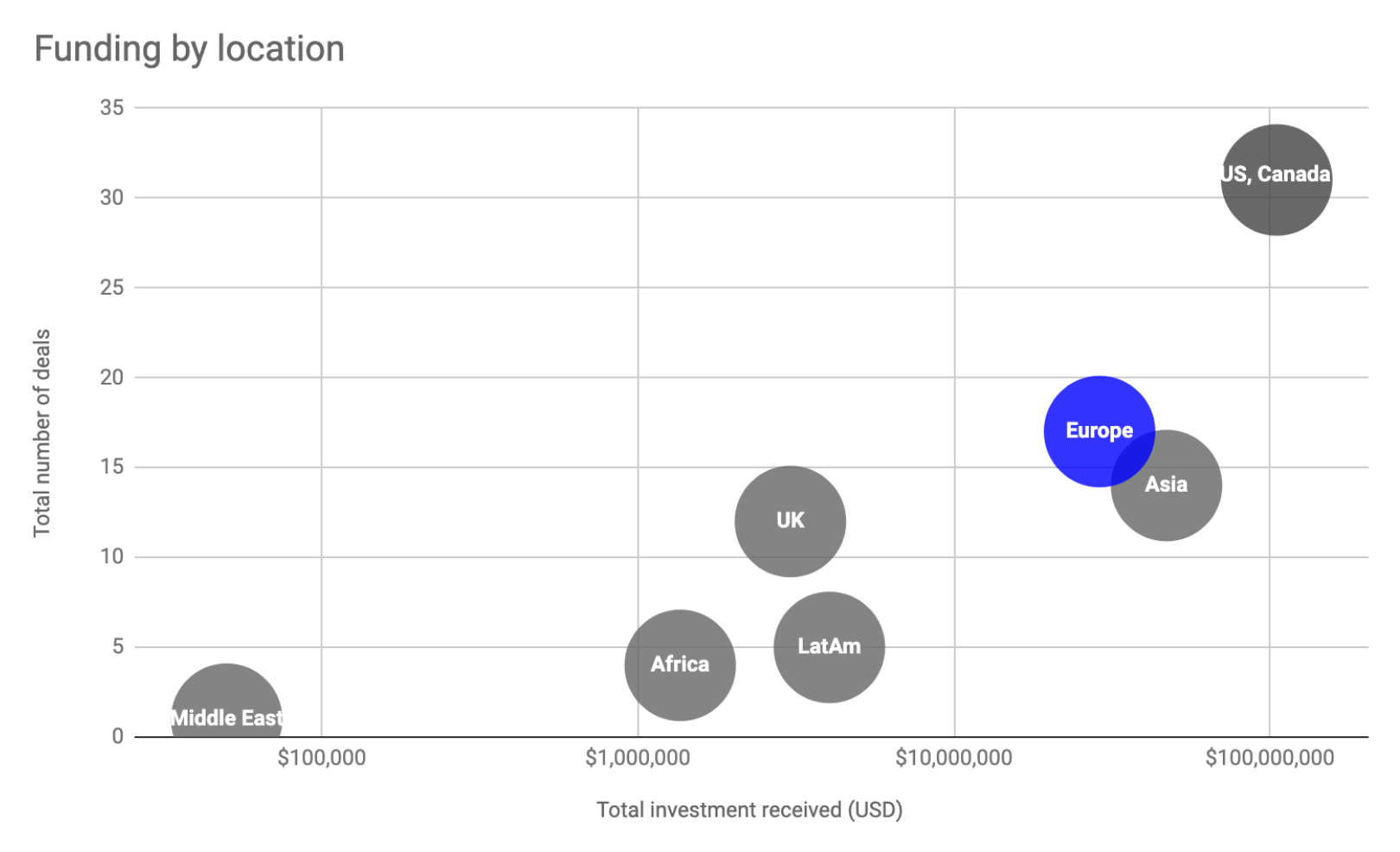

The US is leading the way followed by Asia, Europe and the UK.

Source: Crunchbase

We had 2 decades of development of the tech industry in the UK and Europe and less than a decade in Web 3. Things are picking up. But when we look at it compared to the US we still have a long way to go. Web 3 companies raised over $100 million across 31 deals in the US despite the regulatory environment. Europe saw 17 deals and $29 million in funding. The UK saw some very small raises ending up with 12 deals and only $3 million in funding.

Investors are active again.

March and April were busy times for the investors. Everyone was busy with portfolio companies and emergency boards. Then in May and June they gradually freed up and started looking at their pipelines. Some have already started proactively sourcing and looking at deals. And let’s not forget the 33 funds that closed over 3 billion EUR in the same quarter! See for yourself here by Euro VCs.

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io .

If you’re a startup interested in joining a future Base Camp programme, please register your interest here.