November is solidifying the fundamentals with 61 deals and $357 million raised.

Source: Pitchbook, Crunchbase and The Block

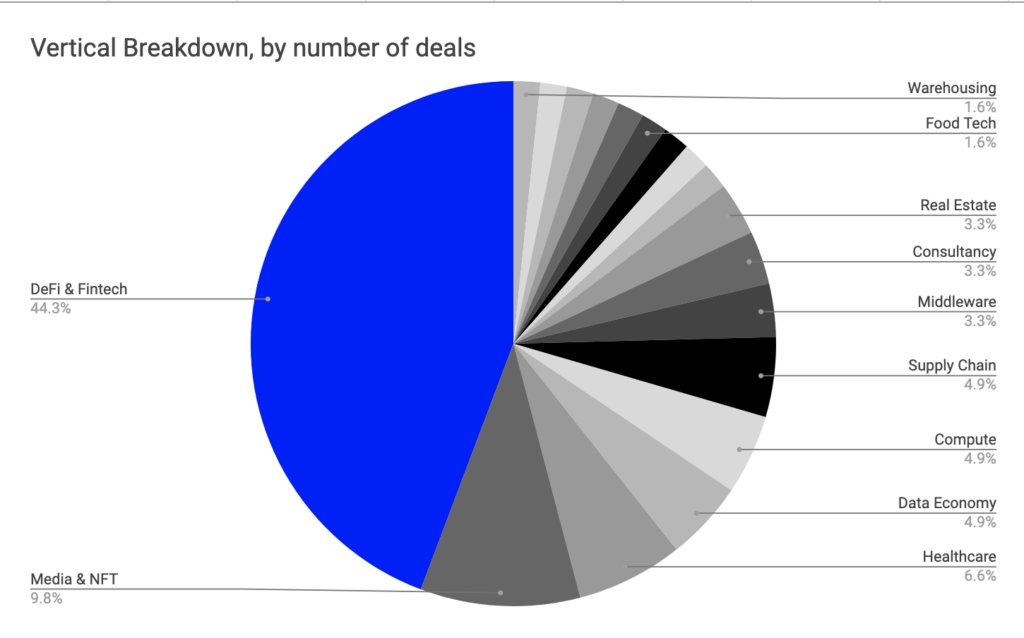

The median raise this month was $2.3 million across 18 different verticals. The majority of the deals were equity-based transactions. In the markets all eyes are still on Bitcoin with plenty of companies who raised equity rounds getting ready to issue their tokens before Christmas, before the Chinese New Year and in the spring. Loads of product development and traction is happening behind closed doors. Definitely very different fundamentals to 2017 whitepaper million dollar raises.

If you’re an investor (angel or institutional) and want to keep up with the latest on Base Camp cohorts and chance to gain early access to deals, sign up here.

45% of the deals were in DeFi & Fintech.

Source: Pitchbook, Crunchbase and The Block

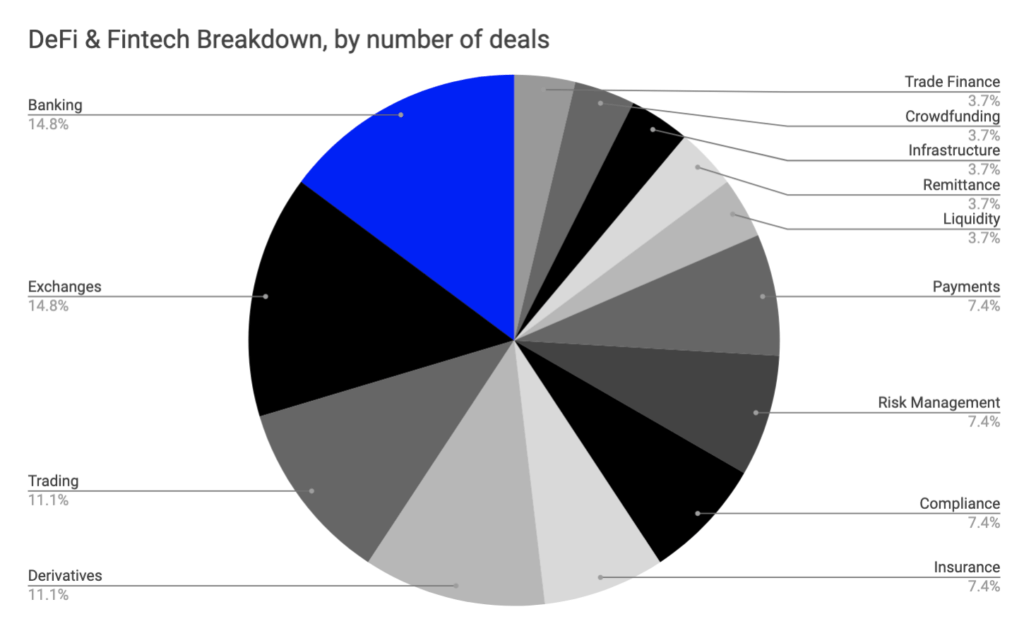

The DeFi & Fintech companies that raised in November are spread across 13 niches. This time around Banking, Exchanges, Trading and Derivatives topped the chart with half of all DeFi deals. Insurance, compliance, risk management and payments are still going strong. We are still in the search of solutions for retail and institutional investors. At more than a few billions locked in DeFi, the tools are still geared towards the more experienced and savvy users. And while an entire suite of financial infrastructure for advanced users is being built a lot of entrepreneurs will be focusing on yield seeking novice users.

If you are a founder looking at the future of finance, drop me a message!

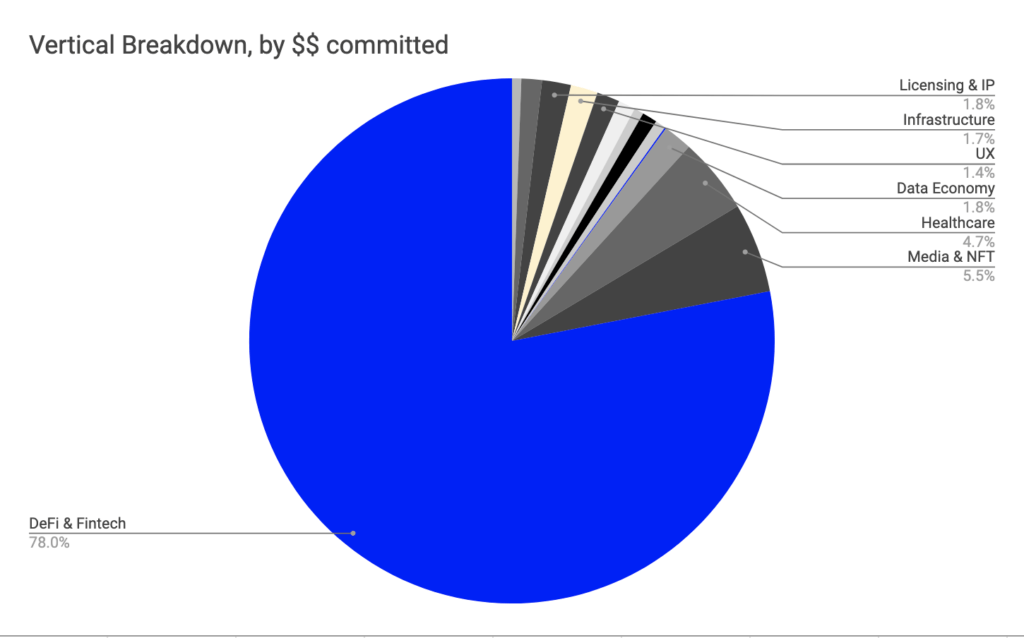

Although DeFi & Fintech attracted 10% less than usual deals, it still attracted the majority of capital at $278 million committed.

Source: Pitchbook, Crunchbase and The Block

This month we are seeing less companies attracting more capital testifying to the burgeoning market. 27 deals and $278 million in commitments primarily in seed stage companies with the mean raise above $2m means a lot of investors were on the sidelines for long enough they are now pulling the triggers and only expected this to grow in the medium term.

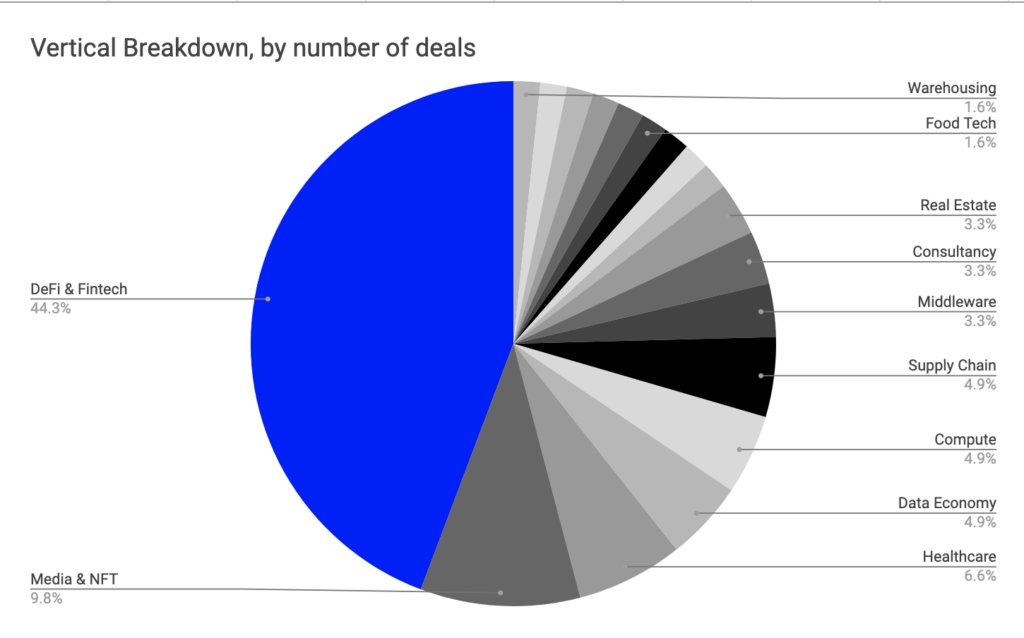

Media & NFTs, Healthcare, Data Economy and Compute are following strongly.

Source: Pitchbook, Crunchbase and The Block

The market is still relatively slow for the Metaverse. However, we’re starting to see the first signs of increased interest from professional investors. A lot are still “playing around” in a quest to grasp the concept while others are doubling down on it in their portfolios.

If you are a founder building in the Metaverse, drop me a message!

Very interesting to see Healthcare, Data Economy and Compute so close together this months. Apart from deep tech developments, some of the most interesting products in Healthcare are related to unlocking value from data – from insurance to telemedicine and diagnostics and prevention. Decentralised compute makes it all possible in a secure way coupled with privacy preserving tools.

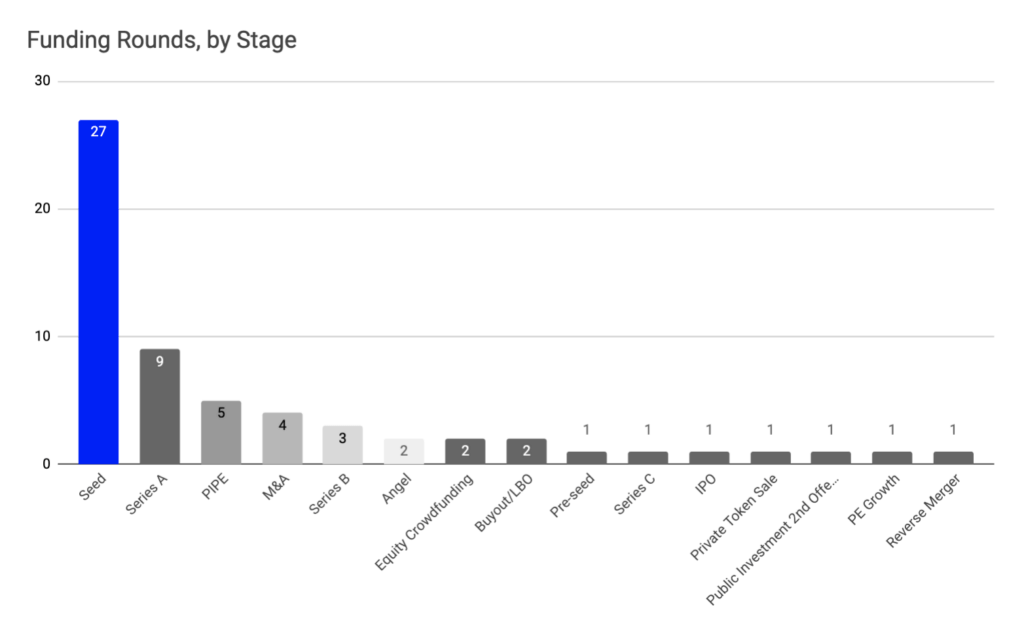

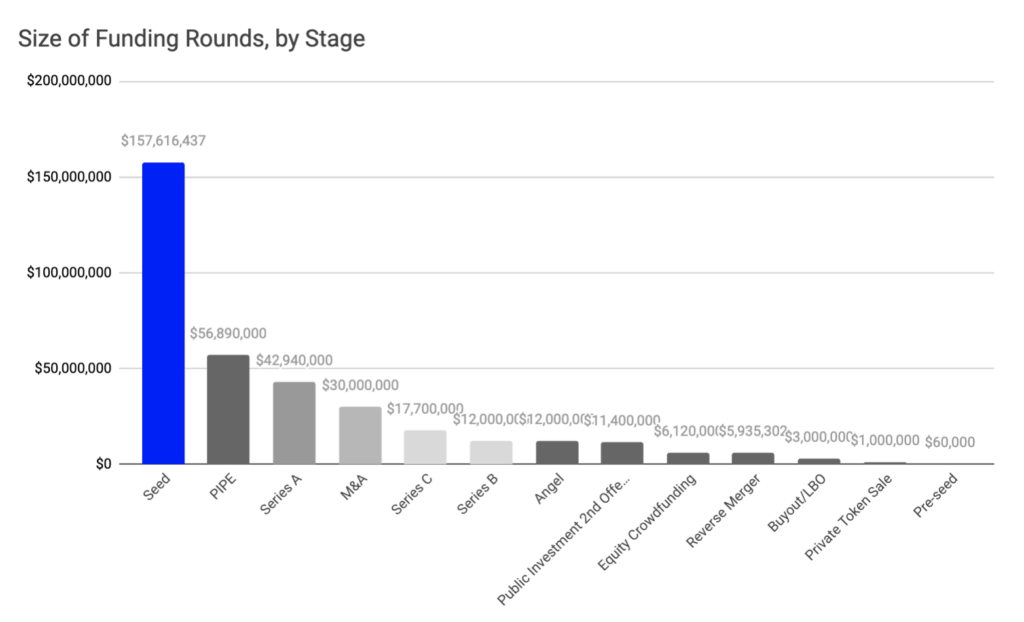

The most common round for October was seed.

Source: Pitchbook, Crunchbase and The Block

Token sales are still not popping just yet. There is definitely a slowly growing appetite from investors of all levels of sophistication and many are preparing for token launches behind the scenes. I expect Q1 and Q2 to be very busy for token investors.

This being said on the equity side of things we are seeing some rather unusual deals for crypto – from PIPE to PE growth and LBOs. These were mostly executed by exchanges, trading platforms and banks.

Source: Pitchbook, Crunchbase and The Block

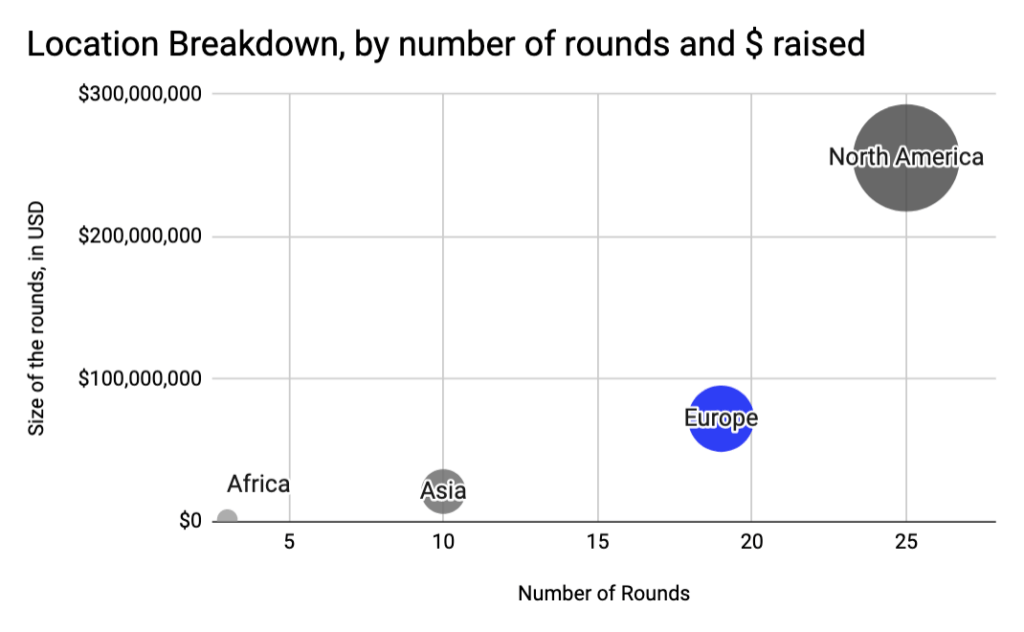

This time around North America is leading fundraising with $255m committed across 25 deals.

Europe remains fairly active in deal making but seeing much smaller rounds. While the median rounds are very similar with $3 million for Europe and $3.75 million for North America, there are some outliers bringing North America’s average to $10 million compared to $3.8 million for Europe. Asia is heating up with 10 deals and $21 million committed. Africa is seeing some action but nowhere near the Fintech levels the continent has recently experienced.

Source: Pitchbook, Crunchbase and The Block

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io .

If you’re a startup interested in joining a future Base Camp programme, please register your interest here.