2020 was a successful year with 587 deals and $2.7 billion raised.

Source: Pitchbook, Crunchbase and The Block

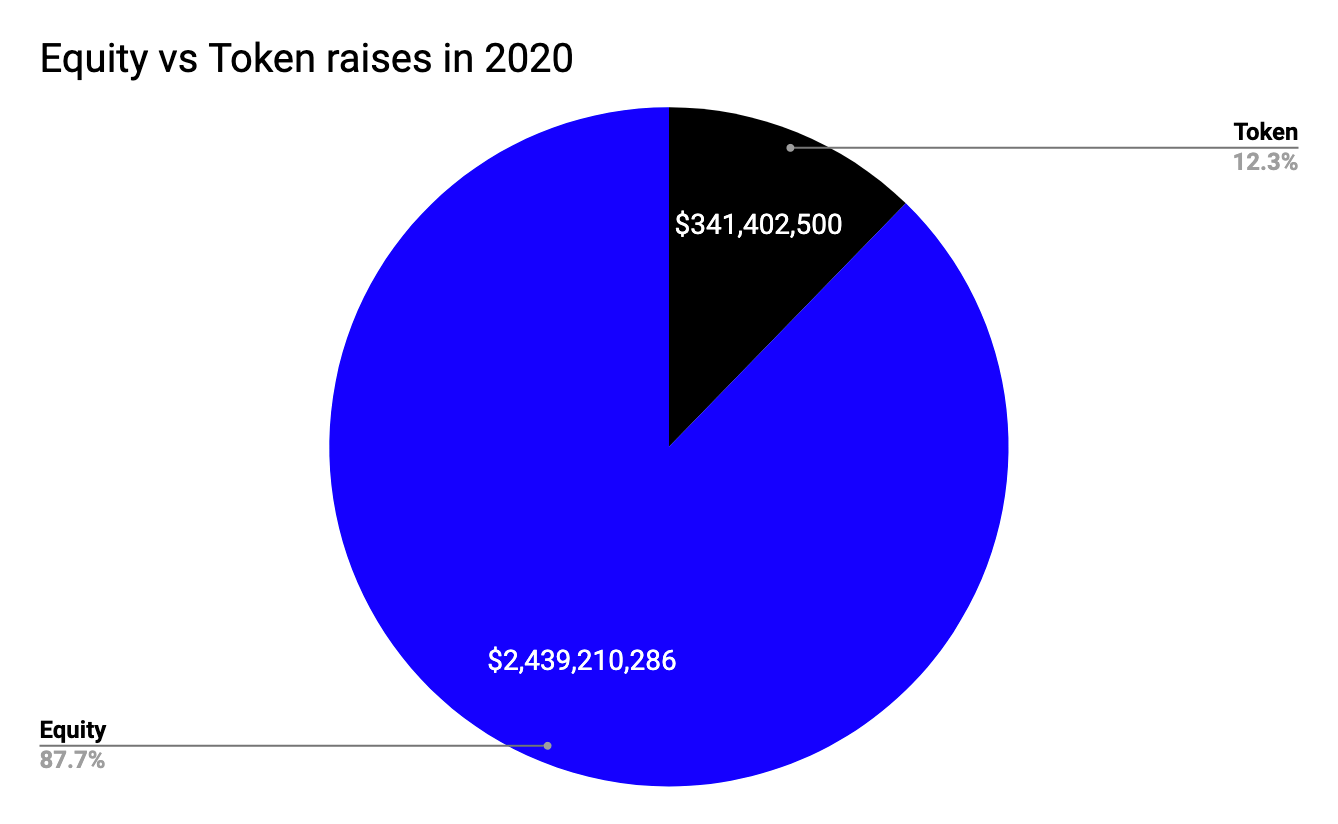

The median raise in 2020 was $1.8 million with the majority of the deals being equity-based transactions. In the markets all eyes are still on Bitcoin, Ethereum and Polkadot (time of writing: mid-January 2021). A new phenomenon took place where plenty of companies raised seed equity rounds (often with token provisions) getting ready to include their communities further in 2021 through their token distribution events. A lot of product development and traction is still happening behind closed doors.As you can see the fundamentals are a lot more solid than the 2017 whitepaper-based multi-million dollar raises. If you’re an investor (angel or institutional) and want to keep up with the latest on Base Camp cohorts and chance to gain early access to deals, sign up here.

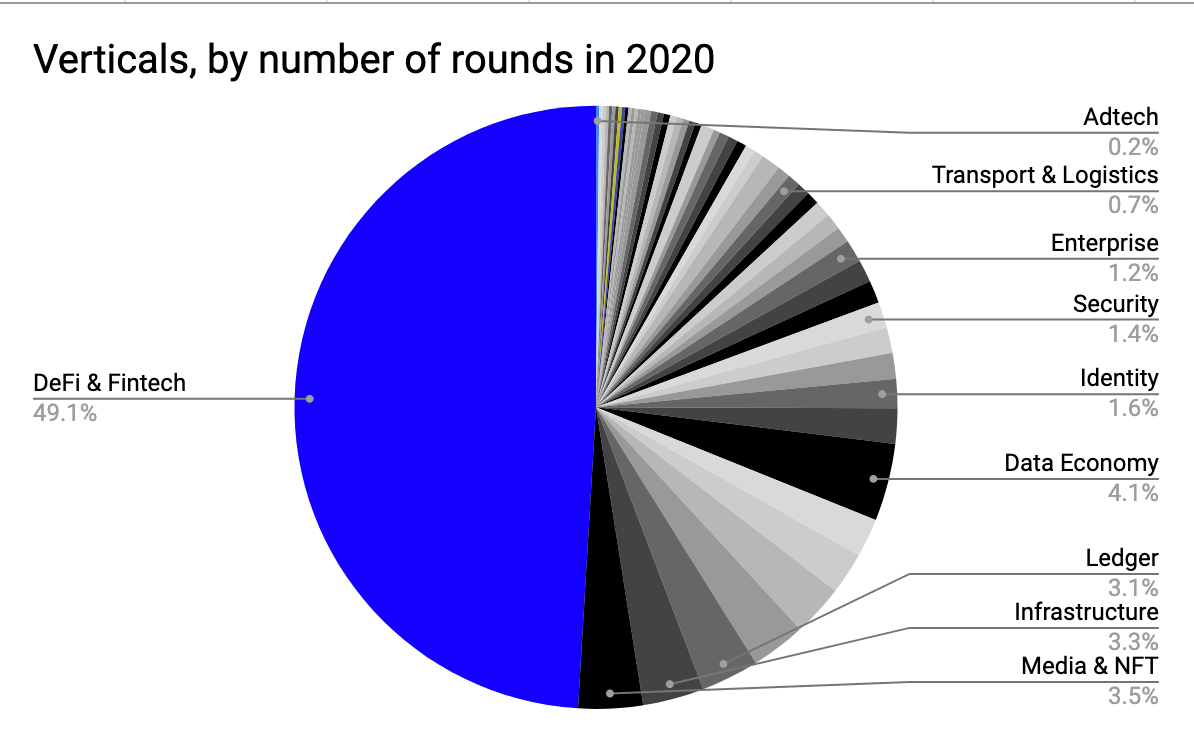

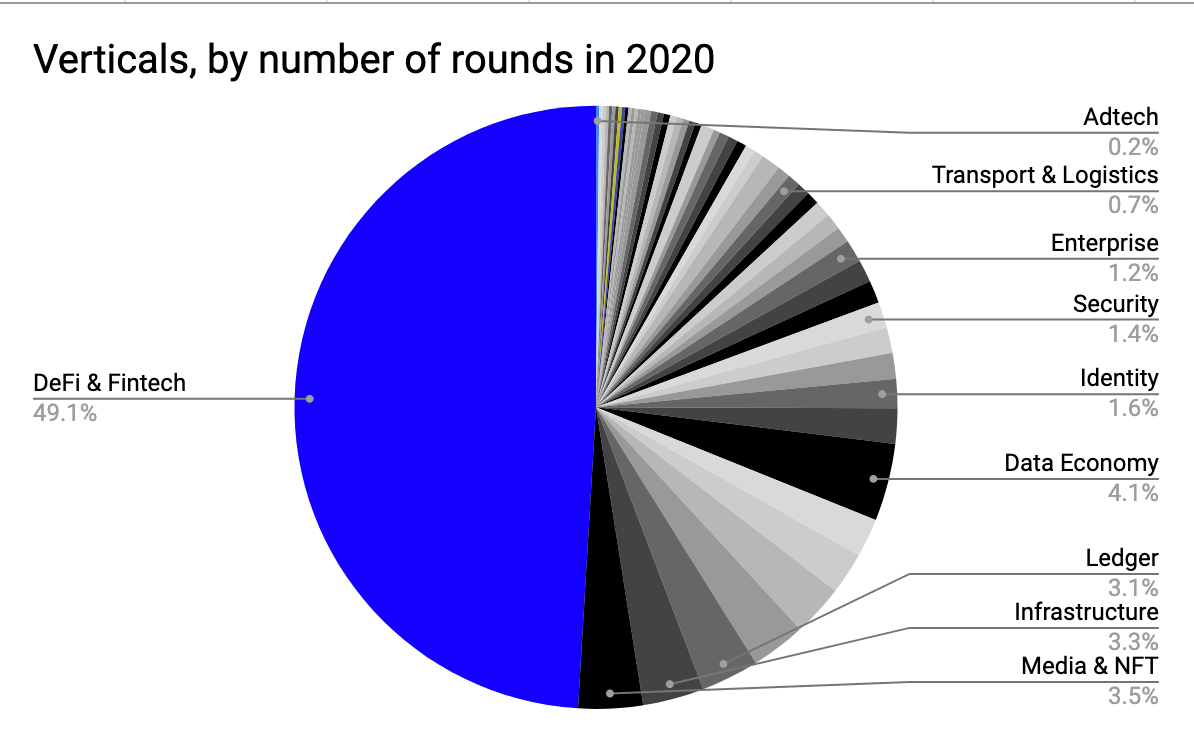

2020 was the year of DeFi.

Source: Pitchbook, Crunchbase and The Block

DeFi attracted the most deals and the most cash. Data Economy and NFTs followed with a number of deals and we are expecting them to grow faster as categories in 2021. Data Economy is a much needed category to enable new business models centred around self-ownership and equitable payouts to users. NFTs as a standard are enabling a great deal of innovation in the creator economy and subsequently changing how social media will be monetised. Ledgers and Identity still receiving attention as categories are a testament to the need of developing infrastructure with the key building blocks. Without robust Identity solutions and scalable (cheap) infrastructure we won’t b able to see DeFi and NFTs scale to levels where entire industries depend on the technology. 2021 will be the year of the NFT Creator Ecosystem.

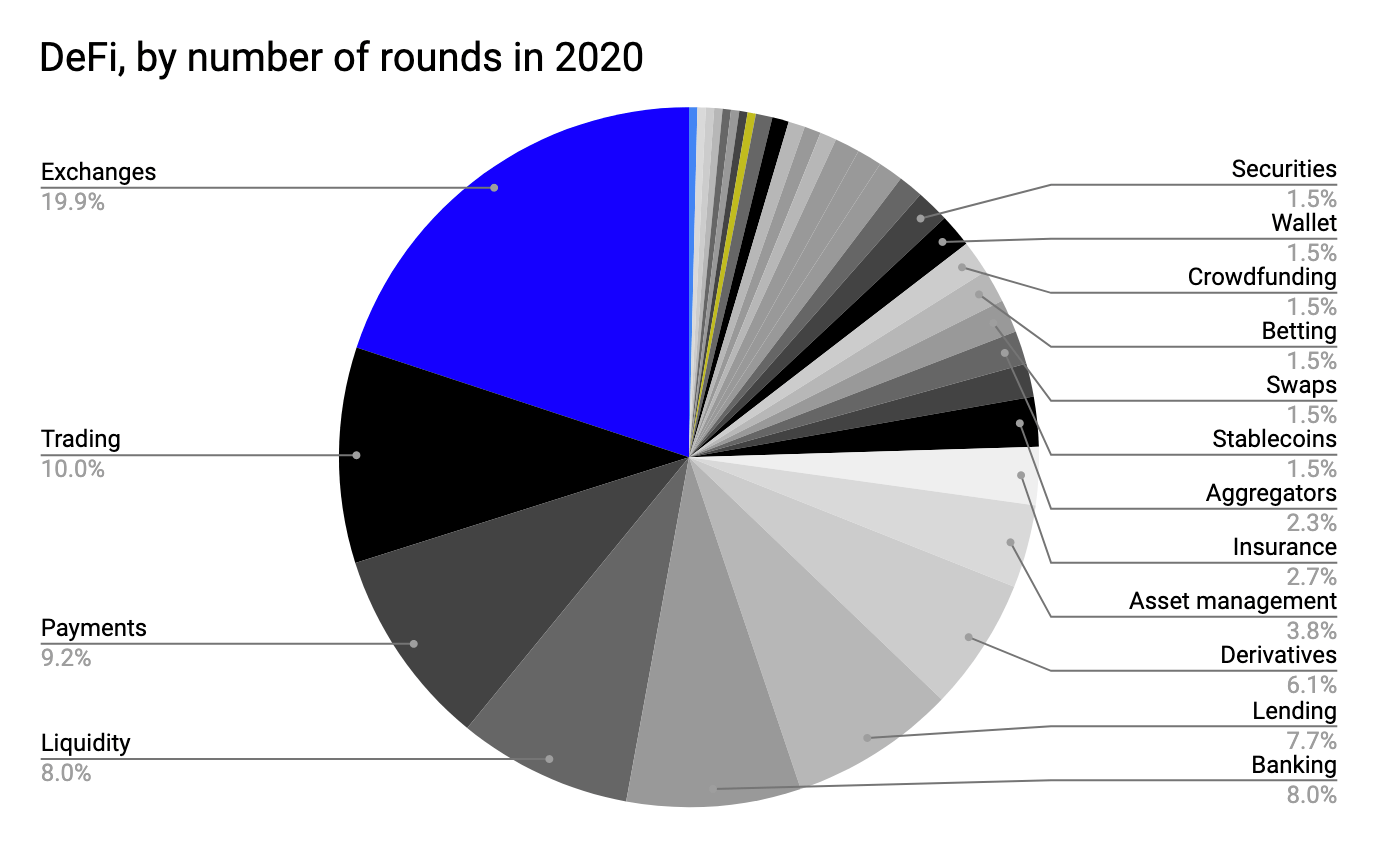

49% of the deals were in DeFi & Fintech.

Source: Pitchbook, Crunchbase and The Block

The DeFi & Fintech companies that raised in 2020 are spread across 34 niche categories. Exchanges, Trading platforms and tools, Payments, Liquidity and Banking topped the chart representing more than half of all DeFi deals. Lending, Derivatives, Asset Management and Insurance are showing early signs of growth. We are still in the search of solutions for best onboarding of both retail and institutional investors. At over $12 billion locked in DeFi, the tools are still geared towards the more experienced and savvy users. And while an entire suite of financial infrastructure for advanced users is being built a lot of entrepreneurs will be focusing on yield seeking novice users. Insurance is of particular interest as it will enable a lot more people commit capital enjoying the higher yield in a safer environment. The intersection of NFTs x DeFi is going to bring some truly novel solutions for KYC, insurance and overall compliance.

If you are a founder building in DeFi, drop me a message or apply here!

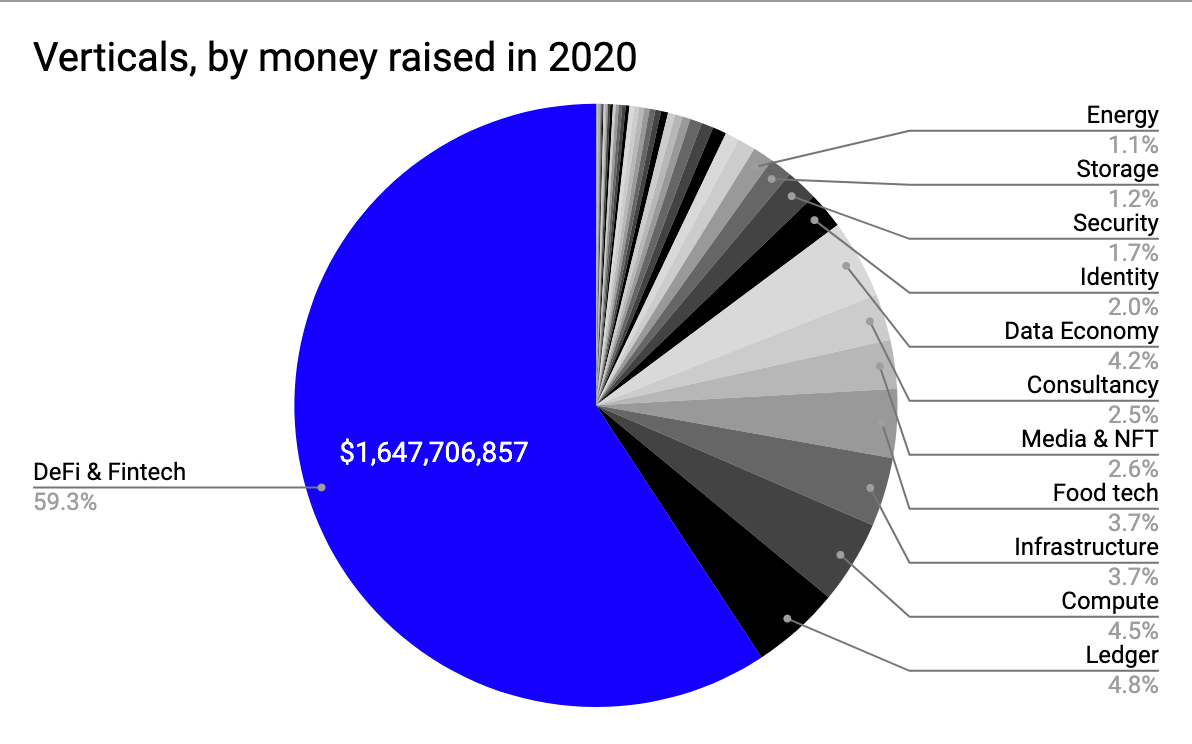

DeFi & Fintech also attracted the majority of capital at $1.6 billion committed.

Source: Pitchbook, Crunchbase and The Block

NFTs, Infrastructure, Data Economy and Ledger tech are following strongly.

Source: Pitchbook, Crunchbase and The Block

NFTs are still where DeFi was in 2018 – a couple hundred of collectors and artists transacting on 3 to 4 platforms and experimenting what can be done. Digital visual art and music are attracting more and more talent as the platforms like Emanate, Audius, SuperRare, NiftyGateway, Rarible are providing much more direct monetisation models. We are starting to see early signs of investor interest. For the next quarter most raises are expected to be led by angels and VCs who are also avid collectors like Outlier Ventures’ Jamie Burke, Coinfund’s Jake Brukhman, successful artists like Pranksy and more.

If you are a founder building in the NFT creator economy, drop me a message or apply here!

Infrastructure and Ledger developments are still interesting to see being developed alongside applications. We have the basic systems in place (open sourced) and like with Linux 30 years ago we are seeing more commercial entities developed capturing value via servicing and making systems easier to use via improving developer experience and open core models.

Without developing the Data Economy we will not be able to see a different iteration of social media. Allowing people to directly monetise their data and make it more searchable will prove disruptive to advertising-based business models as users grow more conscious.

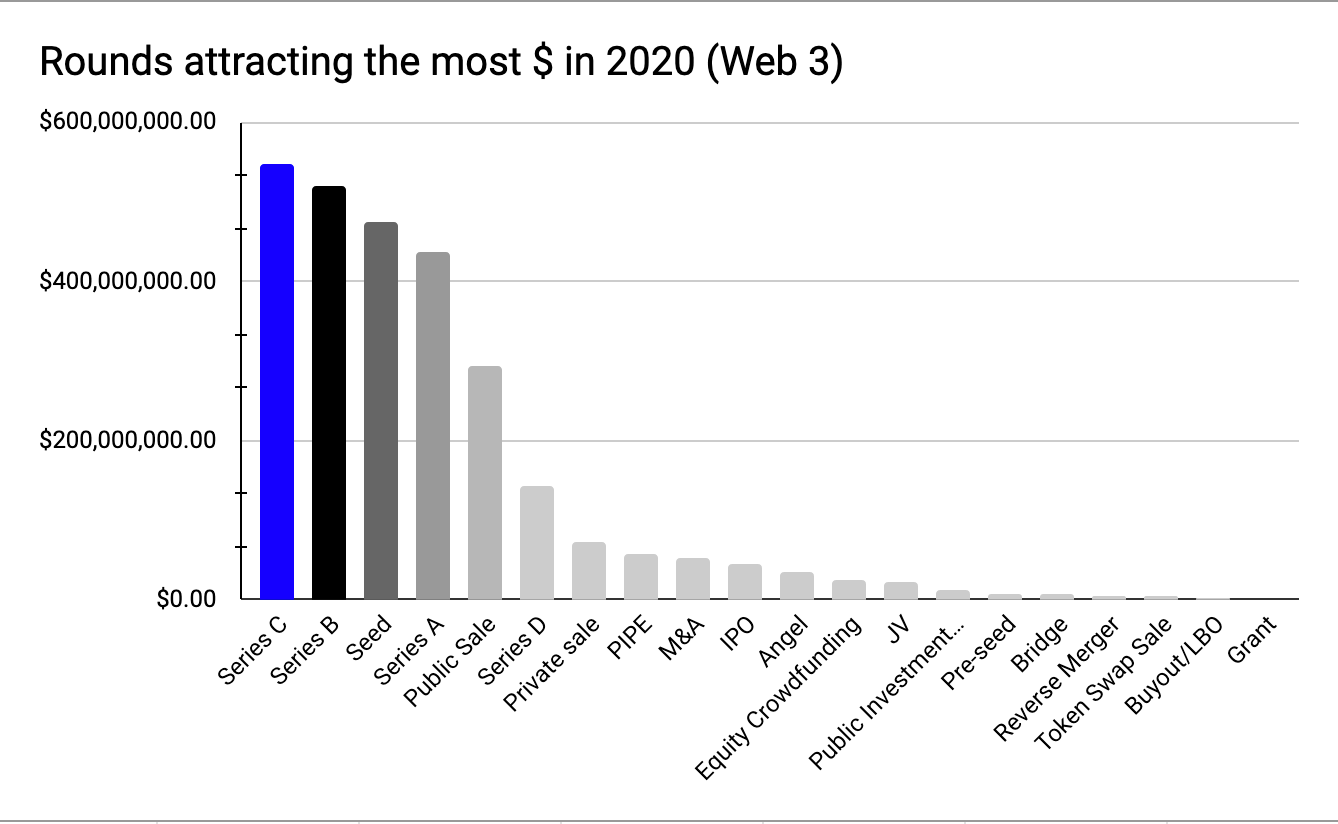

The most common round for 2020 was seed and series C attracted the most cash.

Source: Pitchbook, Crunchbase and The Block

The most rounds we have seen were seed equity rounds. As the year progressed I began seeing a lot more deals including token provisions signposting to founders willing to go out with tokens and include their communities as much as possible and as early as it makes sense (e.g at least MVP out). This leads to a problem for later stage VC firms in crypto as there won’t be a wide array of follow on deals to be made and led by them. This means they either need to start executing on more active and hybrid models including liquidity mining, market making, long position in market, etc, or will have to expand their thesis, invest alongside more traditional players and double down on ‘picks and shovels’.

Source: Pitchbook, Crunchbase and The Block

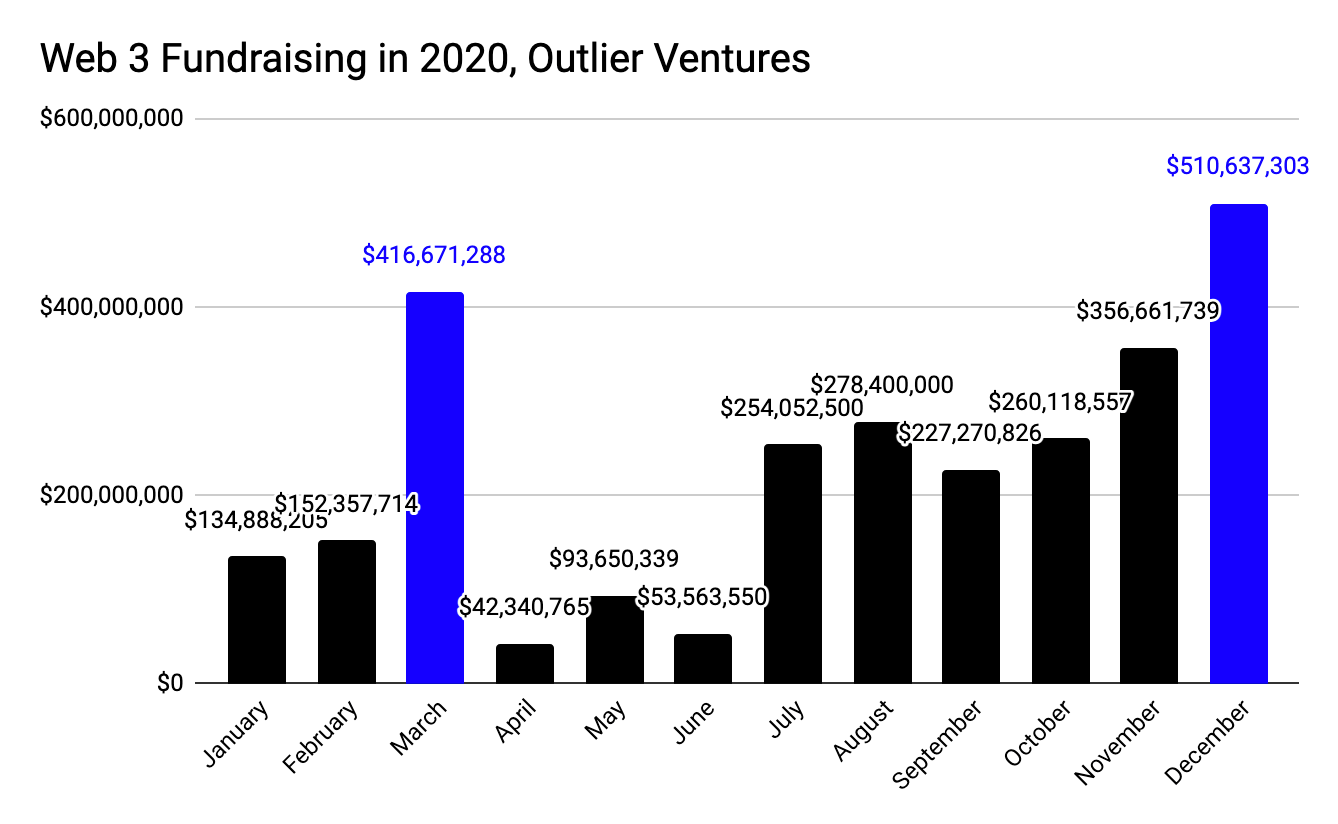

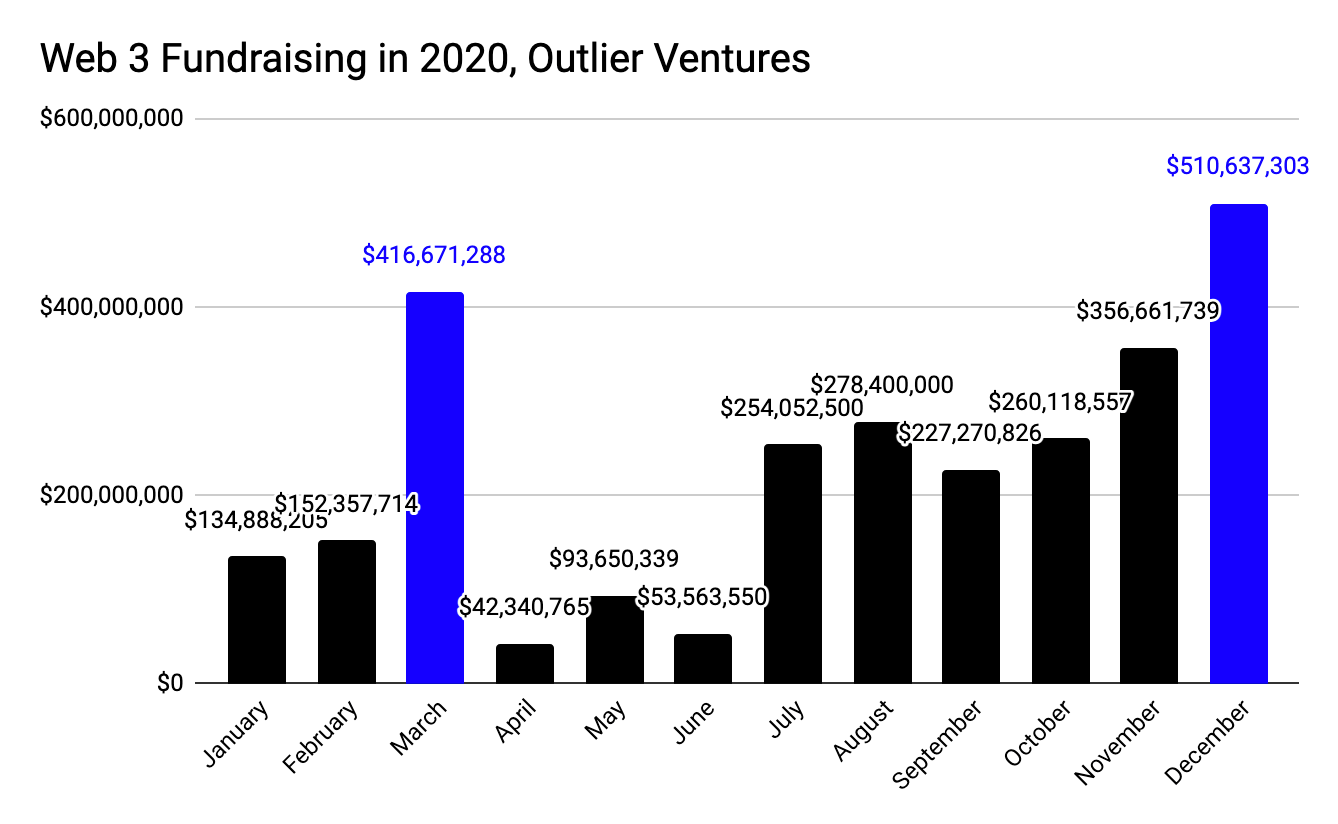

March, November and December attracted more cash than the usual. March announcements were the product of negotiations right before and after Christmas. Fundraising as a metric is backward looking and has a lag of 3 to 6 months. The true effects of the deal making slowdown were seen in April, May and June as the news about the virus started going around in January and investors became cautious. The summer was marked by DeFi growth and as we can see from the deals announcements our industry quickly adapted and started sourcing and making deals after the initial shock in March.

If you’re an investor (angel or institutional) and want to keep up with the latest on Base Camp cohorts and chance to gain early access to deals, sign up here.

Source: Pitchbook, Crunchbase and The Block

We are looking to fund and work with 50 teams in 2021 across DeFi, NFTs and Open Data, apply here!

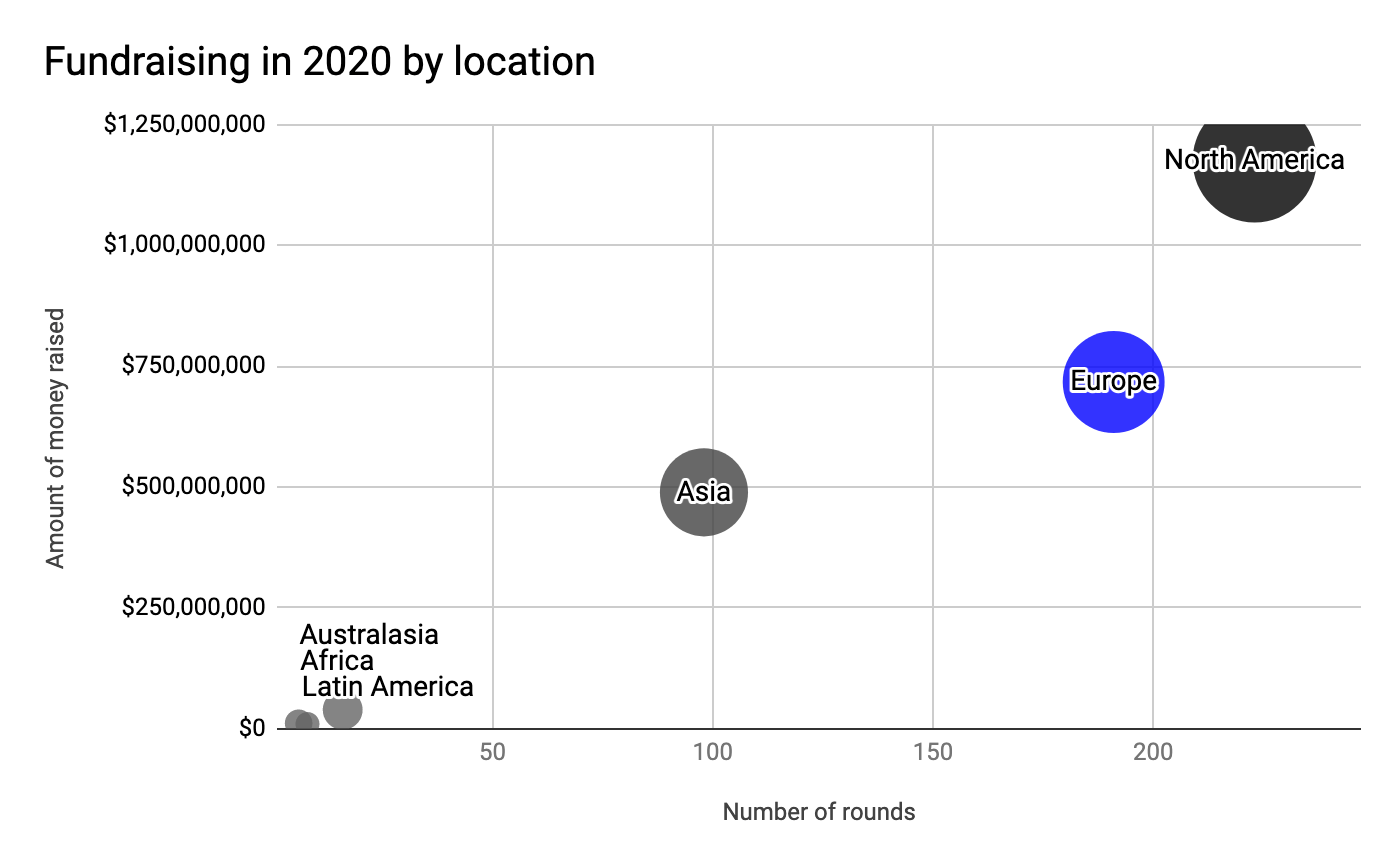

North America is leading fundraising with $1.1 billion committed across 223 deals.

Europe remains just as active as North America in deal making but seeing much smaller rounds when it comes to cash commitments and valuations. Europe attracted $716 million. Asia is following strongly with 98 deals and $488 million committed. Africa is seeing some action with 16 deals and $38 million in funding but nowhere near the Fintech levels the continent has recently experienced. Australasia and Latam are heavily discounted geos with great teams but only 6 and 8 deals and $10 and $9 million committed respectively.

Source: Pitchbook, Crunchbase and The Block

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io .

If you’re a startup interested in joining a future Base Camp programme, please apply here.