Social tokens are one of the many innovations the crypto space has brought forth in recent years. With celebrities from Akon to Ja Rule launching their own social tokens, mainstream media is catching up with this new way of leveraging permissionless blockchains. This article is looking to summarise social tokens, create some conceptual clarity, and open up the discussion around what might make these tokens valuable.

The necessity for artists to find new ways of monetizing their work during COVID-19 has surely catalyzed this increased attention to social tokens. Platforms from Youtube to Spotify have gained increasing power over the distribution over the last decade and are increasingly competing with their own original content. For those reasons, creators are excited about building a medium that allows for Direct-to-Consumer relations, interacting with fans on their own terms. For example, Youtube takes 45% of the advertising revenues creators to generate for the platform and has a reputation of aggressively demonetizing content that might be considered sensitive. Spotify pushes people to original content like Joe Rogan Show rather than 3rd parties to avoid paying royalties. The promise for creators is that by moving off central platforms, they can control the means of production, distribution, and commercialization directly.

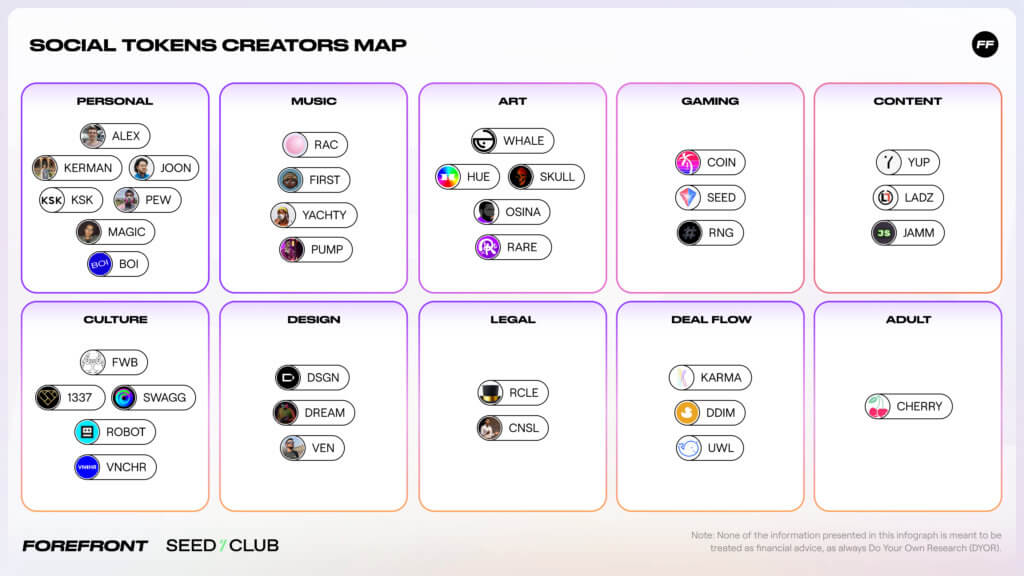

As Linda Xie writes in her beginner’s guide to NFTs, “Social tokens are a broad category of tokens issued by individuals and communities.” However, 2020 was the year social tokens entered explosive growth as a category, as documented in Forefront’s article “Social Tokens Year in review”.

The promise of a digital “ownership economy” for art and communities is to resolve many of the current economic pressures and to unleash a new era of creativity and innovation. However, there is also a real danger that our social relationships become increasingly transactional, eroded by an over-financialization and commoditization. More research is needed precisely because of this superposition of promise and peril that the technology of social tokens holds.

Personal vs. Community tokens

Social tokens have been created by both individuals and by communities, and we can therefore distinguish between Personal tokens and Community tokens.

Personal/Creator tokens

Personal/Creator tokens

Personal tokens are created by and centered around individuals (usually, individuals with a public profile like entrepreneurs or artists – that’s why they are also called “creator tokens”). Most personal tokens we’ve seen so far can be redeemed against services provided by their creators. Matthew Vernon launched one of the first personal tokens at the beginning of 2019: BOI can be redeemed for Matthew’s time as a designer.

Individuals could have different reasons for launching a personal token:

- Alex Masmejean financed the start of a career and a move to San Francisco.

- Coin Artist wanted to incentivise engagement and connect with fans.

- RAC built a platform and direct distribution channel.

A range of different mechanisms have been experimented with, some of which produce tokens with a clear financial aspect like ‘token-redeemable-labour’ or ‘income share agreements’, while other tokens look more like loyalty points or club memberships. How these tokens are then “redeemed” for services or grant access is entirely up to the creators themselves. In practice, this is often done ad-hoc, e.g. over email or Discord. The current iteration of personal tokens is enabled by blockchain technology, but this doesn’t mean there haven’t been attempts before that: Meet “IPO Man” of 2008, who wanted to tokenize himself even before Bitcoin.

A more specific kind of personal tokens could be described as “clout tokens”, which aim to measure the social reputation of influencers through market mechanisms. An example is BitClout, which issues tokens on behalf of Twitter influencers, who can claim their profile including the founder rewards allocated to each token (allowing influencers to “monetize” as their token appreciates). Idea Markets takes a similar approach, except that revenues are generated primarily through interest paid on the capital (Ether) locked in the smart contract, as required to invest in “clout tokens” on the platform.

Community tokens

Community tokens are centered around communities rather than individuals and are often used for memberships that regulate access and participation within the respective community. This token-gated access is the main use case for most of today’s community tokens.

In practice, current implementations of community tokens often involve a communication platform like Discord, Slack, or Telegram that is regulated by a token. This means that only people with the right tokens can enter the platform: Either a certain amount of fungible tokens or access NFT. One of the first projects that pioneered token-gated access is the Karma community, a group chat limited to a maximum of 650 members, gated by its own community token.

- Token-gating is often achieved through tools like CollabLand. Similarly, Unlock and Mintgate are used to gate access to exclusive digital content. This core functionality of token-gated access can also be facilitated by NFTs instead of fungible tokens with the same tools.

- Access NFTs can create an experience very similar to the access key cards or company badges we are used to from the physical world.

In addition, community tokens can be an effective tool to set incentives for desired behaviour within a community, for example incentivizing contributions and disincentivizing freeloading. A token can also meaningfully enhance community cohesion and identity. A great example is Donuts, a community token for an Ethereum-related subreddit. Members are continuously rewarded with Donut tokens, according to how active they are in the community.

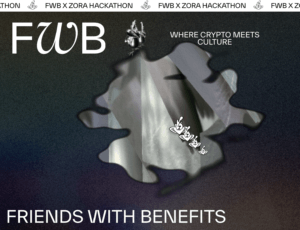

Friends with benefits, another leading token-gated community, uses their $FWB token to incentivise community members to be active in the Discord, attend calls, and host events. There are currently around 3k holders of the $FWB token, which is valued at a fully diluted market cap of ca. $85M. Seedclub is running an incubator/accelerator program focused uniquely on social tokens.

Social tokens are able to set stronger incentives than conventional “points” (from loyalty badges to Reddit karma) for three main reasons:

- Tokens can’t be taken back again and are portable outside of the platform and therefore “truly owned”.

- In successful cases, tokens end up being used for decision-making and therefore as a means of control over valuable resources.

- As a result, they sometimes develop a market value themselves and, if liquid enough, allow early contributors to exit with an upside comparable to early startup employees at IPO. The shared ownership from the beginning glues token-based communities together.

These advantages of social tokens hold no matter whether the focal point is an individual creator or a broader community. In fact, most social tokens might start around an individual creator and over time develop into a community token, as argued in this a16z piece. For example, the FWB community first catalyzed around Cooper Turley, who leads crypto strategy at Audius.

What makes social tokens valuable?

Social tokens, as ERC20 Ethereum tokens, are freely transferable and therefore tend to be listed on exchanges as they have initial success (whether on Decentralized exchanges like Uniswap/Sushiswap or on social token platforms such as Roll). As a result, they have a (fluctuating) market price, giving them a clearly defined value. Early members can use these markets to “cash-out”, and new prospective members use them to buy their way in.

Low barriers to entry and exit make sense in the context of the gig economy and younger generations exploring identity. More generally, these developments epitomise the fluidity of belonging on the internet itself, the transitory nature of group identity online.

Intrinsic community value

Social tokens are at once the entry key to a community and at the same time a financial instrument tracking the perceived value of that community.

How valuable a specific social token mainly depends on which community it represents. intrinsically, through information sharing and collaboration within the community. What we call Intrinsic community value (ICV) is the value members get from being a part of the community. This value can take many forms but usually is mediated by exclusive access, including access to information, to talent, to deal flow, or to expertise, to events, etc.

Even if it is hard to compare qualitatively, the type of access that is provided by the community is an important factor. Crucially, the access should be provided by the community collectively to count towards its intrinsic value, as opposed to provided by only a few persons (e.g. founders).

Finally, there is also an undeniable socio-emotional element involved: status. Being a member of the most popular communities confers exclusive status. By showing off your Cryptopunk, you self-identify either early to NFTs and/or rich enough to spend 100s of thousands on a pixelated JPEG.

Note that ICV is socially constructed and subjective to a large extent. As such it is hard to quantify directly – we will discuss an indirect method as well as some relevant proxies in the second part of this article.

Financial value flows

In the case of some social tokens, there is an aspect much more straightforward to value: financial flows. These financial flows can either be direct (in the form of dividends) or indirect (as token buy-backs) and make the tokens that confer them applicable to valuation by the traditional Discounted Cash Flows method.

The direct variants are cash flows that are directly paid out to token holders, like dividends in a limited corporation. An example is $Alex, who entered an Income-share-agreement (ISA) with token holders, promising to payout 15% of salary over 3 years, capped at 100k.

However, considerations around security laws might make this option less attractive in the future, and tokens with direct value flows will likely be regulated more strictly. This is why indirect value flows have gained popularity over the past years.

Most indirect mechanisms work through token buy-backs, whereas the tokens are bought back from the open market by the treasury of the community at a predetermined rate. Typically, the tokens acquired are burned, that is to say, permanently removed from the supply. This is how value is indirectly transferred to token holders: If the supply decreases while the demand stays the same, the token price goes up and distributes value to token holders proportionally. For example, Kerman is buying back tokens with 5% of the revenues of his newsletter “DeFi weekly”.

In addition, a popular mechanism for increasing token value is by offering products and services exclusively to token holders (or at a discount).

For social tokens, exclusive services are especially relevant: For example, “Dapp Boi”, a designer focused on crypto, has tokenized his time, offering consulting services for his tokens. Among others, Kerman is also offering retweets for tokens.

Digital goods are another frequent value add in the social token space, especially NFTs. Increasingly popular are POAP badges, certifying attendance at specific events. They primarily work on a status level, communicating “I’ve been there too”. An example is the NFT badges the newsletter Bankless offers to its premium subscribers. At last, even physical goods have been used, like RAC’s physical tape tied to the $TAPE token.

Outlook: When money becomes social

The social tokens space is extremely novel and evolving rapidly, so the thoughts here are not conclusive by any means but merely a starting point for conversation.

Even if token categories often overlap (a side effect of tokens being programmable money), it seems clear that social tokens are distinct from governance tokens in important ways. The notion of intrinsic community value and the status conferred with social tokens are key differentiators from governance and other utility tokens. However the community creates its value, social tokens allow it to more effectively capture and distribute the fruits of its collaboration to its members.

The early experiments so far have only just scratched the surface of the potential of social tokens that will unravel in the coming decade. As new use-cases and best practices emerge and more diverse communities choose to issue a token, the different ways ICV can manifest will become increasingly clear. Leading communities will offer exclusive access to information, relationships, and capital to their members.

Over time, social tokens could become the norm for digital status signaling, showing off membership to prestigious groups in a digital-native way, for example, members or alumni of leading companies or universities. Finally, social tokens could also become a coordination mechanism for political action: Tokens that represent a credible commitment to political or social causes could allow strangers to trust each other without knowing anything else about each other, for example when meeting as pseudonymous virtual avatars in the metaverse.

At Outlier Ventures, we are especially excited to explore these new frontiers of Crypto Social. How does social identity manifest in the Metaverse? How do social NFTs interact with avatars and virtual land? How are social tokens baked into self-sovereign identities?

While the potential for social tokens is exhilarating, it is important to consider the downsides and pitfalls in advance. There are important considerations around personal privacy, for example. One could imagine a pressure on creators who launched a personal token for ever-more-frequent updates and to share every detail of their lives, becoming virtually enslaved to token holders. And what if the personal economy crashes and token holders lose their money?

Perhaps an even greater danger is the erosion of social relations for their own sake. If every social interaction is mediated and rewarded by tokens, this over-financialization might crowd out the intrinsic motivation for people to behave prosocially. We need to build social tokens that empower creators and communities without making every interaction transactional. In light of these considerations, combined with unhinged experimentation, it seems clear that the token engineering risks for social tokens are heavily underappreciated.

In a forthcoming article, we will explore some of these considerations from a token design perspective, as well as dive deeper into how we could proxy ICV and which other factors support token value.