TL:DR

- Convergence Stack: We believe our incubated investments form part of a synergistic stack of technologies that when combined deliver the vision of Web 3.

- Filling Gaps: There are many other exciting later stage projects that complete this vision which we didn’t incubate but that are needed to complete the vision.

- Tracker: We will now publicly follow these ‘best in class’ projects from across The Convergence Stack through an open tracker (detailed below)

- Skin in the Game: For the tracker to have a meaning we need to have skin in the game so we have been taking positions in the listed tokens

- Acceleration Services: Because of their importance to The Stack we will optionally extend our advisory practice to support networks listed in ‘The Tracker’ through an Acceleration offering which will offer to integrate them into The Stack and accelerate their development

The Stack is more than just who we advise

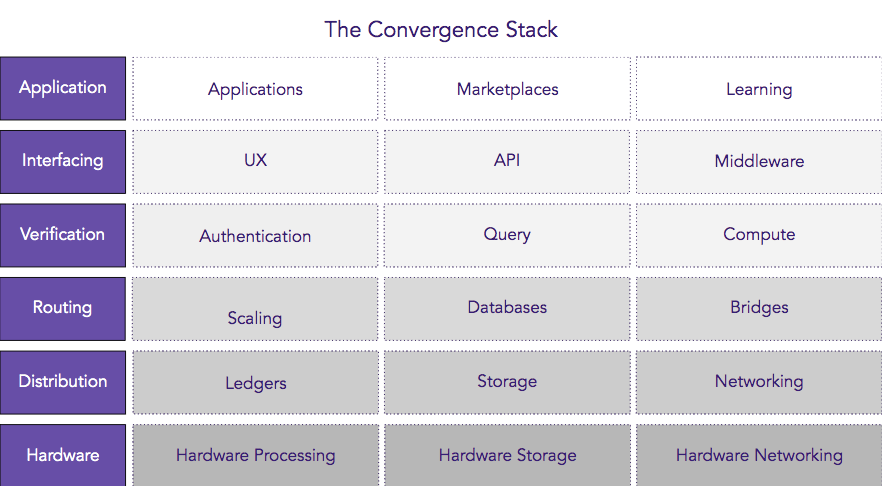

Recently we published an OSI-like framework The Convergence Stack, (‘The Stack’) to help developers contextualise the web3 landscape and give insight into our vision of the decentralized future. We did this because we have increasingly come to see our investments not just as a portfolio but rather a synergistic stack of protocols and businesses that when combined promise a new data economy. An economy with the potential to unbundle the dominant platform monopolies of today’s Web and decentralize ‘The Cloud’ computing infrastructure. This new data economy will put the sovereignty of users and their data at its core whilst more equitably distributing value across the web stakeholders.

The initial version of The Stack listed our own advisory projects and investments as well as other projects in which we didn’t have a direct position, but nevertheless felt were category leaders. Now we want to go one step further by both publicly tracking and directly taking positions in all projects listed in The Stack via something we are calling the Convergence Tracker (‘The Tracker’).

Tracker 1.0

The Tracker is designed to be selective and curated rather than comprehensive. At its core, it is about tracking the best in class technologies and respective token economies. It is absolutely not meant to be based on short to mid-term financial trading performance but instead on where real network value will accrue on a venture time horizon.

As described, The Tracker contains our advisory and investment projects as well as publicly tradable tokens listed on exchanges today. In order to decide on the projects that should be included in the tracker, we have drawn upon our five years of experience in the market and done an assessment of each 18 technology markets in the convergence stack from applications to UX to middleware to ledgers. We picked these projects after analysis across a range of factors including technology, crypto-economics, users/growth, market, competitive landscape, and execution.

In addition to our nine advisory projects and investments: Fetch.ai, Agoric, Haja Networks, IOTA, Ocean Protocol, Sovrin, SEED, plus our continued long-term holdings in Bitcoin and Ethereum, we are adding a further six projects to the tracker: Rightmesh, Golem, FOAM, Chainlink, Cosmos, and Aragon.

Networking

Rightmesh

5 billion people now have a mobile phone. 4 billion have a smartphone. There are about 7.5 billion people on earth so very roughly there are 3.5 billion people globally that aren’t yet connected to the Internet. Pushing down the price of handsets below $20 dollars with KaiOS will bring a few more million. But we are reaching the point where connecting people is an issue for available Internet connectivity more than it is one of costs. Google and Facebook have experimented with balloons and drones to increase Internet usage, and Governments have subsidised infrastructure and connectivity costs around the world. The challenge of ‘connecting the unconnected’ isn’t one of understanding or business focus, it’s one of the costs. Mobile connectivity is expensive to provide and maintain. The capex costs associated with installing and maintaining a wireless network across countries is vast let alone deploying the latest network protocols every 10 years or so. The challenge of getting everyone in the world connected is expensive data and a lack of access in isolated and rural areas.

Rightmesh is making it cheaper, faster and easier for people to connect to the Internet. Using a combination of networking protocols like WiFi, Bluetooth 2.0, and Wi-Fi Direct, combined with switching technologies and crypto-tokens, Rightmesh is enabling peer-to-peer connectivity. This reduces the need for and cost of connectivity infrastructure at the edges of the network. The key new feature is the use of crypto-tokens to incentivise smartphone owners to provide connectivity to their peers. We think this combination of mesh networking and a token-based incentive system is compelling enough to be integrated by mobile network operators at the edge of the network and in high-density areas. But more importantly, it provides a way for billions of people to come online. Rightmesh is the category leader today and we expect mobile connectivity to increasingly become peer-to-peer and decentralized.

Bridges

Cosmos

Today blockchains are relatively slow, lack flexibility, hard to build, and difficult to connect together. The speed problem is being tackled via sharding, different consensus mechanisms, numerous new blockchains, and layer 2 solutions. The lack of flexibility is being addressed as projects seek to deliver execution environments that are optimized for use cases as with Fetch.ai, Kadena, Tezos, and Coda for example, or by moving to web assembly as with Ethereum 2.0, Dfinity, Polkadot, etc. Blockchains are still relatively challenging to build because developers are forced to build all three layers: networking, consensus, and application as well as a lack of SDKs. Finally, blockchains don’t currently have a standardized way to communicate and as blockchain usage grows we will suffer from the same walled garden problems as we faced in Web2.

Cosmos is an ambitious attempt at building an ecosystem of blockchains that can scale and interoperate with each other. Using Tendermint, the Cosmos SDK, and the Inter-Blockchain Communication protocol (IBC), Cosmos offers developers a way to quickly build and deploy flexible blockchains that can be optimized for specific applications while benefiting from the security guarantees of a larger network. Ultimately, we think Cosmos has the opportunity to enable developers to just focus on solving customer problems rather than having to spend time and money on all of the underlying infrastructures.

Query

FOAM

Today much of our critical infrastructure from the aviation, energy, logistics, and communication networks rely on accurate position, navigation and timing (PNT). Currently, the primary source of distributed and accurate timing information at least in the West is through the Global Positioning System (GPS). However, GPS’s space-based signals are low-power and unencrypted, making them susceptible to both intentional and unintentional disruption. As the deployment of mobile sensors grows and the physical world is overlaid with digital information with augmented reality, we expect to see accurate PNT to become ever more critical. Collecting Pokemon in the park needs rough location data, but what about when collecting unlocks a smart contract and tokens are generated? We believe there is an opportunity to deliver PNT in a ground-up, crowdsourced, and censorship-resistant way.

FOAM is providing the tools to enable a crowdsourced map and decentralized location services. As with any data that comes from the real-world, an incentive system is required to encourage data to be submitted and for people to be incentivized to prove that the data is accurate. This is the fundamental problem to solve for all oracles in the cryptos space, and FOAM has designed a system that is designed specifically to validate location data using a novel proof-of-location consensus mechanism. The hope is that if FOAM can generate a trusted map of the world, a whole new breed of location-based permissionless applications can be built quickly and cheaply. We expect something like FOAM to be foundational to an open augmented reality environment and an important component of utilising location data for the Stack.

Compute

Golem

We believe one of the key characteristics of Web3 infrastructure will be the move from a client-server model or a peer-to-peer (P2P) model, in which peers are both suppliers and consumers of resources. The Convergence Stack sees all-digital infrastructure from file storage, to databases, to networking, to compute moving to a P2P model. P2P computing isn’t new, it was popularized by Napster in the early 00s, but limitations in the technology made client-server a more efficient model for the delivery of Web, and especially mobile applications. As Moore’s Law continued its march through the 00s and 10s, smartphones today contain more computing power than servers back in the days of Napster. By 2020 that will have roughly 24 billion Internet-connected devices with computation capabilities. We now have billions of more devices with unprecedented computing power.

For peer-to-peer file storage, there is IPFS. For peer-to-peer databases there is OrbitDB. For peer-to-peer computing there is Golem. Building a protocol that connects PCs, mobile, data centers, and any computing resource, Golem is creating a decentralized, P2P, on-demand, computing utility that means developers and users do not have to rely on cloud providers to rent expensive computing power. Starting with the CGI rendering application that requires a lot of power, Golem is proving that a p2p compute utility can be faster, cheaper and more reliable than a cloud provider. Golem utilises its native crypto-token, GNT, to build a marketplace between providers and consumers of computing power in an attempt to use a public price to allocate resources more effectively. We believe some of the most transformative Web3 applications like machine learning and data trading will require an underlying compute utility that is decentralized and peer-to-peer, and Golem is currently the category leader.

Middleware

Chainlink

For decentralized systems to be useful, we need to get data in and out. Unlike centralized web services, decentralized applications can’t just pull data from anywhere. The data in blocks on the blockchain has been mutually agreed by network participants, so any external data must go through a cryptographically secure verification process before being used in a smart contract. This is the realm of oracles or trusted data feeds. But connecting smart contracts to data inputs through a single node creates the same problem which smart contracts themselves seek to avoid, a single point of failure. Different projects are targeting particular data such as FOAM with location, but we believe there is a requirement for a more general purpose decentralized oracle network that can be used to connect any smart contracts to external data sources and APIs in a tamper-proof, secure and reliable way.

Chainlink can be considered both middleware and query in the Convergence Stack and has built a network that enables smart contracts to get provably secure access to data feeds, APIs and payments. The network does this by connecting on-chain smart contract to chainlink nodes. These nodes are paid for the work they perform collecting and transmitting data from external APIs. It is still early days in the development of the oracle network and API access but the company has some early traction with the likes of SWIFT, Zeppelin OS, and Request Network that bodes well for the teams’ ability to acquire customers. Building out a decentralized oracle network is a huge technical, customer acquisition, and incentive design and game theory challenge. But for web3 apps to be truly useful we must get accurate and verifiable data into smart contracts from the real world. Chainlink has the opportunity to build a foundational piece of infrastructure for The Stack.

Aragon

Organisations are for the majority of the world challenging to incorporate and set up. The process is often long, unnecessarily complex, and costly. Running an organisation is also still a very manual and time-consuming process. Board votes, taking payment and paying suppliers, much of an organisations time is wasted running the organisation rather than serving the customers. Blockchains, smart contracts, crypto-tokens, and other decentralized tools, might for the first time since the creation of the corporation with limited liability in 1612. This organisational innovation demands new models of borderless, virtual decentralized governance to allocate digital resources and assets.

Aragon is building a platform for the creation and management of digital organisations, or more specifically decentralized autonomous organisations (DAOs). Using Ethereum smart contracts and IPFS, Aragon allows anybody to set up a digital organisation in minutes. A company interface allows ownership to be allocated by assigning DAO-specific tokens, payments to be made and received, and votes to be cast. This is just the beginning, apps are already in development for things like payroll, data and code management. The Aragon project is still early and can’t yet compete with traditional organisational registration for the vast majority of people. But the benefits of going blockchain-first will start to become comparable as crypto adoption grows and more people become comfortable interacting with chains and tokens. Aragon could be the platform enabling the next Xero, Box, and Asana to be built all utilising all underlying protocols of The Stack.

Evolving The Tracker

We will continue to add new tokens as projects go live or remove them when it is clearly a project is not living up to its promise based on an open criteria. There are many projects that are currently still private that we are closely following and believe could be best-in-class, and expect to add them once they are publicly available. For example, we are keeping a close eye on Polkadot, NyCypher, Starkware, and Keep Network to name just a few.

In some areas, there may be seemingly conflicting positions for example in the ledger market. We believe whilst the market is still small there is plenty of room for growth and specialization as networks evolve and actual usage becomes apparent. And because the market is still comparatively early, some projects will execute faster than others and begin to win markets the tracker will literally track that development.

These are strategic and long-term positions and we will apply an internal weighting which we will periodically review.. Because we are deploying our own capital and not that of third-party investors, we have the luxury of evolving this model as the market matures, something we intend to open and share with the ecosystem and may over time productise.

Opening our advisory practice to the wider ecosystem

We can’t influence networks where we aren’t an early advisor or investor in the same way as those we have advised over several years and/or where we hold a board seat. But it is our intention to begin an open dialogue with projects and communities we believe are building crucial protocols and technologies to see if we can support them through our advisory practice to address their unique challenges.

Because The Tracker will include projects both with and without our advisory side by side we will endeavour to make a clear distinction between projects in which we are an official advisor in the Portfolio Section of our website. We intend to be long term holders and supporters of the projects in the tracker. Will we be regularly assessing the market and network to inform the selection criteria and any changes that need to be made. As always with our work, we will do this in a transparent and open way.

All projects listed in The Convergence Tracker will have the opportunity to work with us to be directly integrated into The Stack both technically and operationally so they can collaborate with its protocols and ecosystem of corporations, developers and academic communities. They will also have the opportunity to leverage the venture platform we have developed over the past five years through our advisory practice which includes a range of services required for a web3 network including crypto-economics and governance, corporate customer acquisition, developer relations, and community building. We hope over time the value of being listed in The Tracker becomes not just a point of pride but a powerful way to grow the network.

What next?

Over the coming months, we intend to provide a more detailed analysis of the protocols, networks, and products in The Tracker with recommendations about how we think it can be improved. Something we hope leads us to work more closely with the teams behind the tech through our advisory practice.

Equally, we will begin to open up how we measure ‘network health’ to help educate the market in how to understand the real fundamentals of understanding price both generically and specific the networks featured in The Tracker.

As ever we continue to do this with you out in the open.

This article is for information purposes only and does not constitute investment advice. This article does not amount to an invitation or inducement to buy or sell an investment nor does it solicit any such offer or invitation in any jurisdiction.

In all cases, readers should conduct their own investigation and analysis of the data in the article. All statements of opinion and/or belief contained in this article and all views expressed and all projections, forecasts or statements relating to expectations regarding future events represent Outlier Ventures Operation Limited own assessment and interpretation of information available as at the date of this article.

No responsibility or liability is accepted by Outlier Ventures Operations Limited or Sapia Partners LLP for reliance on the contents of this article.

Outlier Ventures is an Appointed Representative of Sapia Partners LLP, a firm authorised and regulated by the Financial Conduct Authority (FCA).