The Web 3 community has adapted very quickly to the “new normal”. In fact it has been our normal for a while apart from the few big events every year. Now people are hanging out in the Metaverses of Decentraland and Somnium. The industry is definitely maturing and here are some observations on what drove the awakening and where we are going next.

Finance. But make it decentralised.

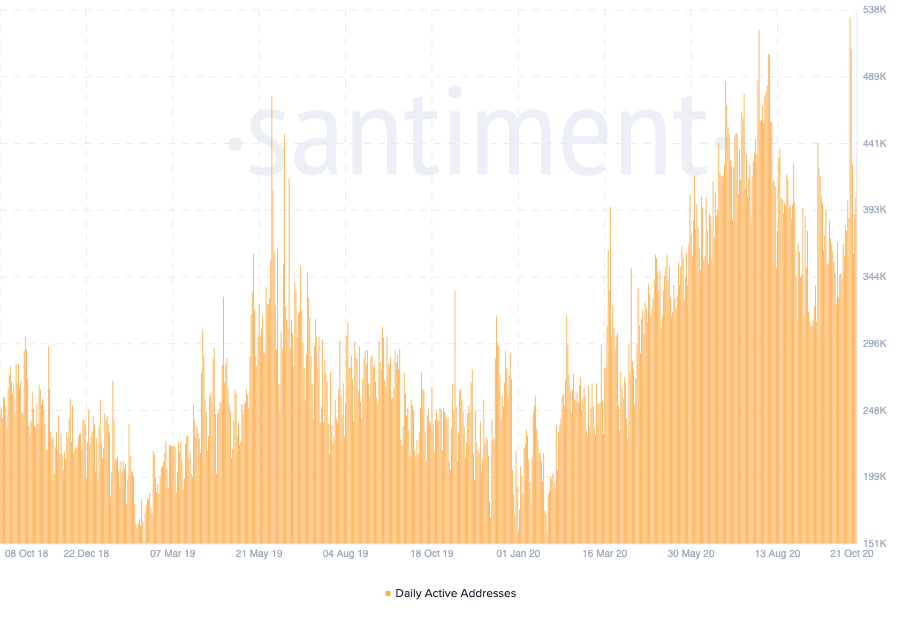

Decentralised Finance seeds were first laid out in 2018. The community of builders expanded in 2019. The early adopters and partial payday came in mid-2020. Very few people were investing early on deeming DeFi too early. The good news is entrepreneurs will build regardless of capital and exits available. A lot of new products finally came to market in 2020 and this spurred quite a lot of usage. We got to the point where it costs $300+ to launch a smart contract due to Ethereum gas fees. Ethereum also reached a 2 year high of on-chain activity.

What’s next: there’s loads of infrastructure talks right now. Scalability solutions like Matic are seeing rapid growth in developers switching, so they can continue shipping useful products. Polkadot is also seeing some early growth signs in DeFi. At the same time, ETH 2.0 will take a while. Let’s see if any of the challengers like Near will manage to attract sufficient dev community and fill the vacuum.

Notable projects: Yearn finance, Uniswap, Curve, Compound

Outlier Ventures portfolio to watch: DIA, Keytango, Fetch.AI, Alkemi

Institutions are here to stay.

Large enterprises may not be allured by AMMs, yield farming and decentralised exchanges but they sure are looking to optimise their operations. The pandemic exposed a lot of vulnerabilities in big companies’ operating and business models. Many were wildly unprepared not only on business, but on technical and cultural levels too. They were forced to adopt tech and innovation quickly. And this is great news for such nascent space as Web 3. Investment arms like CMT Digital, Commerz Ventures, CMS Holding’s CVC and more proved to be some of the active investors in the past couple of months. And most recently Paypal joined the “hype train”.

What’s next: From here opportunities will lie in security, governance, privacy and compliance, data monitoring and workflow optimisations. We expect the innovation budgets to climb back up and DLT to scoop up a larger portion following automation attempts where governance will creep up as a problem.

Notable projects: Hyperledger, R3, Baakt, Curv,

Outlier Ventures portfolio to watch: Bond180, Fardoe Software, Rexsio, Tracifier, Cryptio, Zinc

Macro and the modern portfolio theory.

In March 2020, the world leaders tried to put the economy on pause and central banks had to react with targeted fiscal stimulus. And in a world with inflation targeting being one of the main policies, central bankers had to drop the nominal interest rates to zero or very close to zero and embrace short term inflation. It did not go without consequences. Now many are in search for yield and modern portfolio theory is being updated in real time.

A lot more are now turning to stocks and alternative asset classes. Private equity and Venture Capital traditionally do very well in such environment. But there is an emerging asset class on the horizon that was not there in 2008. While institutional adoption of cryptocurrencies is still relatively low it is safe to say more are looking into allocations. Fidelity has announced they are raising a Bitcoin fund.

At personal level, people also started looking into alternative investments. According Mode Banking research, more and more UK boomers and gen X’ers are now looking to park a portion of their wealth into crypto. The benefit is the 5 to 10% interest rate that can be earned and coupled together with price appreciation of the underlying asset, it is becoming an attractive investment.

Dermot O’Riordan (Eden Block): For me, I repeatedly said throughout the bear market in 2018 and 2019 that if you believed in the potential in 2017 then you should be even more bullish than ever now given the level of developer activity happening. And the growing level of sophistication in terms of how builders are creating these new systems.

As Dan Held says “when the printer goes brrr, the node goes whirrr”.

What’s next: Who knows? The macro environment is quite uncertain but crypto is showing some really improved fundamentals.

Notable projects: Mode Banking, ZeFi, Ramp Network, Argent, Lolli

Bored in the house, in the house bored. Welcome to the Metaverse.

Speaking of alternative asset classes, we have recently seen a small boom in collectibles. Pokemon cards, sneakers, bags, watches, Lego sets, wines. People collect everything. Everyone has been sitting at home for over 6 months now, reminiscing about the “good days” and seeking new forms of entertainment. Gaming has definitely picked up a lot of steam. Normally gambling will do incredibly well in such environment but alas sports were on pause. So people turned to the stock market and r/wallstreetbets instead.

This is the perfect storm for people to embrace the (open) Metaverse. The Metaverse is consisting of a couple of key elements – virtual lands and buildings where people can hang out, fun activities to do together, highly customisable avatars so people can express themselves and hardware that can support it. It all started in multi-player games like Fortnite, GTA and Fifa where people bonded over defeating an enemy. Now they can hang out together while staying safe at home. Hardware is also there with Oculus shipping one of the best headsets so far – the Quest 2.

This will naturally spur the need for digital collectibles and digital collateral. Tiktok fashion month (in place of the Fashion Week series in person) is now featuring digital fashion. Farfetch has been developing one of their digitally native fashion brands for some time and it is coming to fruition. People want to express themselves and we’re seeing the very beginning of Direct to Avatar commerce (kudos to Ryan Gill).

Also the way people buy and consume art is changing rapidly. Normally they’d go out and see the pieces and receive the items in timely fashion. Nowadays all deliveries are being extraordinarily late but that doesn’t curb the purchasing activity. The NFT standard is primed for this moment as we’re seeing the beginning of a fundamental change in purchasing habits.

What’s next: the technology is still nascent but iterating very quickly. We’re expected to see some great developments including living between multiple (open) metaverses.

Notable projects: Decentraland, Somnium, Rarible, Super Rare, Crypto Voxels, OpenSea

Outlier Ventures portfolio to watch: Crucible Network, Boson Protocol, Outplay Games + many more to be announced

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io.

If you’re a startup interested in joining a future Base Camp programme, APPLY NOW.