“This means today we are doubling down on our activities and launching a Diffusion Program dedicated to helping our portfolio engage with industry partners, academia, smart cities, developer communities and one another to increase interoperability, usability and adoption.

As such we are planning to dedicate an estimated USD 30 million to growing our venture platform over the next 3 years, in addition to venture capital investments. This represents 5 x the entire operating budgets of a typical USD 100m venture capital fund (assuming a 2% management fee)”

Understanding Diffusion Generally

Firstly, let’s define what we mean by diffusion in the context of a technology. Diffusion is ‘the contagion of an innovation overcoming psychological and sociological barriers in a social system’. It is the outcome of the successful dissemination of an innovation. When purposeful, as opposed to organic, it means designing for diffusion and taking additional steps early in the innovation process to increase its chances of being noticed, positively perceived, adopted, adapted, and implemented to successfully cross the research-to-practice chasm and become sustained.

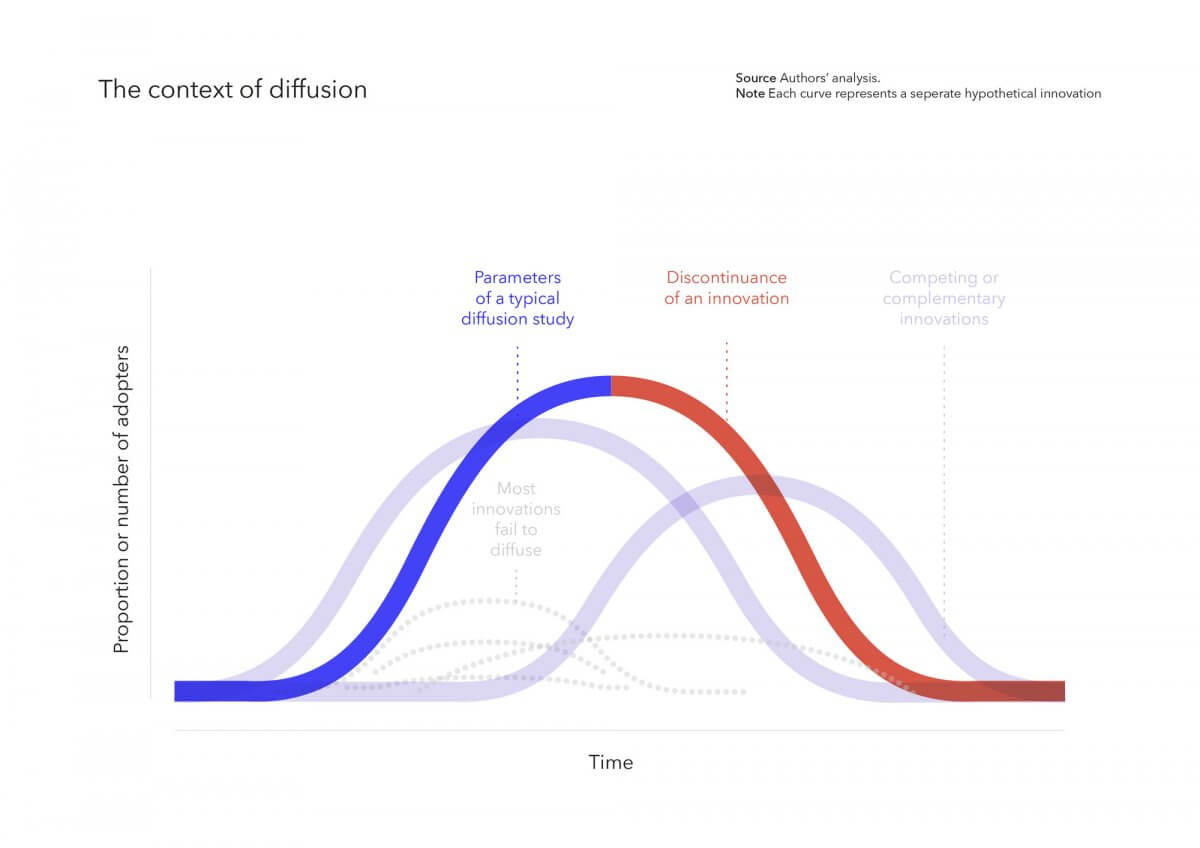

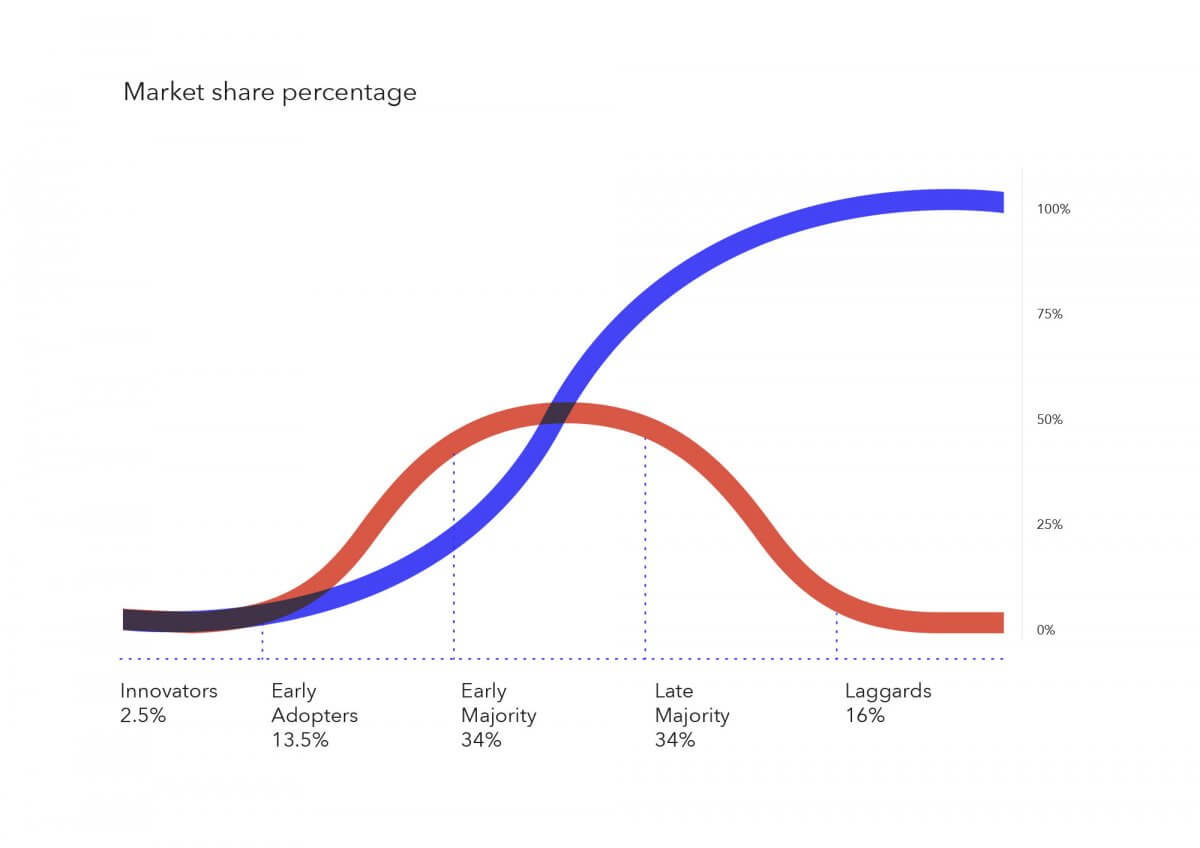

This process is often referred to as the diffusion curve and typical takes the shape of an S-Curve plotted over time, starting with a take-off / tipping point. In reality most innovations fail to diffuse at all and even when adopted experience a significant lag across different types of user groups informed by the characteristics of adopters, perceptions of opinion leaders, their social influence, a larger social and political context, how proponents and opponents frame an innovation and the timing of its introduction. The confluence of these factors has been consistently shown to cluster into groupings of users based on attitudes and towards innovation and risk as shown below.

This process is often referred to as the diffusion curve and typical takes the shape of an S-Curve plotted over time, starting with a take-off / tipping point. In reality most innovations fail to diffuse at all and even when adopted experience a significant lag across different types of user groups informed by the characteristics of adopters, perceptions of opinion leaders, their social influence, a larger social and political context, how proponents and opponents frame an innovation and the timing of its introduction. The confluence of these factors has been consistently shown to cluster into groupings of users based on attitudes and towards innovation and risk as shown below.

The Diffusion of Tokenised Networks

At Outlier Ventures, we design for and invest in open source, tokenised, internet protocols. As a relatively new subset of innovation with just 10 years of data since the inception of Bitcoin and arguably 4 years since its first real peer Ethereum. As a consequence, in our planning we must address a number of unknowns, wrestle with assumptions and emerging nuances with little data but within the context and legacy of open source web innovation.

On the one hand, we have all glimpsed the promise of the emerging toolkit of rules based distributed ledgers and the powerful economic incentives of digitally scarce tokens to coordinate bottom-up adoption of and participation in decentralised networks. On the other hand designing for truly global, permissionless digital economies brings an order of magnitude of complexity compared to startups or enterprise-driven innovation and yet at the same time still needs to be adopted by and serve both as users.

The challenge the industry must now address after a period of frenzied experimentation is how do we trigger real interest and demand from a critical mass of actual users to benefit from our token mechanisms of incentives and disincentives. To date, the adoption of token networks has largely been where the economic incentive is greatest. Principally speculation in the potential for new forms of native internet money, as a currency or store of value, and more recently the crowdfunding of more complex use-cases. However, in most instances, many early network participants have little to no ability, and in some cases intention, of directly adopting the networks themselves as end-users.

The diffusion of innovation is typically said to follow a pattern of ‘outside-inside-outward’ contagion. Where diffusion begins on the periphery of a relational network, is then adopted by a centre of leaders (aka early adopters) and consequently spreads outwards again. But this process is dependent on the centre’s ability to advocate for a technology that speaks to a known and urgent problem or burning platform.

For us at Outlier and with our Convergence Thesis, our interest is principally around data. Other than a handful of platform monopolies who have made our ‘digital exhaust’ the core of their business model through variations of Googlenomics, the longtail of companies see Big Data as a liability and cost centre rather than an opportunity. They have too much data to make sense of or secure, and don’t have the capability to transform it into sustained commercial value.

At the same time consumers are waking up to the fact Surveillance Capitalism, and its ability to turn our experiences into predictive products they sell back to advertisers, is becoming increasingly intrusive and at worst anti-social. And governments, at least in the West, are now realising they must try to tame this new economic cycle and data as an asset. When combined we believe this creates a perfect storm of bottom up and top down momentum to power the diffusion of a more decentralised Web and a new data economy.

Consequently, we believe we are now moving from a phase of ‘early innovators’ and adopters, who are naturally seeking new and novel innovations, to onboarding the ‘early majority’ who only care about tangible improvements to their ways of working or living, and where established habits die hard. So it is the objective of Outlier to help innovators identify and engage segments of the market where the need is greatest and capacity is sufficient to adopt and implement the innovation to good effect. And furthermore, continue to support the process post-dissemination to make sure innovations are sustained and adaptive over time.

Equally, we acknowledge unpermissioned tokenised networks will initially be the ‘outliers’ and will have to coexist with permissioned and untokenised private networks as well as more generalised databases and distributed data systems. Their ability to pragmatically integrate and become interoperable will be key to their successful diffusion.

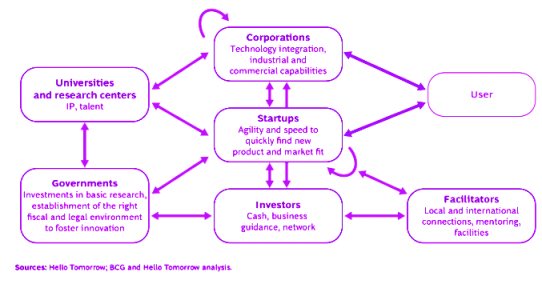

This will mean driving awareness and interest, enabling evaluation, trial and adoption by a diverse ecosystem of participants as illustrated below. Within institutions creating the motivation and ability for change, compatibility and observability of innovation and for enabling regulators to create the political mandate and permissions for it to thrive.

Outlier Ventures Diffusion Program

As such we are happy to announce our continued and deep commitment to supporting our investments that we began over the last 5 years, where we have reinvested the large majority of our gains back into developing a venture platform of 30 people and a number of strategic partnerships such as Imperial College research initiatives. However, we are now looking to expand upon these existing activities and go one up to launch a number of new initiatives detailed below.

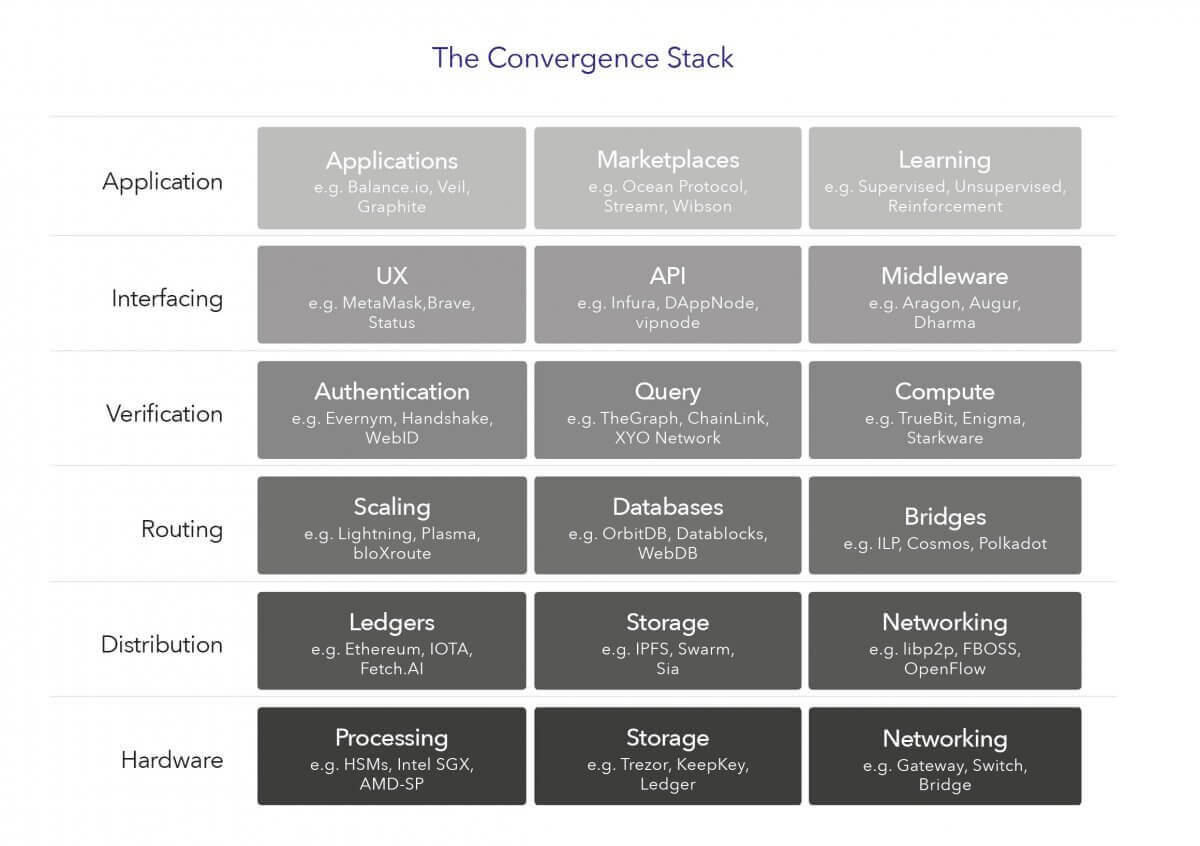

Central to this activity is the belief that our investments, due to the strength of our thesis and a discipline of what we do and don’t invest in, has formed a highly synergistic stack of technologies that complement and accelerate one another. And when combined become a powerful toolkit, or stack, that is easier to adopt and deploy in this new data economy.

We call it ‘The Convergence Stack’. Below is how we look to diffuse it over the coming months.

Get Involved

If you are looking to engage with our Diffusion Program please get in touch with the respective contacts below:

Enterprise, Academia – partnerships@outlierventures.io

Developers and integrators – developers@outlierventures.io

Startups – investment@outlierventures.io

—————————————————————————-

The framing of diffusion has been heavily inspired by: Diffusion of Innovation Theory, Principles & Practice James W Dearing & Jeffery G Cox