The first article of a series on DAOs, or “Decentralized Autonomous Organizations”. We believe we are at the beginning of a paradigm shift from hierarchical command-and-control structures to heterarchical, self-organizing networks.

The piece outlines how DAOs are different at the structural level and how their network structure might help scale human organization and collective intelligence. We then outline the major three types of DAOs that have emerged so far.

Bitcoin as the first DAO (Decentralized Autonomous Organizations) was an event of the magnitude of the invention of the limited corporation with Dutch East India Co. It will change our economic landscape dramatically by upgrading our organizations to the digital age.

In this article, we will first review why DAOs can be described as a paradigm shift in how we organize. We then summarize what types of DAOs are active today and what pieces are still needed to unlock a future of work that does justice to these bold claims. If you’d like more context on the history of DAOs before we dive in, read this excellent piece by Kei Kreutler of Gnosis Guild.

How the network replaces the pyramid

DAOs are a genuine paradigm shift because the emerging innovation touches the fundamental building blocks of human organizations. From hierarchical command-and-control structures, which basically all modern organizations from states to companies espouse to various degrees, to heterarchical, self-organizing networks.

This paradigm shift can be described along two fundamental axes, structural and scalar. On the structural level, the network will replace the pyramid as the dominant form of human organization. On the scalar level, DAOs could be able to scale effective human coordination much beyond levels we’ve seen so far: By removing transaction costs of any market through layers of smart contracts and incentive systems, much larger groups can operate at a level of trust and intelligence previously only available to small high performing teams.

A brief working definition

Enough has been written on defining DAOs, and this piece assumes a working definition along the lines briefly outlined here:

- Vitalik described DAOs as a “capitalized organization in which a software protocol informs its operation, placing automation at its center and humans at its edges”.

- Cooper Turley’s more recent DAO landscape (also a great overview) defines DAOs as “internet communities with a shared cap table and bank account.”

Both of the descriptions above point to the structural difference between DAOs and traditional organizations (e.g. companies): instead of human hierarchies, there are automated software protocols surrounded by fluid communities. We will start with this structural difference before outlining how this different structure may enable a leap in terms of scale.

DAOs have a network structure

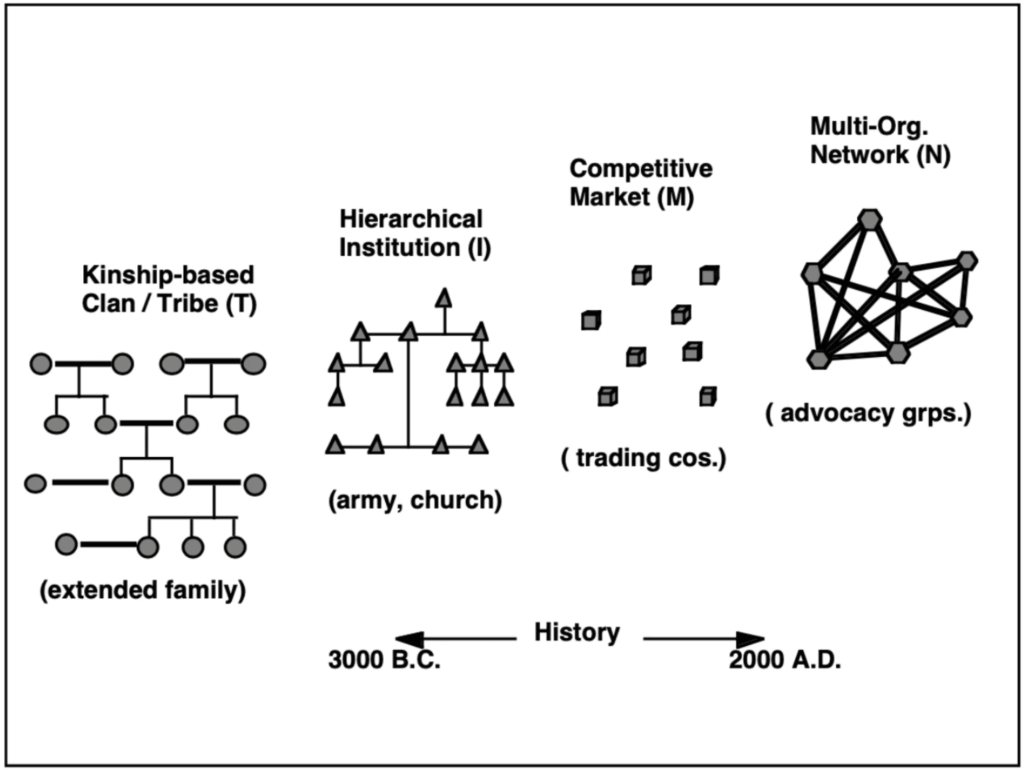

The image on the left (from the classical TIMN report) shows how a network organization structurally differs from a hierarchical institution. In a hierarchy (I), information flows upstream and decisions top-down. Contrast that to the network organization (N), where all nodes are making decisions, and information is shared openly.

Why did we need hierarchical institutions in the first place? The answer from classical economic theory is transaction costs. In “the nature of the firm”, Coase suggests that (hierarchical) firms exist because the transaction costs for economic actors (workers, suppliers, customers, etc.) to directly coordinate make such direct interactions impractical.

Firms aggregate certain market actors and bind them with contracts etc. to create trust. The hierarchical structure has been the most popular pattern, likely due to its simplicity, as well as the clarity, security, and identity it provides.

Smart contract-based protocols are how we can remove the transaction costs that previously necessitated hierarchical firms. With smart contracts and automated incentive and ownership systems, we can now replicate this same aggregation of talent, capital, knowledge, resources, etc., but in a distributed and permissionless network structure instead.

Practically, DAOs often have a native (governance) token that is used to make decisions, distribute rewards, and establish other incentives. Generally, only people who hold a minimum required amount of the native token can participate in the decision-making of the community. Sometimes, certain actions require tokens to be locked up or otherwise put at risk, and other actions lead to rewards in the form of tokens.

Towards collective intelligence at scale

The promise of DAOs (and crypto-economics more generally) is to be able to establish collective intelligence at scale. Creating intelligent organizations is not as simple as hiring smart people. Counterintuitively, the intelligence of the constituting members doesn’t impact the intelligence of the group. Rather, what matters for collective intelligence is the relationship between the members, and to what degree their interaction can effectively surface and “compute” information. There are multiple rabbit holes opening up here that we won’t have time to go down, but I can recommend Surowiecki’s book on the wisdom of crowds if you are hungry for more.

Incentive landscapes opened up by smart contracts can allow individuals to coordinate without a specified leader or any explicit control structures. Every actor makes decisions locally in their own interest, and the shared protocol ties them together into a swarm intelligence.

If guided by the right incentive mechanisms, the local decisions of each member can aggregate into a collective intelligence that much exceeds the capabilities of any hierarchical decision-making process. Not only are decisions made constantly by every actor (tighter OODA loops), a network organization can fundamentally process more information. Whereas a hierarchy processes information linearly (at the top, one decision at a time), a network does parallel processing (every node in the network contributes its intelligence).

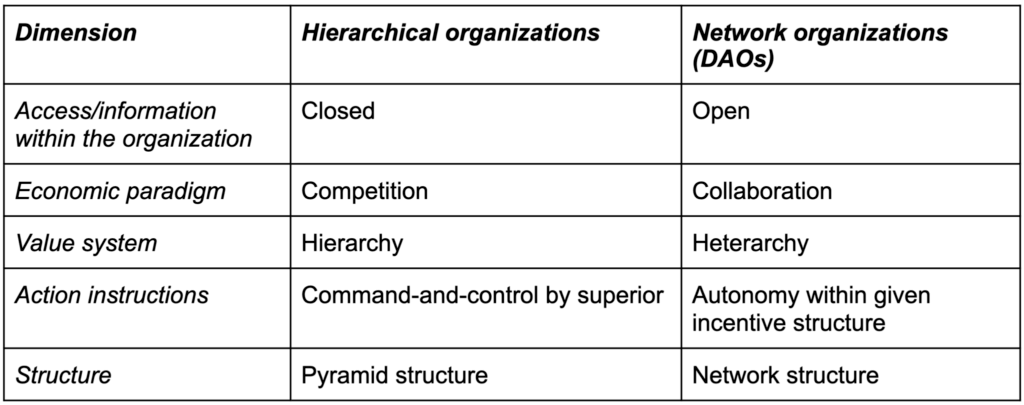

The table above contrasts the legacy hierarchical paradigm with the emerging network paradigm of organizational structure. Note that if access and information within the organization is open instead of closed, the entire economic paradigm changes from competition to cooperation. Since a DAO often can’t hide or legally protect its innovations from being adopted by others, the only way is forward. So the winning strategy becomes innovating further and faster, instead of building “defensible moats” around past innovation. This pushes DAOs to collaborate and work together instead of competing.

State of the DAOs: Pseudonymous capital

Quite some way from the lofty aspirations of rearranging the entire economic paradigm, what we’ve seen so far are three types of use-cases for DAOs: Protocol DAOs, Investment DAOs, and the first worker and social DAOs. Even though they are still confined to the Web3 space, these early use-cases are pointers for things to come.

Protocol DAOs

The first use-case, Protocol DAOs, is entangled with Web3 at a deep level since any blockchain could be described as a DAO: Bitcoin was the first DAO since it coordinates a vast number of actors through its automated software protocol to secure a decentralized ledger, capitalized by its own currency.

Since Bitcoin, there have been several attempts of adding a way for stakeholders to change any given protocol, instead of only being able to accept the predetermined mechanisms, exit, or “fork”. A multi-year discussion about off-chain vs. on-chain governance has accompanied these experiments, whereas clearly defined and executable governance (“on-chain”) has become more popular over time: Governance patterns like proposals and voting systems are currently the most widely used in the context of Protocol DAOs.

Protocol DAOs are still by far the most prevalent use-case since the majority of Web3 protocols that have a native token and a treasury also have a governance mechanism associated with them, including major DeFi protocols like Uniswap, Aave, and Compound. Token holders can govern how that treasury is spent, as well as make changes to any of the parameters of the protocol (e.g. fees).

Most Protocol DAOs are following the progressive decentralization playbook and token holders in practice often only have limited control, but we will likely see protocol DAOs mature and become truly autonomous in the coming years.

Investment DAOs

The second use-case for DAOs that clearly emerged is investment DAOs. From the fabled “the DAO” to the NFT investment collective FlamingoDAO, pooling capital and managing shared investments through DAOs is becoming increasingly popular.

The main improvement over traditional fund structures is removing administrative friction in a global investment context: Instead of painstakingly setting up legal structures, coordinating banks, and sending notarized papers around the world, joining a DAO can be as easy as a few clicks on a Web3 wallet. MetaCartel, for example, is one of the first and most active InvestmentDAOs. The trustworthiness of smart contracts that hold the pooled funds (e.g. Gnosis Safe that has been securing billions in treasury assets for years) replaces the need for legal contracts, and token-based voting replaces traditional governance procedures.

Most of the benefits that investment DAOs are getting at this time are around ease of setup and use, especially in an international context. In traditional finance, it is often complicated or impossible to syndicate investments from different countries, and even more so if the target assets are unconventional too (say blockchain tokens). Even though investment DAOs don’t rely on legal structures, they are still subject to the national regulations of wherever their participants live. For those reasons, investment DAOs (FlamingoDAO is one example) are often limited to a given number of accredited investors (e.g. in the USA).

Note that some DAOs fall between ProtocolDAOs and investment DAOs. An example would be OlympusDAO which holds a diversified treasury with the purpose of backing its decentralized reserve currency. Similarly, DAOs at the heart of a protocol that has grown into a large ecosystem tend to send up an investment arm or at least a grant program (e.g. Unigrants).

The first worker collectives & social DAOs

Beyond protocol DAOs and investment DAOs, we are seeing a third use-case emerging: Worker collectives and social DAOs.

The first worker collectives, often set up similarly to traditional cooperatives, pool resources, and knowledge to produce economically valuable products or services together. Some examples are Metafactory, a DAO that is creating Web3-themed merchandise and clothing, and DeveloperDAO, an early attempt at a developer collective.

The boundaries between what is a worker collective vs. a social DAO are already blurry. YGG and gaming guilds create extremely social communities that combine work and play: “Metaverse workers” are earning their living from engaging in a Web3 gaming guild, but that same Discord server they use to work is also the place to make new international friends, and find community.

Friends with Benefits is a social DAO with an increasingly large treasury and professional opportunities, blurring the boundary between social and work from the other side.

The topic of social tokens has been explored previously (including how to value them), whereas the play-to-earn space was described first generally, then with case studies, and lastly from an ecosystem perspective.

In the future, some have predicted that this distinction between work and play will become increasingly fuzzy – in most contexts, we will both be playing and working at the same time (to different degrees).

Governance as a competitive advantage

In addition to the network architecture of DAOs, openness is also required by the very nature of blockchain-based applications: The inner workings of smart contracts need to be inspectable by others in order to be trusted (and are public by virtue of being on an open blockchain like Ethereum). As alluded to above, this changes the economic paradigm from competition and proprietary information to collaboration with open-source software. Most active DAOs use the same set of battle-tested smart contracts “off the shelf” instead of having to rebuild everything themselves. In an open environment where every new innovation is immediately available to the entire market (instead of providing a proprietary advantage), the quality and speed of decision-making become one of the most powerful distinguishing features. The potential of collective intelligence described above can only become a reality if the right governance mechanisms are discovered and implemented.

This is in stark contrast to the current reality of DAOs, where mostly simplistic governance mechanics are at play. Usually, a proposal/voting mechanism is used to make decisions, whereas the ownership of the governance token grants proportional voting power (“coin-voting”). Industry figureheads like Vitalik have long pushed for more advanced governance, but we’ve only seen early experiments so far.

In the next article of this series, we will survey the governance schemes and specific smart contracts that can be considered “best practice” at this point. We will then have a critical look at what pieces are still missing in order for DAOs to reach their disruptive potential when it comes to the concrete procedures through which decisions are made in the context of a DAO.