September is solidifying fundamentals with 97 deals and $227 million raised. This is 4x more deals than August.

Source: Pitchbook, Crunchbase and The Block

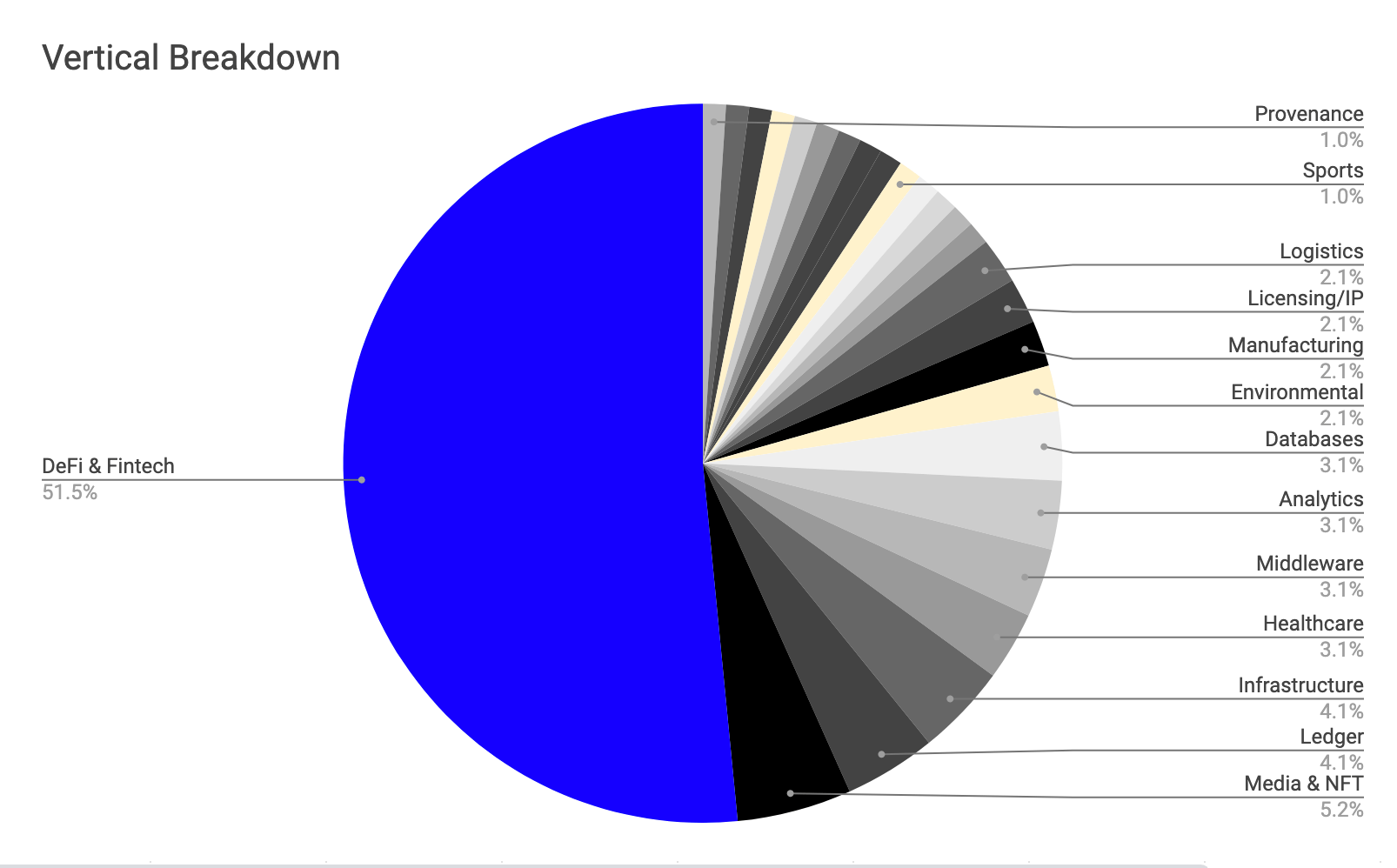

The median raise this month was $1.4 million across 26 different verticals. The majority of the deals were equity-based transactions. The markets are taking a break from an August filled with sales and farming. We are solidifying the fundamentals as uncertainty looms in the macro picture.

52% of the deals were in DeFi & Fintech.

Source: Pitchbook, Crunchbase and The Block

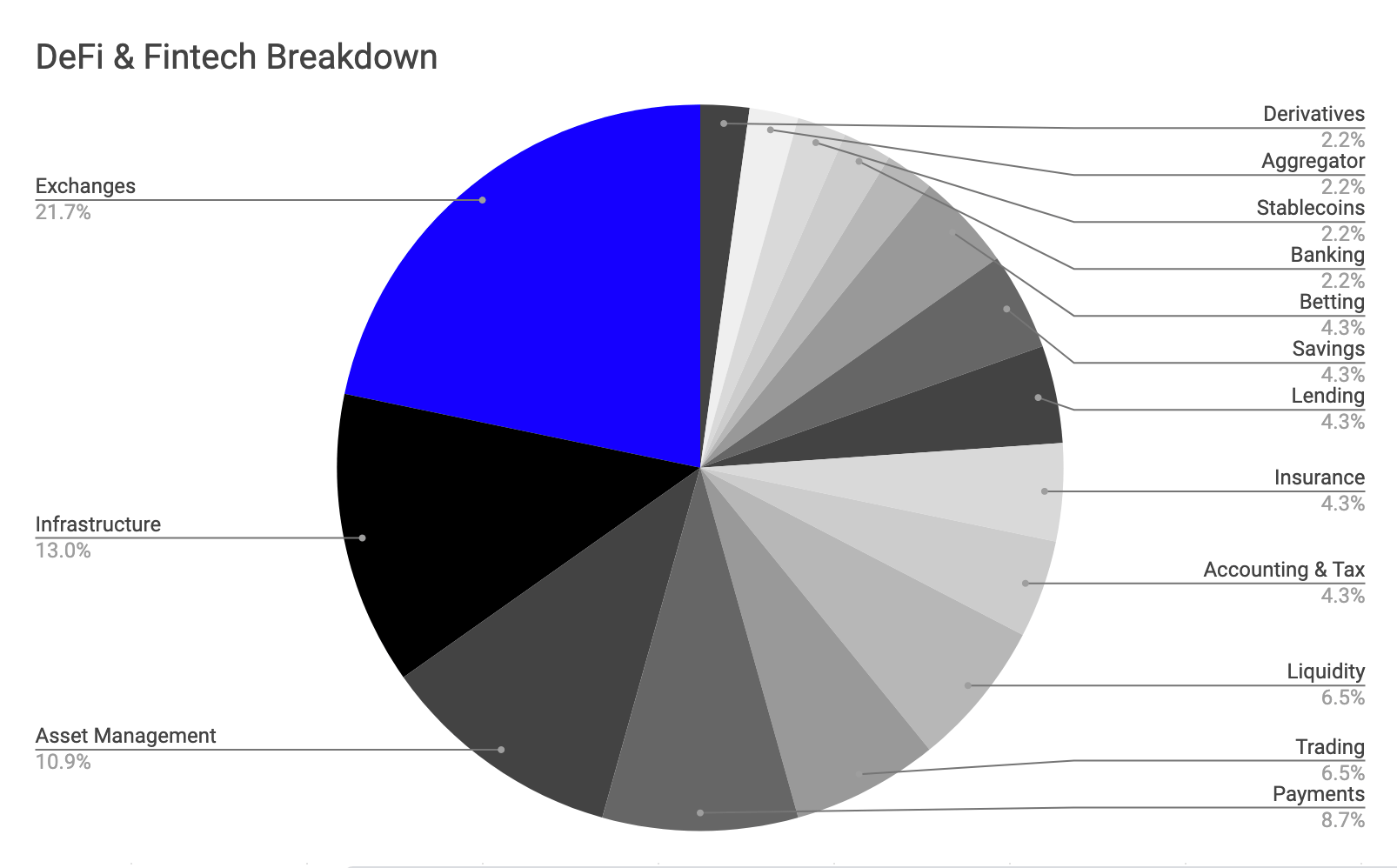

The DeFi & Fintech companies that raised in September are spread across 16 niches. This time around Exchanges, Infrastructure and Asset Management topped the chart with almost half of all DeFi deals. Payments, liquidity and accounting and tax are still going strong. Very positive to see more and more infrastructure being built around the challenges experienced in the sharp uptick of usage and contracts deployed in August. DeFi is all about experimentation and iteration.

If you are a founder looking at the future of finance, drop me a message!

DeFi & Fintech also attracted 2/3rd of the funding with $157 million committed!

Equity investors are catching up on deal making this month with DeFi projects. The fundamentals of the industry are being developed alongside speculation and experimentation. Unlike Fintechs, DeFi adopted a “build now, ask for forgiveness later” mentality which is definitely shortening innovation cycles. The downside is regulators being on their toes again, but the market is not too bothered.

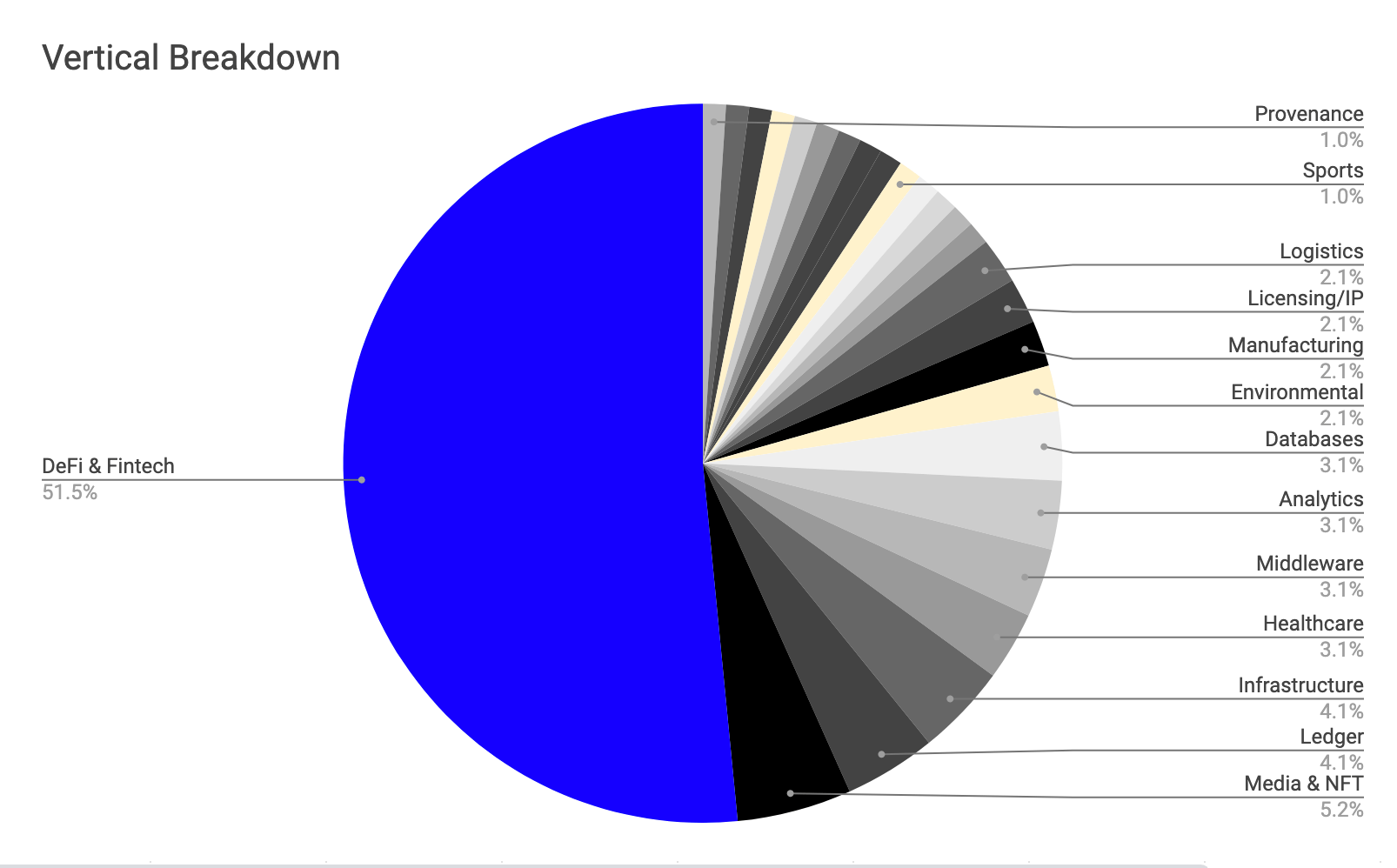

Media, NFT, Ledger, Infrastructure are amongst the other 26 verticals with 4-5 deals each.

Source: Pitchbook, Crunchbase and The Block

In the past few months we had a spike in infrastructure with Near announcing a raise, DIA raising via bonding curve sale and Avalanche going public with their token. This month we saw 5 ledger deals despite having a broad choice of layer 1 ledgers, teams are launching continuously. Hopefully they’ll be putting these raises to work with developer adoption.

This month the focus in the media was on NFTs but the influx of new teams are still to show traction and raise. Fundraising is a lagging indicator. I am very bullish on the short term outlook for the Metaverse. From virtual lands, avatars, art to digital fashion and experiences, we are exploring a variety of use cases.

If you are a founder building in the Metaverse, drop me a message!

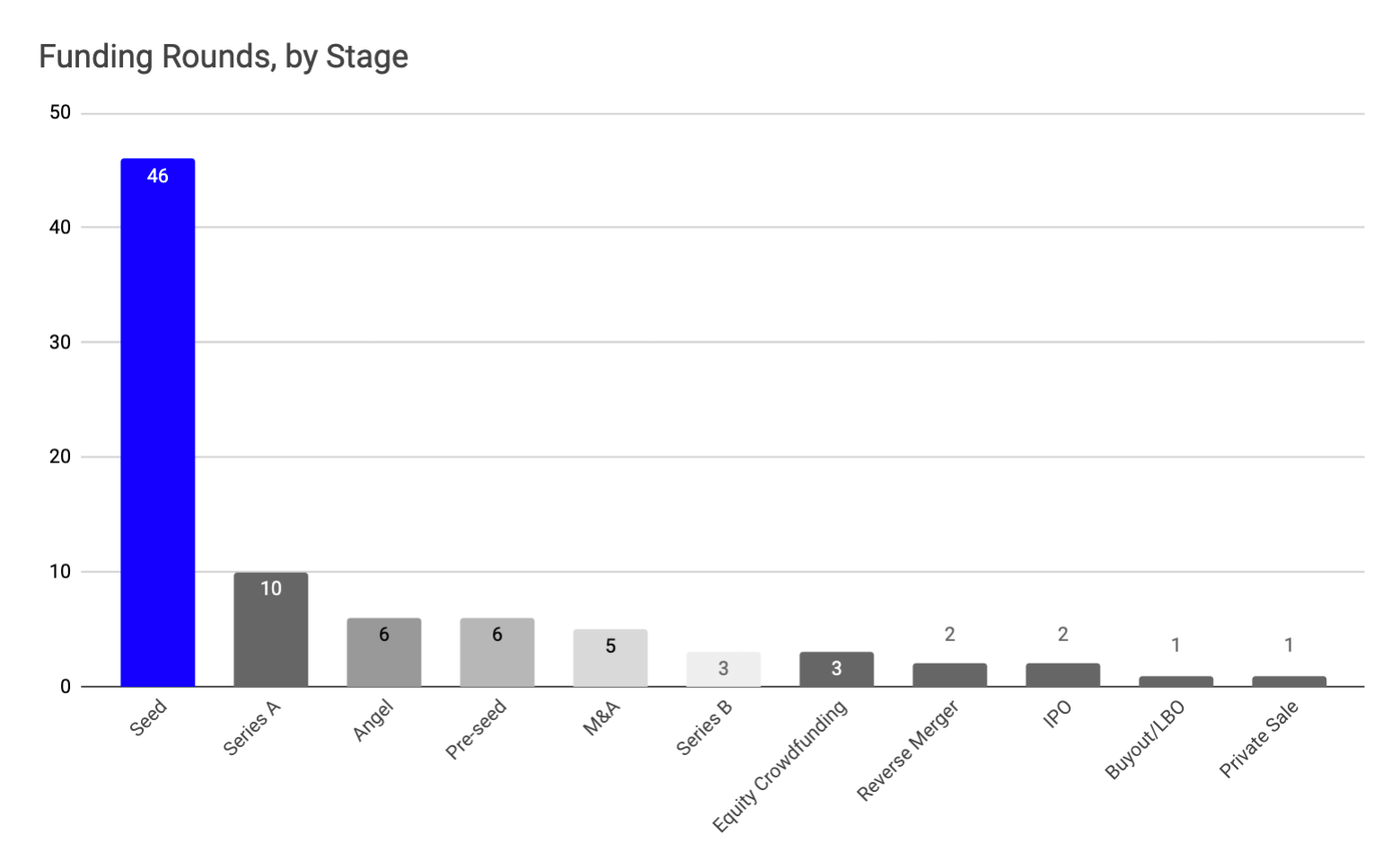

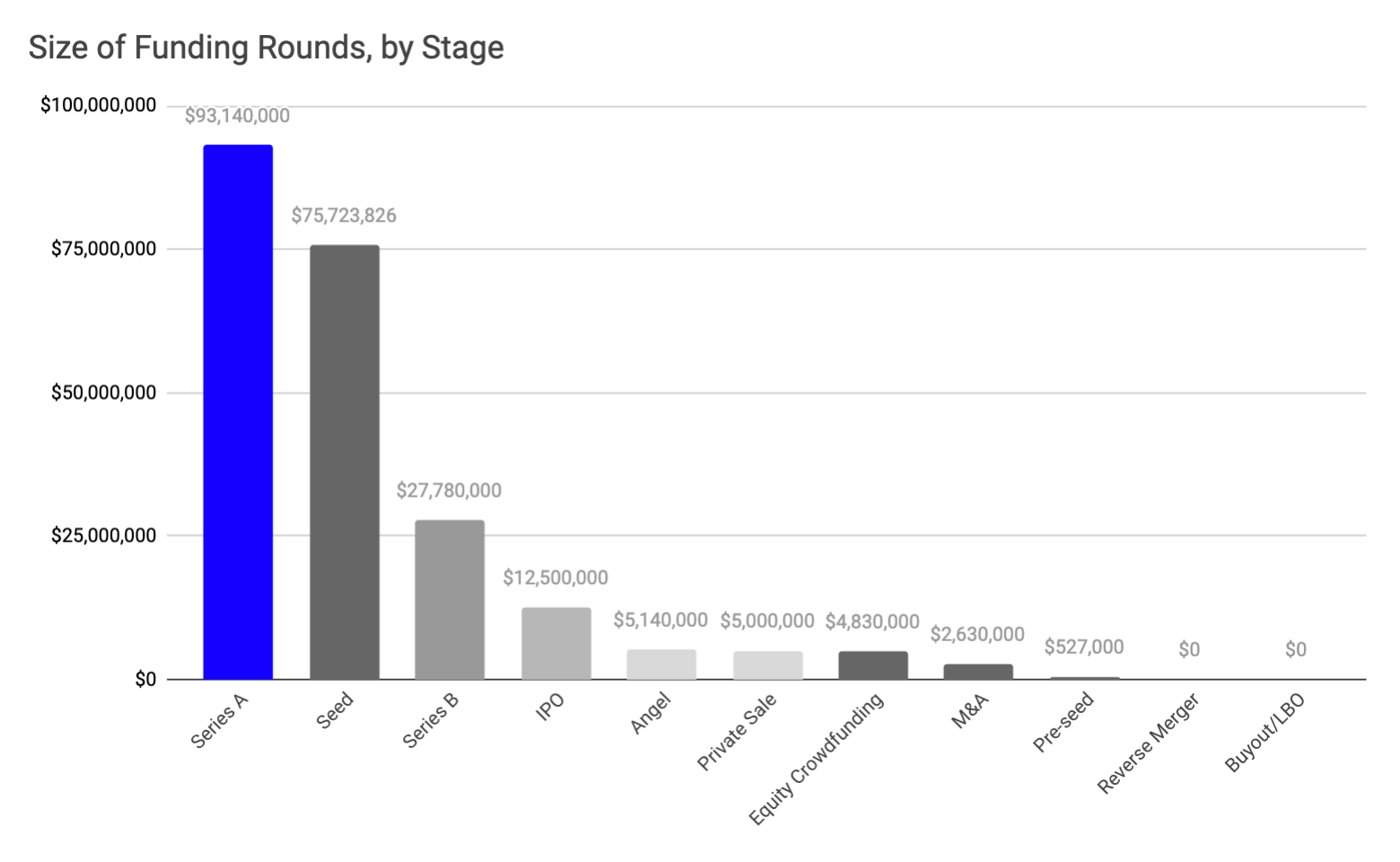

The most common round for September was public token sales seed.

Source: Pitchbook, Crunchbase and The Block

How the tables have turned. The past 2 months were quite crazy and the markets took a bit of a break. This month the most popular raises are equity-based seeds. In fact we only saw one private sale (publicly announced). The month was also quite positive for M&A activity and equity crowdfunding. Congrats team Pynk!

Source: Pitchbook, Crunchbase and The Block

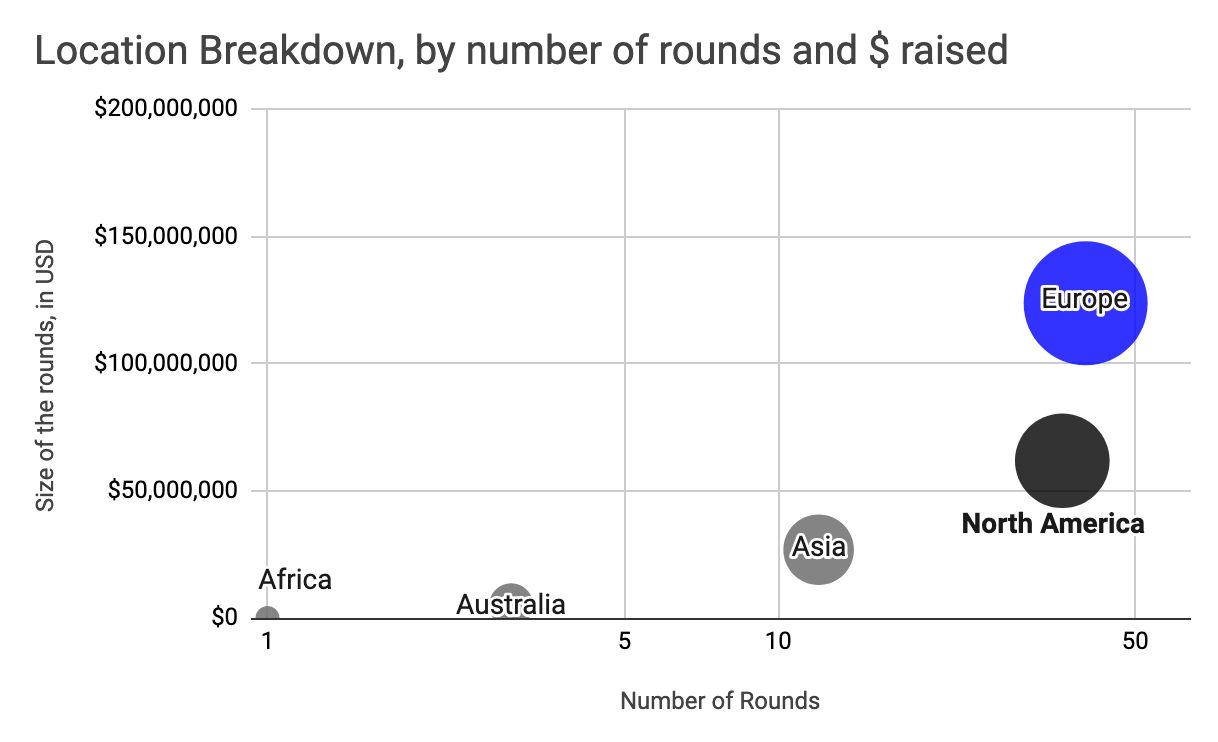

Europe is hooot and leading the US by 4 deals with 40 in total and about $60m more committed putting Europe at $123m.

Thank you Bitpanda and congrats on the $52m!

Source: Pitchbook, Crunchbase and The Block

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io.

If you’re a startup interested in joining a future Base Camp programme, APPLY NOW.