October is solidifying fundamentals with 76 deals and $267 million raised.

Source: Pitchbook, Crunchbase and The Block

The median raise this month was $1.5 million across 22 different verticals. The majority of the deals were equity-based transactions. In the markets all eyes are on Bitcoin with plenty of companies who raised equity rounds getting ready to issue their tokens. Loads of product development and traction is happening behind closed doors these days. Definitely very different fundamentals to 2017 whitepaper million dollar raises.

If you’re an investor (angel or institutional) and want to keep up with the latest on Base Camp cohorts and chance to gain early access to deals, sign up here.

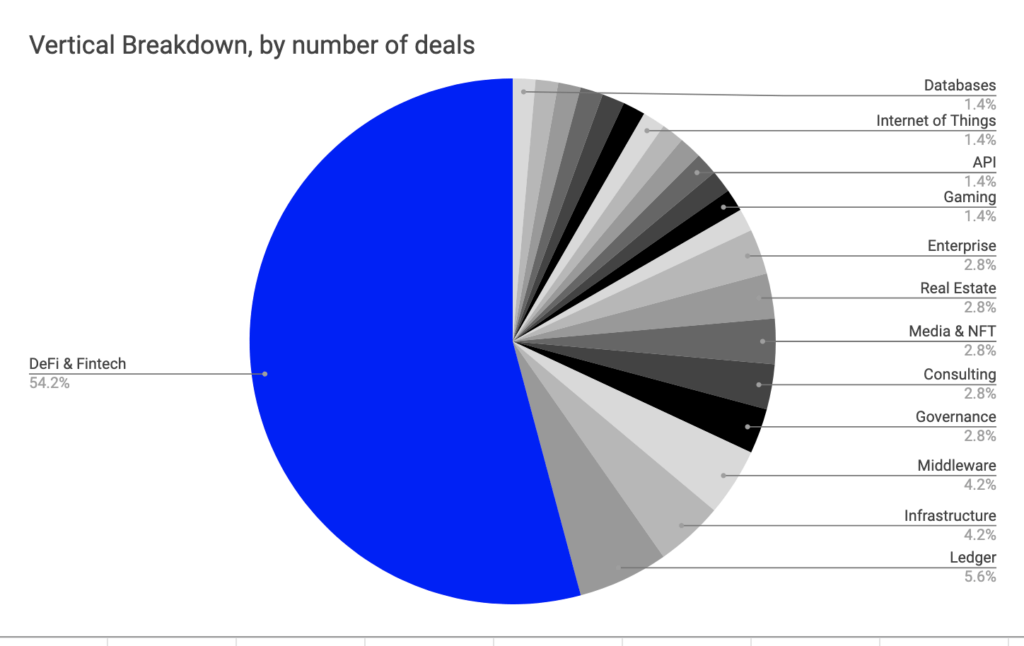

54% of the deals were in DeFi & Fintech.

Source: Pitchbook, Crunchbase and The Block

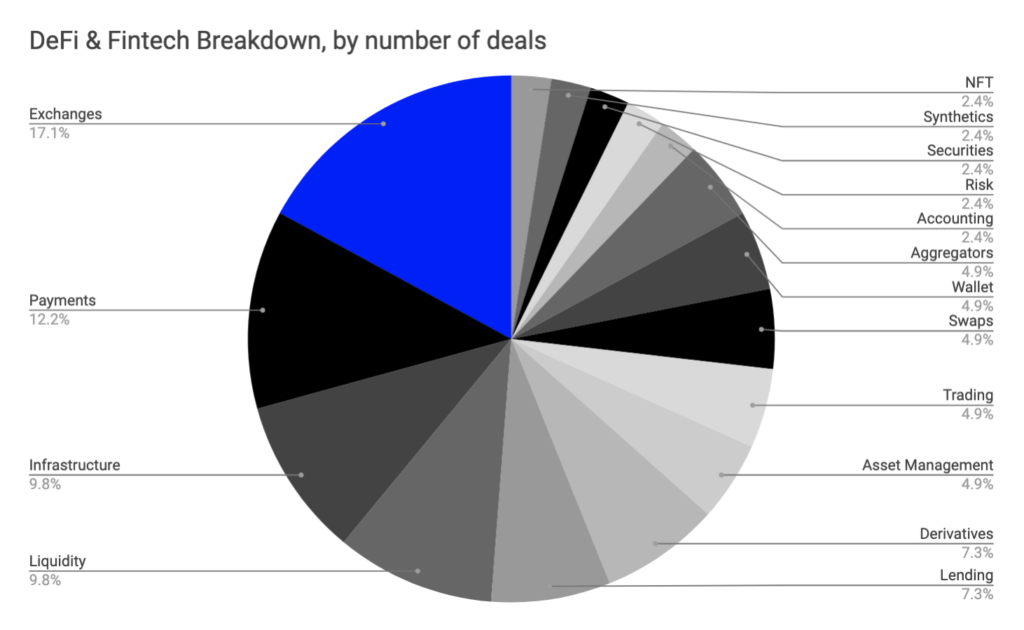

The DeFi & Fintech companies that raised in October are spread across 16 niches. This time around Exchanges, Payment, Liquidity and Infrastructure topped the chart with almost half of all DeFi deals. Derivatives, lending and swaps and trading tools are still going strong.

If you are a founder looking at the future of finance, drop me a message!

DeFi & Fintech cooled off this month with $149 million committed.

Equity investors caught up on deal making last month in DeFi with over 45 deals and $150 million committed. This month the trend is continuing with 40 deals and $149 million in commitments. The makeup of the deals is slightly different.

Ledgers, Middleware, Governance, Media & NFTs are chipping in with 2 to 4 deals each.

Source: Pitchbook, Crunchbase and The Block

The market is still relatively slow for infrastructure and the Metaverse. People are still expecting to see what the current infrastructure can do as we still haven’t pushed protocols like Near or Flow to their limits. The Metaverse community is relatively small and mostly focused around digital art. The bigger driving force with the mainstream here would be social gaming. There’s a good number of Metaverse-related startups being built or started now so expecting the first fundraising boom within 8 months. With the Metaverse we are where we were with DeFi in late 2018.

If you are a founder building in the Metaverse, drop me a message!

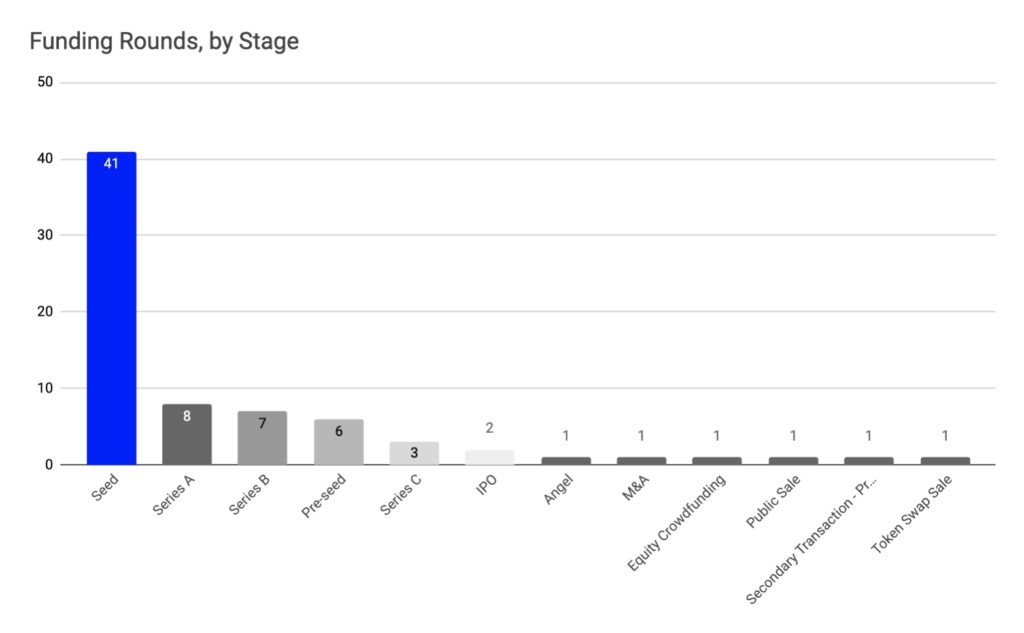

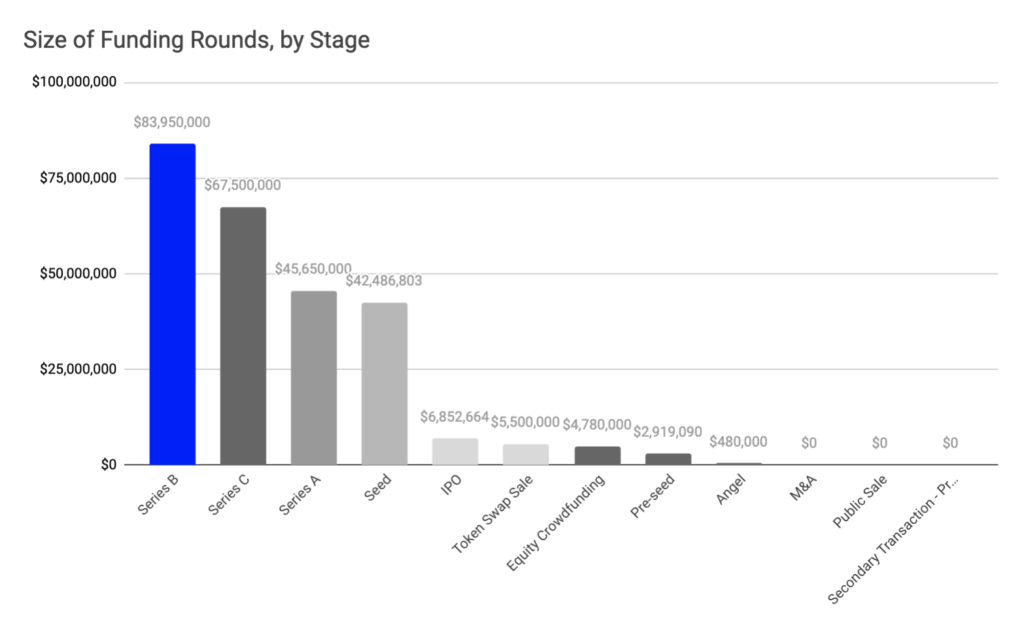

The most common round for October was public token sales seed.

Source: Pitchbook, Crunchbase and The Block

Not many projects are going for token sales just yet. There is definitely a slowly growing appetite from investors of all levels of sophistication and many are preparing for token launches behind the scenes. I expect Q1 and Q2 to be very busy for token investors.

Source: Pitchbook, Crunchbase and The Block

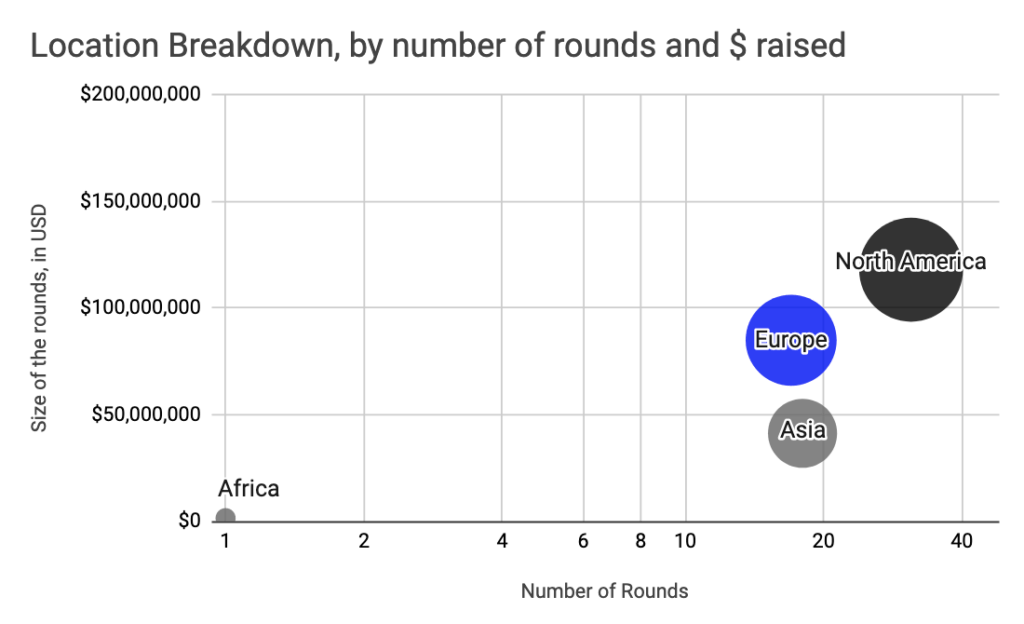

Europe is still steady with almost $85million and 17 deals. North America is reclaiming first place with almost $118million and 31 deals.

Asia is pretty active these days with $41million and 18 deals. In Europe, the UK accounted for 14million and 6 deals. Congrats to Pollen, Archax, Coinrule, Wirex and more.

Source: Pitchbook, Crunchbase and The Block

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io .

If you’re a startup interested in joining a future Base Camp programme, please register your interest here.