July set almost a record since the pandemic with 29 deals and over $254 million raised. This is more than what we did for the entire Q2 2020.

Source: Crunchbase and The Block

The median raise this month was up by $1.5 million and reached $3.4 million across 7 different verticals. The massive difference this month comes from token sales. For the first time in the past 3 years equity and tokens saw almost the same amounts of funding from seed to Series B stage.

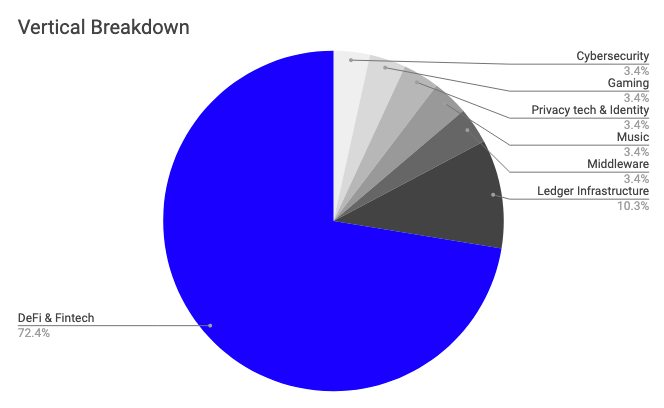

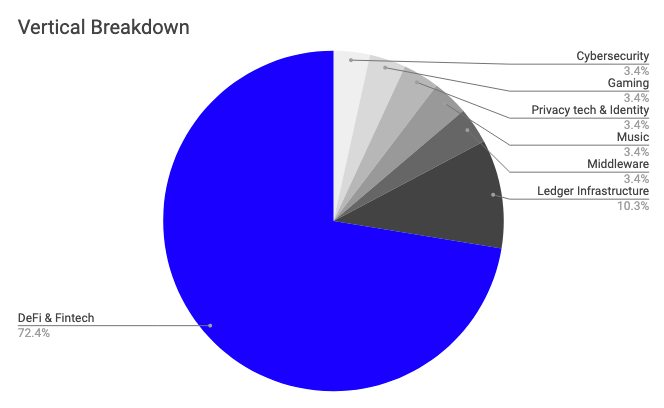

Exceeding the yearly trend, 72% of the deals were in DeFi & Fintech.

Source: Crunchbase and The Block

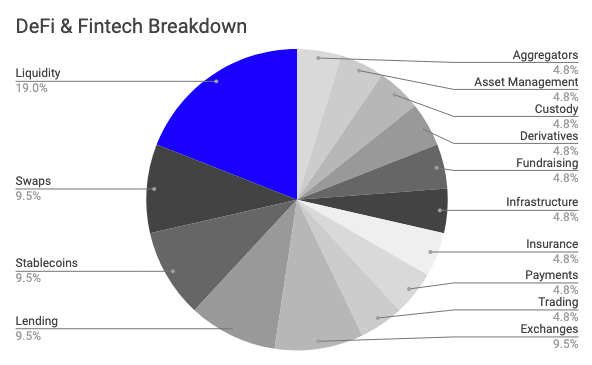

Companies that raised in July and are working on DeFi & Fintech are spread across 14 niches. This time around Liquidity providers and protocols topped the chart with 19% or 4 deals. A new niche we are seeing to pop up more and more is cross-blockchain swaps. While not a new technology and many started more than 2 years ago, now it seems like the perfect time for such a product and in markets timing is everything. Being too early to a market is not always an advantage.

Stablecoins, lending and exchanges continue to see deals and new challengers popping up. Another interesting category that we saw coming is Aggregators. These usually start coming in once we are seeing some market maturity. While many will disagree with me, I do think we are reaching the levels where having platforms to find the best lending, staking or farming deal becomes a lucrative business. Experimentation is in full swing, so we’re following the space closer than ever.

If you are a founder looking at the future of finance, drop me a message!

DeFi & Fintech also attracted almost half of the funding with appr. $140 million committed!

1-4-0 million, yes, that’s right. You may be laughing at the yield farming memes and people playing with CLO^2 but investors are seeing some real potential. One good thing about market cycles is at the end of each stage we are coming out with amazing pieces of tech, learnings and insights that we can apply to various scenarios. Remember the ICOs? Well, some lost money but as a community we ended up with some great core infrastructure that we can build on.

Less than a tenth of all funded startups in July are building in Infrastructure and middleware.

Source: Crunchbase and The Block

Yes, I didn’t even have to change the title here. It is the same trend as in Q2 2020. The interesting part is that the funding here is mostly follow ons. We have Polkadot’s newest sale, Everledger’s bridge financing (debt) and The Graph’s $5 million private sale.

Music, Privacy Tech & Identity, Gaming and Cybersecurity closed 1 deal in each category.

Audius, HOPR, Sorare and Valid Network all closed their seeds and Series As! Particularly interested to be following Privacy Tech and Identity in the coming months. In the Web 2 world the 4 biggest tech CEOs faced hearings and privacy concerns around TikTok were some of the hottest topics this past week. Whether you like it or not, the Internet is where we live. Especially after 4 months of lockdown globally. And we should be treating it as our home. The German population is one of the most aware of privacy issues with over 40% of the population expressing concerns. It is a massive market riddled with dilemmas and paradoxes of all kinds including ethics, human behaviour, politics, power and money.

If you are a founder building in privacy tech and/or identity, drop me a message!

Another interesting theme is gaming. It is no longer only the nerds who will bond over multiplayers or LAN parties. Some executives have tried and saw success bonding with prospects over Fortnight and GTA. It is a massive market, growing quickly and seeing mass adoption across mobile, PC and console. Definitely keeping my tabs on it.

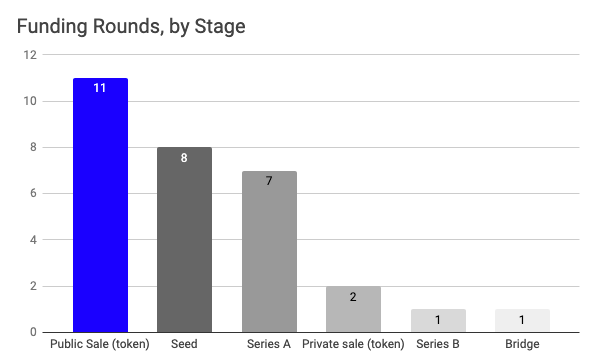

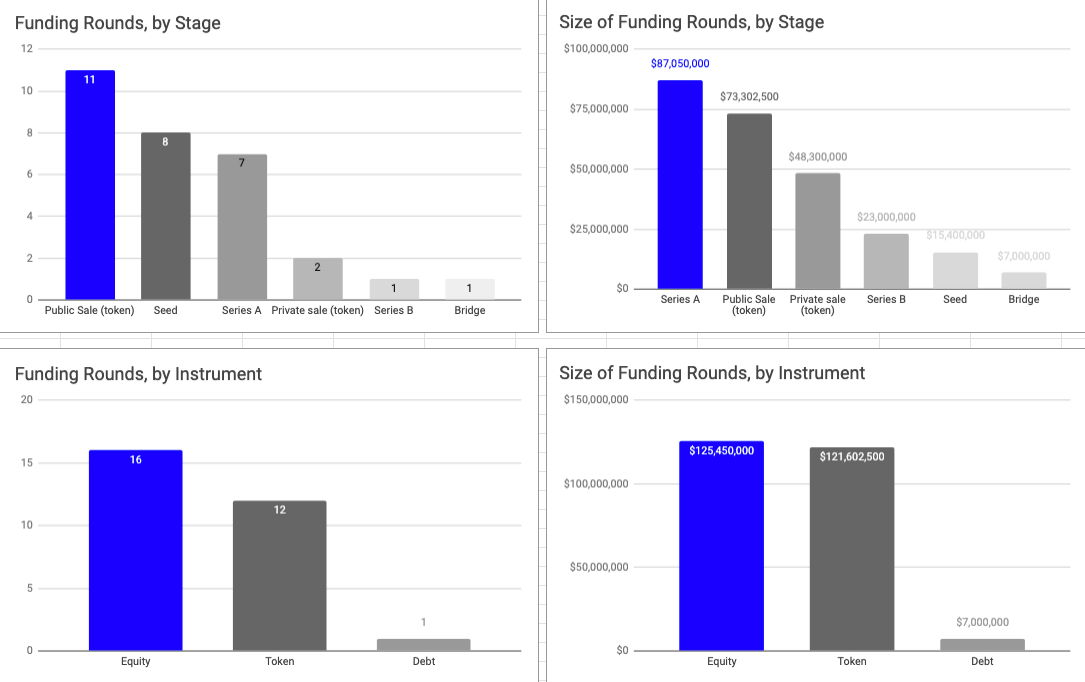

The most common round for July was seed public token sales.

Source: Crunchbase and The Block

While equities and tokens attracted almost the same amount of $ this month, 11 companies chose to go with a live token while 8 did their seed and 7 did their series A. Two went with private sales and one received series B, and one received bridge financing.

If we look at the charts below, we notice some very interesting dynamics this month that we haven’t seen in the past 3 years.

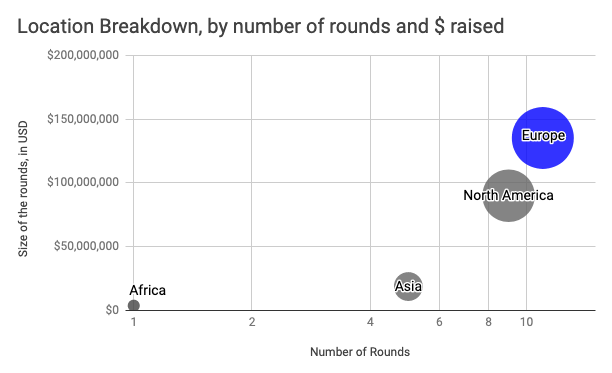

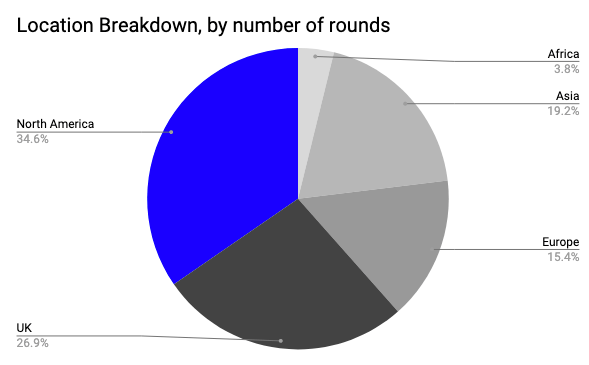

Europe is leading the way followed by the US, the UK, Asia and Africa.

Source: Crunchbase

This time around Europe 11 deals and attracted the most $$. Europe saw 11 raises at the total amount of $135 million! Yes, 1-3-5. The US saw $89 million in raises across 9 deals. Out of the $135 million for Europe, the UK saw $25 million across 7 deals. European ecosystem lagged behind on Web 1, worked very hard on Web 2 and are finally seeing some great communities with Web 3.

Investors are active again.

March and April were busy times for the investors. Everyone was busy with portfolio companies and emergency board meetings. Then in May and June they gradually freed up and started looking at their pipelines. Some even started proactively sourcing and looking at deals.

The most active investors that committed to more than 2 deals in July were:

- DCG

- Framework Ventures

- Maven 11 Capital

- ParaFi Capital

- Lightspeed Venture Partners

- Coinbase Ventures

- Three Arrows Capital

- Pantera Capital.

Congrats to all our fellow investors and all founders who worked hard during the pandemic to negotiate these deals.

Also let’s not forget the 33 funds that closed over 3 billion EUR in the same quarter! See for yourself here by Euro VCs.

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io.

If you’re a startup interested in joining a future Base Camp programme, please register your interest here.