August keeps on setting records with 24 deals and $278 million raised. This is more than what we did for the entire Q2 2020.

Source: Crunchbase and The Block

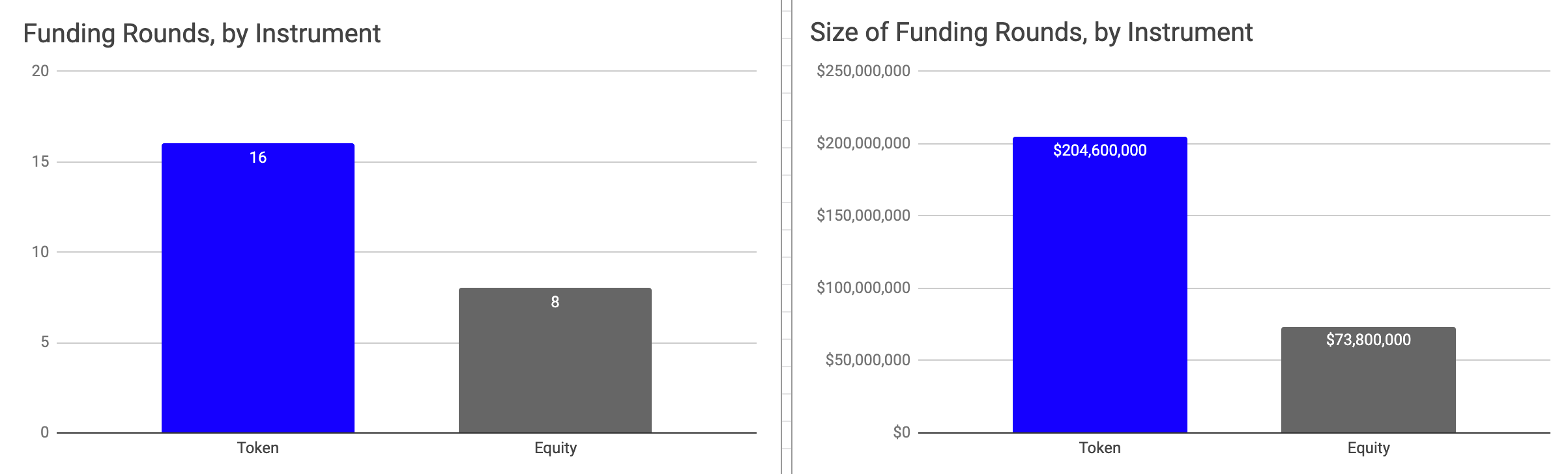

The median raise this month was $2.9 million across 5 different verticals. The massive difference this month again comes from token sales. For the first time in the past 3 years public token sales saw more funding than equity ranging from seed to Series B stage.

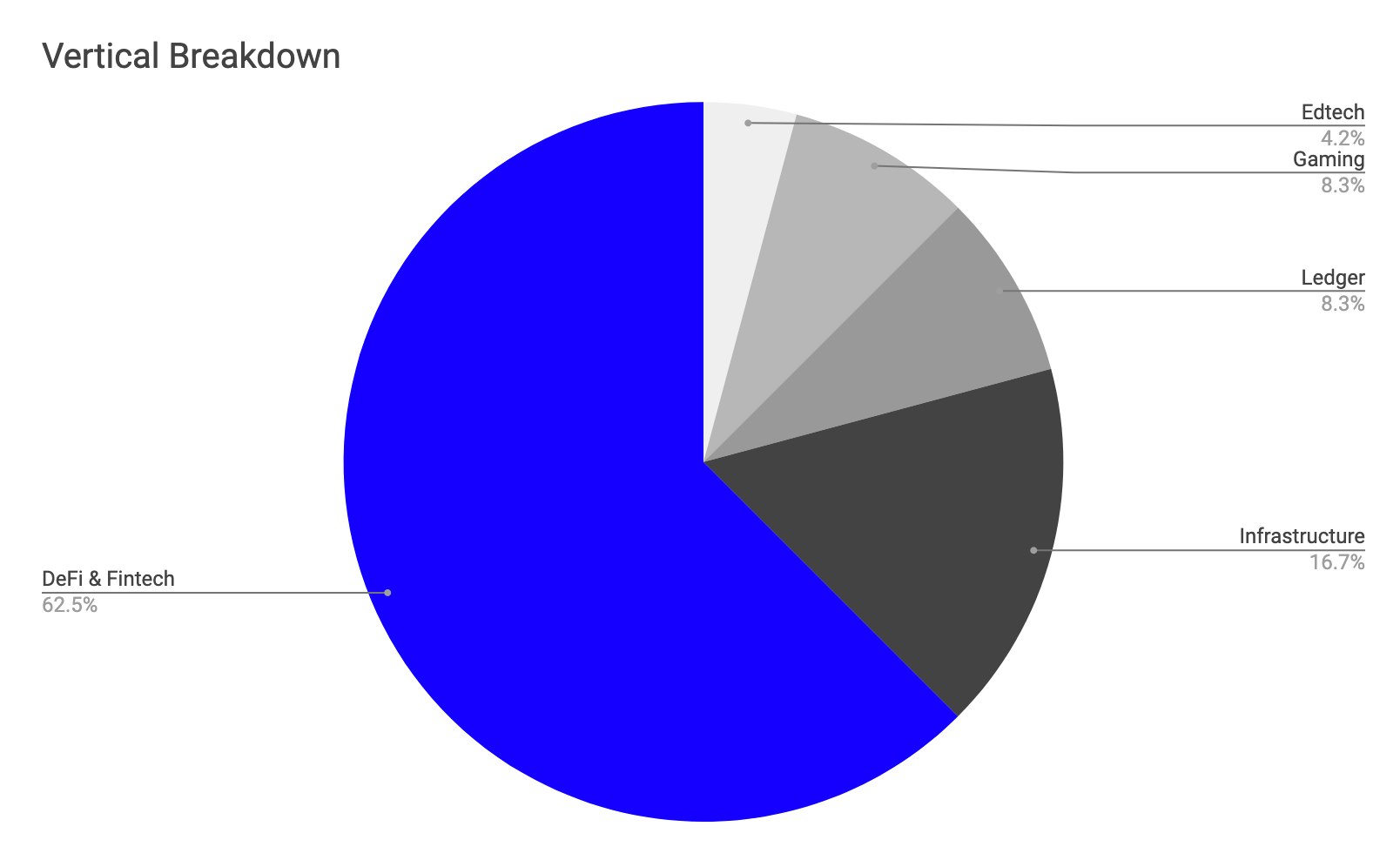

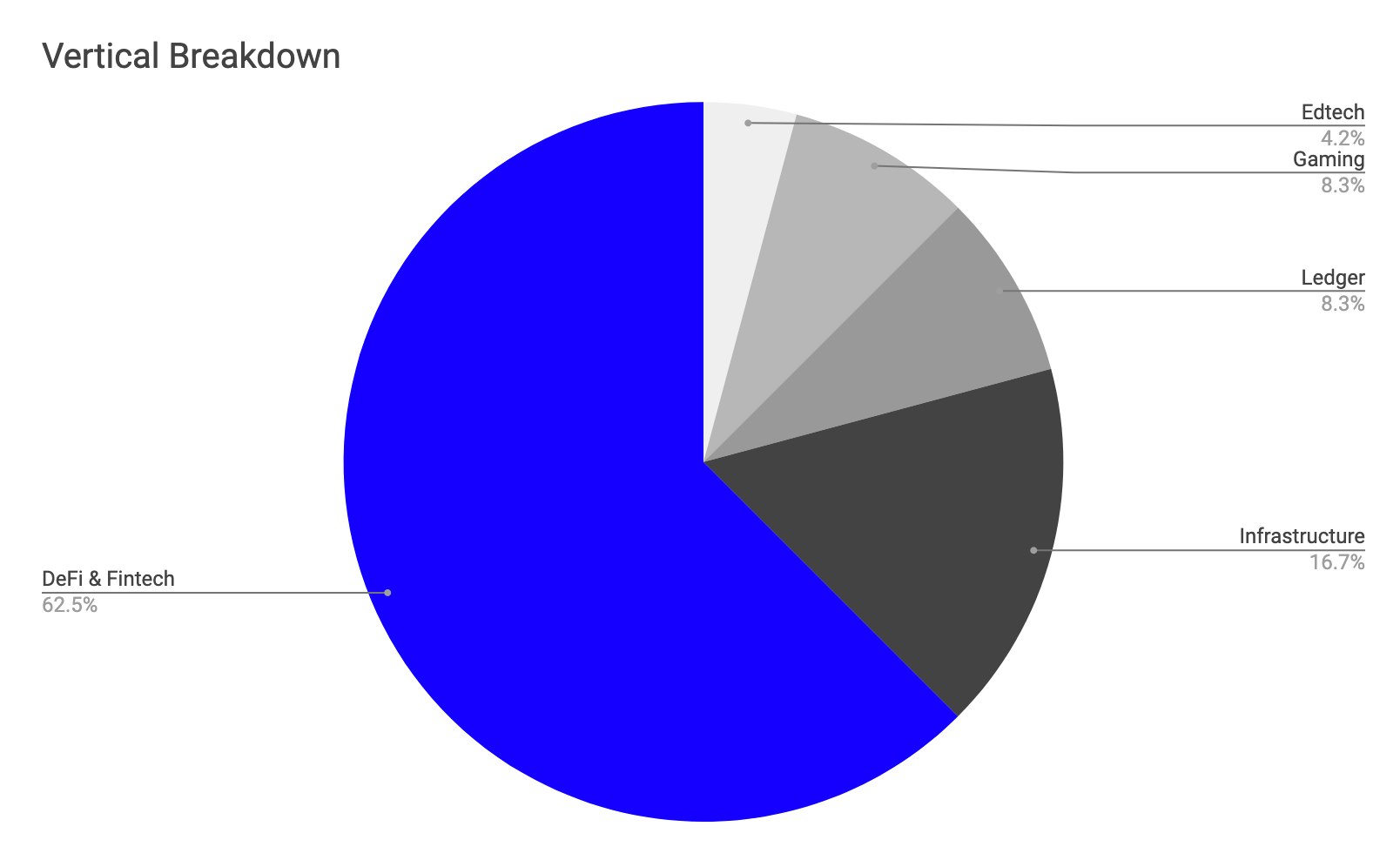

62% of the deals were in DeFi & Fintech.

Source: Crunchbase and The Block

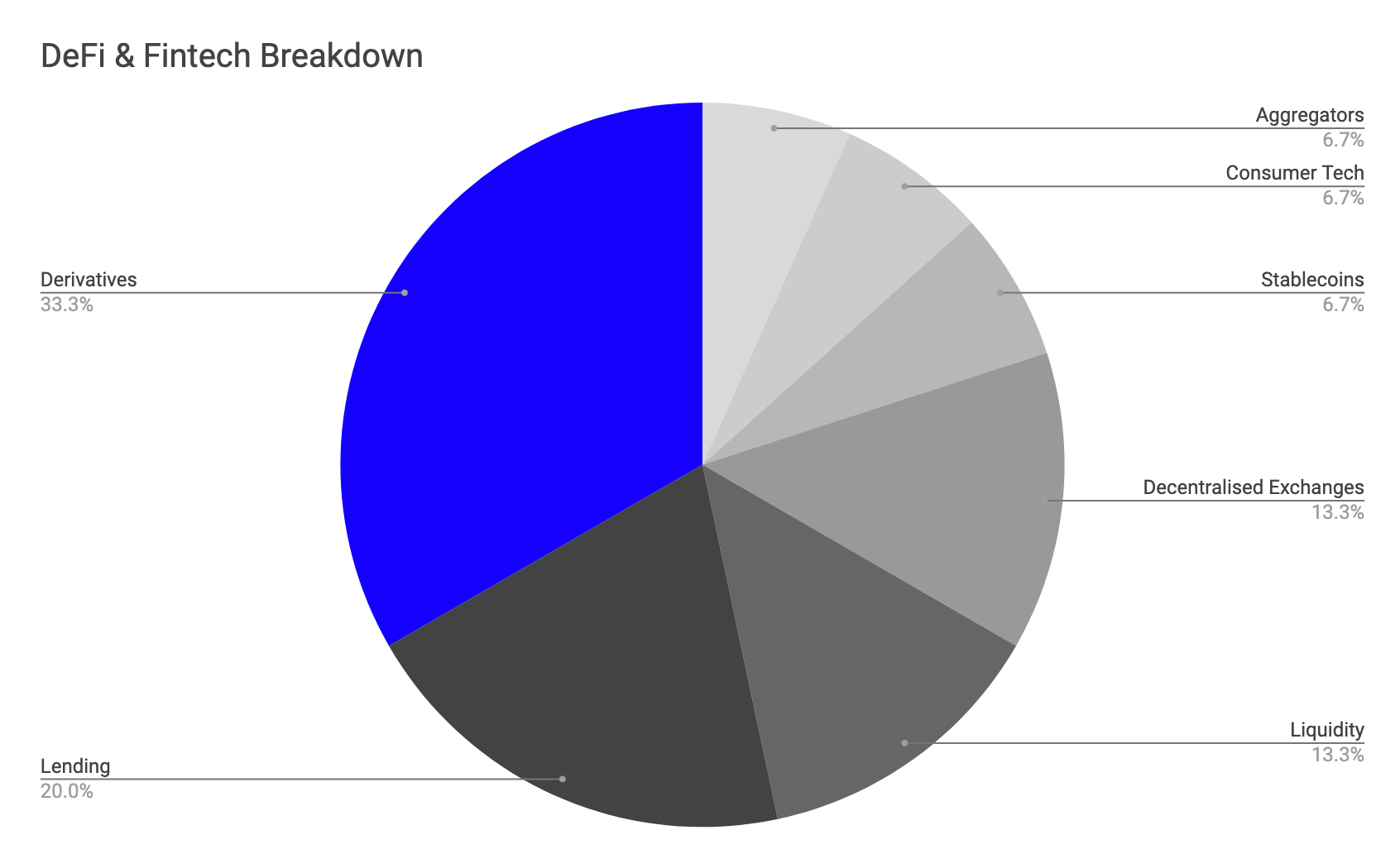

Companies that raised in August and working on DeFi & Fintech are spread across 7 niches appearing that DeFi may be converging to a few areas. This time around Derivatives tech and exchanges topped the chart with a third of all DeFi deals. Lending and liquidity are still going strong. Sushi’s controversial success is spurring a new batch of decentralised exchanges. The question is whether there will be a new inflow of capital providing liquidity, so more traders can join or they will all fight for the same users turning the market into a ‘red sea’. My theory is that exchanges, centralised or decentralised, are fundamentally natural monopolies. Let’s see if I get proven wrong here driven by total market growth.

If you are a founder looking at the future of finance, drop me a message and apply to Base Camp here!

Stablecoins, consumer tech and aggregators continue to see deals and new challengers popping up. We are seeing some market maturity although customer acquisitions has slowed down a bit there. We are definitely reaching the levels where having platforms to find the best lending, staking or farming deal becomes a lucrative business. Experimentation is in full swing, so we’re following the space closer than ever. On consumer tech, mainstream is most likely not going to jump on DeFi as it is super technical and we will need Bitcoin moves to attract more people. Some encouraging stats from Mode Banking show more people consider parking their savings in crypto in an unclear macro environment.

DeFi & Fintech also attracted almost half of the funding with appr. $138 million committed!

You may be laughing at the yield farming memes and the speculators (a.k.a the degens) but investors from all backgrounds are seeing some real potential. One good thing about market cycles is at the end of each stage we are coming out with amazing pieces of tech, learnings and insights that we can apply to various scenarios. Remember the ICOs? Well, some lost money but as a community we ended up with some great core infrastructure that we can build on. The most interesting part of it is that some institutional investors keep betting on low level financial infrastructure around custody and derivatives.

24% are building in Infrastructure and Ledgers. Less than a tenth are in Gaming and Edtech.

Source: Crunchbase and The Block

Near Protocol raised another $33million for building scalable infra. Also Outlier Ventures’ backed DIA and Sperax successfully completed public distributions. This goes to show we have built a lot of infrastructure in the past 3 years but there is a lot to go. Ethereum gas fees are paralyzing a lot of consumer businesses and many new founders keep turning to centralised tech stacks in the early days to avoid these issues. We can do better!

Another interesting theme is gaming. It is no longer only the nerds who will bond over multiplayers or LAN parties. Some executives have tried and saw success bonding with prospects over Fortnight and GTA. It is a massive market, growing quickly and seeing mass adoption across mobile, PC and console. Definitely keeping my tabs on it. Sandbox and Infinite Fleet are two of the promising gaming startups in the space. Many more to come with the Metaverse development.

If you are a founder building in the Metaverse, drop me a message and apply to Base Camp here!

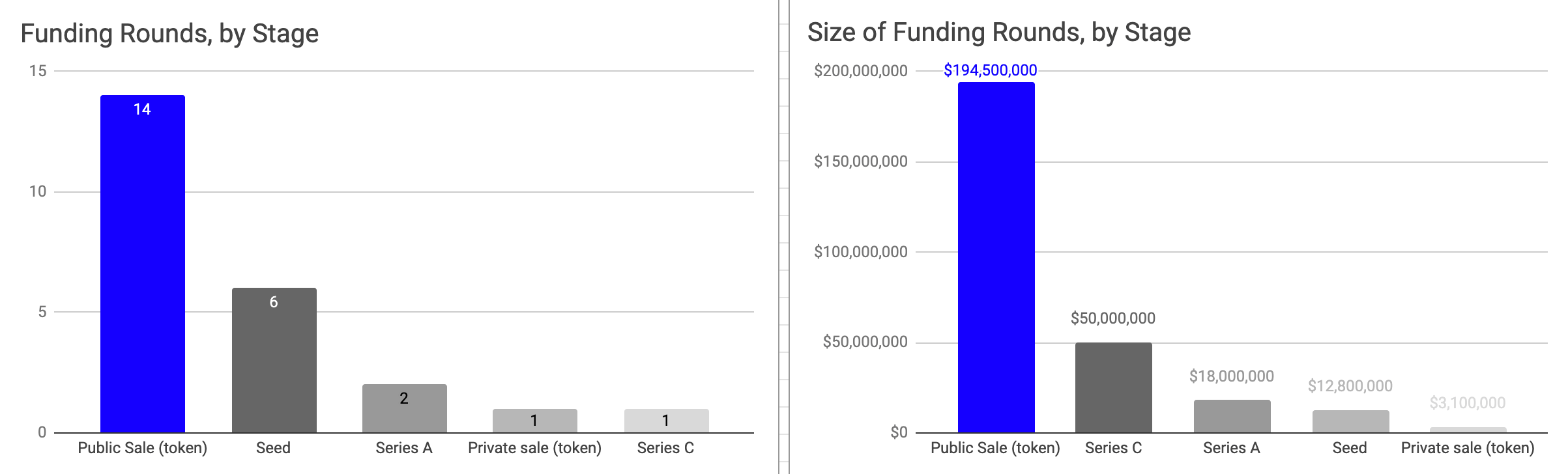

The most common round for August was seed public token sales.

Source: Crunchbase and The Block

14 companies chose to go live with their tokens while 6 did their seed, Acala and Uniswap did their series A and BlockFi did a series C. Infinite Fleet went with a private sale.

If we look at the charts below, we notice some very interesting dynamics this month that we haven’t seen in the past 3 years like having two thirds of all funding to go to token sales.

Investors are active again.

March and April were busy times for the investors. Everyone was busy with portfolio companies and emergency board meetings. Then in May and June they gradually freed up and started looking at their pipelines. Some even started proactively sourcing and looking at deals.

The most active investors that committed to more than 2 deals in August were:

- Arrington XRP Capital

- CMT Digital

- Altonomy

- Galaxy Digital

- Polychain Capital.

Congrats to all of our fellow investors and all founders who worked hard during the pandemic to negotiate these deals. It was very interesting to see CMT Digital and CMS Holding who keep doing corporate investments.

Join our growing ecosystem

Outlier Ventures is all about building an ecosystem that collectively strives to drive innovation and progress within the world of Web 3. We’re always looking for amazing mentors, investors and Web 3 enthusiasts to join us on this journey. Let us know how you want to be involved at basecamp@outlierventures.io .

If you’re a startup interested in joining a future Base Camp program, please apply here here.