>> Base Camp 6 accelerator applications are now open. $50k immediate cash, up to $250k total investment and access to market leading mentors and investor network. Apply now. <<

Gameplay

Axie Infinity is a complex gaming ecosystem based on NFTs with different levels of rarity and utility, generated by genetic algorithms. Each Axie is an ERC 721 token with unique characteristics that influence its rarity and in-game utility. The characteristics of each Axie depend on the characteristics of its parents, assembled probabilistically based on the genetic algorithm as a new Axie is born.

The game is supported by a token system that includes two utility tokens: an in-game currency (LPT) and a governance token (AXS).

Breeding Axies is one of the ways gamers can earn from playing, as new Axies can be sold on the marketplace for ETH.

On the value of Axies

However, not all Axies are equal: Their value is determined by a combination of rarity and utility. The overall Axie population can be distinguished according to different classes of rarity or scarcity. Contrary to the inflationary supply of Axies in general, ‘Origin Axies’ are strictly limited in supply (to ca. 4000). Even more rare are ‘Mythical’ Axies, which is a smaller class within Origin Axies (ca. ⅓ of them).

The utility of an Axie is mostly determined by their usefulness in battles, which in term depends on the Axie’s stats, abilities, and resources (more on that below). The factors of rarity and utility often overlap in practice – for example, only Origin Axies (a class of rarity) can develop Mystical Parts, which not only make the Axies more rare, but eventually more powerful in battles. This report by Delphi Digital goes analyses the relative rarity of Axies with more granularity.

Interaction of breeding and tokens

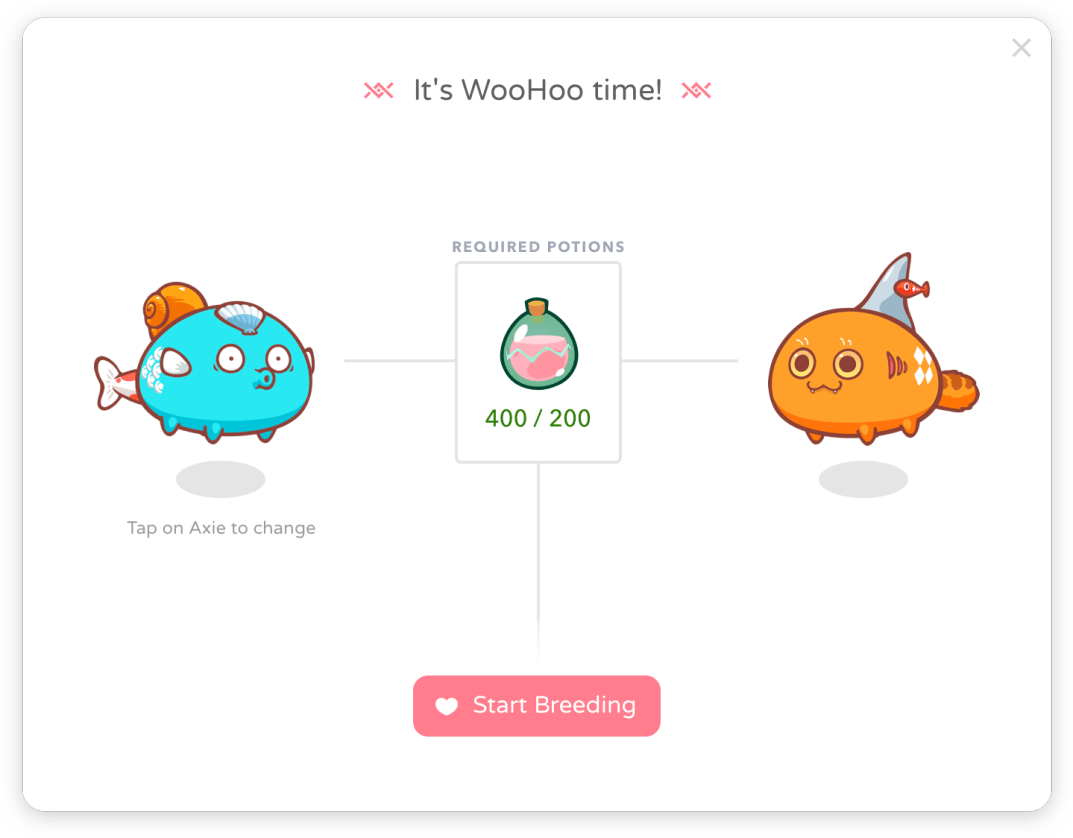

In order to breed a new Axie, the in-game currency ‘Small Love Potion’ (SLP) is needed, as well as a breeding fee that is paid partially in the governance token AXS. A probabilistic combination of the characteristics of the two parents, guided by the genetic algorithm of the game, is what determines the characteristics of the newly born Axie. For those reasons, Axies tend to reproduce along similar levels of rarity and utility in general. Axies have a breeding limit, yet another factor influencing the utility, which decreases every time they breed. This breeding limit also caps the growth of all Axies to a known maximum, making the digital pets more scarce (and valuable as a result).

Battling Axies

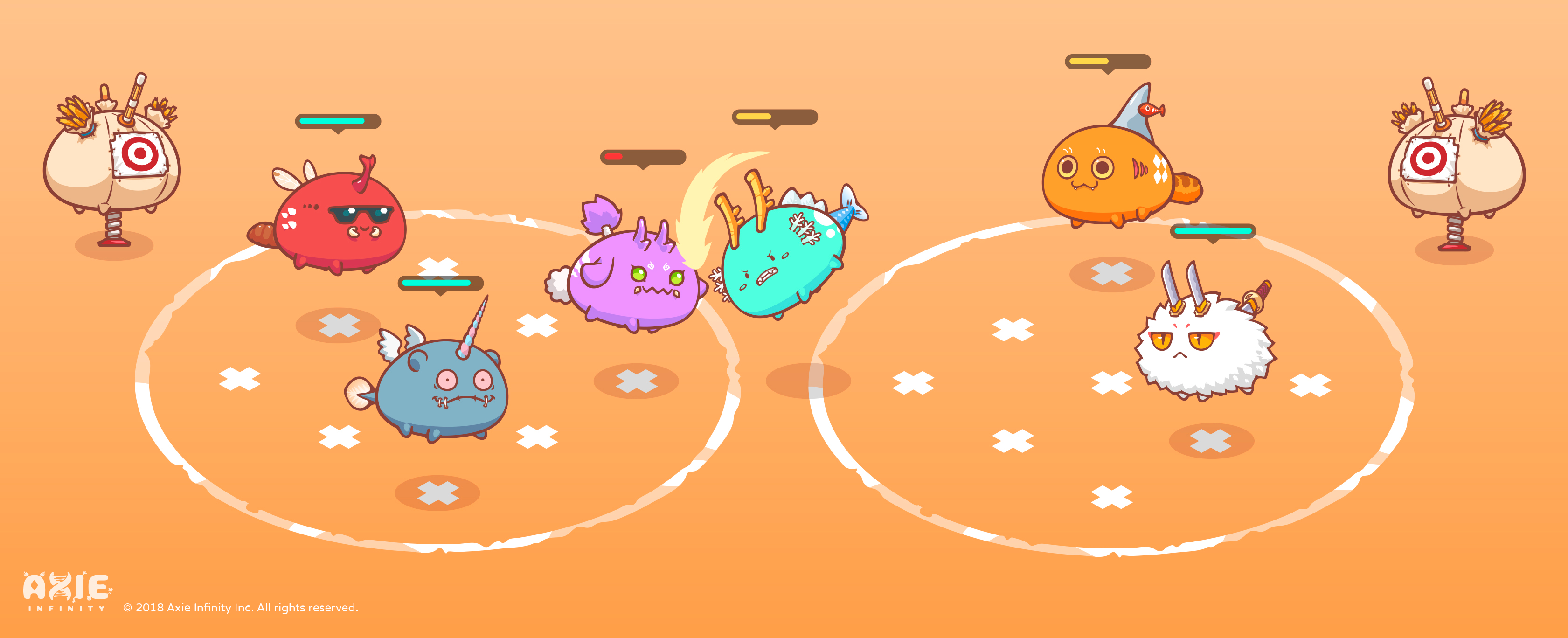

The way Axies generate yield – a significant part of their utility – is by battling other Axies in teams of 3 to 6. The opposing players take turns attacking each other’s teams by playing cards that correspond to their Axies’ given battle moves, until one team is fully defeated. Battling Axies revolves around a few core mechanics: an Axie’s stats, abilities and resources (energy and card draw). These base stats are dictated by an Axie’s class, each class specialised on a certain role in battle. In that way, winning teams of Axies work synergistically, with some being better at attack and others at defense, for example.

As is evident from the description above, battling Axies is quite complex and highly strategic, and therefore requires real skill on the part of the players. When successful in battles, players win the in-game currency SLP.

In-game currency: Small love potion (SLP)

Powering the Axie economy

As we’ve explored above, SLP is the fuel of Axie Infinity’s internal economy. SLP can be used within the game to breed new Axies, and earned by playing the game, especially by winning battles. SLP is an uncapped utility token, that is to say its supply grows as more players join the game. The token is needed to breed Axies, a major avenue to earn from playing the game. The cost in SLP per breed is a function of the breed count of the parent Axie’s – the higher each breed count, the more SLP is needed to breed.

A self-regulating supply

Upon initiating the breeding of an Axie, SLP is burned (permanently removed from the supply). As a result, there is a natural buying-pressure for SLP to unlock Axies’ reproductive capacity, and additionally, the burning mechanism at least partially offsets inflation. Interestingly, the increasing cost of breeding as an Axie’s breed count increases contributes to curbing the growth of the Axie population, or at least compensating a higher growth rate of Axies with a higher burn rate of SLP.

Governance token: Axie Infinity Shards (AXS)

Axie Infinity Shards (AXS) are an ERC 20 governance token for the Axie universe. AXS holders are meant to influence the future of Axie Infinity by signaling their support for upgrades to the ecosystem and by deciding on the usage of a community treasury. As opposed to the in-game currency SLP, AXS governs the Axie ecosystem on a meta level.

Leveraging ‘buy-back-and-make’

Whereas SLP has an unlimited supply, AXS is limited to a maximal supply of 27 million. Like many governance tokens, AXS also redistributes value within the ecosystem. For instance, the breeding fee is paid partially in AXS, which is subsequently added to the community treasury. Note that this creates a similar buying-pressure than the burning mechanism used for SLP, but AXS is reallocated to be spent by the community instead. This article by Placeholder VC further elaborates on the benefits of this “buy-back-and-make” mechanism.

Incentives for the ownership economy

Since the value of AXS is loosely tied to the success of the Axie Infinity game and ecosystem, it allows additional capital to enter without needing to hold Axies or play the game directly.

Another key mechanism at play is staking: AXS holders can deposit their tokens for yield within the governance platform, improving the capital asset properties of AXS. Additionally, staking rewards active participation, and gradually dilutes passive holders (with tokens in wallets or on exchanges).

Finally, AXS can be used to incentivise specific actions that aren’t at the level of the game itself (where SLP would better apply): From participating in public tournaments to governance votes, or even generating content, AXS is a flexible tool to set incentives for the community to create value.

Why P2E 2.0 is the future of gaming

Play-to-earn models powered by blockchain technology are opening up digital-native economic opportunities to an entirely new part of the population. Axie Infinity is an excellent example which has been making impressive headway during that mission, as documented in this video. Crucially, especially during the time of the pandemic, underprivileged groups in need of subsidiary income have tended to benefit the most. Since a part of crypto’s mission from the beginning has been financial inclusion and open sourcing access to the digital economy, it is crucial to bring on the populations that are most in need thereof – P2E 2.0 is finally making that happen. Understanding Axie’s economic model helps illuminate how crypto concepts from provable scarcity to monetary policy apply in a play-to-earn context.

A convergence of gaming and crypto?

Gaming is a focal point for onboarding new crypto users in general and has fueled innovation in both crypto UX and scalability, delivering enormous value to the industry as a whole. Axie Infinity shows how this interaction with crypto at large goes both ways – innovations from Decentralised Finance (DeFi) make their way into the latest token designs from yield-bearing NFTs to governance tokens. In the future, we expect this convergence between gaming and finance within crypto to accelerate. Finance will become increasingly gamified and games will become increasingly financialised. Especially in an open metaverse context, the combination of gaming and earning will become interesting for more and more people. Above all, these developments might radically change the cultural perception of gaming in the future: from a nerdy time sink to an accepted and valued way of earning one’s living.