All on-chain indicators hint at what is about to come

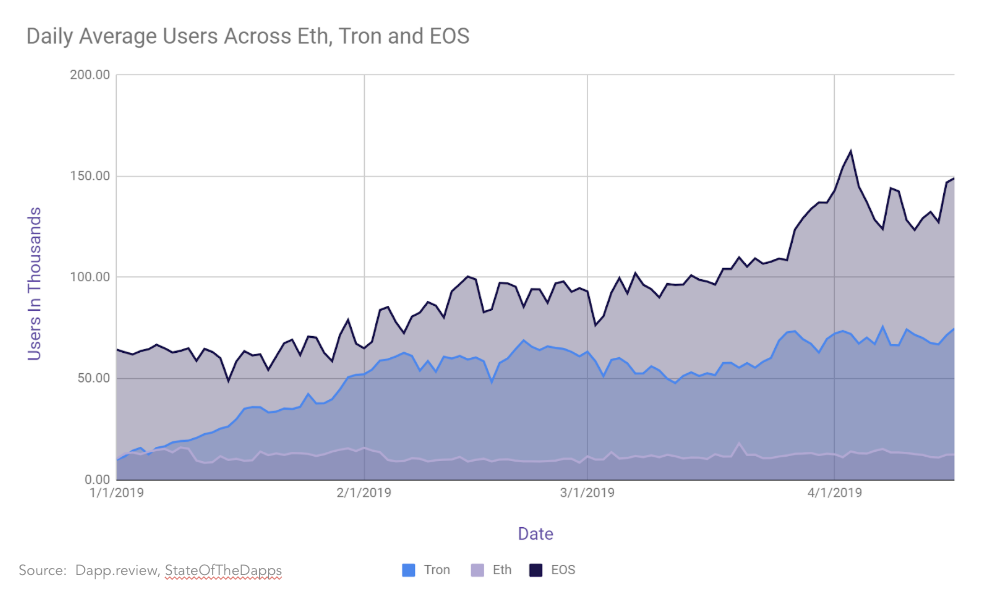

Markets and the weather hold one common attribute – they function in cycles. The token economy has suffered a prolonged winter throughout 2018 to Spring 2019. However, things have been looking increasingly positive throughout the second quarter of 2019. Whilst the price of tokens are already up roughly 3 times, analysis of on-chain activity indicates that a full recovery may be imminent. Metrics such as transactions, hash power (dedicated to mining) and the number of new wallets opened have begun showing recovery signs similar to highs witnessed during the bull run of 2017. While Bitcoin’s rapid surge from a low of $3,200 to $11,000 surprised many analysts, it could be noted that price is simply following other indicators driven by actual demand in comparison to pure hype of the past.

Venture dealflow is distributed across stages

The Netscape browser or Hotmail led wider Web adoption, but the token ecosystem is yet to find its gateway to mass adoption. That said, Brave Browser continues to enjoy strong growth with over 5.5 million users, and a number of decentralised finance applications such as Synthetix and Nuo show promise. Investor appetite for risk-taking does not seem to have diminished either by the lack of early stage traction. A cumulative $822 million was raised across 279 deals during this time period, 159 of these were seed stage deals indicating that new entrepreneurial talent is still flowing into the space. Exchange issued offerings going by the name of ‘IEOs’ have been taking off, indicating an interest from the retail market in still backing new token based projects. Bitfinex claims to have raised $1 billion from a token sale for their exchange even as concerns around Tether’s redeemability looms in the market. IEOs have proven instrumental in helping startups with discovery, listings, and liquidity.

Enterprise Blockchains Embrace Going Open-source

Enterprise focus on the space has evolved from merely testing blockchains in walled environments to now contributing open-source code. JP Morgan and EY have both released open code towards making transactions on Ethereum private. Bank consortiums have been collectively working towards issuance of a digital currency much like stable tokens. However, the biggest development has been Facebook’s plans to launch a global blockchain initiative focused on payments and remittances with a consortia of partners including the likes of Uber, Spotify and. It could indicate that social networks are evolving from an advertisement driven model to potential social financial service marketplaces that derive revenue from transactions through them instead of advertisements. Facebook could also match social data with financial data and develop further efficiency in how products are advertised to their users.

Governments involvement continues to rise

Where governments were ambiguously trailing market activity in 2017, they have become active contributors to the industry’s evolution in 2019. The SEC and CFTC have captured much of the globe’s attention with their proactive involvement in the industry. In addition to pursuing legal action against what may have been unlawful issuances of tokens in 2017, the SEC has clarified its stance on certain late stage networks such as Ethereum and Kin. Similarly, regions like Hong Kong and Switzerland have clearly issued guidelines for the issuance, trading, and ownership of digital assets. Economies like those of Japan have gone from a fully restrictive, license-based regime to a self-regulated industry over the past 18 months. One indication of how closely governments are tracking the space was on display when Facebook’s Libra launched. The Bank of England suggested it will keep an open mind to the initiative. Meanwhile, governments in the EU and the US asked for a halt to it. We may receive more clarity around token ownership in the upcoming G20 summit. However, if trends point to anything – it is that regulators are no longer learning about tokens. On the contrary, they are active market participants much like they have been with more traditional asset classes such as equities and currencies.

Market Cycles Repeat With Fundamentals In Place

We had reasons to believe a bottom is in when we issued the Q2 report for 2018 and Bitcoin was trading at $6000. Markets slid further downwards amidst fear and uncertainty. With market capitalisation of the industry now hitting $336 billion at the time of writing this, we have reason to believe that price is simply trailing other activities within the industry due to a hangover from the ICO mania of 2017.

Unlike the hubris of 2017, the nature of tokens that are seeing traction today have better-defined ecosystems associated with them, trading infrastructure has evolved substantially and regulatory compliance has become easier for institutional giants. With this in context -it is safe to suggest, winter is finally over and we may witness a full-blown summer around Bitcoin’s halvening next year.

To find out more read our report below:

This article is for information purposes only and does not constitute investment advice. This article does not amount to an invitation or inducement to buy or sell an investment nor does it solicit any such offer or invitation in any jurisdiction.

In all cases, readers should conduct their own investigation and analysis of the data in the article. All statements of opinion and/or belief contained in this article and all views expressed and all projections, forecasts or statements relating to expectations regarding future events represent Outlier Ventures Operation Limited own assessment and interpretation of information available as at the date of this article.

No responsibility or liability is accepted by Outlier Ventures Operations Limited or Sapia Partners LLP for reliance on the contents of this article.