In case you haven’t come across non-fungible tokens already, here’s a short explainer: non-fungible tokens act as unique identifiers for digital items, allowing a creator to assign an unhackable string of data to a product, which is tradable via blockchain. This has multiple use-cases, but most importantly, we can now uniquely identify the owner of a single digital-only product, and track its history, which previously would have been made up of simple data, that could have been unpacked, duplicated and modified.

NFTs have brought forth a boom in creative digital products, with art, sculptures and collectibles selling into the millions of dollars on marketplaces like OpenSea. This speculative purchasing is backed by the continuing approach of a digital, virtual, open, metaverse, a universe of interlinked game-like software, on which an economy similar to our physical one, can only exist, and be tracked, using NFT technology.

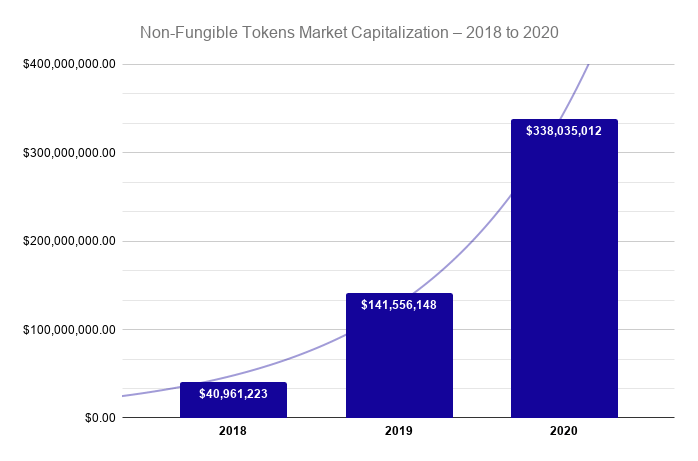

Data provided by NonFungible.com

Data provided by NonFungible.com

Presently, it is still possible for anyone to feed your NFT-backed art into their own gallery, e.g. Alice has a gallery, and places crypto-artwork that is owned by Bob into her gallery, or she could simply natively copy the data of your item, and whilst people could check for ownership, the likelihood is, they won’t. Similarly to standard ERC-20 tokens, NFTs sit in your crypto-wallet, and are typically only viewed by the most curious of outside observers – public access and duplication is not an overt concern, although it has often been a key factor in the criticism of NFTs.

Currently, a basic social trust system exists to deter malicious actors from replicating owned digital items. However, as these products become increasingly socially experienced in virtual worlds, being able to make objects exclusive, protected from competitive imitation, and limited to the owner alone, will give NFT minted assets higher, protected, premiums. Effectively, if we can prevent a NFT backed item from becoming fungible, then we have justified its value.

Of course, what we’re trying to create in a Web3 environment is a trustless space, so this social system of trust, not to duplicate and mimic, feels somewhat archaic in its current form, and doesn’t correctly provide the advantages of NFTs to a mass Web3 native audience. Fortunately, cloud streaming (gaming) may be the answer to this.

Cloud Gaming, the Open Metaverse & NFTs will make file extraction and duplication a thing of the past.

Cloud gaming is becoming an inescapable part of the Open Metaverse puzzle, an upward trend both in investment and release of cloud streaming platforms (some successful, some less so) has made the technology hard to avoid – Steam Cloud Play, PS Now, Google Stadia, Amazon’s Luna, GeForce Now, and Xbox Cloud Gaming – effectively any interactive media distributor worth their salt has pushed into the foray of streaming services.

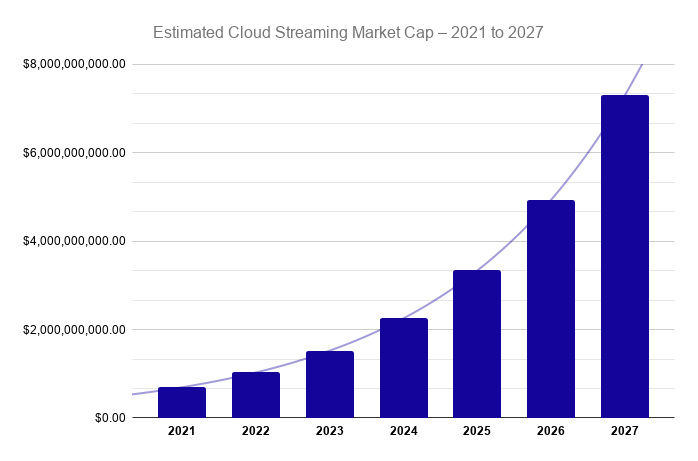

CAGR of 48.2% from 2021 to 2027. (Grand View Research, Inc.)

CAGR of 48.2% from 2021 to 2027. (Grand View Research, Inc.)

Currently many parts of the world lack the high fidelity connection to make the most of these streaming services, but with increased internet capabilities like 5G rollout, and Elon Musk’s Starlink project, the use of cloud streaming as a means for media dissemination is increasingly becoming the cheapest form of interactive entertainment for consumers.

These cloud gaming services provide benefits to both the supplier and purchaser. Similarly to Netflix, they perform as a media platform which provides access to a wide range of games, quality titles that can be accessed at a low monthly subscription cost. Alongside this lower fee, they allow users to play computationally demanding games on their tablets, phones and notebooks, removing the upfront cost of required hardware that this media often requires – powerful GPUs coupled with CPUs quickly bring costs into the thousands of dollars.

For suppliers, similarly to films, cloud streaming helps gate their product to distribution between the creator and an end user, preventing value loss from the action of reselling physical games or product keys on a secondary market, whether that’s second hand, or by using third party marketplaces.

Most importantly, for NFTs, it also keeps program files stored in a secure location, providing end users with an image projection through the internet, while still allowing an interactive platform for end user input, which doesn’t impact enjoyment of a 3D experience – this method of storing files remotely, and only providing a projection, prevents users from modifying, pirating or damaging the content provided.

Why is this important for Creative Products backed by NFTs?

As mentioned in the Open Metaverse OS, we are continually moving forward towards a virtual reality which coexists with our physical one, a space which is mapped digitally, but which provides very real, social experiences. We can see clear trends towards how we will interact in these spaces, through virtual worlds similar to those primitively found in MMOs like Rust, World of Warcraft, Fortnite, Minecraft, and so on, as well as in more curated multiplayer experiences like Valheim, Overwatch and Rocket League.

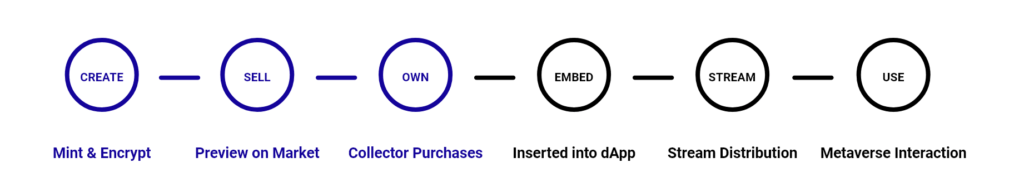

On the Web 3 front, Decentralised gaming has begun to lay the path for these social experiences to take place while also incorporating the practical applications of NFTs. Unique digital assets can be ported into virtual worlds like Somnium, Decentraland and CryptoVoxels, displayed or interacted with by participants through these platforms, and shared on various marketplaces.

However, often these virtual worlds render supplied NFTs natively on your computer, with data accessible to the end user, meaning a form of your digital assets data can be extracted and used without your permission, effectively rendering it fungible, and therefore negatively impacting its long-term value to a collector who no longer has to purchase the item to revel in its use.

We await the advent of decentralised game streaming to allow for these items to move around outside of a centralised body as secure assets, but what these centralised services offer is a glimpse into what will most likely be the future of our metaverse interaction, if items are to be truly non-fungible.

Cloud streaming, although currently centralised, would remove this security risk for NFTs, by providing end users with a projection of their experience, gating vulnerable files to encrypted transactional hubs in which only the seller can choose to provide their fully accessible item, along with the perimeter of its use to the public. Therefore, cloud streaming allows us to remove ‘copy and paste’ as an attack on NFT value. Decentralised streaming services, of course, would make this system more ethically aligned with Web 3, but centralised or not, we can now not only identify the owner of an item, but also protect against the cloning and duplication of that item. In simple terms, your avatar’s hat is now your hat.

How can we use this to define long term creative product value?

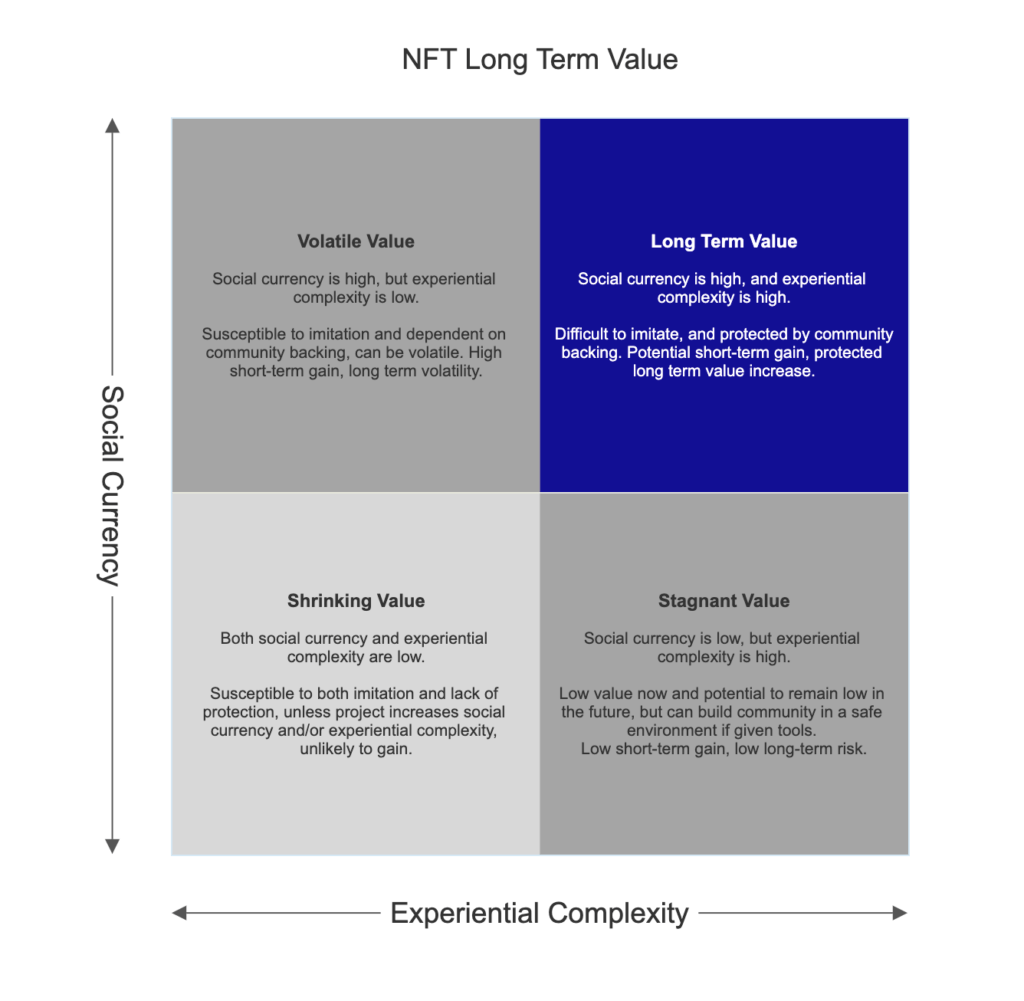

So how does this lead to assessing long-term value? An Open Metaverse which is streamed to users via the cloud, coupled with ownership being defined by non-fungible tokens, facilitates clear obstructions on how creative products can have their value diminished by competition via imitation.

The issue of duplication and distribution being a key devaluing factor for creative products becomes increasingly less of a concern when files are stored remotely and streamed as an image to end users. However, this doesn’t prevent mimicry in its entirety, as users can infer and replicate from a 2D projection, and therefore we can define two key macro-factors as predictors for the vulnerability of an owned asset, whether it can return to a fungible state, and therefore its long-term value.

—

Experiental Complexity

If a still 2D image is rendered through cloud streaming, its frames can be traced and copied. A complex 3D shape which has moving parts becomes increasingly harder to mimic – a moving sculpture in Blender therefore would have more predictable long-term value than a drawing of that same sculpture.

If an item has complex forms of interactivity and capability, whether that’s a game, software, or artwork which is impacted by ongoing stimuli, the coding required to make that work isn’t provided by the stream, and therefore is harder to mimic as interactivity levels increase – for example, a procedurally generated open world would therefore have a more concrete long term value than pixel art generated at source.

Social Currency

Arguably the most important of the two factors, and yet the most volatile, If an item has the protection of communal knowledge, through group appreciation, an item is harder to copy due to social policing, and therefore harder to devalue, this would mean a first edition Avastar would have a clearer long term value increase than a highly skilled yet unknown artist’s work.

—

When scoring highly within these key factors, an item can maintain its ‘uniqueness’, the value gained from being minted as an NFT, and therefore will be increasingly attractive to those looking to purchase, less likely to compete in a crowded market and be devalued by imitation.

Every creative project sits on the sliding scale of each of these factors at its inception, and they can adjust as time moves by, but if we take these concepts into consideration, it becomes monumentally easier to assess the myriad of NFT projects popping up in the current bull-run, and may help decide which you should devote your purchasing power to.

Generative art is currently a hot-topic for the NFT market, art created not by a person’s hand but rather by a set of processes. So, to give an example of how this assessment might work, let’s take an imaginary five hundred pixel square, 2D generative collectible which uses a selection of animated shapes as an output, for the input of your purchasing wallet address. As an example, we’ll call them Arabesques:

Experential Complexity

Arabesques are flat animated 2D images without audio, composed of a defined 500×500 pixels. We can assess these as low on a scale of sensory complexity, as they lack audio, and don’t convert into a three dimensional plane, therefore in an Open Metaverse could be easily replicated when our end user is provided with an image projection.

Arabesques are generated at source, and therefore aren’t interactive outside of their initial creation. We can assess these as having more interactivity than a static image, but lacking versus a work impacted by ongoing stimuli. The programming for these would be easy to replicate, and compete with. We can see examples of this in what is quickly becoming a crowded generative art market.

Social Currency

We’ve just made Arabesques up, so they have no community, with rare items being seen no differently to common ones, pieces would fetch low prices as they infer little social credit upon collectors, and the lack of community policing doesn’t prevent copies from stealing market share. So, they are easier to mimic, and therefore, devalue.

—

So what can we infer from this? We can see from both sensory complexity and interactivity that Arabesques should be an easy concept to replicate, the current interest in, and creation of, generative art projects is proof of this. What this means is Arabesques as items will have to battle with a crowded market, and are at risk of a reduction in value long term.

If the Arabesque’s creator has defined it as requiring limitations in its first two factors, to achieve its creative goal, then it will depend largely on social currency to maintain its long term value as a unique product, and prevent it from becoming ‘fungible’.

What are the pros and cons of each factor?

To weight each factor, and to assess how this might impact our own buying decision, we need to look more deeply at the pros and cons of each, for example, CryptoPunks is proof of a simpler concept succeeding short-term, and is also an early mover, which relies heavily on social currency – they have a keen community and active market which provides an incredibly high amount of social credit, therefore its value as an item remains high in the short-term, and if wide interest persists, will maintain its value long-term.

However, with the recent appearance of BinancePunks as a competitor to the original CryptoPunks, we can also see the impact of focusing heavily on social currency as a factor, it is easy for a competitor to step into the space and take up market share, especially when the attitudes currently tend to skew towards the acceptance of duplication and modification, and the lack of barriers towards copying owned items

Supreme is a fantastic example of this hype-culture losing its grip on value, an argument could be made that as an originator of ‘drops’, collaboration and community building as a key pillar of their business model, in a similar way to NFT trends, we could still see a ‘Supreme Brick’ moment for brands in the NFT space.

We will look to discuss pros and cons of a product’s creator focusing on each factor in detail during later posts, but for now I will leave you with this to summarise:

Creative content is typically social, and so is the collector – the success of NFTs lies in their ability to maintain an item’s uniqueness so that an owner can justify their private purchase. The higher an items value from experience, the more important it will become to prevent duplication to maintain an items value – with the advent of Cloud streaming, this becomes increasingly possible, and using our two key macro factors of experiential complexity, and social currency, we can now better assess a product’s likelihood of becoming fungible again, and therefore what long-term value behaviour we are likely to see from creative content being minted as an NFT in the Open Metaverse.

—

If you’d like to see more posts like these, then please reach out on Twitter, and if you’re keen to become part of the discussion on Web 3, then feel free to get in touch.

With thanks to contributors including: Outlier Ventures, 100xArt, Jamie Burke, Aron van Ammers, Aleksandra Artamonovskaja, Mudit Marda, Patryk Baranowski and Ana Yanakieva.