Kicking off our series on the Design Phase of Token Ecosystem Creation, we discuss setting a network’s objective function and how to best approach setting the foundations for a token design that can effectively create and capture network effects. Network effects are a multi-dimensional concept that is a bit of a moving target. At its base level, networks effects describe an osystem that becomes more valuable as more users are added to it. The term can be applied to any number of things, from products, services, applications, data, countries, cities, and even your group of friends. These examples should highlight the very different types of network effects there are, and the dynamic nature network effects can have over time.

As we saw in the Discovery Phase, these tokenised ecosystems can have multiple layers of participants and utilities. Setting your network’s objective function is the first step to designing a strong base for your network to create and capture the required network effects it needs. In the same way that Uber has now expanded into food delivery, network effects and network utilities can be layered on top of each other.

Token design is an emerging concept that consists of building an ecosystem surrounding the market or the business model that an entity is trying to operate in or create via the use of blockchain technology. It is an extremely complex task, comparable to designing and launching a completely new economic structure. The key is to keep the design and the underlying token architecture as simple as possible and minimize one’s assumptions about agents’ behaviours because even very simple structures can lead to extremely complex interactions and outcomes. Accordingly, overloading models with assumptions would not only restrict their capability but also increase error and overall system fragility.

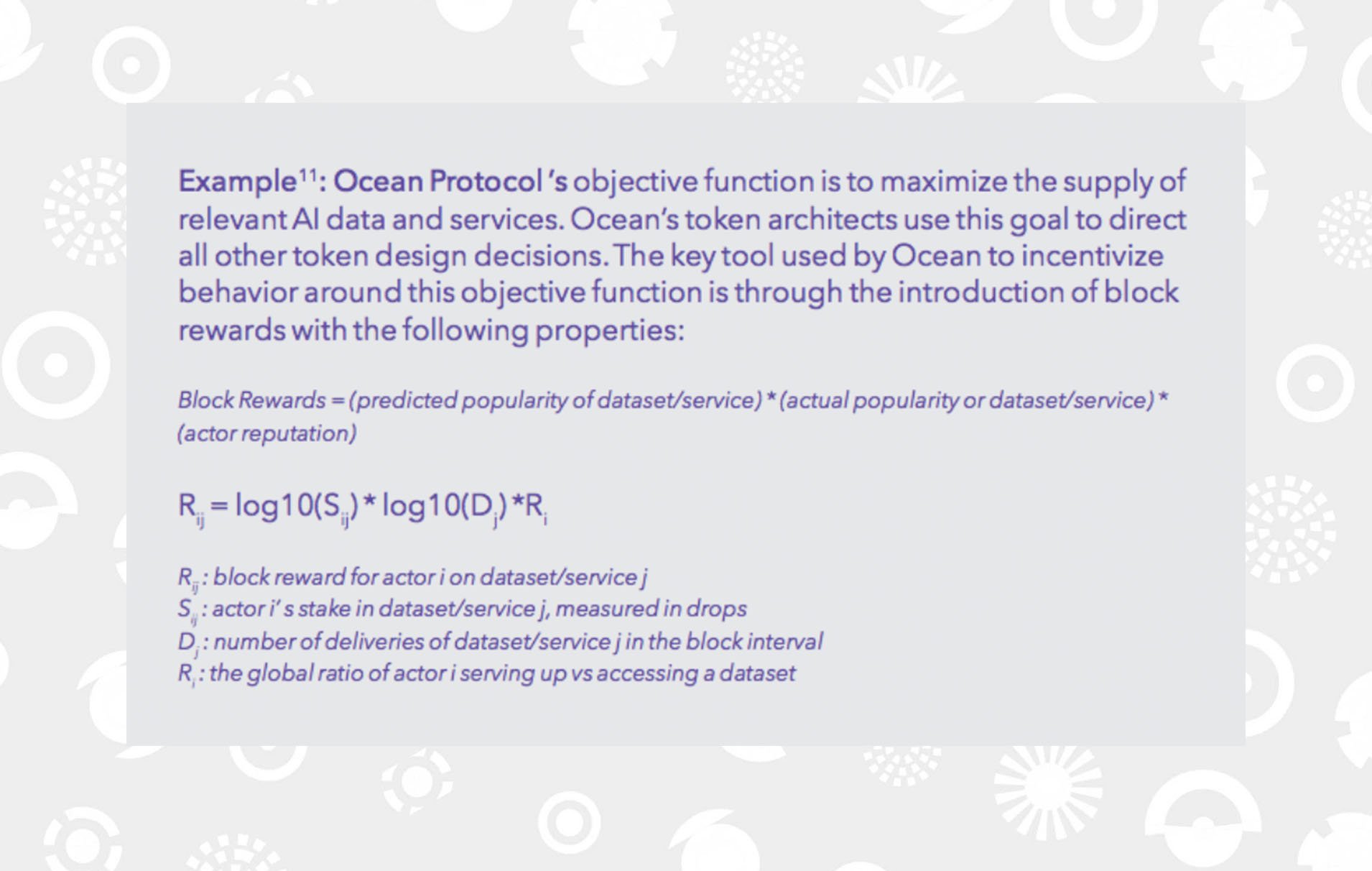

The Network Objective Function is the primary objective we want the network to optimize for above all else and helps us aggregate the different goals of a particular network depending on their relevant importance. For example, Ocean Protocol ’s objective function is to maximize the supply of relevant AI data and services. Ocean’s token architects use this goal to direct all other token design decisions. The key tool used by Ocean to incentivize behaviour around this objective function is through the introduction of block rewards with the properties described below.

The objective function of Ocean is to first and foremost support the network effects of its data. Although this is the focus, other utilities and network effects can be added and layered on top of those provided by the data itself. One such layer is curation. This utility is directly linked to the objective function by the amount staked (Sij) and despite having its own unique set of network effects, is able to leverage and support the network effects of the data on Ocean. Much like how Uber evolved to include Uber Eats, as Ocean continues to evolve, more utilities and network effects will undoubtedly be added and layered on top of each other.

The key to this evolution and layering of network effects is finding Token-Network Fit. Once the requirements of network participants are determined at the ecosystem level and subsequently at the small sub-systems level, we can start to recursively build our token infrastructure. In other words, the higher level design of the token will have to meet the needs of the market(s) it is facilitating, which in turn should fit the protocol design that is required for the network nodes to sustain the ledger in a healthy manner.

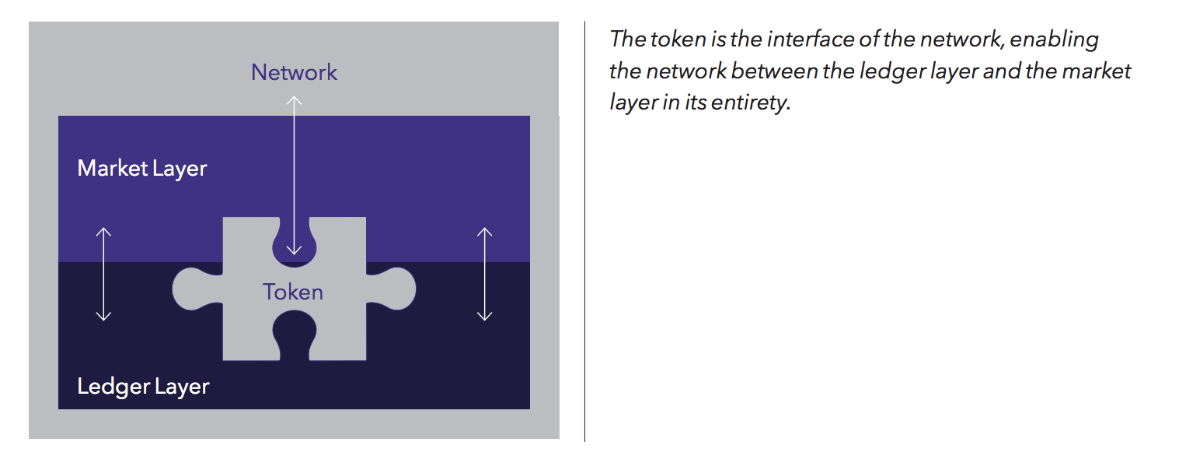

Another consideration of the design process is the Ledger-Market Fit. For this, it is useful to visualize tokens operating in between two distinct but complementary layers, namely the market and ledger layers.

Another consideration of the design process is the Ledger-Market Fit. For this, it is useful to visualize tokens operating in between two distinct but complementary layers, namely the market and ledger layers.

On the one hand, the market layer is where the network participants interact and transact (sometimes off-chain), hence, this is where we formulate and/or incorporate the business’ model/s by taking into account network effects and externalities. On the other hand, the ledger layer is where all the necessary transactions and/or other relevant information are ordered and recorded. Token models act as the interface between these two layers, limiting and incentivizing behavior in the market layer, and acting as the sensor funnelling data onto the ledger layer to be recorded. To design for Ledger-Market Fit, the network architect needs to determine the needs of the market and the business model, induce participants to reveal their preferences and/or hidden information truthfully in that market, and create the correct incentives in recording in and sustaining the ledger itself. This requires understanding the constraints and computational feasibility of running a specific market on a particular ledger.

When setting the network’s objective function it is important to also think through the various utilities and types of network effects that will need to be supported. The token is not just the interface between different network layers, but also different utilities and network effects. To ensure that your token can support the continued layering of utilities it is critical to make sure that you find proper token network fit early on in your design.

When setting the network’s objective function it is important to also think through the various utilities and types of network effects that will need to be supported. The token is not just the interface between different network layers, but also different utilities and network effects. To ensure that your token can support the continued layering of utilities it is critical to make sure that you find proper token network fit early on in your design.

To learn more about our phased strategic process for token ecosystem creation, please download the full report.