2017 has been one hell of a year for everyone in crypto. However, like all those who have been involved professionally for many years now, on the one hand we feel vindicated (and a little wealthier), on the other hand frustrated.

In recent months it seems we are losing control of the industry. When I see The Financial Times seeking opinion about crypto from The Wolf of Wall Street, someone I am pretty sure has little understanding about the underlying tech, I am concerned we have lost control of the narrative.

Sure ICOs have taken the blockchain industry mainstream, at least as an asset class, and the wild gains have brought the attention of many thousands of speculators but there are still very few meaningful products we can actually use, as humbly acknowledged by Vitalik Buterin himself recently

It seems, unsurprisingly, with all the attention on daily price movements many have gotten distracted from the real job at hand…

Creating the next phase of The Web, and fixing its many problems*

*well documented by Tim Berners-Lee himself recently in Wired.

So this post isn’t about predictions because to be frank they are simply too passive. I don’t want to provide commentary from the sidelines whilst the industry crashes into obscurity for several years. I want to propose actions and offer fixes..

As such this is a first shot at a manifesto of sorts as to how we (as entrepreneurs, developers, early adopters & investors) can get the industry BACK TO (THE JOB OF) THE FUTURE.

I would love to hear what you think we need to do on #BTTF2018

However, before we get into next steps let’s look at where we are today, and how we got here.

Where are we?

Today, whenever you turn on the news or open a newspaper mentions of crypto will never be far away. I kid you not, my last flight ticket had adverts to trade crypto all over it. I sit on trains or in bars and hear ill-informed discussion about tokens from the general public. For all intents and purposes it will come as no surprise when I say we are well into a full blown bubble.

In case you need more ‘signals’ lets take these as starters:

- ⅓ of South Korean population now hold crypto

- Ripple founder was momentarily 5th richest man in world (on paper)

- Coinbase (a crypto wallet) is the No. 1 downloaded app in the US

- The crypto exchange Binance is signing up millions of new users a week

- Kodak announce an ICO and their shares jump 125%

- Current hyper-sensitivity to news & illiquidity regularly swings prices 30–50% in a day

- Even the CEO of JP Morgan is suffering FOMO and publicly flip flops on Bitcoin

And yet despite all the hype the reality is today we still don’t have a reliable and scalable infrastructure to support the promise of what we true believers know is possible. Let’s face it, it doesn’t even consistently support the basic flow of purely speculative value. With exchanges, one of the only real products out there, still proving a major bottleneck (which might not be a bad thing for now containing the problem).

Furthermore;

- Bitcoins fees are too high and transaction times impossibly slow

- Ethereum grinds to a halt with crypto kitties

- And almost all other alternatives are still too immature today to offer an immediate challenge to Web 2.0.

Note: all these links are to mainstream media articles not community blogs. So during all this the industry is suffering a serious case of bad press leading people to conflate there isn’t, nor will there ever be, any value in all in this stuff.

So does it make sense this is on the way to become a Trillion dollar market?

Well, this is on the one hand just how bubbles go when markets get excited about a new technological innovation without established fundamentals on how to price it. The market runs ahead of itself. Especially when the said market is 24/7 and borderless from day 1.

Equally one could argue Tech Stocks generally have been significantly overvalued the last few years as cheap money looks for a home in low interest environments.

But make no mistake we in crypto are in a full on hype-cycle that disturbs, perverts and corrupts genuine attempts at innovation, which I fear is going to get worse before it gets better.

I have had editors of leading tech publications tell me they can’t navigate the truth through the noise of crypto tribes talking up their book and down the competition.

So what chance does Average Joe have of understanding value?

Subsequently, today there are many instances of Top 20 cryptos (let alone the top 100) where there is very little that represents the principles of the new decentralised Web we seek, let alone just some basic usable value.

In an ideal world we could have done without all the noise, money and attention for another year or two before we went prime time. Whilst it still ultimately would have experienced a bubble (because its ultimate promise is so profound) my fear is the steeper the incline the deeper the crash. That’s important because if it’s too deep it’s going to take a long time to win back the hearts and minds of all these investors and more importantly potential users.

So many, myself included, can’t see anything but a temporary yet deep correction of the entire asset class to clear the air. It will likely be indiscriminate because there are still no commonly accepted market fundamentals to assess value, something we at Outlier (and others), are working on.

Whilst long-term there is no doubt in my mind crypto will be a multi trillion market if you are trading Top 50 ‘in market’ at today’s prices there is little value to be had until there is a 50+% haircut.

At the same time many teams have come to possess large amounts of Bitcoin or Ether through successful ICOs (often raising more money than they needed or asked for) to deliver on new projects, but instead (just by sitting on their holdings as they have multiplied) they have found themselves multi-millionaires many times over without even needing to innovate. In fact the terms of the raise clearly state they are under no legal obligation to do so.

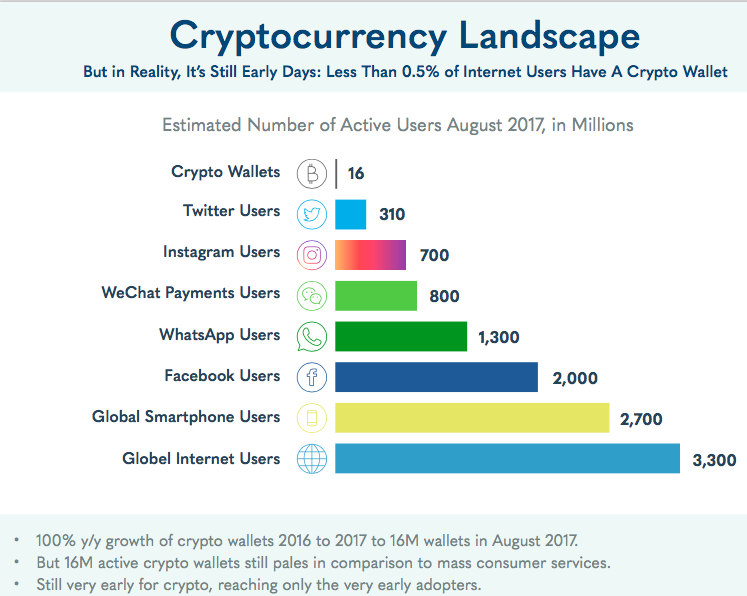

Whilst there have been a few industrious and committed teams working hard on core projects generally there is just too little incentive to do the hard work of building anything difficult at present. Most importantly the hard slog of winning actual user adoption, especially through the painful enterprise sales cycle of months (if not years). And for real world usage we have a LONG way to go (see below).

In fact, we are in the perverse scenario where founders are even selling their holdings entirely because being incentivised any more than they already are is seen as a ‘conflict of interest’.

A relevant Buffet’ism: Only when the tide goes out do you discover who’s been swimming naked.

The McAfee ‘Coin of the Day’ (now Coin of the Week) is the perfect illustration of everything that is wrong with crypto right now. Where people of low integrity and little interest in the philosophy of the space and it’s sustainability create hype where there is no substance and yet can successfully move markets purely because of reach on Twitter.

But if there were one token that sums it all up… it’s the parody, Dogecoin. Which even the founder can’t believe has become a $2bn token.

So, getting back to the future

For me this was and is about disintermediation, open source and creating a new, ‘better’ Web.

I spoke in Singapore recently on a great panel about why I believe, despite all the hype and bullshit out there, this is still such a pivotal moment in the Web’s history (see below). And despite all of my complaints I stand by it more than ever.

Because this is about deconstructing Silicon Valley, and better distributing the value it creates. Something we as an industry have already begun to achieve as you can see below (click on image to see awesome time-lapse of ICO growth by geography).. resulting in Europe as market leader!

Because the technology is (and should be ) largely open source it is about making a more sustainable and less fragile way to finance innovation compared to the 90% failure rate of proprietary equity financing models.

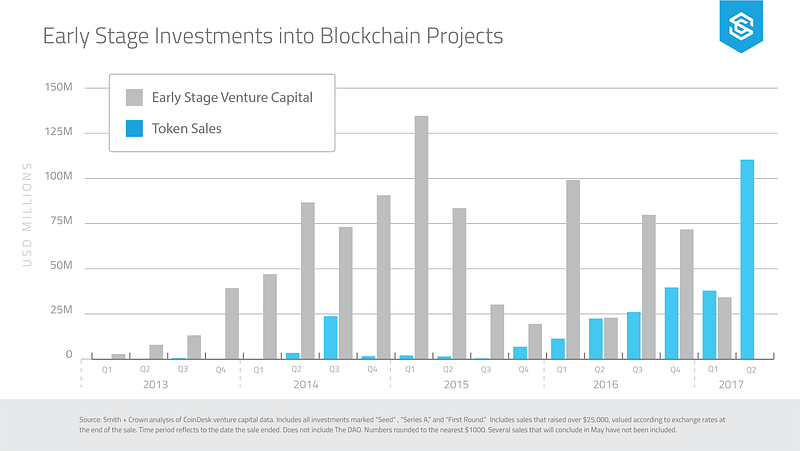

As you can see below, tokens have already overtaken equity venture capital by the middle of 2017.

This is a real and tangible silver lining. Because no matter what happens in the market, in many cases, if a project fails it’s codebase is preserved and can be picked up by a new part of the community and driven forward (in what is called a fork).

Compare this to a situation were 90% of all proprietary value (IP , team know how, community traction) is lost forever.

Furthermore if a new team wants to continue the community momentum and goodwill they can preserve the token ownership distribution (effectively where it’s ledger serves as a shareholder cap table) in their fork. So they honour the contributions and investments of those before them.

And this could happen multiple times, and in parallel, so these things begin to look biological and evolutionary in form because they can have many shots at survival as they mutate and evolve overtime.

This can serve as an insurance policy to investors and could be one reason to actually justify why tokens ARE worth more than equity as an asset class. Time will tell.

So this is actually about democratising the ‘printing of money’ itself and mass experimentation in hard-coding new digital economies with monetary and fiscal policy (referred to as Tokenomics or Cryptoeconomics). And being able to quantify which perform better in market, at least when it becomes more orderly.

It’s my belief this will be the greatest live experiment in socioeconomic engineering we have ever seen.

It was also about creating a counter to the current status quo of platform monopolies like central banks, Facebook, AirBnB or Uber.

But ultimately end users don’t care about decentralisation. Because decentralisation is not an understood need nor is it a panacea. And let’s face it it’s also largely a myth.

People want better UX: cheaper, faster and more secure.

Much of the decentralisation movement was built on an almost religious dogma that has lacked pragmatism. It was utopic.

Like most utopias this has lead to things that don’t scale, are too slow and too expensive. However so far we have managed to avoid mass genocide. Although internecine Twitter brawls can feel pretty brutal sometimes.

Ultimately today our new system is uncompetitive with the status quo.

The alternative we have built is not usable, beyond narrowly as a new store and exchange of value.

And when everybody is paid on the promise of potential rather than success we get fat and lazy.

When everyone is already ‘rich’ (imho blind HODL is an act of faith akin to utopic beliefs, and has a lifespan) from early crypto gains its hard to overcome ego and be hungry.

Today all we offer users is the opportunity to become speculators, in a get rich quick scheme.

And where there are guppies there are sharks, now with industrial scale financial firepower with 120 hedge funds just focused on Bitcoin alone.

Yet we seek, and worse celebrate, the validation of Wall Street because it keeps the new money flowing in, and those of us that know how to print money atop of the pyramid.

But remember if they can create a run on a nation (remember Soros and The Bank of England) they can wipe out Bitcoin in a day.

The question is: is there an incentive to spoil the game or keep it alive? And for how long?

Futures and ETFs will test this tension to the limits. However maybe they will ultimately be the trigger to help clean out the market.

But right now we don’t need more speculators we need value creators.

It means nothing to say a crypto hedge fund has backed you today any more than it does they dumped you tomorrow.

We need conviction investors, that put their reputations on the line with every deal they do.

We need people to play down hype (you can see me doing my tiny bit below). We need to focus attention. We need to take back control of the narrative.

A manifesto for 2018

- We need pragmatism over dogma in making Web 3.0 usable and competitive with platform monopolies

- We need founders AND lead investor lock ins (3 years minimum)

- We need vesting milestones against clear deliverables

- We need quarterly reporting (as seen at Filecoin)

- We need a brain trust focused on open market fundamentals (not just prop trading algos)

- We need more even token distribution to actual end users, as Ryan Selkis said maybe even airdrops

- We need to shine a light on opaque reporting and ownership structures

- We desperately need to professionalise how we communicate. We have the attention of the world’s markets and leading enterprises so need to act like public companies

- Regrettably, we likely also need more ‘get poor quick’ not just get rich

- We probably need a temporary but significant crash to rebalance value creators from pure speculators

- We need a cleaning out of tokens with no real technical innovation, intention or capability to deliver it

- In particular we need to kill off app token hubris built on protocols when there is no infrastructure to support their use-case

- We need real teams who have been in the trenches together (ideally have met in person at least once) with real technical depth, real products and ideally with possible clear market fit

- We need commitment to responsible design thinking. We should only back projects which clearly demonstrate they understand they are building digital economies and have thought about how to make them behave in a sustainable way.

- We need token sales only when there is clear utility we can purchase real products with

- We need teams raising only what they genuinely need and that they only get when it can actually be appropriately deployed

- We need proper treasury management and financial reporting

- We need complete commitment to open source to deliver the promise of less fragile innovation

- We need less crypto hedge funds and more long term angel and ‘VC like’ backers

Investor Activism

So what can you do as a believer in the space, one where we are almost all investors?

I like Fred’s suggestion; to start with it would be prudent to take some money off the table (if you have been lucky enough to make big crypto gains already), which might also take some heat out of the market.

However first principles should be: all projects with a live token (that have completed a successful ICO) have all the money they need to deliver on their promise to the community. Watch if they do before you make them paper billionaires..

Accept as of today they are almost all overvalued. Inflating the value of a token further actually weakens the incentive to complete the mission and equally is assuming you can beat the market and cash out before an inevitable correction.

It is much better, safer (and in the long-term more profitable) to put your capital to work into new projects (yet to ICO) that have the beginnings of the missing infrastructure the industry needs to scale, compete and replace Web 2.0.

I personally would prefer to see limited listings on exchanges until the product is ready for mass usage.

Disclaimer: none of this constitutes investment advice. Please do your own dd.

Why this, why now?

I personally believe the proverbial genie is out of the bottle

Tokenisation, fractionalisation (and ultimately securitisation) of value is here to stay. It is inherent and fundamental to Web 3.0.

This can deliver a more truer and equitable p2p Web

Furthermore, we are in a position to finance open source with billions, without the direct help of Silicon Valley or the status quo’s buy in

And what we build can’t be bought and killed off as Zuck is just figuring out. Although it can be bought into, and is vulnerable to manipulation unless accounted for in it’s design.

But if we let rampant and premature speculation break confidence in what we are building we put off the mainstream users we need to adopt our solutions, potentially for several years

This means the new Web we want to realise could take 15 rather than 5 years to make happen

The reason why that makes all the difference is because I believe we are at the tipping point of an existential threat…

Platform monopolies of Web 2 have amassed unparalleled levels of (our) data to develop an AI advantage, that we in crypto may already be too late to catch up.

This means anything we can build that better distributes the value derived from our data and ownership of AI may already struggle to compete with the compound advantage in learning already gained by FANGs & BATs

This is THE existential threat to The Web because the mass public will sadly almost always choose user experience, price and convenience over ethics or the future welfare of society.

It is the job of those that understand this threat to mobilise a compelling and competitive system that is first better (as an experience), cheaper and thirdly more equitable.

That’s why DLT / blockchain + AI (supported by IoT data) is the combination of technologies we at Outlier Ventures are focused on for the decentralised Web because it is about catching up to the data, and subsequent intelligence advantage, the incumbents enjoy.

We call it ‘Convergence’ (and wrote a whitepaper on it back in 2016)

This is why we have invested in:

Evernym / Sovrin (DLT + Self Sovereign Data)

Ocean (DLT + AI) .. post coming soon

with a number of related deals in the pipe..

All of our investments have this shared mission and purpose. They understand what’s at stake and the urgency involved.

So let’s take back control of the narrative. Invest responsibly. And together get back to the urgent job of building a ‘better’ Web.

Share your thoughts on #BTTF2018