What are the benefits of the reserve currency status?

The global reserve currency is a currency that the world’s central banks use as their foreign exchange reserves. Foreign exchange reserves are typically used by countries to:

- Balance international payments

- Manage the exchange rate of their domestic currencies

Balance of international payments is the difference between all the money flowing out of a country and into the country in exchange for goods and services within a particular timeframe, resulting in either a surplus or a deficit. A surplus occurs when a country exports more than it imports, and it is manifested by hoarding of reserve currencies. A deficit occurs if a country exports less than it imports, and it is manifested by building debts denominated in the reserve currency (as it needs the reserve currency to pay for the imports). Countries use reserve currencies to manage the exchange rates of their domestic currencies by either buying their domestic currency in the open market to strengthen the currency (i.e. if they need cheaper imports or lower inflation), or selling to weaken the currency (i.e. if they need more competitive exports).

The global reserve currency status gives the emitting country certain advantages over other countries. In the course of the last 70 years, advantages stemming from the global reserve currency status have mostly been afforded to the United States. They include:

- Political leverage: The country whose currency is used as foreign exchange reserves can reward its allies with liquidity and deny it to its foes. For example, in 2015, BNP Paribas, a French bank, allowed transfers of $30bn to Sudan, Cuba, and Iran, effectively circumventing US sanctions. US regulators subsequently threatened to ban BNP Paribas from clearing USD (which would utterly destroy its business). The bank agreed to cooperate. They stopped making transfers to US sanctioned countries and paid $8.9bn in fines to the US government.

- More flexible fiscal policy: United States can run current account deficits without depreciation of the USD, because growth in international trade spurs demand for USD and transfers foreign currencies to the United States, which compensates for current account deficits caused by trade imbalances.

- Smaller FX risk: Foreign exchange risk for US corporations taking part in international trade is lower, as transactions are predominantly settled in USD, their domestic currency.

The dominance of USD as global reserve currency is a legacy of two historical events. First, the 1944 Bretton Woods Conference pegged most major world currencies to the USD (and the USD to gold), which made the USD a reference currency for exchange rates of all major world currencies. Secondly, the collapse of the Soviet Union along with the US victory in the Cold War led to a period of undisputed global supremacy of the US economy (ca. 1/3 of global total). This gave the USD strong network effects that made the currency the most convenient choice for a reserve currency for most countries.

Is RMB a suitable challenger to USD?

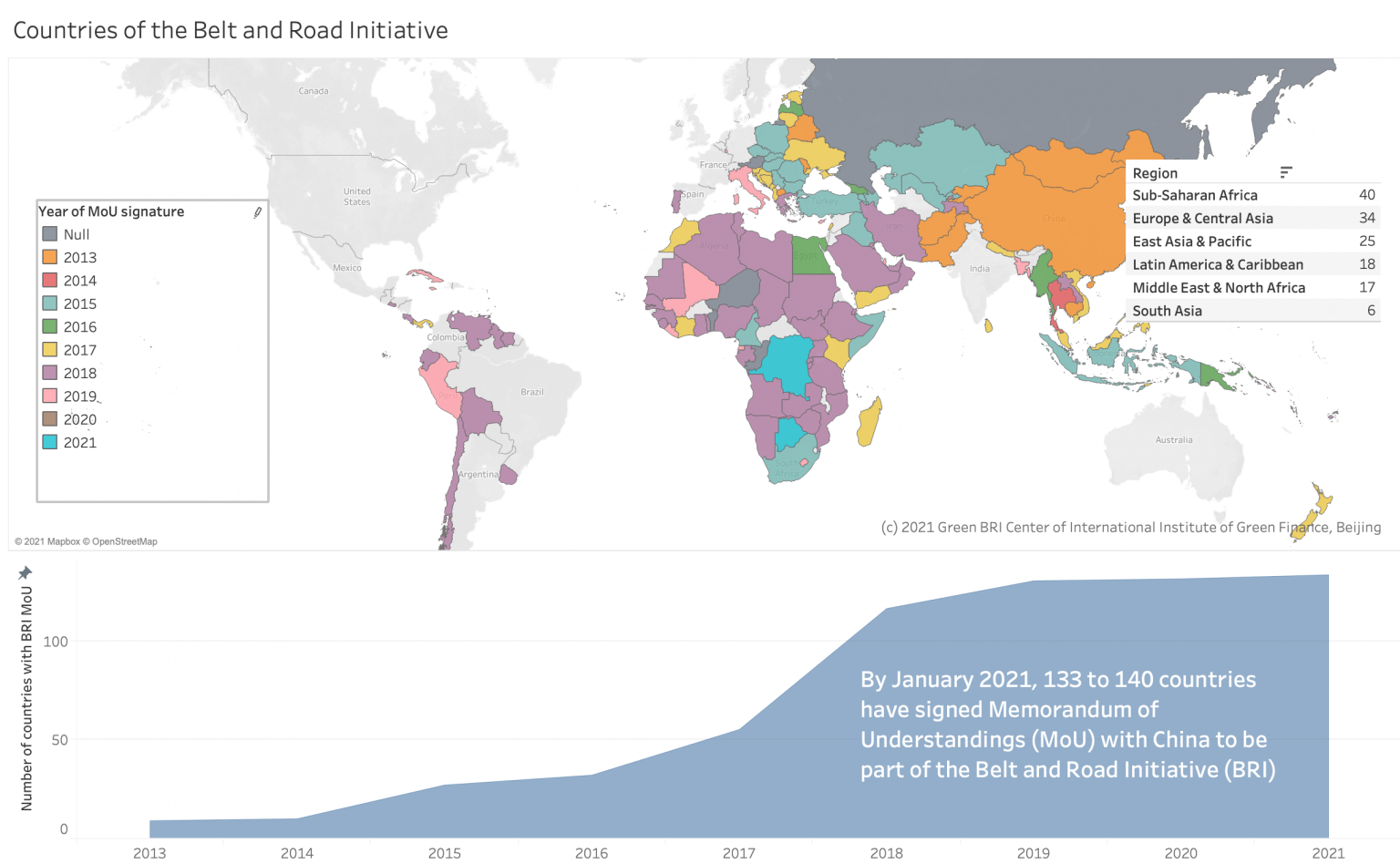

There is mounting evidence that China has ambitions for the RMB to gradually displace the USD in its role as the global reserve currency. China has set up RMB clearing banks in 25 countries and 25% of its 2019 foreign direct investments of $15bn in Belt and Road countries was settled in RMB. Overall, China now settles 15% of its foreign trade in RMB, up from 11% in 2015. It is working on internationalizing its bond markets, with foreign investors currently owning 3 times as much Chinese bonds as in 2017. However, if the international expansion of RMB continues, it can lead to a series of conflicts and potentially to a new financial Cold War between the United States and China. Some of the disadvantages of such a conflict would include:

- Market Fragmentation: This type of financial conflict would result in emergence of an RMB trade block (mostly made of Belt and Road countries) and a USD trade block. International trade could be hindered by inefficiencies stemming from incompatibility of the two systems. Furthermore, the lesser degree of possible diversification in fragmented financial markets would result in overconcentration of risk.

- Triffin Dilemma: A paradox coined by a Belgian-American professor Robert Triffin, which claims that nation state currencies are not well-suited to serve as global reserve currencies, because there is a strong discrepancy between a country’s internal monetary policy requirements and global reserve currency requirements. On the one hand, the United States wants to provide the world with USD liquidity, on the other, it does not want to develop an unsustainable deficit in the balance of payments while doing so.

Therefore, the global community should not want a financial Cold War with one single currency to emerge victorious. Alternatives should be proposed and actively discussed. Fortunately, history shows us that nation states are able to use dialogue to explore alternatives to nation state currencies as global reserve currencies.

Map of countries of the Belt and Road Initiative BRI 2021 (Source: IIGF Green BRI Center, 2021)

What are the alternatives?

In the past, there have been several attempts at proposing supranational currencies that would offer a more equitable way of dealing with the problem of global currency reserves. The first one was Bancor, proposed by John Maynard Keynes at the Bretton Woods conference in 1944. It was not a currency in a strict sense of the word, but a unit of account made from a basket of 30 currencies. Countries could get Bancor by exchanging it for nation state currencies. Bancor was supposed to be used in international trade and incentivize member countries to maintain a balanced trade account. If a country’s Bancor account was positive (i.e. it received more Bancor for exports than it paid for imports), it would mean that it had a trade surplus and acted as a creditor to countries that needed Bancor to pay for imports. If a country’s Bancor account turned negative, it meant the country was running a trade deficit and acted as a debtor. Chronic debtors would be allowed to depreciate their domestic currencies and chronic creditors would be made to appreciate them. However, this proposal was rejected by the United States, which was in favour of other currencies being pegged to USD.

A more recent and actually implemented alternative are Special Drawing Rights (SDR) of the International Monetary Fund (IMF). The SDR is a claim on the currencies of top 5 exporters among IMF members, and it can be freely exchanged for these currencies. The current SDR made of a basket of currencies consisting of USD (41.73%), Euro (30.93%), RMB (10.92%), Japanese Yen (8.33%), and British Pound (8.09%). The USD equivalent of the SDR is calculated as the sum of specific amounts of basket currencies expressed in USD. SDRs are distributed to members based on their IMF quotas. Upon distribution, each member is provided with an asset called SDR Holding and a corresponding liability called SDR Allocation. Countries can then freely exchange their SDRs for currencies with IMF members. If Holdings of one country are above its Allocations, it earns interest on the difference. If its Allocations are above its Holdings, the country pays interest on the difference to countries with SDR surpluses. China has shown willingness in the past to consider the SDR as the global reserve currency. In 2009, Zhou Xiaochuan, the governor of the People’s Bank of China proclaimed that “China wants a new international reserve currency, one that is disconnected from economic conditions and sovereign interests of any single country” and the SDR would be a suitable instrument.

Although central bankers claim that the adoption of SDR as the global reserve currency would be technically feasible, the SDR has been criticized by academics for lacking the main attributes of global reserve currencies, such as deep and liquid capital markets, convertibility on international financial markets, and a functioning clearing system. Another major criticism is the way SDR is governed. SDR is not a market-based asset, it has always been administratively controlled by the IMF in every respect, from its valuation and yield to who may hold it and what it may be used for. The executive board or board of governors of the IMF needs a supermajority vote of 85% to approve major IMF decisions. At 16.52% of total voting power, the United States has unique veto power over major IMF policy decisions. It is difficult to imagine China and Russia subscribing to such a global reserve monetary system. The alternative global reserve system needs to be more transparent, equitable and fairly governed.

Blockchain as a solution?

Inspiration for such a solution could potentially come from the world of fintech. Facebook recently proposed a blockchain-based international stable payment currency with a near-instant settlement called Libra. Although Libra has recently been shelved on the grounds of challenging the hegemony of central banks and replaced with a much simpler concept called Diem, the underlying blockchain technology is relevant for our purposes.

Blockchain is a digital chain made of blocks of information hosted on a decentralized and distributed network of computers that cannot be altered. Multiple stakeholders hold their copies of the ledger and supervise each other’s transactions. Blockchain technology thus allows transferring value without the need of control and supervision from any centralized entity. Facebook borrowed from the SDR design of the IMF and created the Libra currency, a synthetic asset whose value is pegged to a basket of national currencies. It is to be governed by private companies with voting rights allocated according to their contribution, but capped at a certain level, so that no company has too much influence. The Libra blockchain is to have its transactions validated by private companies like PayPal or Amazon. However, US regulators have stopped Libra’s rollout due to concerns over its possible interference with monetary policies of sovereign states. Although the roll-out of Libra was paused, it managed to highlight the problems with speed and cost of processing transactions in the traditional financial system and spurred dialogue on the nation-states level on what the future of money looks like.

Central Bank Digital Currencies (CBDCs)

Nation states have also been warming up to the idea of using the blockchain technology in financial applications through CBDCs. CBDC is central bank-issued digital money denominated in the national unit of account, and it represents a liability of the central bank. The main selling point of CBDCs is their potential of greater financial inclusion and payment efficiency. The first CBDC has been rolled out in the Bahamas in October 2020, introduced to help facilitate financial inclusion in this nation of 390,000 people spread across 30 inhabited islands, many of them remote. CBDCs are seeing increasing traction all over the world. 86% of the world’s central banks are exploring the use of CBDC, with Brazil, Turkey, UAE, Thailand and China actively developing one. In terms of the intended use case, there are 2 types of CBDCs:

- Retail CBDC (general purpose CBDC)

- Wholesale CBDC

Retail CBDCs are intended to be used as an alternative to cash by individuals, households and businesses. It is a new way to hold money, because it represents a direct claim on a central bank, and not a liability of a private bank. Wholesale CBDCs on the other hand are intended to be used by a limited number of financial institutions. They are similar to central bank’s reserve and settlement accounts and will be used for settlement of large interbank payments or to provide central bank money to settle transactions of digital tokenised financial assets in new infrastructures.

China’s CBDC

In October 2019, Xi Jinping proclaimed that China should seize the opportunity to adopt the blockchain technology and urged China to compete in the field of the blockchain technology globally. China has since launched a country-wide blockchain infrastructure called Blockchain Service Network (BSN). In April 2020, the People’s Bank of China began rolling out its own CBDC. China’s digital renminbi is a “central bank digital currency”, making it in some ways the opposite of cryptocurrencies such as bitcoin. Cryptocurrencies are often decentralised; they are not issued or backed by governments. The “e-yuan”, by contrast, is part of China’s top-down design. It is issued and regulated by the central bank and its status as legal tender is guaranteed by the Chinese state. According to the FT, the initial focus is payments in domestic economy, the government hopes to use it increasingly in international settlements. There are signs that this is already happening. On February 23rd 2021, the People’s Bank of China and the Central Bank of the United Arab Emirates announced that they are launching a joint project called the Multiple CBDC Bridge, a proof-of-concept prototype to facilitate real-time cross border foreign exchange payments on distributed ledger technology.

Source: Sonny Ross/CoinDesk archives

Source: Sonny Ross/CoinDesk archives

United States’ CBDC

In the United States, the Boston branch of the Federal Reserve is cooperating with the Massachusetts Institute of Technology in looking for “the opportunities and limitations of possible technologies of digital forms of central bank money.” Nation states are exploring opportunities in digital currencies and, thanks to Facebook’s Libra, they do not have to start from scratch.

What would the ideal global reserve currency look like?

Libra’s design could be an inspiration for a possible solution to the governance issues with global reserve currencies. A new international currency could live on a single ledger distributed among national central banks and be backed by a reserve of the world’s digital currencies, in a way similar to SDR, but not centrally stored or managed. Any transaction on the global ledger could be seen by all member central banks and would have to be approved by a certain amount (e.g. 2/3) of all central banks’ votes. All central banks could agree what should be on the ledger without having to trust each other. This would help with the necessary transparency, as well as with a sense of trust and control. This type of design would make it difficult for single countries to ostracize other countries, as in theory as much as 2/3 of the global economy would have to agree on any kind of punitive actions. This currency could either be a mere unit of account (similar to Bancor), or it could be distributed by individual central banks in a digital form to people and businesses.

What would the benefits of such system be?

It is unlikely that the United States is going to relinquish USD’s global reserve currency status willingly, but there is a wide range of benefits for the United States if conflict is avoided and a viable compromise for an international reserve currency is found:

- China would have much less space for gaining unfair trade advantages from RMB manipulation.

- US exporters would be less hurt by USD appreciation as a result for demand for USD as global reserve currency, especially at times of economic crises.

Equally, China would benefit from a constructive approach to building a new international reserve currency system by means of:

- Smaller exposure to USD risk through its current $2tn USD holdings.

- Smaller FX risk, as the RMB would be a significant component of the new global reserve currency.

- Smaller risk of being a victim of US currency weaponization.

A new system is needed but building it will not be easy

United States are becoming a smaller part of the global economy, while China’s share has experienced explosive growth in the course of the last 3 decades. It is now the largest economy in terms of purchasing power parity, but its currency, the RMB, is still only a small fraction of the global financial system. It is clear that the United States will not be able to maintain its currency dominance by means of its weight in the global economy in the long run and the USD supremacy is going to decline. As the international ascent of the Euro has slowed due to its incomplete financial infrastructure, it is the Chinese RMB which is the most ambitious contestant for the position of a global reserve currency. The imminent period of competition between USD and RMB can either lead to a conflict detrimental for the entire global community, or it can be resolved through dialogue and diplomacy. One solution is harnessing the power of cutting-edge technology to create a more equitable international currency system. The entire global community can have control over the new global reserve currency. Benefits would be substantial, but there is also a wide range of obstacles, such as lack of consensus among experts over what the international monetary system should look like, potential unwillingness of the United States to abandon the status quo, or unwillingness of countries to bear the initial costs of bootstrapping of the new global reserve currency system. Although the future of the international financial system is unclear, it is evident that resolving the conflicts stemming from its flux will require a great amount of vision, political acumen and diplomatic skills.