In the blockchain development trends report, we analyze critical projects and protocols of the Web3 ecosystem. We identify trends such as rising commit levels, consistent commit levels, a rising number of core developers, and other related areas of development activity. In the process of conducting our research, we analyzed 4,831 individual repositories, 1,246,318 code commits, and 2,002,393,842 lines of code. The report outlines clear development trends amongst the 50 open-source blockchain protocols by market capitalization; additionally, we include non-tokenized protocols such as Hyperledger and Hedera Hashgraph. We also outline development trends of the top 50 open-source, decentralized finance protocols by market capitalization.

The Web3 ecosystem has experienced a substantial increase in interest from the general public from Q2 2020 to Q2 2021. In this period, we have observed core protocols such as Ethereum, Filecoin, and Polkadot gaining widespread popularity for their unique programmatic functions. We have seen great projects rise, considerable growth in development activity for decentralized finance, and more developers coming with great talent and fresh ideas contributing to the Web3 ecosystem. This report establishes a clear high-level overview of protocol development activity.

Core Blockchain Protocols

We have observed stable commit levels of the top-50 core blockchain protocols by market capitalization (including non-tokenized projects) per 12-month period. The commit levels have slightly decreased in the recent 12-month period by -1.30%, going from 362,125 total commits for Q2 2019/20 compared to 357,406 commits for Q2 2020/21. This slight decrease in development activity does not indicate any downward trend for overall development in the Web3 space. However, as seen in the later chapters of this report, the slight decrease in development activity may be related to explosive growth in decentralized finance.

Inside the full report, we summarize protocols that ranked top five in the following categories: highest average throughput of commits per month, rising levels of commits, declining levels of commits, and protocols that perform consistently across the 24-month reporting period. Similar to the steady levels of commits described above, the number of active developers per 12-month period increased by 0.60%, indicating a consistent developer base contributing across 24 months.

Decentralized Finance Protocols

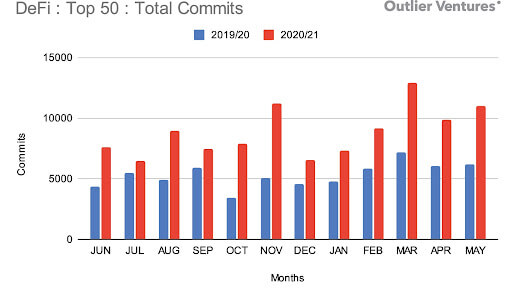

We have observed substantial growth in development activities for decentralized finance (DeFi) protocols. The top-50 protocols, according to market capitalization, went from 63,807 total commits in the previous 12-month period to 106,157 total commits in the recent reporting period, resulting in a 66.3% increase of total commits overall. During the summer of 2020, we experienced an exponential rise in the general interest in decentralized finance protocols from a consumer perspective; this is consistent with our main findings, as indicated in the graph below.

The report provides an insightful overview of the development activity of the selected protocols ranked by market capitalization. Further, this research pinpoints new protocols in the recent 12onth period that exhibit great activity. The total number of active developers per 12-month period increased by 66.6%, reflecting the substantial increase in yearly commits as described above.

We feel this guide would be helpful for technical teams or individuals that are currently choosing what frameworks to build on. Further, it will be relevant for those individuals and organizations looking to establish a clear overview of the current Web3 space and its continuous developments.

Please download the full report for a complete review of the current blockchain development trends.