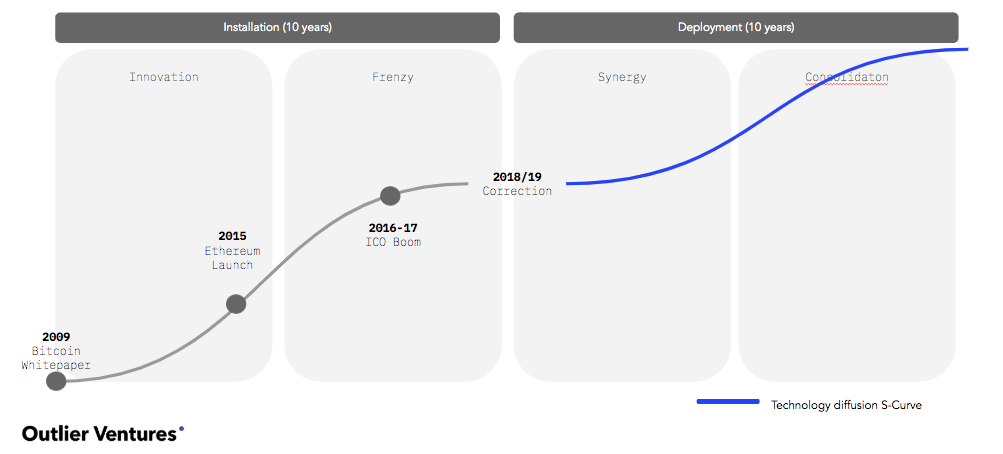

This journey into deployment will last throughout 2020 and into 2021. This will finally be when blockchain grows up, institutional money begins to trickle into the market based on real fundamentals and there is a great sorting of projects with traction versus what are to all intents and purposes ‘zombie tokens’.

At the same time there will be more mature and usable networks to create dapps creating an increasingly competitive landscape for projects to battle it out with in order to ‘cross the chasm’. But make no mistake this is the beginning of the cycle where tomorrow’s next internet unicorns are born, built on demand and mass usage. For that to happen distribution, over any necessarily fundamental innovation, will become key. This can only be built, bought or borrowed and is why we continue to champion the creation of an open stack of collaborating technologies, we call the Convergence Stack, to build the ecosystem together through shared events like diffusion.events

-

The reckoning: bluechip vs zombie tokens and indices

The big story throughout 2020 will be ‘The Reckoning’. Despite the longish bear market, aggregate total market capitalisation of all cryptoassets being down 88% from an all time high in January 2018 individual valuations for the vast majority of projects are still not reflective of network activity or development progress. As exchanges are forced to increasingly professionalise, zombie tokens will be more aggressively delisted and investors will gradually flock to quality. This dynamic will lead to a proliferation of new indices joining the likes of Tradeblock, CMC, Huobi, and CIX tracking particular fundamentals making it easier for passive institutional capital to enter the space. This is why we recently invested in Dia Data who supply crowdsourced yet institutional grade and compliant data feeds to benchmark providers.

The idea of projects worth $100 million without product-market fit will go away. Public crypto markets can be currently thought of as early-stage startup markets rather than later-stage companies, but as more sophisticated investors and institutions enter the picture they will bring much needed rigour to the market. Valuations can no longer be sustained by just a vision and an idea. 2020 will all be about traction and usage. And not just press release partnerships, beta releases, and funding rounds. We are talking about Brave Browser level 10 million monthly active users traction, again something we are a proud early investor in.

Measure: More than 5 new indices will launch in 2020 onboarding >$5 billion

2. Beyond the halving, the Bitcoin narrative will be about LApps

Predicting that Lightning usage will increase is hardly revolutionary. But we do think in 2020 the narrative around Bitcoin will move away from simply ‘store-of-value’ to an open financial “platform”, with the most secure and trusted settlement layer in the market. Digital Asset Research exploring the Bitcoin technology stack has been helpful in reframing the discussion about what Bitcoin is, and we expect performance enhancements with Schnoor and Erlay to further change the perception of Bitcoin as a slow and stagnant ecosystem.

Obviously, the halvening will capture much of the attention of the industry and media, and price action will dominate mind share. But the growth of LApps (Lightning Apps) and more broadly data anchoring will be a stronger fundamental signal of the development of a fee market and the long-term viability of Bitcoin.

Measure: Bitcoin will increase market dominance from 66% to at least 75% by the end of 2020.

3. Ethereum 1x maintains momentum, as DeFi creates a deeper moat

With Istanbul now live, we expect EIP-2028 to have a major impact on layer 2 adoption opening up use cases beyond crowdfunding and DeFi. Expect to see games currently using EOS and Tron to migrate over to Ethereum to take advantage of the DeFi lego available. With the development of MAST/Taproot on the Bitcoin network as well as the influx of new smart contracting platforms reaching mainnet in 2020, we are likely to continue to see a stable pool of developers spread over ever more platforms. Leading to fewer new dapps being built on Ethereum, but with a select few DeFi apps like Maker and Compound driving an increase in monthly active users and value locked up in contracts. The prediction that is hard to make is whether a break out application using DeFi lego building blocks entrenches Ethereum as the base layer or if interoperability projects like GEO Protocol and others reduce the importance and value of the base layer over time.

Measure: Total value locked up in Ethereum DeFi will surpass 1 billion dollars in 2020

4. Smart contract platforms battle for developers

The glut of new smart contracting platforms will come to market in 2020 and begin heavily focusing on developer and customer acquisition. In time, general developers will become more familiar with blockchain-based platforms, currently estimated to be less than just 1% of the global developer population, but in 2020, we will still see more supply than demand. In the context of prediction 1.0, when crypto assets are largely thought of as digital commodities, this glaring disparity will impact price.

From a problem-to-be-solved lens, the vast majority of developers want to be able to use stable, secure, fast, and easy-to-use software. Polkadot, Fetch.ai, Dfinity, Hashgraph, Near Protocol, Spacemesh, Solana, Telegram Open Network, Thunder Token, nCent, and all the platforms already now in the market like Cardano, Tezos, Holochain, Algorand, Blockstack, et al, are all differentiated in some way, but the biggest question is: how do they cut through with developers who will need to build “killer” apps and attract consumers? Different developer acquisition strategies will be deployed: protocol accelerators, ecosystem funds and Devcons, and whilst some will grow the total number of developers and their share of the market most will struggle for critical mass head to head against Ethereum and Bitcoin in 2020.

This is why we continue to champion and support through our advisory business an alliance of protocols to both be interoperable with Ethereum and Bitcoin but importantly directly integrate and collaborate together through what we call The Convergence Stack, and shared Dev Con we call Diffusion which brought together over 23 protocols for hackers to integrate and deploy in combination.

Measure: No new smart contract platform has more than 400 total applications by EOY

5. DAI ecosystem grows to solve end-user experience challenges

Dai will continue its path as the de facto stable coin for Ethereum-based services (It seems Tether will be hard to dislodge for trading). Expect to see improved integration into all on-boarding services like wallets, exchanges, debit cards, and browsers. Access to services will be automated by token swap tools like Uniswap so users will only hold tokens will demonstrable store-of-value characteristics. It’s hard to see how many tokens with just a payment function can compete with a dominant DAI. The more apps like Zerion, Instadapp, DeFi Saver, Argent, etc integrate with DAI, the more entrenched DAI becomes and throughout 2020 expect DAI to become the de facto onboarding tool as developers build apps on Ethereum. All this said, DAI will only continue as the de facto stable coin for as long as it is not considered by Governments as a systemic risk to existing monetary systems. For the same reason, don’t expect Libra to launch with any stablecoin functionality.

Measure: DAI becomes 10% of stablecoin market share by transaction volume (25% if Tether collapses)

6. The Central Bank Digital Currency (CBDC) goes mainstream in China first

Talking of stablecoins, the Bank of International Settlements (BIS) survey of 63 central banks in 2018 shows the majority were researching or starting proof-of-concept work on digital currencies, although most of them were not ready yet to actually launch. Christine Lagarde, the ECB President, said a CDBC “could satisfy public policy goals, such as financial inclusion, and security and consumer protection; and to provide what the private sector cannot: privacy in payments”. So CBDCs are coming, the question isn’t if, it’s when. For starters, these CBDCs will be wholesale CBDCs rather than retail. It’s likely central banks will focus on the wholesale market leaving the retail market for regulated institutions. In 2020, we expect this to be how the Chinese Digital Currency Electronic Payment (DCEP) launches with licenses given to select exchanges and dominant platforms as distribution platforms to hundreds of millions of users like Alibaba, Baidu and Tencent.

Measure: More than 500 million Chinese citizens to be using a service connected to the DCEP network by the end of 2020.

7. Staking becomes institutional as returns are dampened

In 2019, as predicted, it became clear that users would hold tokens that they could stake and earn a yield. The median staking yield hovered around 7% but the median real staking yield hovered at -1%. As more proof-of-stake networks launch like Cardano and staking providers professionalize, the complexity will be offloaded from end-users to service providers. Users don’t care if their assets are locked up in Ark or Ardor, they just want a higher yield. This means staking networks are in competition with lending providers like Dharma and Compound for user assets to put to work. In 2020, there will be more places to put your money than money to be put to work, driving down the real median staking yield further, making staking less profitable and undermining the security of a large number of PoS networks. This power-law dynamic will mean staking operators and individuals will focus on the most profitable networks crowding out the long-tail of PoS token networks.

Measure: Median real staking yield over the year remain negative

8. The great delisting and zombie token armageddon

Potentially between 50% and 75% of publicly listed tokens will be delisted and/or cease trading in 2020. So from 2,345 tokens actively traded today to >1000 tokens by the end of 2020. This could go closer to <500 if Binance decides to go on a delisting exercise to protect users, and get ready for regulation and staking ends up in a race to the bottom.

New tokens coming to market will be few and far between and will be more mature. By the end of 2020, public offerings and listings will no longer be accepted for seed businesses, won’t be quite as advanced as a traditional IPO, but will at least have a product with product-market fit in the market. Token distribution events will be used, as originally intended prior to ERC20, to incentivise the usage, growth and development of a live distributed network.

Measure: More than 50% of today’s publicly listed tokens will be delisted.

9. The search for sustainable token distribution strategies continues as equity comes to dominate 2020 in The West

Since the collapse of the ICO market and lacklustre returns from IEOs, projects have been exploring alternative token distribution strategies that seek to raise capital and align the interests of network participants. The ideal distribution method would both solve for speculative intent, regulatory implications, network deanonymization, market irrationality, and stakeholder alignment. All sorts of exotic strategies have been proposed and tested like the lock-drop, warlock, liquid airdrops and others. But in Western markets, largely driven by conservatism in the US, it will become clear in 2020 that the total pool of investors who can also become genuinely active network participants is too small to raise enough capital for the full lifecycle of a new protocol network.

Despite Europe having perhaps the most permissive regulatory environment for tokens as a form of crowdfunding globally, its primary market made up of angels, family offices and VCs, due to a history of seeing the US as where tech companies go for later stage growth capital, will follow suite continuing the trend of seeing equity as the main fundraising instrument and tokens as the network reward instrument. Equity shareholders will just receive a portion of the profits from network services as they would expect with any non-tokenized Saas product.

However, this will continue to be in stark contrast to Asia where there is still a heavy preference on tokens vs equity with a preference to quicker paths to liquidity where we may even still see one one last hurrah for the ICO in SouthEast Asia in growth markets like Thailand and Vietnam where retail investors didn’t get burnt in 2018. Increasingly, projects will have to decide if they invest their time in raising capital and building a presence in Asia or The West, with all the associated trade-offs that come with that.

Measure: Equity in The West becomes the dominant fundraising instrument before network launch at 90% of money raised.

10. Treasury funding for open-source permissionless networks will be retrofitted despite backlash

In 2019, the debate over EIP-2025 and the Zcash founders’ reward reignited the long-standing debate on how open-source projects are sustainably funded. Treasury funding as with Decred, Beam, Dash hasn’t won but without relying on a rich benefactor, corporate generosity, or venture capital subsides, we still don’t have a way to reward contributors to open-source projects. Gitcoin and pooled funding like pooled cDAI feel like experiments rather than sustainable business models. Policies like Harberger Taxes and NFT continuous auctions will be discussed throughout 2020.

Measure: 5 projects in the top 100 Y2050 market cap, to instigate a treasury funding model as it becomes clear previous token funding cannot sustain the project.

11. DAOs are intellectually interesting, but still many years from mainstream understanding or acceptance

2019 was the year of the DAO with MolochDAO gaining the attention of the industry, and Maker continuing to execute and deliver multi-collateral DAI. But the real-world is still nowhere near ready for DAOs. Whilst definitely intellectually interesting and almost certainly the precursor to a new type of global digital organisational structure to compete with the inefficient corporate built for a different age. But we have a very long way to go before DAOs can go mainstream. And it is still not clear if and when a collective of decision makers can outperform a brilliant entrepreneur like say CZ, Mark Zuckerberg or Steve Jobs in a commercial context.

Being able to vote on how funds are spent, isn’t so much a technology problem solved by DAOs, but rather a social problem that can be solved with non-decentralized software in cooperative movements. In 2020, we imagine a proliferation of DAOs limited to spending decisions, but they will be ineffective and suffer badly from collusion leading to suboptimal outcomes.

Measure: DAOs will stay limited to capital allocation vehicles and less than $50 million will be allocated in 2020

12. A breakout game will bring blockchain networks and cryptoassets to the masses

Gaming will be the break-out application area in 2020. We already have games like Splinterlands on Steem; CardMaker: NatureTown on NEO; and My Crypto Heros on Ethereum, but no break out games as of yet. Enjin looks like a good bet with distribution through Blockchain KeyStore of the Galaxy S10 and Microsoft Azure Heros using the platform. By the end of 2020 many of the pieces needed for a break-out mainstream game will be there: high-performance platforms; easier to use on and off-ramps for digital assets; and better digital asset storage and distribution tools for gamers. So all that is left is distribution and reaching gamers.

This will be accelerated by the ability for gamers to earn credits that can be used in and possibly across games by renting out their GPU and CPU hardware to run computational and rendering tasks which is why we recently began advising Cudo.

Measure: Valve with Steam and/or Epic through Unreal to launch a blockchain-based service

13. Synthetix: The Chainlink of 2020

The project to watch will be Synthetix. With a16z publicly buying it up and with $245 million Y2050 market cap, it’s certainly not an unknown, but I think it will become as important to the DeFi space in 2020 as MakerDAO was in 2019. As a synthetic asset platform that providing on-chain exposure to real-world currencies, commodities, stocks, and indices. The early obvious use cases are long and short positions to the price of other cryptoassets, but all sorts of other exotic financial instruments can now be built in a permissionless and trustless way.

Measure: Synthetix will be to 2020 what Chainlink was to 2019. Outperforming almost all over projects it will end the year above $700 million market cap, up from circa $210 million today.

14. Telegram to win the first battle of messaging apps

With Klatyn (KakaoTalk) and Link Network (LINE) live, TON (Telegram), Mobilecoin (Signal) and Libra sans stablecoin (Facebook) expected, 2020 should begin to see real usage of blockchain-based platforms (Potentially BlueSky from Twitter fits in here too). Telegram reaches about 200 million users a month all of whom have opted into a messenger specifically differentiated on privacy and security and many whom have been early adopters of crypto projects. Even if TON has to return funds to US investors as part of a settlement with the SEC, TON and the apps that run on top of the network will find a ready-made audience in a way that Klatyn, LINE and Facebook likely haven’t/won’t.

Measure: By the end of 2020, TON will have the most monthly-active users of any blockchain network.

15. Enterprise: Corda dominates Hyperledger, Ethereum and Quorum

Corda will emerge as the market leader in the enterprise blockchain market. While consolidating the lead in the financial services market, R3 will continue making inroads into other verticals like energy and telecommunications. Enterprise-friendly services such as training, customer services, and certification programmes will differentiate the platform driving more usage which in turn will drive developers to build for the platform. In 2020, it may not be as sexy as building DeFi apps on Ethereum, but real customers and real money will be made with Corda apps.

Measure: Corda will overtake Hyperledger, Ethereum, and Quorum by market share and become the market leader in enterprise blockchain.

16. Web3 middleware/developer experience will be the hot new market

To make smart contracting platforms and other types of decentralized software more usable, middleware is critical. The DeFi middleware market has been built out over the last few years providing service-oriented tools to developers so they don’t have to deal directly with Ethereum or other base layers: 0x, MakerDAO, Kyber, Augur, Compound, dydx, Uniswap, Nuo Network, DAOStack and Aragon to name just a few. However, now similar middleware is being built out on EOS with the likes of Newdex, EOSDAQ, EOSREX, etc. and Cosmos, Polkadot and others will need to develop their own middleware ecosystem as they seek to attract developers.

These are all protocol-specific middleware solutions but 2020 will see the development of general-purpose middleware that connects in with numerous blockchains, compute, storage and other computing resources. This is a massive task today but as tooling for protocols develops in 2020, Web3 middleware/developer experience will emerge as the hot new crypto market. This is especially important if unpermissioned networks wish to compete with players like R3 who can offer enterprise grade levels of product support.

Measure: The next Binance like blockchain unicorn success will be a middleware company that comes to attention in 2020.

17. East / West Divergence

As suggested in previous predictions the more time we at Outlier have spent in Asia this year, in particular China, the more we have come to believe there will be a divergence between the East and West in blockchain, and more specifically digital assets. Of course this is nothing new; there have always been in effect two versions of The Web but the acceleration of adoption driven by the Chinese central and provincial governments is staggering.

The great irony is whilst China itself formally pursues a path of permissioned and untokenised blockchain, Bitcoin mining and several POS networks like EOS are already dominated, and some argue controlled by Chinese companies. Equally, the majority of exchanges and trading volume is still Chinese originated and it is understood by Q2 of 2020 there will be a few national champions formally given licenses, likely to operate initially in fairly restricted ways, possibly out of free trading zones. We can also expect various provinces and SOEs (State Owned Enterprises) to begin to champion their own regionally based tokenised networks within central guidelines.

As we have already predicted Chinese Digital Currency Electronic Payment (DCEP) will reach hundreds of millions of consumers overnight by forcing adoption by dominant platforms, but this also further entrenches their business models where in the West we like many believe Web 2.0 platforms will be unbundled. Perhaps we will see a longer period of Web 2.5 in Asia or an entirely different form of Web 3.0 but the outcome will lead to a battle for not just technological but potential financial dominance.

Measure: 3 Chinese exchanges are given official permission under license to operate domestically under restrictions

18. Europe becomes The West’s hub for blockchain projects

Perhaps as a subset of prediction (17) there are many signs in 2019 that 2020 will see Europe begin to steal a march on the US as The West’s hub for blockchain projects, in particular tokenised networks, to both finance and base themselves. However, it is to be seen to what extent with Brexit, London continues to be part of that narrative, it was previously the second most popular city globally for early-stage blockchain financing.

This is all largely driven by the EUs determination to break away from the last few decades of US hegemony over the internet what it sees as Silicon Valley’s anti-social and extractive web monopolies, initially based on concerns around data but now with Libra the very stability of it’s financial system. Therefore, with the launch of several European funding initiatives (including a blockchain + AI fund) complemented by new regulatory pushes (inc. BAFIN the German regulator allowing its retail banks to hold and sell crypto) it will begin to see the growth of a stronger secondary market within the wider common economic zone with what is traditionally it’s more conservative primary market following suit.

Measure: European venture capital in blockchain companies was $700 million in 2019 and will surpass the all time high of $850 million of 2018 to reach $900 million in 2020

Further Reading

- EIP-2025, Github

- Chinese Digital Currency Electronic Payment (DCEP), Boxmining

- The Evolution of Crypto Capital Markets: Part 2, Jack Purdy

- The Evolution of Stablecoins: From Mastercoin to Libra, Ryan Watkins

- Compounding Utility Through Composability, Wilson Withiam

- The DeFi Deja Vu, Placeholder

- Fire Before Growth, Placeholder

- Q219 Crypto Retrospective, Circle Research

- The State of European Tech, Atomico

- A Look at Innovation in Bitcoin’s Technology Stack, Lucas Nuzzi

- A Comprehensive view of Ethereum 2.0 (Serenity), sheinix

- Hard Problems in Cryptocurrency: Five Years Later, Vitalik Buterin

- Exchanges Are Open Finance, Kyle Samani

- The Separation of Time and State, Ryan Gentry

- Central Banks and Distributed Ledger Technology: How are Central Banks Exploring Blockchain Today, World Economic Forum

- Central bank digital currencies – design principles and balance sheet implications, Bank of England

- The Rise of Staking: From Theory to Building Large Infrastructure, Binance Research

- Institutional Market Insights – 2nd edition, Binance Research

- A history of Crypto Exchanges – Nomics Team

- Illiquidity and bank run risk in DeFi – Alethio