An open-source report

Outlier Ventures’ development trends report was motivated by the need to provide insights for the teams in our Base Camp accelerator, so that they can choose their blockchain platform with confidence and identify major trends beforehand. No one wants to build their business on a platform that will die out, and how to avoid this is part of the guidance we provide through Base Camp. While a number of high-quality developer reports have been published in the past, such as Electric Capital’s commendable work in 2020, no 2020 report is comprehensive in its coverage of core development and contributor data for top protocols.

Whereas similar efforts have been made in the past with few good reports as well, there is no way to verify that the data and methodology is genuine and correct, as each of such reports rely on proprietary technology that crawls development data and processes them to generate insights. Therefore, there is no way of knowing if the publisher inflates statistics for their friends, distorts statistics for their competitors, or even if there are inconsistencies in the analysis approach or human error in calculation. At Outlier Ventures, we want to turn that on its head, so the full methodology, data sources and code used for our report are open-source and available on our GitHub.

Executive Summary

Blockchain Protocols

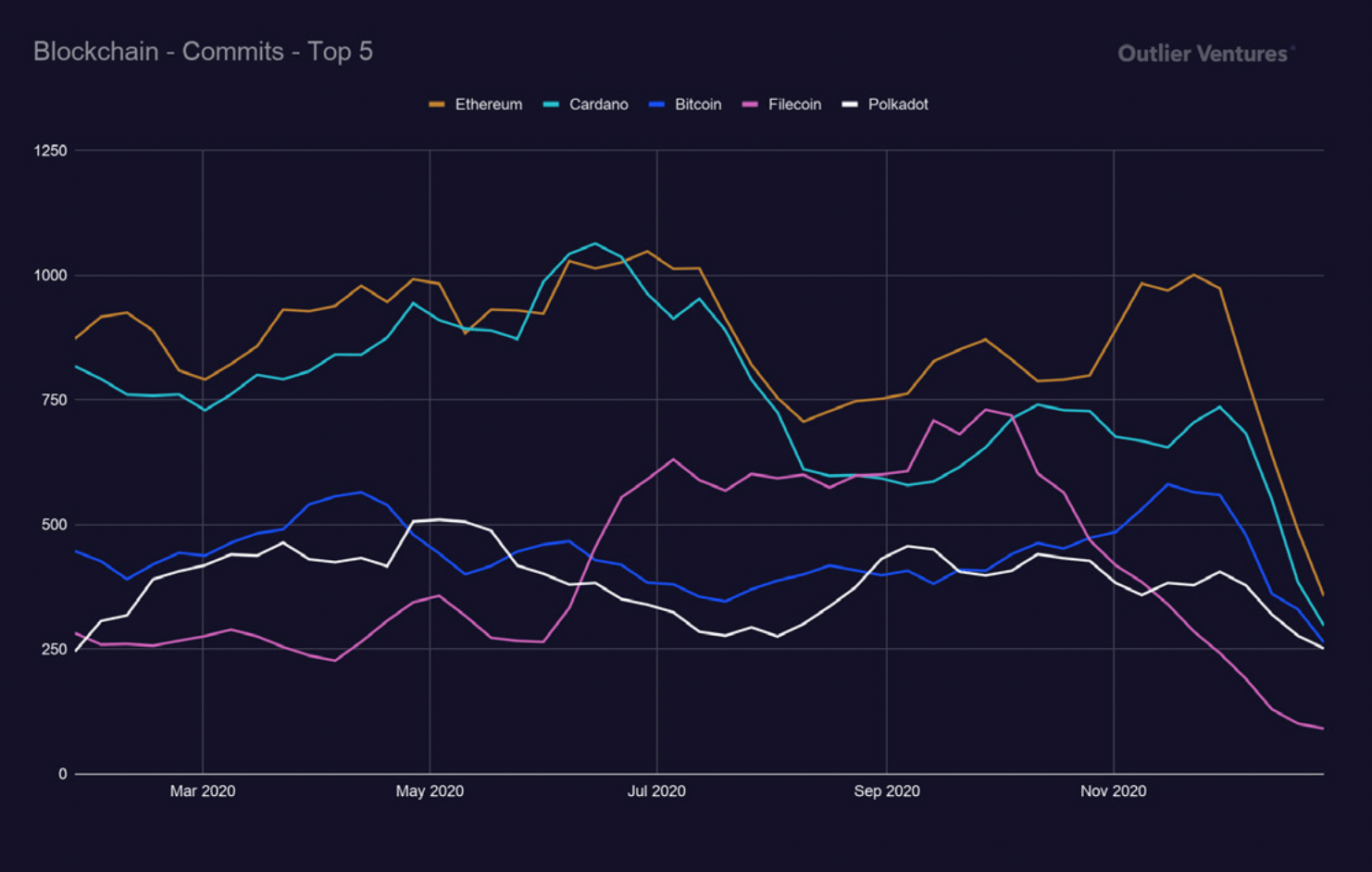

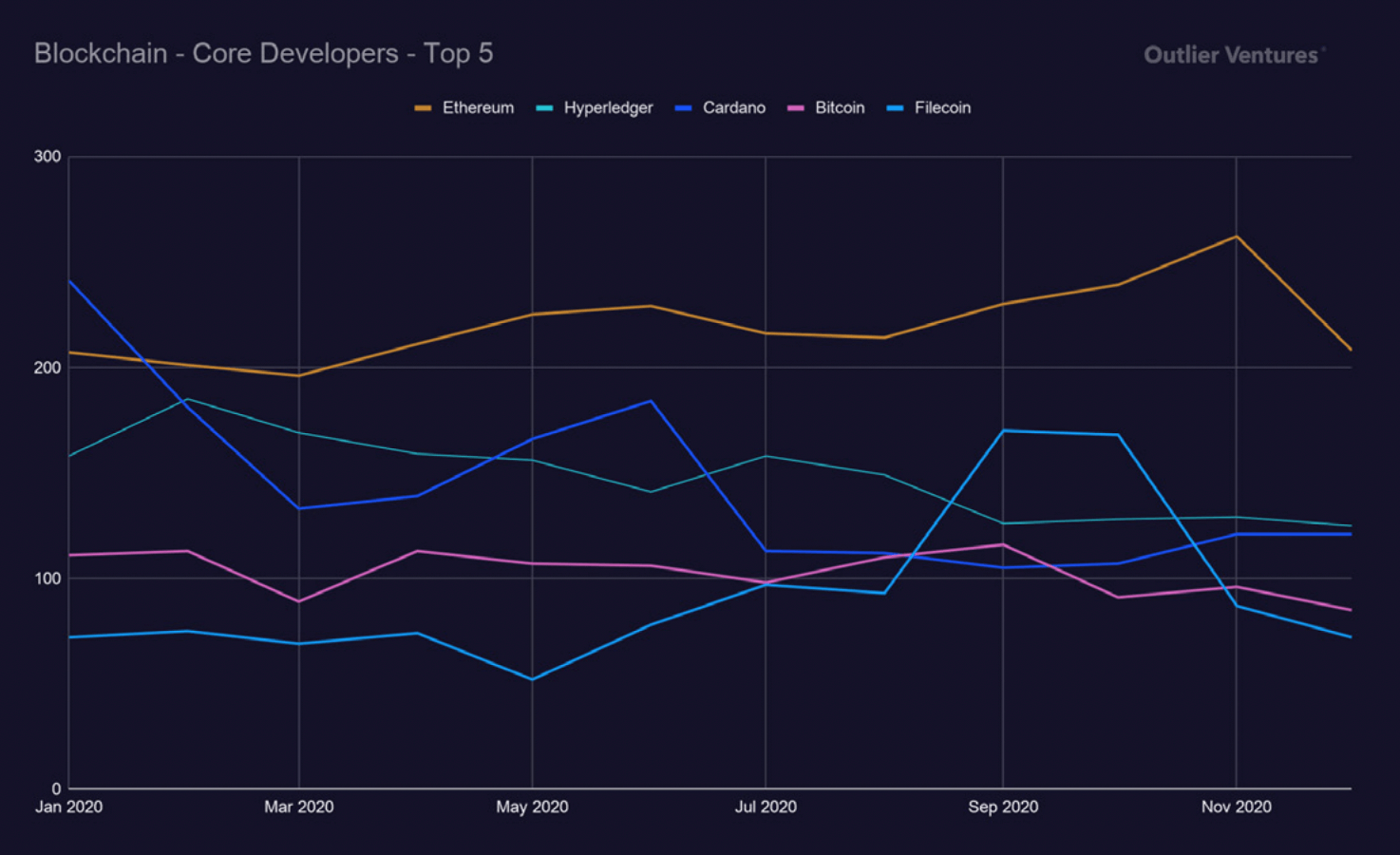

While some new protocols came into the limelight over this year, Ethereum is still the most actively developed Blockchain protocol with 866 average weekly commits, followed by Cardano (which saw a decline over the year) with 761 and Bitcoin with 441. Ethereum also leads the monthly active developer count, with 220 monthly active core developers on average, followed by Hyperledger, Cardano and Bitcoin having 149, 144 and 103 active core developers on average respectively.

However, multi-chain protocols like Polkadot, Cosmos and Avalanche are garnering a lot of interest and also seeing a consistent rise in core development and developer contribution. Avalanche’s code commits grew 4x, while Polkadot doubled its amount of monthly active core developers and Cosmos developers increased by 60% over the course of the year.

In the year of its public launch, the decentralized file storage project Filecoin jumped straight into the top 5 of most actively developed projects. This speaks volumes about the state and future of decentralized storage.

Ethereum killers – Tron, EOS, Komodo, and Qtum are seeing a decrease in core development metrics and developer contribution.

Here were the top 5 active blockchains in terms of commits to their core organizational repositories and active contributing developer counts.

DeFi Protocols

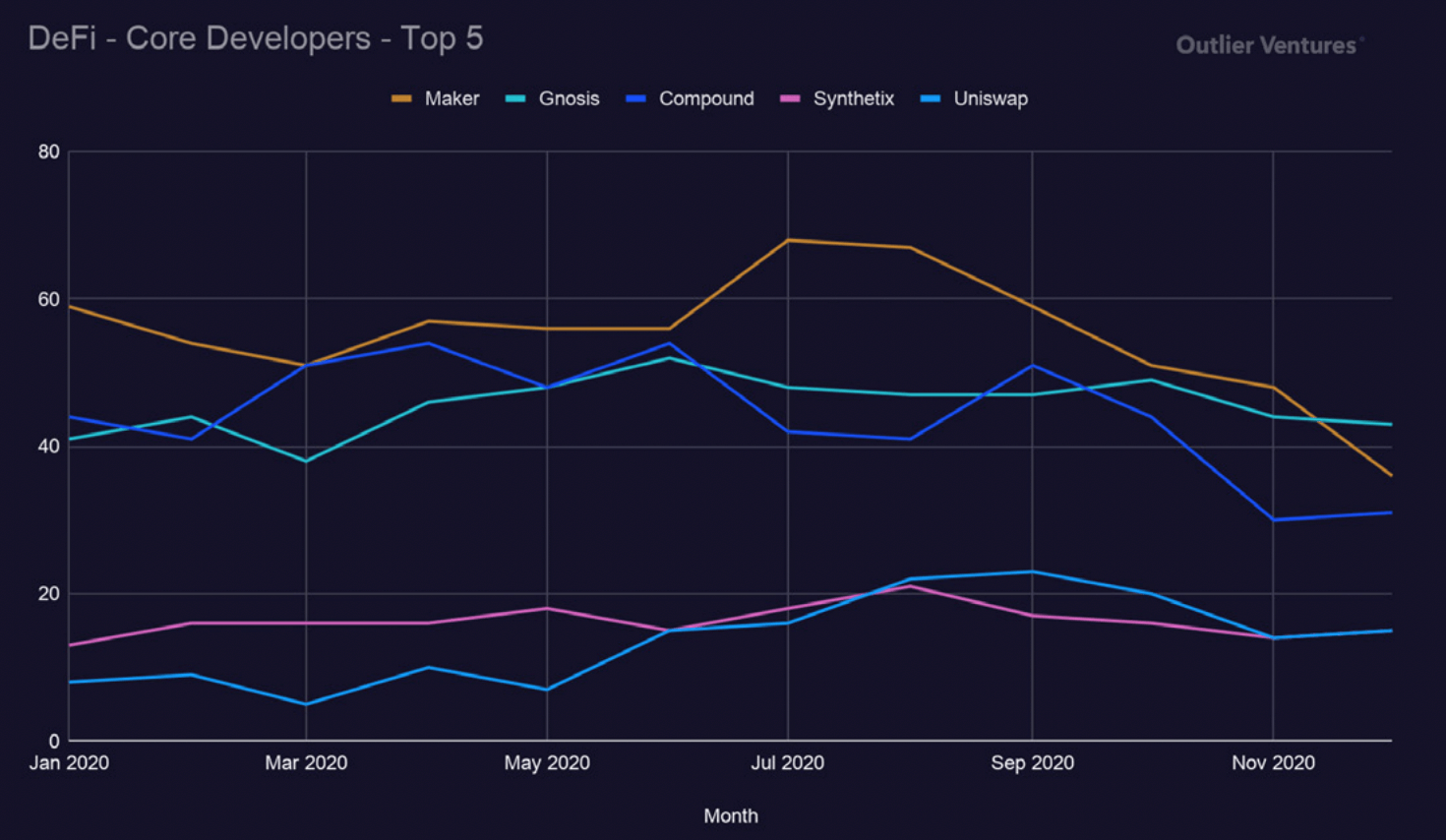

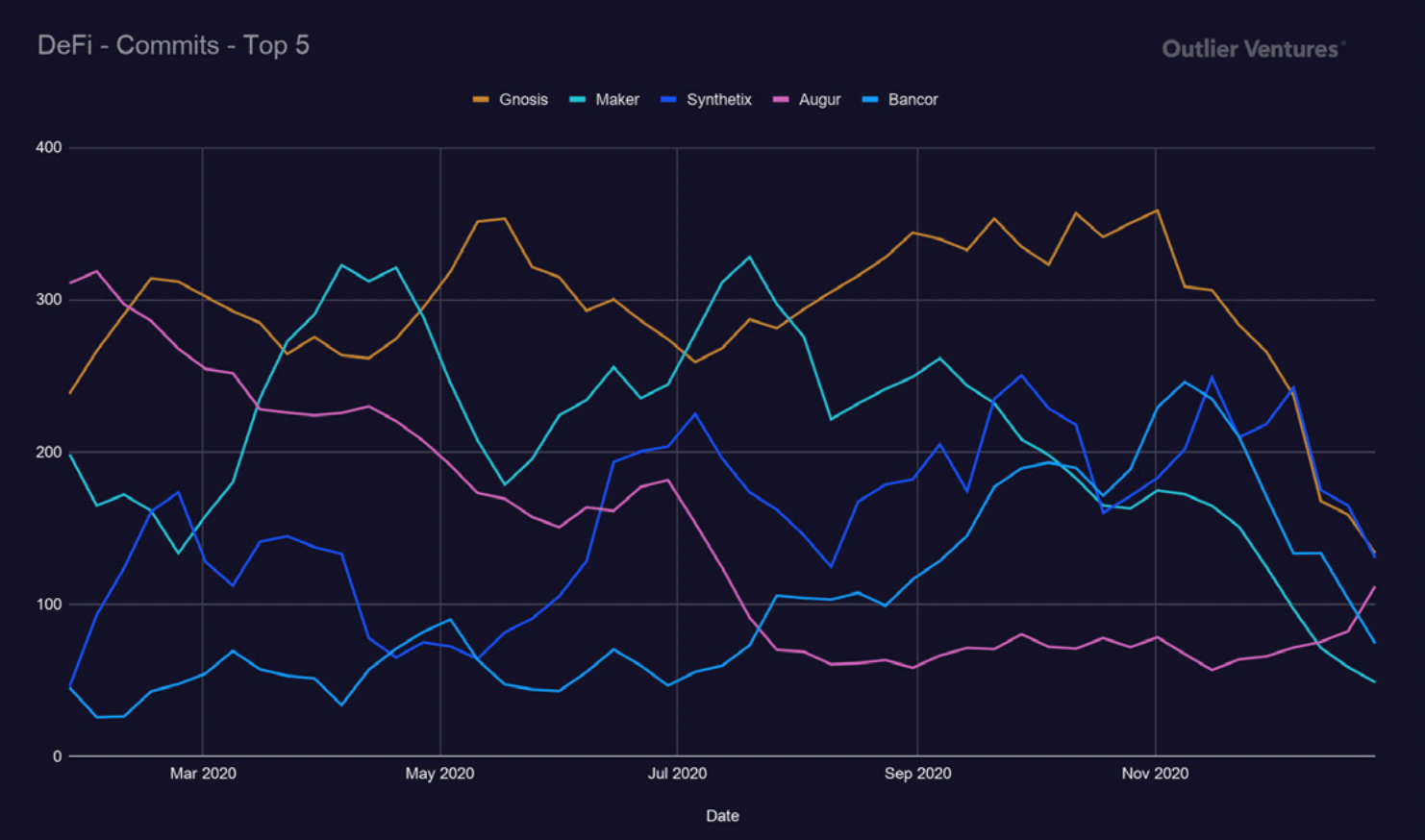

In 2020, decentralized finance (DeFi) protocols took the space by storm with Ethereum being the choice of the underlying blockchain and smart contracts platform. They saw an increase in core development and developer contribution activity over the year which was all open sourced. The most active projects were Maker, Gnosis and Synthetix, with Aave and Bancor showing the most growth, and Uniswap closing the top 5 of core developer count. SushiSwap, Yearn Finance, and Curve Finance all launched in 2020, quickly grew toward and beyond the development activity and size of most other DeFi protocols.

Here were the top 5 active DeFi protocols in terms of commits to their core organizational repositories and active contributing developer counts.

Special Mentions – NFT and Metaverse

NFT and Metaverse projects like collectibles, gaming, crypto art and virtual worlds saw a market-wide increase in interest, but mostly followed a closed source development approach as was seen in our analysis. A notable exception is Decentraland, which has development activity on the levels of some major blockchain technologies like Stellar and Algorand, and ahead of some of the most popular DeFi protocols like Uniswap and Compound.